Get the free Credit Application - FA International

Show details

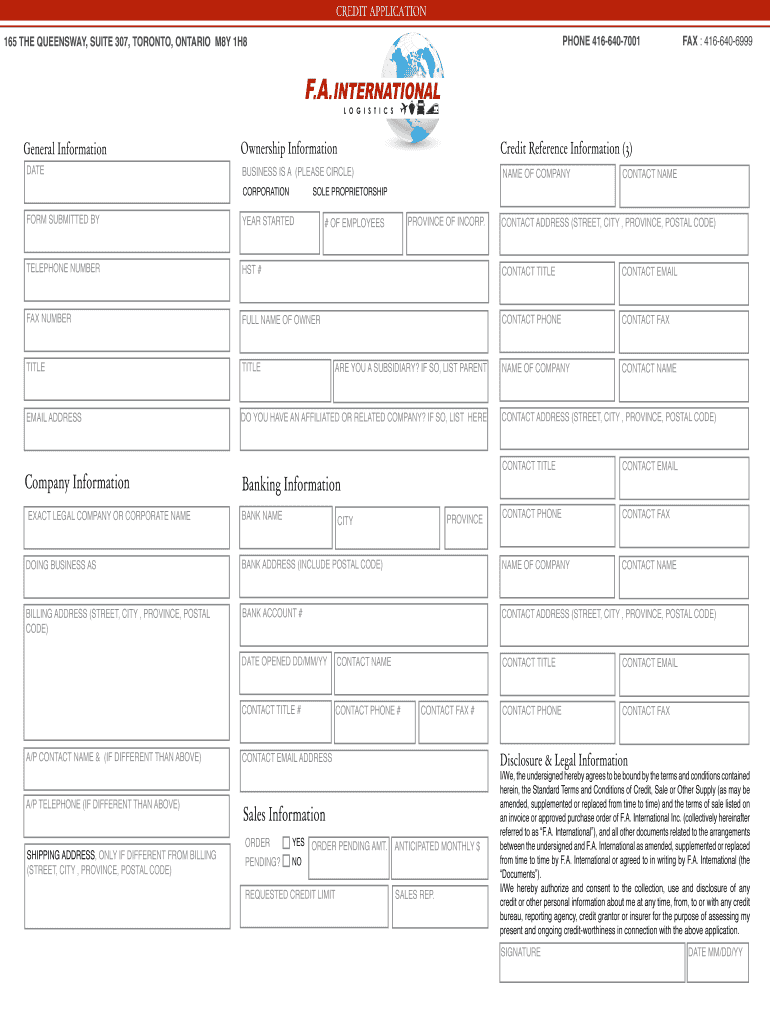

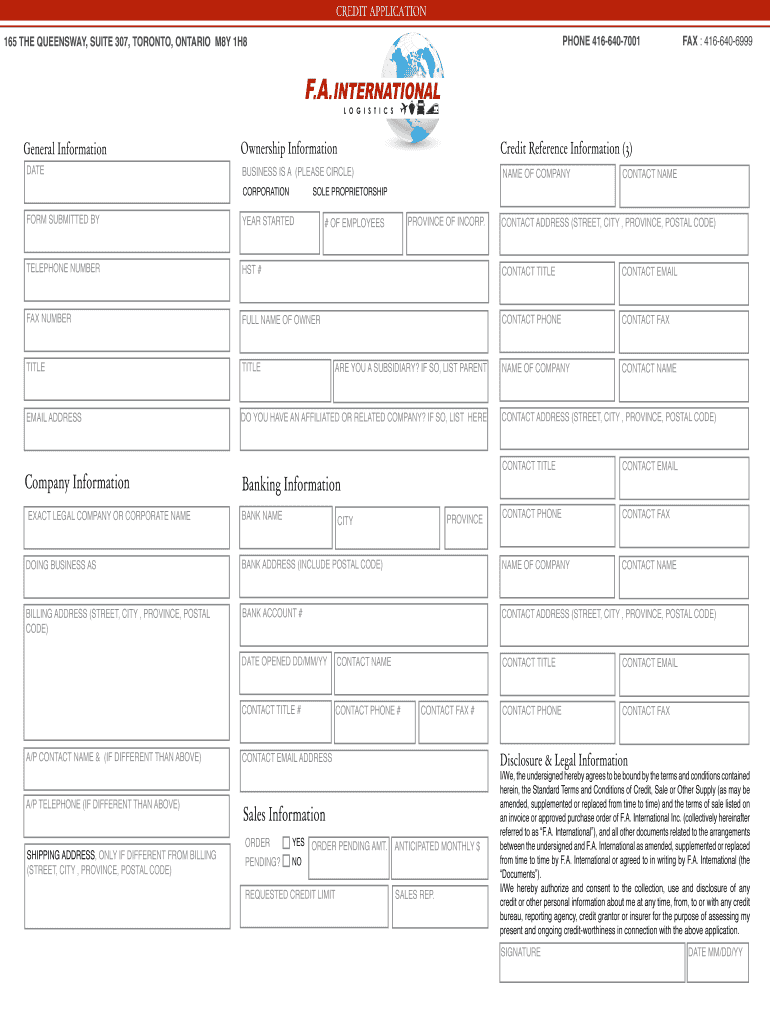

CREDIT APPLICATION 165 THE QUEENSWAY, SUITE 307, TORONTO, ONTARIO M8Y 1H8 General Information DATE Ownership Information FAX : 416-640-6999 Credit Reference Information (3) BUSINESS IS A (PLEASE CIRCLE)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application - fa

Edit your credit application - fa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application - fa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application - fa online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application - fa. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application - fa

How to Fill Out Credit Application - FAQs:

01

Start by gathering all necessary information: Before filling out a credit application, make sure you have all the required information handy. This includes your personal details such as your full name, contact information, social security number, address, and employment details.

02

Understand the form: Familiarize yourself with the structure and layout of the credit application form. Identify the different sections, such as personal information, employment history, financial details, and references. Knowing how the form is organized will help you complete it accurately.

03

Provide accurate personal information: Fill in your personal information accurately and honestly. Make sure to double-check your contact details, including your phone number and email address, to ensure that the lender can easily reach you if needed.

04

Enter employment details: Include details about your current employment, such as your employer's name, address, and contact information. Provide accurate information regarding your job title, salary, and length of employment. If you have recently changed jobs, provide information about your previous employment as well.

05

Present your financial information: Fill out the financial section of the credit application with care. This typically involves disclosing your income, monthly expenses, and any existing debts or obligations. Providing accurate financial details will help the lender assess your creditworthiness and determine your ability to repay the loan.

06

Provide references: Some credit applications may require you to provide references who can verify your character and vouch for your reliability. Choose individuals who know you well and are willing to provide a reference if contacted by the lender.

07

Read and understand the terms and conditions: Before submitting your credit application, carefully read through all the terms and conditions outlined on the form. Make sure you comprehend the interest rates, repayment terms, and any associated fees or penalties. If you have any questions or doubts, do not hesitate to seek clarification from the lender.

Who needs credit application - FAQs?

01

Individuals applying for a loan: Anyone seeking loans, whether it's a personal loan, a mortgage, or an auto loan, may need to fill out a credit application. Lenders use these applications to evaluate the borrower's creditworthiness and assess the risk involved in extending credit.

