Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Understanding Campaign Finance Receipts and Form: A Comprehensive Guide

Understanding campaign finance receipts

Campaign finance receipts serve as vital documentation in the political funding landscape, ensuring transparency and accountability. These records are crucial for verifying that funds received by a campaign comply with legal standards and regulations.

At the heart of this process lies the legal requirement for campaigns to accurately document all contributions and expenditures. Understanding these rules not only protects the integrity of the electoral process but also helps prevent potential violations that could lead to fines or disqualification.

The compliance landscape

In the United States, campaign finance laws are enforced at both the federal and state levels, adding complexity to the compliance process. In general, the Federal Election Commission (FEC) governs federal elections, while each state has its own regulations and agencies overseeing local campaigns.

Failure to adhere to these regulations can have serious repercussions, including hefty fines or damage to a campaign's credibility. Common pitfalls include incomplete documentation and misreporting of contributions, which can jeopardize the entire campaign.

Key forms in campaign finance reporting

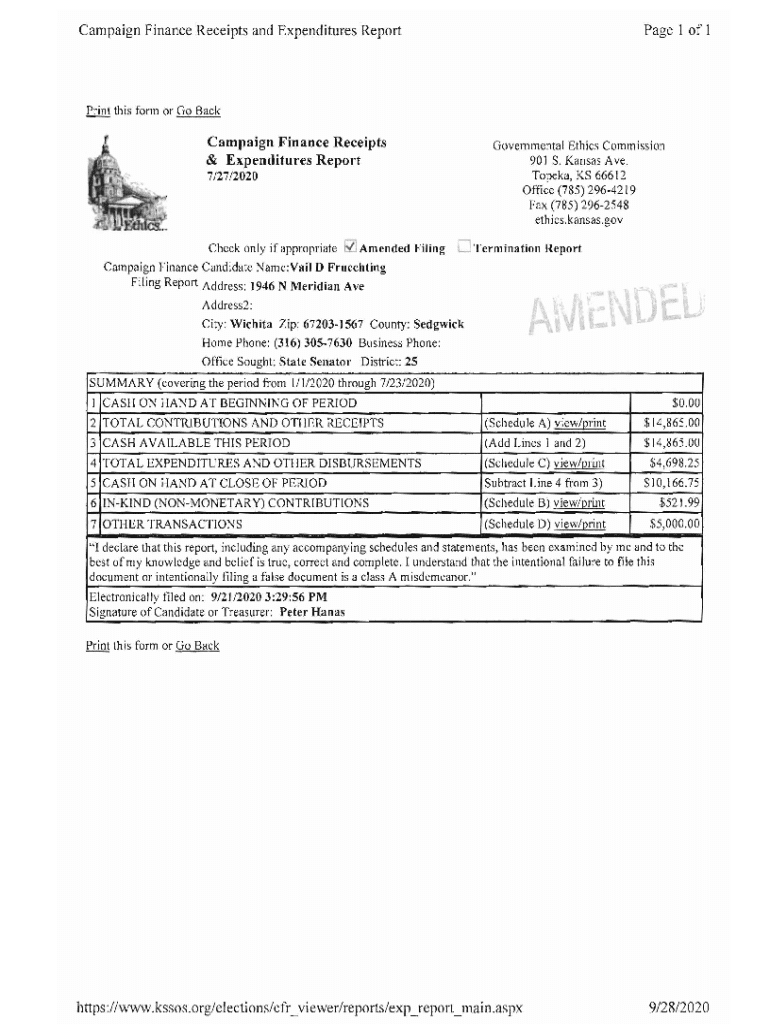

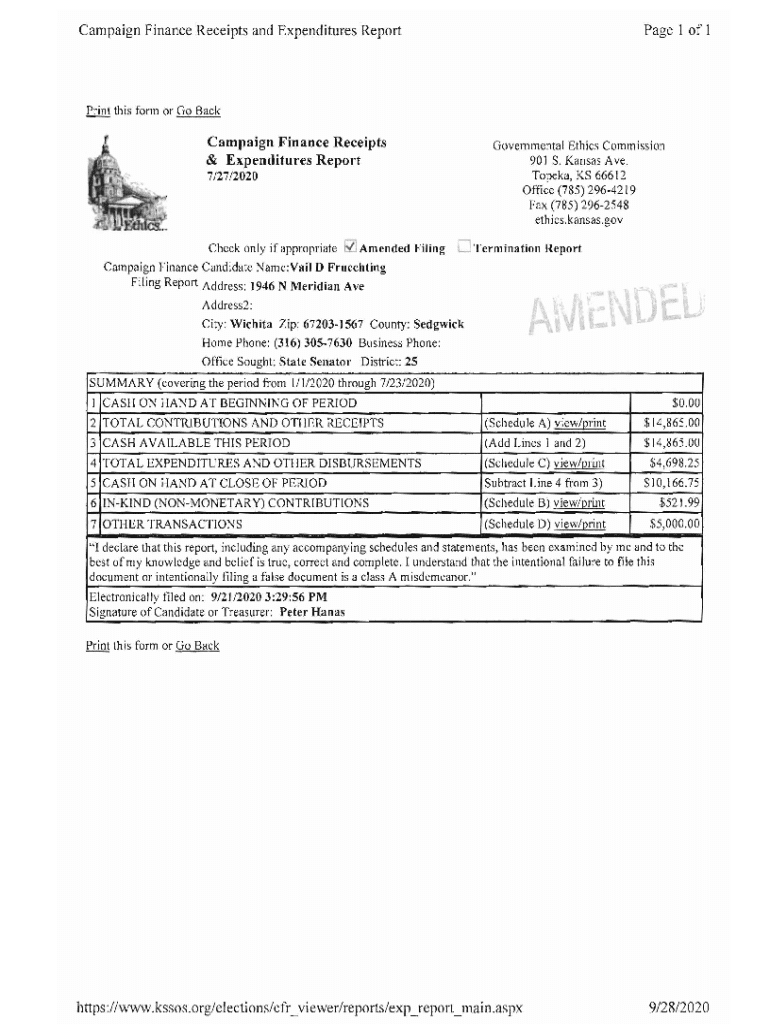

Various forms are utilized to report campaign finance information. Familiarity with these forms can streamline the reporting process and help ensure compliance. One of the most significant forms is the Report of Receipts and Expenditures, with OCF Form 10 being a prevalent example used across many states.

OCF Form 10 is divided into several sections, each serving a distinct purpose in documenting campaign finances. Understanding the structure and requirements of this form is essential for accurate reporting.

Step-by-step guide to filling out campaign finance forms

To successfully complete campaign finance forms, begin by gathering all relevant information concerning contributions and expenditures. This includes donor names, amounts, dates, and the purpose of spending.

Organizing this data efficiently is crucial; consider utilizing tools such as spreadsheets or specific financial software to keep track of all transactions systematically.

Detailed breakdown of OCF Form 10

Electronic filing and tracking

