Get the free Creditors - Secured and Unsecured / Créanciers - Garantis Et Non-garantis

Show details

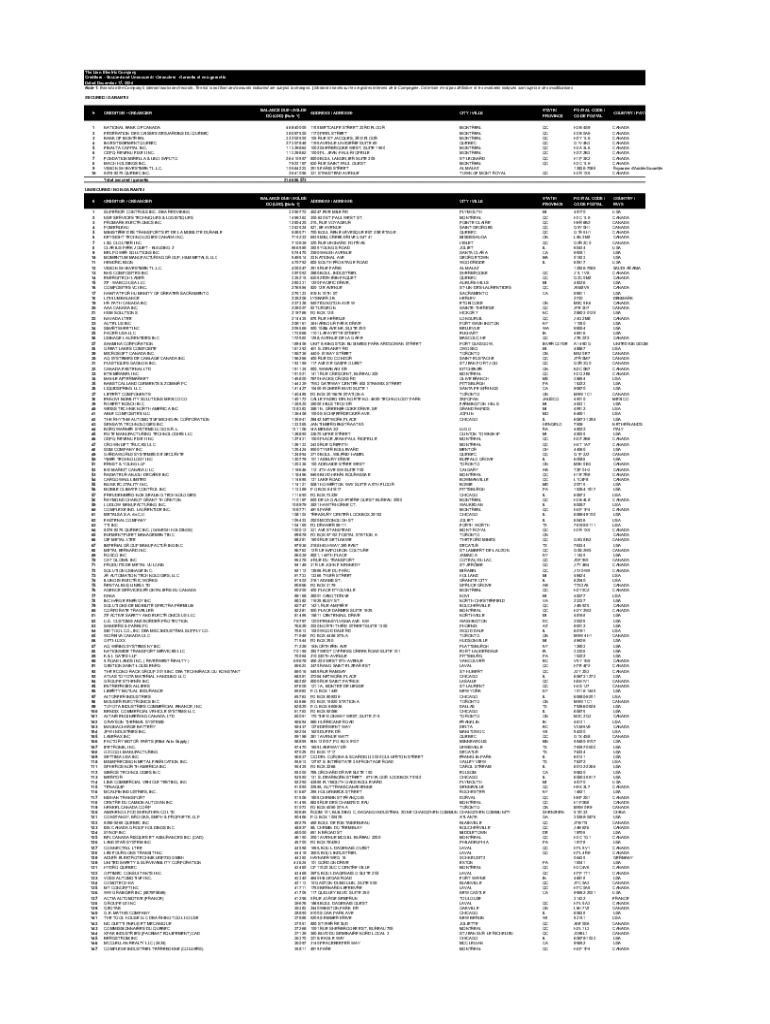

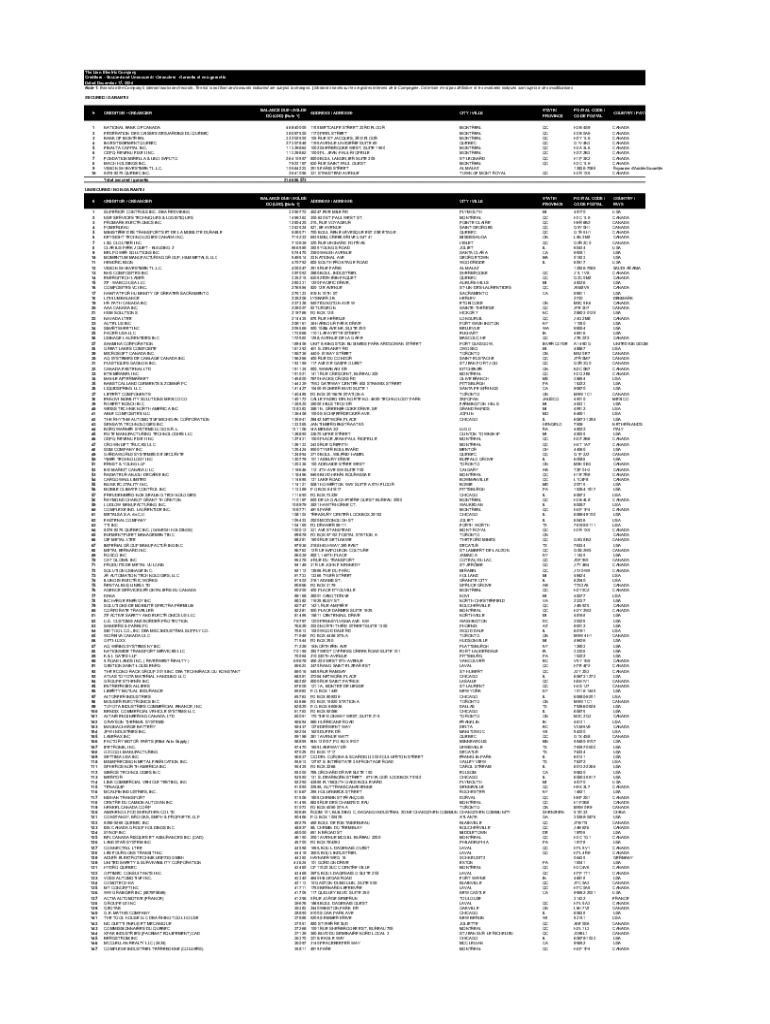

Liste des créanciers garantis et non garantis de la Lion Electric Company, datée du 17 décembre 2024, comprenant les montants dus et les adresses des créanciers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creditors - secured and

Edit your creditors - secured and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditors - secured and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit creditors - secured and online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit creditors - secured and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditors - secured and

How to fill out creditors - secured and

01

Gather necessary documents related to your secured debts, such as loan agreements and titles.

02

Identify all secured creditors, including banks, credit unions, and lending institutions.

03

Provide your personal information including your name, address, and contact details.

04

List each secured creditor individually, including the amount owed and the type of collateral pledged.

05

Describe the type of security for each creditor, such as a vehicle, property, or equipment.

06

Ensure accuracy in the details provided to prevent discrepancies.

07

Review the completed information for accuracy before submission.

Who needs creditors - secured and?

01

Individuals or businesses with secured loans or debts.

02

People undergoing bankruptcy proceedings.

03

Creditors seeking to understand their secured positions.

04

Financial institutions requiring verification of security interests.

05

Anyone restructuring their debts or negotiating terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit creditors - secured and online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your creditors - secured and to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my creditors - secured and in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your creditors - secured and right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out creditors - secured and on an Android device?

Use the pdfFiller mobile app to complete your creditors - secured and on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is creditors - secured and?

Secured creditors are those who have a legal claim to specific assets or collateral in the event of a debtor's default. Their debt is backed by an asset, which means they have a higher likelihood of recouping their investment.

Who is required to file creditors - secured and?

Individuals or entities that hold a secured claim against a debtor are typically required to file creditors - secured. This includes banks, financial institutions, and suppliers who have liens or other security interests in property.

How to fill out creditors - secured and?

To fill out creditors - secured, one must provide details such as the debtor's information, the amount owed, the specific collateral secured, and any relevant documentation that supports the claim.

What is the purpose of creditors - secured and?

The purpose of creditors - secured is to provide a formal record of secured debts, which helps establish the priority of claims in bankruptcy proceedings and ensures that secured creditors can pursue their rights over the collateral.

What information must be reported on creditors - secured and?

On creditors - secured, the reported information must include the name and contact details of the secured creditor, the debtor's information, a description of the collateral, the amount owed, and any agreements related to the secured claim.

Fill out your creditors - secured and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creditors - Secured And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.