Get the free Checklist for Llc

Get, Create, Make and Sign checklist for llc

Editing checklist for llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checklist for llc

How to fill out checklist for llc

Who needs checklist for llc?

Checklist for Form: Your Comprehensive Guide

Understanding formation

A Limited Liability Company (LLC) is a popular business structure that combines the benefits of a corporation and a partnership. An LLC protects its owners, known as members, from personal liability, which means personal assets are generally shielded from business debts and lawsuits. This structure is ideal for entrepreneurs and small business owners who wish to enjoy flexibility in management while also safeguarding their personal finances.

The benefits of choosing an LLC over other structures include pass-through taxation, which allows profits to be taxed at the individual level rather than at the corporate level, thus avoiding double taxation. Moreover, forming an LLC can enhance your business's credibility with customers and vendors, making it a preferred choice for many startups.

Preparing for formation

Before diving into the formation process, it’s essential to choose a compelling and unique business name for your LLC. The importance of a unique name cannot be overstated—it distinguishes your business and helps prevent legal issues related to trademark infringements. Start by researching existing trademarks and conducting name availability checks through your state’s Secretary of State website.

An essential step in setting up your LLC is appointing a registered agent, who acts as your official point of contact for legal documents. The registered agent is responsible for receiving critical legal notifications, so it's vital to choose someone reliable. When selecting an agent, consider individual attributes such as availability and knowledge of state regulations.

The formation process

The first significant step in forming your LLC is filing the Articles of Organization, which is the document that officially registers your LLC with the state. This document includes key components such as your LLC’s name, address, the purpose of the business, and the details of the registered agent. It's important to understand that each state has its own specific filing requirements and fees, so researching your state's guidelines is crucial.

Creating an Operating Agreement is another essential part of the formation process. This document lays out the management structure, responsibilities of members, and operating procedures for your LLC. Even if it's not required by law in your state, having an Operating Agreement is beneficial as it provides clarity and helps prevent future disputes among members.

In addition, obtaining an Employer Identification Number (EIN) is necessary if your LLC has more than one member or plans to hire employees. An EIN functions like a social security number for your business, needed for tax purposes. You can easily apply for an EIN through the IRS website.

Post-formation steps for your

Once your LLC is formed, the next step involves acquiring the necessary licenses and permits to operate legally. Depending on your industry and location, there may be different licenses you'll need. For example, a retail business might require a sales tax permit, while a restaurant may need health and safety permits. Always check with local government agencies for specific requirements.

Opening a business bank account is another important post-formation step. Keeping your business and personal finances separate helps maintain clarity and accountability. Look for banks that offer business accounts with features that meet your needs, such as online banking, low fees, and ease of access. Establishing a business account also makes accounting easier and is often required by many LLCs.

It's also essential to understand your tax obligations after forming an LLC. Be informed about federal and state tax requirements, which can vary greatly depending on your jurisdiction and business type. Make sure to understand applicable sales tax rules, and stay on top of any employee-related taxes if you plan to hire.

Business operations and management

Choosing the right business insurance is crucial for protecting your LLC from unforeseen circumstances. Common types of insurance coverage include general liability, property insurance, and professional liability insurance. Assess your coverage needs based on your business activities and any risks associated with them to ensure adequate protection.

Setting up business accounting systems is equally important. Whether you choose to utilize accounting software or hire a bookkeeper, effective financial management is essential for tracking income, expenses, and tax obligations. Familiarize yourself with invoicing and payment processes to maintain a steady cash flow and clear financial records.

Marketing and building a brand is vital for attracting customers. Develop a comprehensive marketing plan that outlines your target audience, strategies for outreach, and the channels you'll use. Don't forget to establish an online presence through a professional website and active social media profiles to engage with your audience effectively.

Common mistakes to avoid

Neglecting legal requirements can have serious consequences for your LLC. Understanding and maintaining compliance with state requirements ensures your business remains in good standing and avoids penalties. Regularly check in with local regulations to avoid oversights.

Mixing personal and business finances is another grave mistake that many business owners make. This can complicate financial reporting and lead to legal issues if the LLC is not properly maintained. Always keep detailed records and conduct transactions through your business account to maintain financial clarity.

Finally, underestimating the importance of proper documentation can lead to operational inefficiencies and disputes. Keeping accurate records from the outset helps in minimizing misunderstandings among members and supports compliance requirements. Invest in a reliable document management system to keep all essential forms organized.

Frequently asked questions (FAQs)

One common question is how long it takes to form an LLC. Generally, the timeline can vary from a few days to a few weeks, depending on state processing times. Can you be your own registered agent? Yes, many states allow this, but it's worth checking specific state laws to confirm eligibility. As for costs, forming an LLC can range from $50 to $500 or more, based on state fees and additional services you may require. Finally, ongoing requirements involve annual reports and other filings that keep your LLC compliant and in good standing.

Tools and resources for management

There are numerous online tools available to assist with LLC management. Interactive document creation tools can simplify the drafting process for essential forms, including Articles of Organization and Operating Agreements. Additionally, software designed for managing LLC documentation can help keep your records organized and easily accessible.

For collaborative teams, platforms enabling document editing and sharing in real-time can streamline communication and teamwork around LLC operations. Utilizing such tools effectively enhances organization, productivity, and compliance throughout your business’s lifecycle.

Final checklist for formation

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit checklist for llc online?

How do I make edits in checklist for llc without leaving Chrome?

