Get the free CHECKLIST FOR ESTATE TAXES

Show details

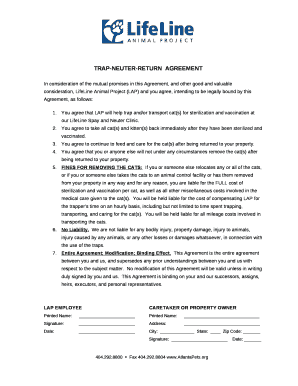

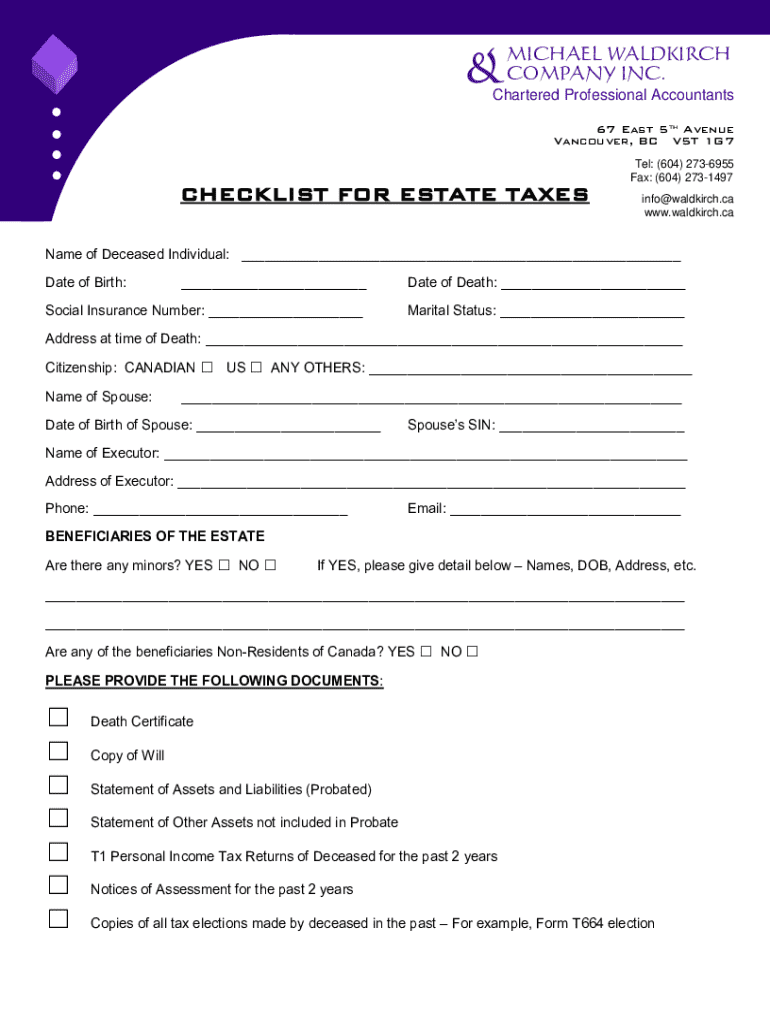

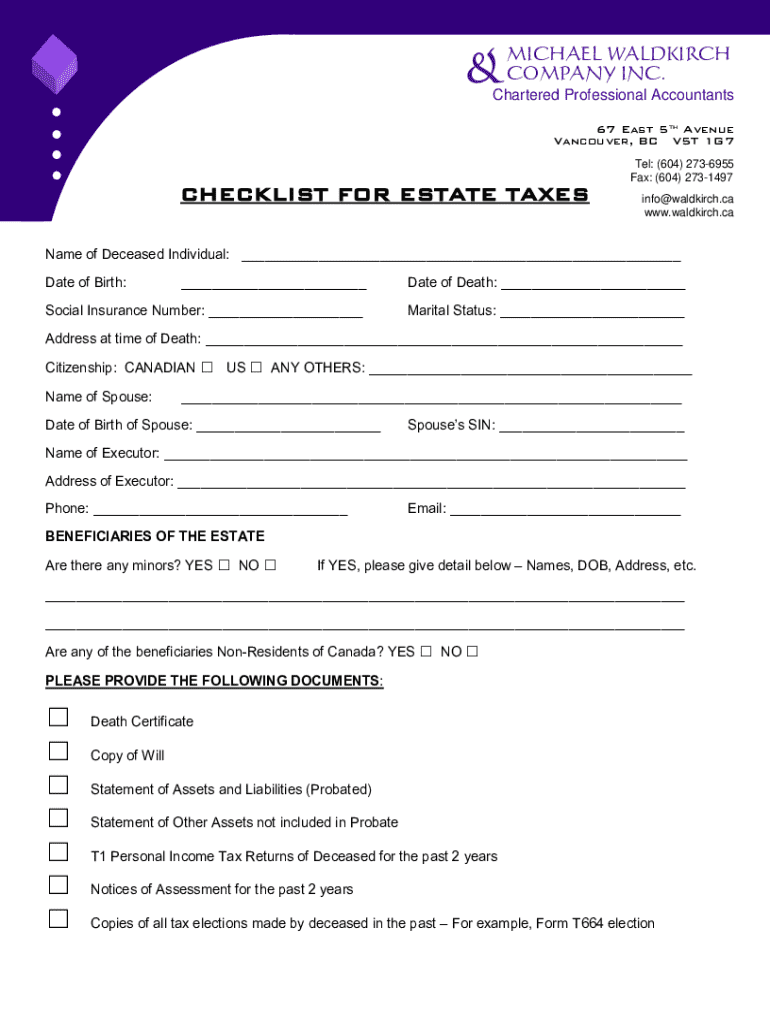

&MICHAEL WALDKIRCH COMPANY INC.Chartered Professional Accountants 67 East 5th Avenue Vancouver, BC V5T 1G7CHECKLIST FOR ESTATE TAXESTel: (604) 2736955 Fax: (604) 2731497 info@waldkirch.ca www.waldkirch.caName

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checklist for estate taxes

Edit your checklist for estate taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checklist for estate taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing checklist for estate taxes online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit checklist for estate taxes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checklist for estate taxes

How to fill out checklist for estate taxes

01

Gather all necessary financial documents, including tax returns, bank statements, and asset records.

02

Compile a list of all assets, including real estate, investments, and personal property.

03

Determine the value of each asset as of the date of death.

04

Identify any debts and liabilities that need to be settled.

05

Calculate the total gross estate by adding the value of all assets and subtracting liabilities.

06

Assess potential deductions, such as funeral expenses, debts, and estate administration costs.

07

Complete the required estate tax forms, ensuring accuracy of all information.

08

File the estate tax return by the appropriate deadline, keeping copies of all submitted documents.

09

Consult a tax professional or attorney if additional guidance is needed.

Who needs checklist for estate taxes?

01

Individuals who have a taxable estate based on the total value of their assets.

02

Executors or administrators of estates who are responsible for filing estate tax returns.

03

Beneficiaries who need to understand potential tax implications on inherited assets.

04

