Get the free Chapter 313 Annual Eligibility Report Form

Get, Create, Make and Sign chapter 313 annual eligibility

How to edit chapter 313 annual eligibility online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 313 annual eligibility

How to fill out chapter 313 annual eligibility

Who needs chapter 313 annual eligibility?

Chapter 313 Annual Eligibility Form – How-to Guide

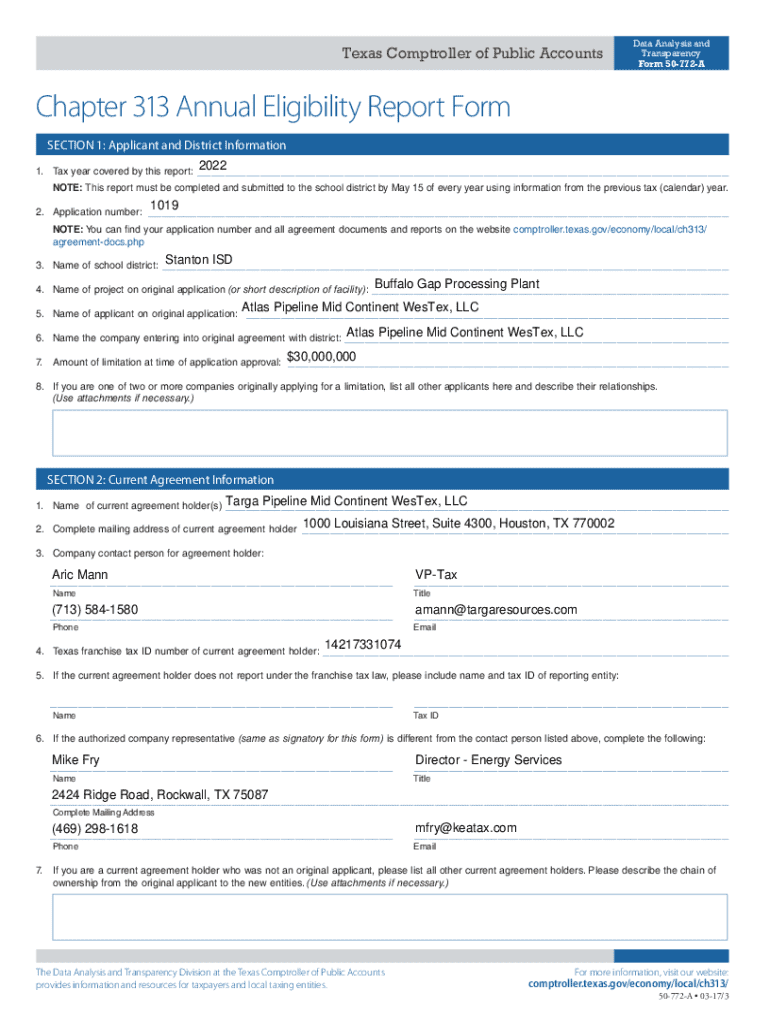

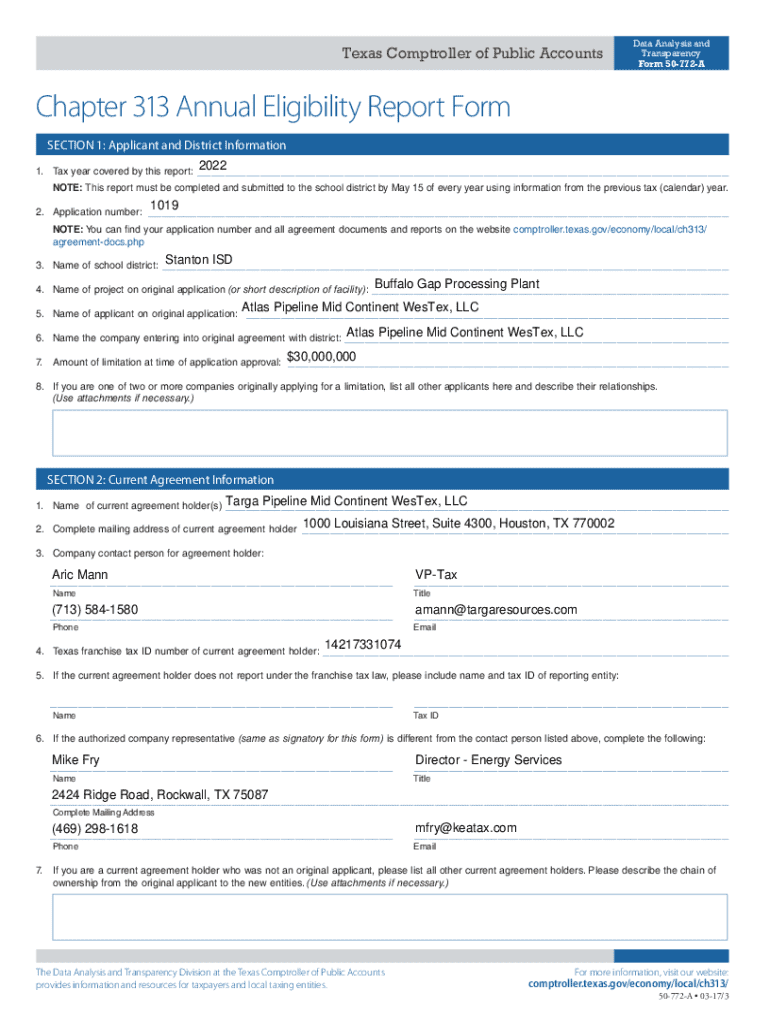

Overview of the Chapter 313 Annual Eligibility Form

The Chapter 313 Annual Eligibility Form is a critical document designed to facilitate the assessment and verification of eligibility for individuals and teams involved in specific programs governed by Chapter 313. The form plays a vital role in identifying applicants who meet the necessary criteria, ensuring that only qualified candidates proceed in the application process.

