Get the free Consumer (ppd) Payment Authorization Agreement

Get, Create, Make and Sign consumer ppd payment authorization

How to edit consumer ppd payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer ppd payment authorization

How to fill out consumer ppd payment authorization

Who needs consumer ppd payment authorization?

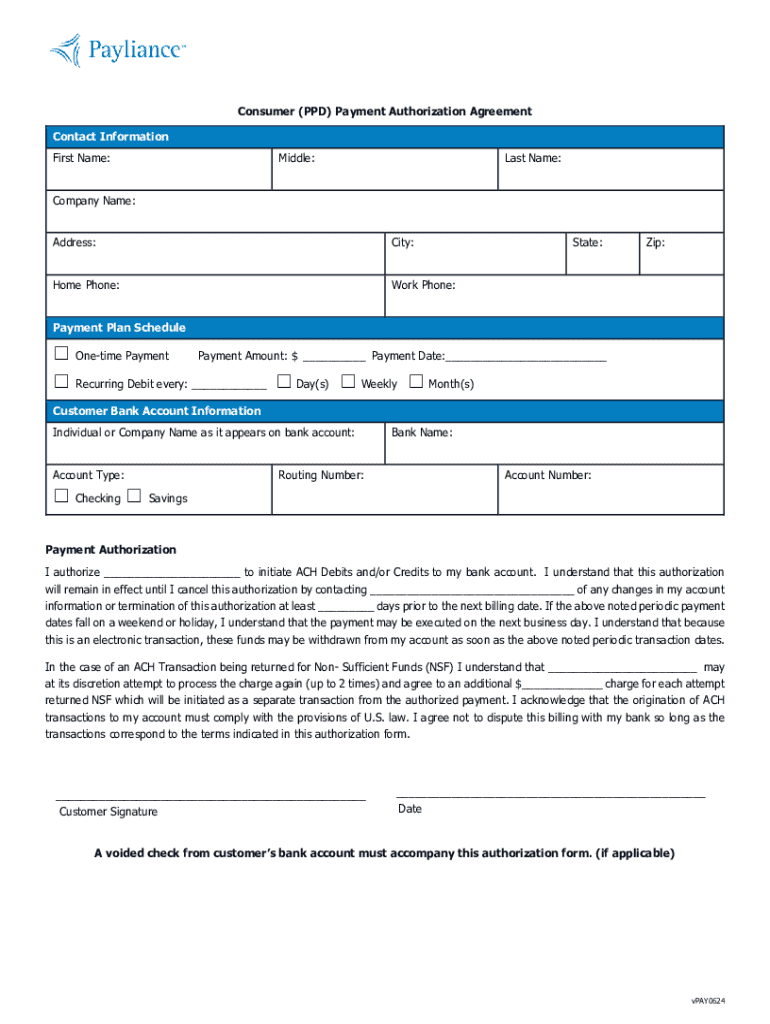

Understanding the Consumer PPD Payment Authorization Form

Overview of PPD (Prearranged Payment and Deposit) transactions

PPD transactions, or Prearranged Payment and Deposit transactions, represent a fundamental aspect of the Automated Clearing House (ACH) network. Typically utilized for recurring payments, PPD transactions allow consumers to authorize companies to withdraw specified amounts directly from their bank accounts on predetermined schedules. This enables convenient payment for bills, subscriptions, and loans, alleviating the need for consumers to manually process recurrent transactions.

In contrast to other ACH types such as CCD (Cash Concentration or Disbursement), which is more business-focused, PPD transactions specifically cater to individual consumers. While CCD transactions often involve larger sums and are geared towards corporate transfers, PPD highlights the convenience and security of personal finance management.

Understanding the consumer PPD payment authorization form

The consumer PPD payment authorization form is a critical document that facilitates the establishment of automated payments from a consumer’s bank account. By completing this form, consumers grant explicit permission to an organization to debit their bank account for specified transactions. This authorization is essential in streamlined payment processes, ensuring that both consumers and businesses maintain transparent financial interactions while ensuring compliance with legal standards.

The importance of the authorization form cannot be overstated. It protects consumers from unauthorized transactions and provides a formalized process that businesses must adhere to, ensuring that both parties understand their rights and responsibilities under the agreement. Failure to complete this form fully or accurately can lead to delays and issues with payment processing.