The shift towards electronic filing has revolutionized how campaign finance data is managed. Utilizing cloud-based platforms, such as pdfFiller, allows for real-time editing, signing, and collaborative approaches to managing campaign documents.

Features available on pdfFiller, like eSigning and document tracking, enhance efficiency and compliance. Collaborating on forms digitally minimizes errors and helps teams maintain oversight, critical in adhering to campaign finance laws.

Best practices for managing campaign finance records

Establishing a well-organized filing system is fundamental for maintaining clarity in campaign finance records. Implementing secure cloud storage for electronic documents ensures that critical data is safeguarded and accessible from anywhere.

Regular internal audits are also important for compliance. Scheduling routine reviews of financial data can uncover discrepancies early and protect the campaign from potential violations due to incomplete or inaccurate records.

Common mistakes and how to avoid them

Misreporting contributions or failing to update financial information can lead to severe consequences during audits. Identifying areas at risk for error is essential for maintaining accurate records.

Common mistakes include not categorizing donations properly, neglecting to report loans, and overlooking deadlines for submissions. Developing a checklist for form completion can mitigate these issues effectively.

Frequently asked questions

Mistakes happen, and it’s important to know that corrections can be made. For instance, if you make a mistake on your form, promptly notify the relevant election authority and follow their guidelines for corrections.

Additionally, keeping updated with changes in state or federal finance regulations is crucial. Resources like the FEC and local election boards can provide valuable insights and assistance for candidates and teams navigating this complex landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts and for eSignature?

Can I create an electronic signature for the campaign finance receipts and in Chrome?

How do I fill out campaign finance receipts and using my mobile device?

What is campaign finance receipts and?

Who is required to file campaign finance receipts and?

How to fill out campaign finance receipts and?

What is the purpose of campaign finance receipts and?

What information must be reported on campaign finance receipts and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.