Get the free Check Request Form

Get, Create, Make and Sign check request form

How to edit check request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request form

How to fill out check request form

Who needs check request form?

Understanding the Check Request Form: A Comprehensive Guide

What is a Check Request Form?

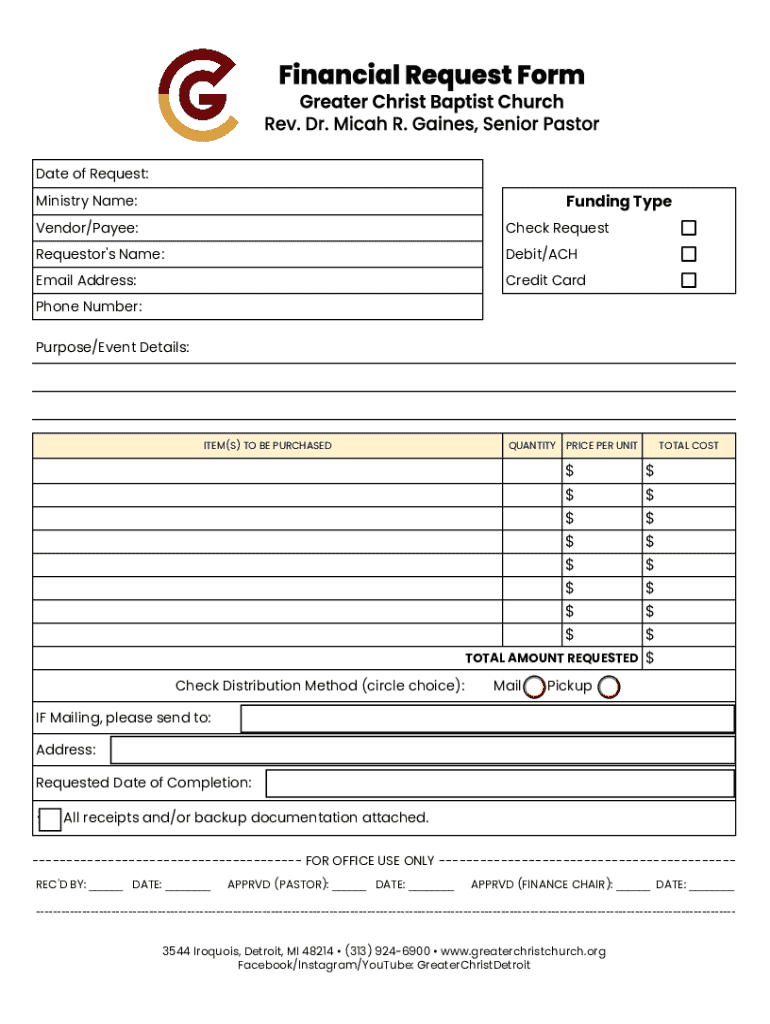

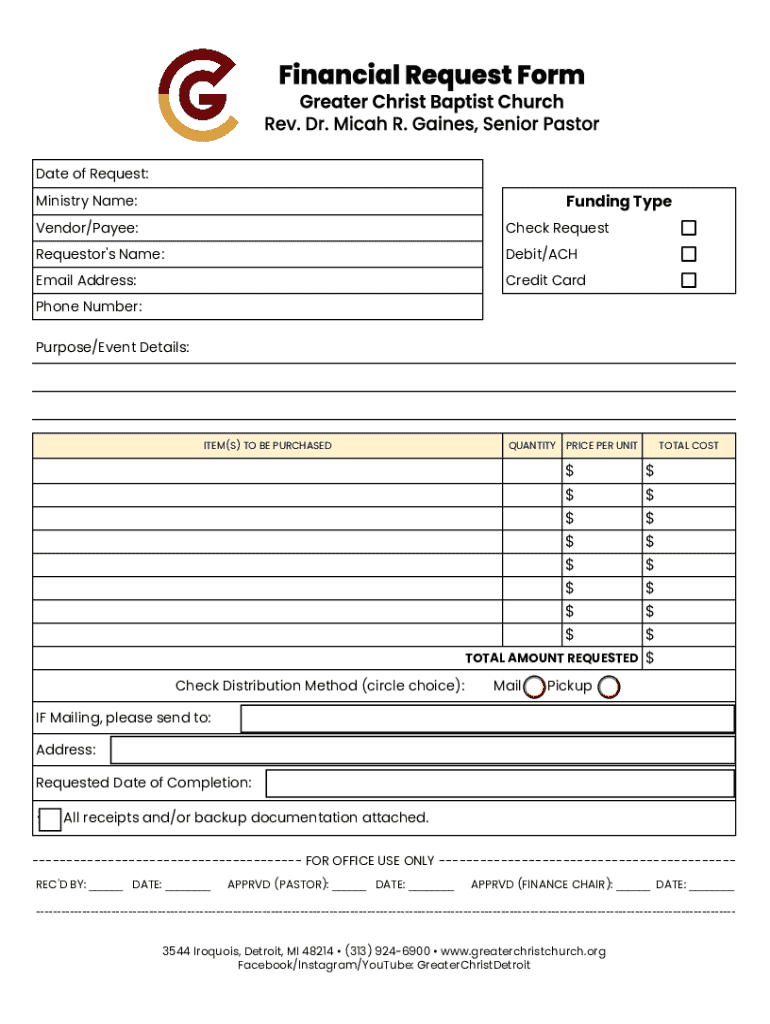

A check request form is a document used to request payments to individuals or organizations for goods or services rendered. It serves as a formal request presented to the finance department or accounts payable team within an organization. This form is crucial for maintaining transparency and ensuring proper tracking of financial transactions. By distinguishing a check request from other financial documents, it provides a specific framework that records who is owed money, how much, and for what purpose, creating a streamlined process for financial management.

Importance of check request forms in financial management

Check request forms play a pivotal role in financial management by helping organizations track expenses systematically. They provide a clear trail of payment requests that can be referenced for audits or budget assessments. By enforcing a standardized protocol for requesting payments, these forms help maintain accurate financial records, promote accountability among employees, and prevent unnecessary delays in processing payments.

Sample check request forms

To demonstrate the versatility of check request forms, consider the following samples which include critical elements such as the date, payee name, amount requested, purpose of the expense, and any supporting documentation attachments. Various templates are available, ranging from simple one-page forms to more complex ones that accommodate multiple signatures or approval levels. By examining these forms, users can glean insights into what information is vital for successful processing.

How to fill out a check request form

Filling out a check request form accurately ensures swift processing and approval. Here’s how you can do it effectively:

When to use a check request form