Can I create an electronic signature for signing my checklist for llc in Gmail?

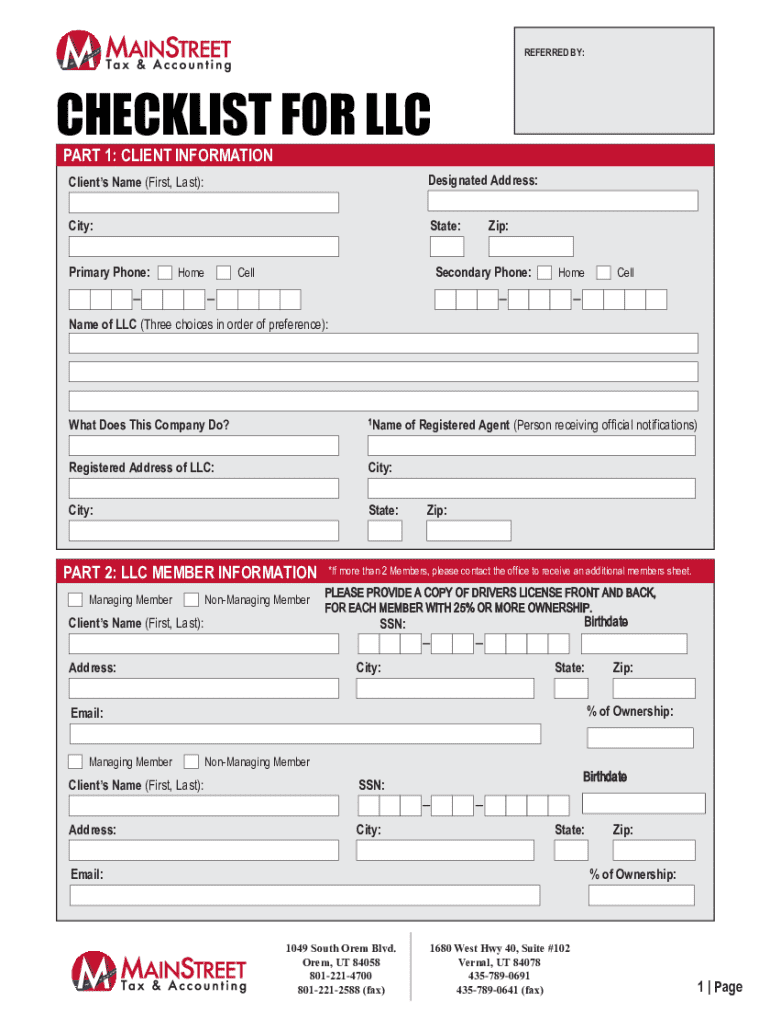

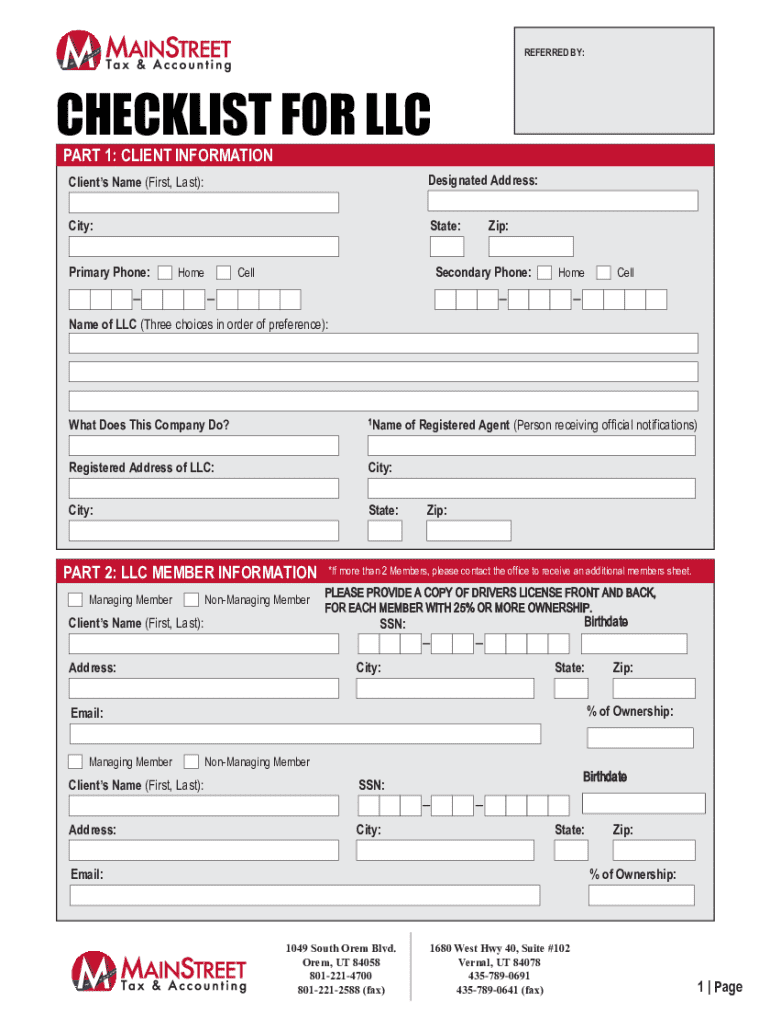

What is checklist for llc?

Who is required to file checklist for llc?

How to fill out checklist for llc?

What is the purpose of checklist for llc?

What information must be reported on checklist for llc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.