Estate planning professionals assisting clients in preparing for potential tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in checklist for estate taxes?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your checklist for estate taxes to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the checklist for estate taxes in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your checklist for estate taxes and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit checklist for estate taxes on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share checklist for estate taxes on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is checklist for estate taxes?

A checklist for estate taxes is a detailed list of the necessary documents, forms, and steps required to properly prepare and file estate taxes after an individual's death.

Who is required to file checklist for estate taxes?

Estates that exceed the federal estate tax exemption limit or the applicable state exemption limit are required to file a checklist for estate taxes. Typically, the executor or administrator of the estate is responsible for this filing.

How to fill out checklist for estate taxes?

To fill out the checklist for estate taxes, gather all necessary documents related to the estate's assets, liabilities, and deductions. Follow the guidelines outlined in the checklist, ensuring that each item is completed accurately and any required forms are attached.

What is the purpose of checklist for estate taxes?

The purpose of the checklist for estate taxes is to ensure compliance with tax regulations, facilitate the accurate reporting of the estate's financial affairs, and to aid in the calculation of any tax liability owed.

What information must be reported on checklist for estate taxes?

The checklist for estate taxes typically requires reporting information such as the value of the estate's assets, liabilities, details of gifts made in the taxable period, funeral expenses, and any other deductions that may apply.

Fill out your checklist for estate taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checklist For Estate Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.