Get the free Corrective Account

Show details

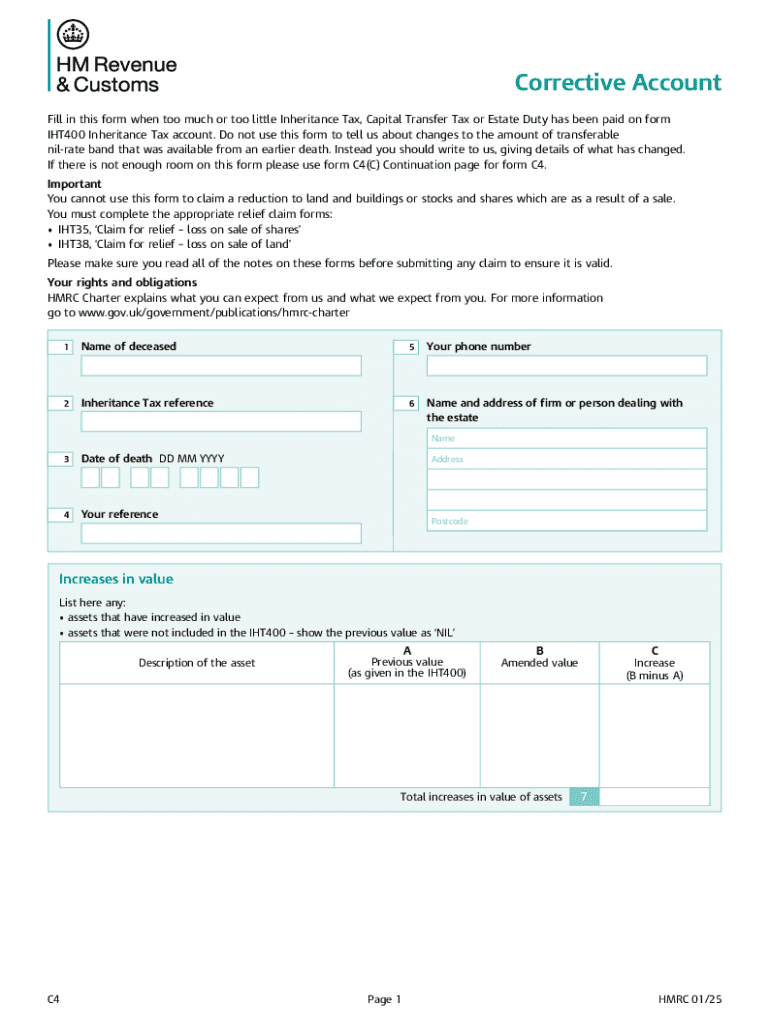

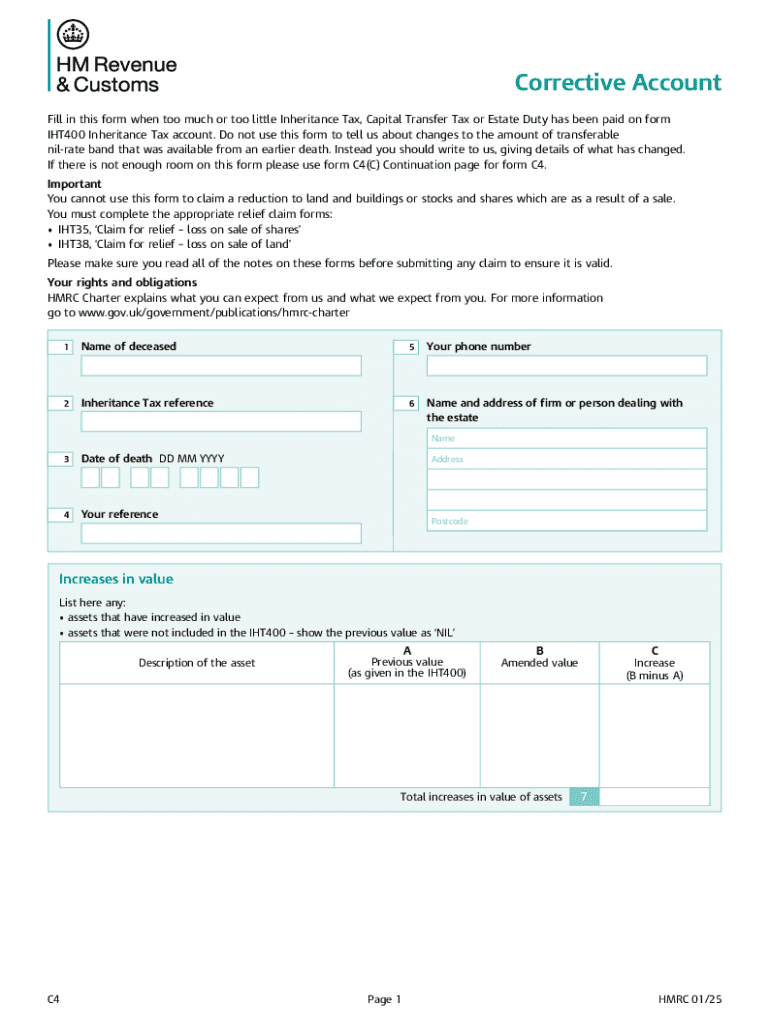

Este formulario se debe llenar cuando se ha pagado de más o de menos el Impuesto sobre Sucesiones, el Impuesto sobre Transferencias de Capital o el Derecho de Sucesión en el formulario IHT400. No se debe utilizar este formulario para informar sobre cambios en el monto del umbral transferible nil-rate disponible de una muerte anterior. Se deben usar formularios de reclamación de alivio apropiados si corresponde.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corrective account

Edit your corrective account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corrective account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corrective account online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corrective account. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corrective account

How to fill out corrective account

01

Gather all necessary documentation related to the account that requires correction.

02

Log into the corrective account system with your credentials.

03

Locate the specific account that needs correction.

04

Review the details of the account to identify errors or required changes.

05

Fill out the corrective form, providing accurate information for each required field.

06

Attach supporting documents if necessary to validate the corrections.

07

Verify all information entered for accuracy and completeness.

08

Submit the corrective account form for review.

09

Monitor the status of the submission for any updates or further actions required.

Who needs corrective account?

01

Individuals who have made errors in their accounts.

02

Businesses needing to rectify discrepancies in financial records.

03

Organizations that need to comply with regulatory requirements.

04

Professionals managing accounts that have inaccurate information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corrective account to be eSigned by others?

corrective account is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit corrective account on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing corrective account.

How do I fill out corrective account using my mobile device?

Use the pdfFiller mobile app to fill out and sign corrective account. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is corrective account?

A corrective account is a financial statement or document used to rectify or amend previously filed financial information or records that were found to be inaccurate or incomplete.

Who is required to file corrective account?

Anyone who has submitted financial reports that contain errors, such as individuals, businesses, or organizations, may be required to file a corrective account to ensure compliance with financial reporting regulations.

How to fill out corrective account?

To fill out a corrective account, one should identify the errors in the original account, provide accurate information for each affected item, include explanations for the corrections, and submit the revised account following the prescribed format.

What is the purpose of corrective account?

The purpose of a corrective account is to rectify mistakes in previous financial reports, ensure accuracy in financial records, maintain transparency, and comply with legal or regulatory requirements.

What information must be reported on corrective account?

The information that must be reported on a corrective account typically includes the corrected data for the errors, a description of the changes made, the reasons for the corrections, and any supporting documentation as required.

Fill out your corrective account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corrective Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.