Get the free Chapter 313 Annual Eligibility Report Form

Get, Create, Make and Sign chapter 313 annual eligibility

Editing chapter 313 annual eligibility online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 313 annual eligibility

How to fill out chapter 313 annual eligibility

Who needs chapter 313 annual eligibility?

Chapter 313 Annual Eligibility Form: A Comprehensive How-To Guide

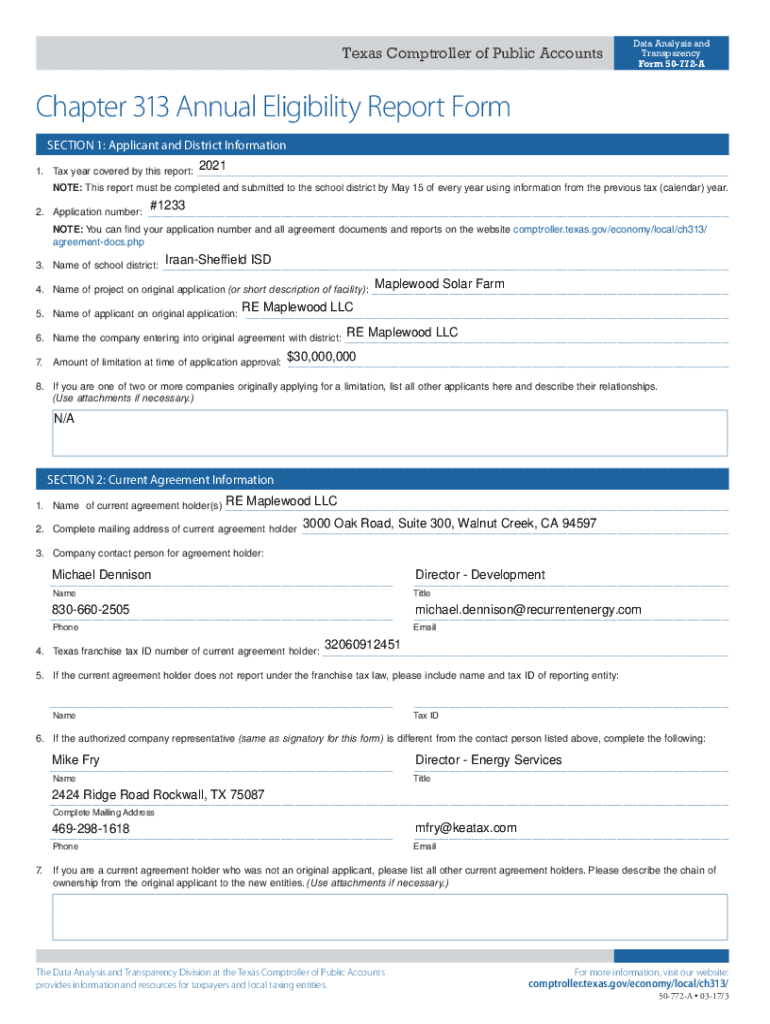

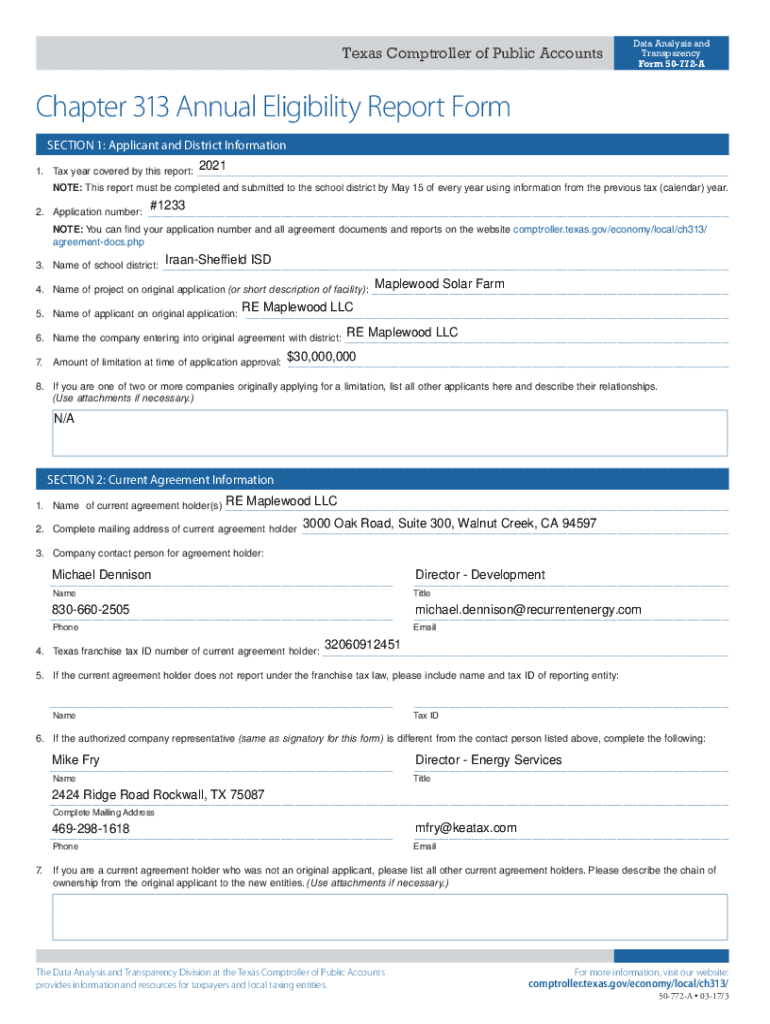

Overview of the Chapter 313 Annual Eligibility Form

Chapter 313 of the Texas Tax Code is pivotal for promoting economic growth by providing certain tax incentives to businesses. The Chapter 313 Annual Eligibility Form is an essential document that allows businesses to apply for and maintain eligibility for these tax programs. This form plays a crucial role in ensuring compliance and enables businesses to benefit from significant property tax reductions while committing to create jobs and invest in local economies.

Filers should be aware that not every business qualifies for these tax benefits. Specifically, industries eligible include renewable energy, manufacturing, and research and development, making it vital for interested parties to assess their status before filing.

Key concepts and definitions

Before diving into the details of the Chapter 313 Annual Eligibility Form, it's crucial to understand the key concepts and terms associated with it. The eligibility requirements are designed to ensure that only businesses making significant investments and contributions to the local economy can take advantage of reduced tax rates.

Preparation for filling out the form

Filling out the Chapter 313 Annual Eligibility Form requires careful preparation to ensure all requirements are met. Having the appropriate documents ready beforehand will streamline the completion process.

Documents required for completion

Tools for efficient document management

Utilizing effective tools can significantly ease the burdens of document preparation. For example, pdfFiller provides robust document management capabilities through its cloud-based platform.

Step-by-step guide to completing the Chapter 313 form

Completing the Chapter 313 Annual Eligibility Form can be straightforward if you follow these step-by-step instructions.

Common mistakes to avoid

