Get the free ,"-cT-12

Get, Create, Make and Sign quot-ct-12

How to edit quot-ct-12 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quot-ct-12

How to fill out quot-ct-12

Who needs quot-ct-12?

A comprehensive guide to the quot-ct-12 form

Understanding the CT-12 form

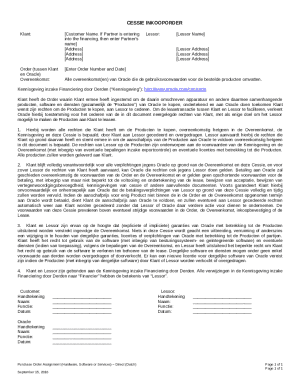

The quot-ct-12 form serves as a vital document within the real estate and property management sector. This form is primarily utilized for reporting property assessments and ensuring that property owners are compliant with local tax regulations. By accurately filing the CT-12 form, property owners can ensure that their properties are assessed correctly, leading to fair taxation based on current market values.

The significance of the CT-12 form extends beyond taxation; it is also an essential tool for potential buyers. This is particularly true when assessing the fair market value of properties they are considering purchasing. Understanding how this form works empowers both buyers and owners to make informed decisions.

Who needs to file the CT-12 form?

The quot-ct-12 form needs to be filed by various individuals and teams involved in property transactions. Primarily, property owners are responsible for submitting this form as part of their property assessment. However, real estate agents and brokers also play a critical role in guiding clients through the filing process.

Specific scenarios that necessitate the filing of the CT-12 form include changes in property ownership, significant renovations that could affect property value, or when a property is placed on the market for sale. Understanding the nuances of filing requirements is critical in ensuring that all necessary documentation is submitted promptly to avoid delays or penalties.

Components of the CT-12 form

The structure of the quot-ct-12 form is designed to capture essential information succinctly. Each section aims to address specific elements that can impact property assessments. The first section focuses on personal information, where the filer provides their name, address, and contact information, ensuring the local tax authorities can easily identify the individual responsible for the property.

The second section requires detailed property information. This includes the property address, type, and current market valuation—all fundamental for taxation purposes. The third section delves into financial information, including existing liens or debts associated with the property, further informing the tax assessment process.

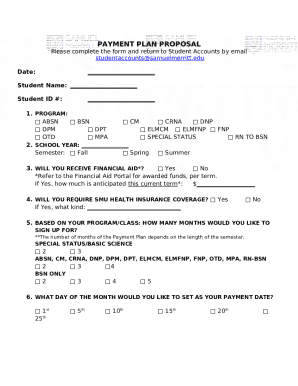

Step-by-step instructions for filling out the CT-12 form

Filing the quot-ct-12 form can seem complicated, but with a structured approach, it can be a straightforward task. Start by gathering all necessary documents, such as proof of ownership, property tax statements, and any previous assessments. These documents will facilitate accurate completion of each section of the form.

The first step involves completing Section 1 with your personal information. Make sure to double-check your contact details to avoid any potential communication issues. Next, move to Section 2, where you will enter specific details about the property including its address and current assessed value. Finally, complete Section 3 with any financial debts or liens. Do not forget to review and verify the information thoroughly before submission to ensure accuracy and to prevent any delays in processing.

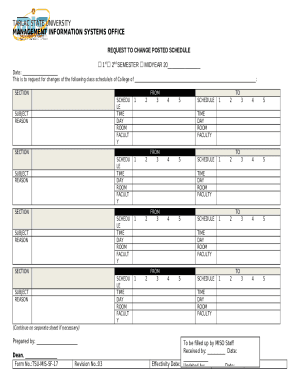

Editing and managing the CT-12 form

After filling out the quot-ct-12 form, it’s crucial to have the ability to edit and manage the document efficiently. Utilizing tools like pdfFiller allows users to edit PDF forms seamlessly, ensuring that all entries can be corrected or updated as needed before final submission. This platform not only facilitates editing but also enables collaborative document management.

With pdfFiller, users can save, share, and resubmit the CT-12 form with ease, streamlining the process to ensure timely filing. The platform’s cloud-based approach ensures that documents can be accessed from anywhere, effectively catering to the needs of individuals and teams that require comprehensive solutions for document management.

eSigning the CT-12 form

In the digital age, using electronic signatures has become increasingly popular for document submission, and the quot-ct-12 form is no exception. With pdfFiller, users can easily eSign their documents, ensuring a secure and legally binding signature process. The convenience of eSigning allows for quick execution of the form without the need for physical presence.

To eSign within pdfFiller, follow a simple step-by-step guide: first, select the eSignature option; then, choose your preferred method of signing, either by typing, drawing, or uploading a signature image. Once completed, ensure that the document is saved appropriately for submission. It's crucial to understand that electronically signed documents carry the same legal weight as traditional signatures, thereby enhancing the efficiency of filing the CT-12 form.

Common mistakes to avoid when filing the CT-12 form

Filing the quot-ct-12 form can present several common pitfalls that filers should strive to avoid. One frequent error involves incorrect personal information entries, which can lead to processing delays or communication issues with tax authorities. Ensure that all details, including names, addresses, and contact information, are accurately inputted.

Another common mistake is neglecting to review all sections thoroughly. Failing to check Section 2 and Section 3 for accuracy can lead to incorrect data being submitted. If errors are discovered after submission, it’s important to know how to correct them promptly to minimize potential penalties.

What happens after filing the CT-12 form?

Once the quot-ct-12 form is filed, the waiting period begins. Processing times can vary depending on the volume of submissions at local tax offices, but typically, filers should expect to receive feedback within a few weeks. Understanding the potential outcomes—whether approval or denial—is crucial for the next steps in property management.

Should the form be approved, property owners can expect to receive confirmation and continued compliance with their current assessment. However, if denied, it's important to review the reasons for denial and gather any additional documentation that may be required for a refile. Staying organized and proactive during this period can streamline follow-up actions.

Frequently asked questions (FAQs) about the CT-12 form

Filing the quot-ct-12 form often prompts various questions, the answers to which can significantly ease the filing process. One common query is about the necessary documents required for submission—clarifying what constitutes proof of ownership and assessment values is key.

Another frequent concern revolves around timelines: how soon after filing should participants expect to receive feedback? Providing clear timelines assists filers in planning their next steps efficiently. Additionally, addressing misunderstandings about terms used in the CT-12 form ensures filers fully comprehend the information they are submitting.

Related forms and additional filing resources

Understanding the quot-ct-12 form in context often requires consideration of related forms and additional resources. Property owners may also find themselves needing to file other connected forms like the homestead exemption applications or various property tax appeal forms, all of which have distinct requirements and timelines.

A comparative analysis of the CT-12 with these related documents helps filers understand their obligations better. Furthermore, accessing regulatory websites for the latest updates on property tax regulations can provide essential guidance and support through the filing process.

Penalties and consequences for incorrect filing

Failure to accurately file the quot-ct-12 form can result in various penalties, including fines or a reassessment of property values that could lead to higher taxes. Being aware of these potential consequences emphasizes the importance of diligent completion of the form.

Resources for seeking advice are abundant for property owners unsure about the filing process. Consulting with tax professionals can provide peace of mind and ensure compliance. Understanding best practices is key to maximizing efficiency and reducing potential liability in filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit quot-ct-12 from Google Drive?

Where do I find quot-ct-12?

How do I fill out quot-ct-12 on an Android device?

What is quot-ct-12?

Who is required to file quot-ct-12?

How to fill out quot-ct-12?

What is the purpose of quot-ct-12?

What information must be reported on quot-ct-12?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.