02

Small business owners: Entrepreneurs and small business owners often need to access credit to fund their business operations. When applying for business loans or lines of credit, they are typically required to fill out credit applications to provide necessary information about their business and financial history.

03

Renters and tenants: When moving into a new rental property, landlords often require potential tenants to fill out a credit application. This allows landlords to evaluate the tenant's financial stability and determine their ability to pay rent consistently and reliably.

04

Individuals applying for credit cards: Credit card companies usually require applicants to complete credit applications to assess their creditworthiness and determine their credit limit. The information provided on these applications helps determine whether the applicant will be approved for a credit card and what terms will apply.

05

Those seeking to establish or repair credit: People who are new to credit or looking to improve their credit score may need to apply for credit products specifically designed for this purpose. These individuals may need to fill out credit applications to initiate the process of building or rebuilding their credit history.

Remember, it's essential to consider that the specific requirements and processes may vary depending on the lender and the type of credit application being filled out. Always follow instructions provided by the lender and provide accurate and truthful information to increase the chances of success in your credit application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit application - fa?

Credit application - fa stands for a credit application form in Farsi.

Who is required to file credit application - fa?

Businesses or individuals seeking credit or loans are required to file a credit application - fa.

How to fill out credit application - fa?

To fill out a credit application - fa, one must provide personal and financial information requested on the form.

What is the purpose of credit application - fa?

The purpose of credit application - fa is to assess the creditworthiness of the applicant.

What information must be reported on credit application - fa?

Information such as personal details, employment history, financial statements, and credit references must be reported on a credit application - fa.

Can I sign the credit application - fa electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your credit application - fa in seconds.

How do I fill out the credit application - fa form on my smartphone?

Use the pdfFiller mobile app to fill out and sign credit application - fa. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit credit application - fa on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as credit application - fa. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your credit application - fa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application - Fa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.