Numerous pitfalls can arise when completing the Chapter 313 Annual Eligibility Form. Understanding these common mistakes can save you significant time and effort in the submission process.

Editing and signing the form using pdfFiller

pdfFiller offers extensive features that make editing and signing your Chapter 313 Annual Eligibility Form efficient and quick.

Utilizing pdfFiller’s editing features

Submitting the Chapter 313 Annual Eligibility Form

Once the form is completed and signed, the next step is submission. It is crucial to know your options and timelines to ensure an efficient process.

Post-submission actions

After submitting your Chapter 313 Annual Eligibility Form, it's important to understand the subsequent steps in order to maintain compliance and reap the expected tax benefits.

FAQs about the Chapter 313 Annual Eligibility Form

Having access to accurate information is critical when managing your submission, so here are some frequently asked questions regarding the Chapter 313 Annual Eligibility Form.

Tools and resources offered by pdfFiller

pdfFiller empowers users by facilitating a streamlined and effective document management experience ideal for completing forms like the Chapter 313 Annual Eligibility Form.

Advanced tips for organizations

Organizations can leverage pdfFiller in a myriad of ways to enhance their submission processes and overall operational efficiency.

Conclusion: Maximizing the benefits of the Chapter 313 Annual Eligibility Form

Successfully navigating the Chapter 313 Annual Eligibility Form can greatly impact your business's financial landscape through tax relief. By adhering to best practices in preparation, filing, and post-submission processes, you set your business up for long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chapter 313 annual eligibility in Chrome?

Can I create an electronic signature for signing my chapter 313 annual eligibility in Gmail?

How do I complete chapter 313 annual eligibility on an iOS device?

What is chapter 313 annual eligibility?

Who is required to file chapter 313 annual eligibility?

How to fill out chapter 313 annual eligibility?

What is the purpose of chapter 313 annual eligibility?

What information must be reported on chapter 313 annual eligibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.