Proper management of this document is essential for both individuals and teams, as it impacts the overall efficiency of document handling. Accurate completion of the form ensures that applicants do not miss out on valuable opportunities that Chapter 313 offers.

Understanding the Chapter 313 program

The Chapter 313 program aims to provide financial incentives in the form of property tax abatements for businesses looking to invest in Texas and generate new local jobs. The program's goals are both economic development and job creation, encouraging companies to operate and expand within the state.

Eligibility for the Chapter 313 program is broad, covering a range of businesses across varied sectors. However, not all entities automatically qualify. Understanding the nuanced criteria for eligibility is crucial as it defines who can benefit from the program. Businesses must review their circumstances against these criteria before submission of the form.

Completing the Chapter 313 Annual Eligibility Form also brings numerous benefits, including potential tax savings, which can be reinvested in the business, thus further bolstering economic impact in local communities.

Step-by-step instructions for filling out the Chapter 313 form

Completing the Chapter 313 Annual Eligibility Form requires attention to detail, as multiple sections gather essential information about the applicant. Each section must be filled accurately to avoid delays in the approval process.

Section 1: Personal and business information

Personal and business information consist of critical data such as the name of the business, owner details, and contact information. Ensure that all fields are filled out completely and accurately, as errors can lead to submission rejection.

For best practices, consider using a checklist to ensure all required information is compiled before starting the form.

Section 2: Eligibility criteria verification

In this section, applicants verify their eligibility by providing necessary documentation. This often includes proofs like tax returns, investment reports, and projections of job creation. Each document must be relevant and correctly formatted; otherwise, it can result in processing delays.

Section 3: Review and confirmation

After completing the form, review all inputted information meticulously. Errors or omissions can lead to rejection or delays. A thorough review is a safeguard to ensure that what you submit reflects true and accurate information.

Completion of this review process is vital as it lays the foundation for a successful application.

Editing and customizing your Chapter 313 form

Editing your Chapter 313 Annual Eligibility Form can streamline the application process, ensuring clarity and precision. pdfFiller offers essential tools for modifying your documents efficiently.

How to edit the form using pdfFiller tools

Using pdfFiller, users can easily edit their forms using an intuitive interface. Key tools include text editing, annotation features, and pre-filling capabilities for frequently used information.

Adding digital signatures

Digital signatures not only enhance the credibility of your application but also expedite the submission process. pdfFiller provides a secure and efficient way to sign documents electronically.

Submitting your Chapter 313 Annual Eligibility Form

After editing and signing the Chapter 313 Annual Eligibility Form, the next crucial step is submission. Understanding your submission options is vital to ensure your application reaches the appropriate department without delay.

Submission options: Online vs. Physical submission

You can submit your Chapter 313 form either online or via physical mail. While both have their advantages, choosing the right method can greatly affect your submission's processing time.

Tracking submission status

Once submitted, tracking your application status is crucial to know if additional information is required or if the application is progressing successfully. pdfFiller provides tools that allow you to monitor your submission status effectively.

Managing your Chapter 313 documentation

Once your Chapter 313 form is completed and submitted, effective management of your documents becomes essential. Proper organization ensures you can quickly retrieve necessary information as needed.

Organizing and storing your form in pdfFiller

pdfFiller offers advanced organizational features to help you store and manage the Chapter 313 documentation systematically. Users can create folders, manage access permissions, and utilize tagging systems for ease of retrieval.

Collaborative features for teams

For teams working on Chapter 313 submissions, collaboration is key. Utilizing pdfFiller’s collaborative features, teams can work simultaneously on the form, thanks to real-time editing and commenting systems.

Common challenges and solutions

While filling out the Chapter 313 Annual Eligibility Form, applicants may encounter various challenges. Identifying common issues early on can save time and effort in the long run.

If you face any challenges, contacting support through pdfFiller can offer immediate solutions and additional guidance.

Additional tools and resources

Having access to additional tools can enhance the experience of managing the Chapter 313 Annual Eligibility Form. pdfFiller offers various resources that provide insights into related documents and forms.

Best practices for using pdfFiller for document management

To fully leverage pdfFiller's capabilities in managing the Chapter 313 Annual Eligibility Form, employing best practices is valuable. A well-organized approach can enhance efficiency and productivity.

Future updates and changes to the Chapter 313 program

Staying informed about potential updates or changes within the Chapter 313 program is crucial for current and future applicants. Regularly checking for updates can ensure compliance with evolving requirements.

Managing the Chapter 313 Annual Eligibility Form does not have to be complicated. With the right approach, tools, and knowledge, applicants can navigate the process with confidence and ease.

At pdfFiller, we empower users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, ensuring users can focus on their goals without document management hindrances.

By understanding the intricacies of the Chapter 313 Annual Eligibility Form and properly utilizing pdfFiller’s robust features, applicants can enhance their chances of a successful application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my chapter 313 annual eligibility directly from Gmail?

How do I fill out chapter 313 annual eligibility using my mobile device?

How do I complete chapter 313 annual eligibility on an iOS device?

What is chapter 313 annual eligibility?

Who is required to file chapter 313 annual eligibility?

How to fill out chapter 313 annual eligibility?

What is the purpose of chapter 313 annual eligibility?

What information must be reported on chapter 313 annual eligibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.