Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A comprehensive guide to credit application forms

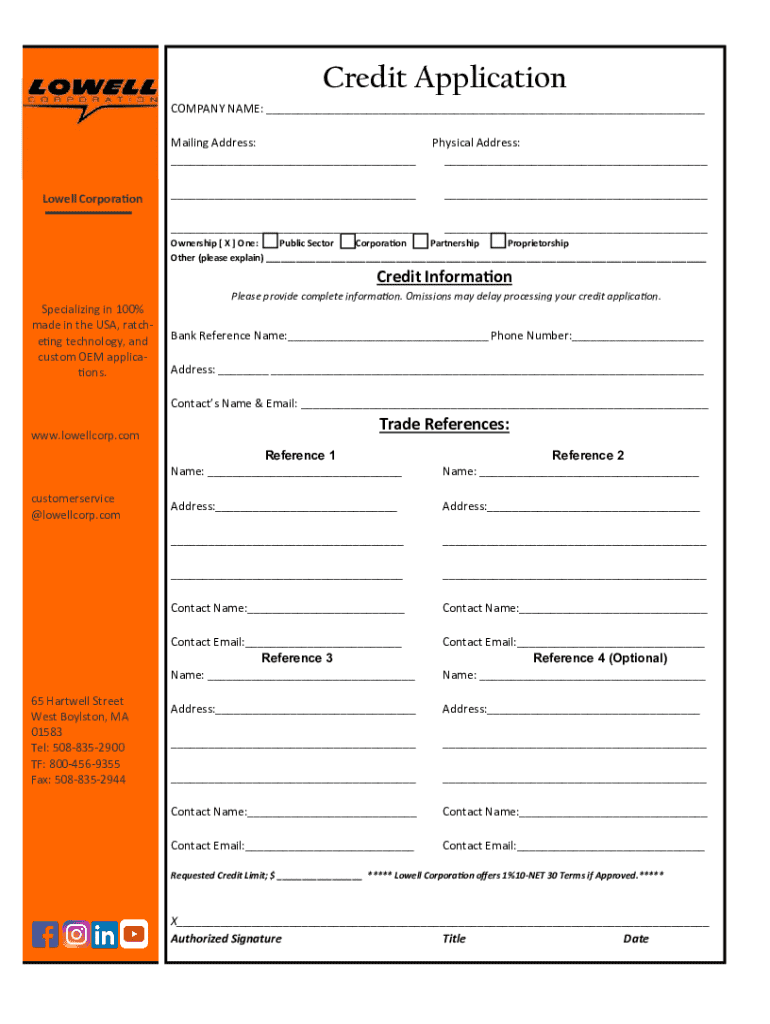

Understanding the credit application form

A credit application form is a formal document used by individuals or businesses to request credit from lenders, banks, or retail companies. It serves as a standardized way for applicants to provide essential information that helps the creditor assess their creditworthiness. By quantifying financial history and personal data, these forms enable lenders to make informed decisions on whether to extend credit.

The purpose of the credit application form goes beyond merely presenting data; it acts as a critical tool in financial transactions, helping to safeguard both lenders and applicants. Accurate information on this form can expedite the approval process, making it integral to secure loans for purchases such as homes, cars, or business expansion.

Types of credit application forms

Credit application forms come in various types, tailored to suit the unique needs of individuals or businesses seeking credit. The two primary categories are personal and business credit application forms, each containing tailored sections for their respective audiences.

Personal credit application forms typically focus on the individual's financial history, while business credit applications delve into the company’s financials, governance structures, and business health. Additionally, these applications can be found in both online and paper formats. Online submissions have gained popularity due to their efficiency and ease of use.

Key components of a credit application form

A credit application form typically contains several critical components that help lenders evaluate the creditworthiness of the applicant. Understanding these components is essential for completing the form accurately and efficiently.

The first section usually collects personal information, including the applicant's name, address, and contact details. Next, employment information is required, detailing the individual's current job, job title, and length of employment. Financial information follows, asking for details regarding income, assets, and existing debts, which provides lenders with a snapshot of the applicant's financial health. Lastly, the form typically requires the applicant’s consent and signature, affirming that the information provided is truthful and complete.

Step-by-step instructions for completing a credit application form

Completing a credit application form can seem daunting, but with the right preparation and understanding, you can make the process straightforward. Start by gathering all required documentation to facilitate filling out the form accurately.

You'll typically need proof of identity, like a driver's license or passport, and financial statements such as recent pay stubs or tax returns. Once you have these on hand, proceed to fill out each section of the form methodically, starting with your personal information, then moving on to your employment and financial details. Finally, do not forget to review the completed form to ensure everything is accurate before submission.

Editing and customizing your credit application form with pdfFiller

Editing and customizing your credit application form can streamline and simplify the application process. With pdfFiller, users can easily upload their credit application forms and use various editing tools available on the platform.

The editing tools allow for text addition or removal and field customization, enabling individuals to create a form tailored to their specific needs. Additionally, pdfFiller helps ensure compliance with legal requirements, so you can rest assured that your document is up to standard.

Saving and sharing your credit application form

Once you've completed your credit application form, saving and sharing it correctly is essential for future reference or submission. PdfFiller provides various options for saving your form, including multiple download formats to suit your needs.

Furthermore, the platform offers seamless cloud storage integration for easy access across devices. You can also share your form securely by emailing it directly from pdfFiller or generating secure links for others to review, preserving your data's confidentiality while ensuring accessibility.

Signing your credit application form digitally

Digital signatures have revolutionized the document signing process, and understanding their legality is essential when signing a credit application form. Electronic signatures are generally regarded as legally binding in many jurisdictions, allowing users to sign their forms quickly and efficiently.

Using pdfFiller, adding an electronic signature is convenient. This method simplifies the approval timeline, as documents can be signed from anywhere, streamlining the entire credit application process.

Frequently asked questions about credit application forms

Navigating credit applications can lead to many questions, and it's crucial to address these proactively. After submitting your credit application form, applicants may wonder about the review process and what happens next. Typically, the lender may take a few business days to review the application before making a decision.

Common reasons for denial include a lack of sufficient credit history, poor credit scores, or inconsistencies in the provided information. If you need to update any submitted details, it's best to contact the lender directly to understand their process for handling amendments.

Best practices for managing your credit applications

Effectively managing credit applications is crucial for maintaining financial health, especially if you are applying for credit on multiple fronts. Keeping records and tracking your applications can prevent confusion and help you understand how your applications affect your credit score.

Being aware of the implications of credit inquiries is key. Multiple hard inquiries can impact your credit score negatively, so pacing your applications strategically is beneficial. Additionally, practicing habits such as timely repayments and regular credit report checks can help sustain a healthy credit score.

Conclusion

Utilizing pdfFiller provides an efficient and reliable way to handle your credit application forms. With features designed for editing, signing, saving, and sharing, pdfFiller empowers users to navigate through their document needs effectively.

By leveraging pdfFiller for your credit application forms, you ensure that you have a streamlined experience that enhances your ability to secure the credit you need. Make pdfFiller your go-to solution for all future document management tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit application directly from Gmail?

How do I fill out credit application using my mobile device?

How do I fill out credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.