Legal and regulatory framework governing PPD authorizations

Several regulations guide PPD authorizations, predominantly focusing on consumer protection. NACHA, the organization responsible for overseeing the ACH network, mandates compliance with its rules to protect consumers. This includes stipulations on the information that must be included in the authorization form, such as clear definitions of the payment terms and conditions. NACHA guidelines also emphasize the necessity of obtaining consumer consent before processing any transactions, ensuring transparency in financial operations.

Components of the consumer PPD payment authorization form

Completing the consumer PPD payment authorization form entails providing essential information that affects the processing of payments. Required details often include personal identification elements such as name, address, and the designated bank account number involved in the transaction. Additionally, payment specifics, including the amount, frequency of payments (e.g., weekly, monthly), and the start date, must be specified to delineate the terms under which payments are authorized.

Errors on the form can lead to significant consequences, including unauthorized debits or failed transactions. Common penalties for incomplete or incorrect information could range from processing delays to potential fees applied by the financial institutions involved. Furthermore, it is vital for the individual to ensure that a signature and date are affixed; without these, the authorization may not hold legal weight, jeopardizing the intended payment arrangements.

Steps to fill out the consumer PPD payment authorization form

How to manage your consumer PPD payment authorizations

Effective management of consumer PPD payment authorizations is crucial in maintaining healthy financial practices. Begin by tracking authorized payments as they occur; this can often be done securely through your bank account statement or online banking tools. Best practices include setting transaction alerts that notify you of withdrawals as they happen, ensuring you stay informed about your available balance.

Should you need to modify or cancel an authorization, it is critical to understand the specific process mandated by the organization. Typically, consumers must submit a written request to revoke authorization, and clear instructions regarding modifications are outlined in the original authorization terms. Keeping comprehensive records of all authorization forms helps safeguard your interests, especially in the event of disputes.

Common mistakes in PPD authorizations and how to avoid them

Several common errors can lead to complications during the PPD process. Among these, the most frequent mistakes include providing incorrect account information, failing to sign or date the form, and not adhering to submission guidelines specified by the payment processor. To prevent these missteps, consumers should carefully review form instructions and confirm the details with their banks ahead of submission.

Frequently asked questions about consumer PPD payments

Alternative methods of payment authorization

In addition to traditional paper forms, consumers now have several options for payment authorization. Online authorization processes enable quick, secure consent through digital platforms, ensuring timely interactions. This modern method reduces potential delays that can occur with paper documents. Furthermore, consumers might consider verbal authorizations via secure phone calls when necessary, though these should always be supplemented with written confirmation for legal protection.

Digital signatures have also gained popularity, offering a secure and efficient means to authorize payments electronically. Utilizing verified digital signature solutions can enhance security and streamline the authorization process, but it is essential to employ reputable services that comply with legal thresholds for electronic signatures.

The importance of PPD authorizations in your payment strategy

Timely and accurate PPD authorizations form a cornerstone of effective cash flow management for consumers. By ensuring all necessary authorizations are in place, consumers can ensure that their financial obligations are met promptly, avoiding late fees and service interruptions. Moreover, having a structured authorization process fosters consumer trust with service providers, encouraging successful, long-term financial relationships.

Given the significance of these authorizations, integrating them into your financial strategy can enhance overall management and organization. Using a reliable document management platform like pdfFiller can transform the way you handle authorizations, leading to more potent financial controls and improved accountability across all payment processes.

Conclusion: Navigating consumer PPD payment authorizations with confidence

Understanding the ins and outs of the consumer PPD payment authorization form is vital for consumers looking to manage their payment obligations effectively. Remember, accuracy and compliance are key; ensuring that all aspects of the form are fully completed can prevent unnecessary complications. Embrace modern solutions, like pdfFiller, to create, edit, and manage your forms seamlessly, empowering you to handle your payment authorizations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer ppd payment authorization for eSignature?

How can I fill out consumer ppd payment authorization on an iOS device?

How do I fill out consumer ppd payment authorization on an Android device?

What is consumer ppd payment authorization?

Who is required to file consumer ppd payment authorization?

How to fill out consumer ppd payment authorization?

What is the purpose of consumer ppd payment authorization?

What information must be reported on consumer ppd payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.