A check request form is essential in both pre-purchase and post-purchase scenarios. Using it before purchasing can prevent financial discrepancies by ensuring proper authorization is in place before expenses are incurred. In contrast, after purchasing, the form facilitates reimbursement processes, ensuring accountability and financial tracking within organizations.

Benefits of using a check request form

Utilizing check request forms provides numerous advantages that can significantly enhance an organization's financial procedures. First and foremost, they streamline financial transactions, reducing the risk of errors during payment processing. Additionally, they contribute to better budget management by giving a historical view of expenditures. Moreover, check request forms can enhance fraud prevention efforts as they require specific details that must match supporting documentation before approval can be granted.

Check request form examples for various scenarios

Regardless of the context, check request forms can be tailored to meet specific needs. For instance, an employee reimbursement check request form might include fields to detail personal expenditures for company activities, while a vendor payment form may require contractual reference numbers and contact specifics to ensure proper allocation.

Key considerations for creating effective check request forms

Creating effective check request forms necessitates careful thought about what to include. Begin by identifying the required fields to ensure that all necessary information is collected. Additionally, clear instructions should accompany the form to avoid confusion during the submission process. Maintaining compliance with organizational policies and record-keeping standards is imperative to ensuring forms are processed securely and effectively.

Enhancing collaboration with pdfFiller

Utilizing pdfFiller can enhance collaboration and streamline check request forms further through its cloud-based platform. Users can access their forms from any location, making it easier for teams to work together, whether in a physical office or remotely. The platform also supports real-time editing and sharing capabilities which expedites the feedback process. Furthermore, digital signing functionalities allow requesters to approve documents quickly, facilitating a faster turnaround on requests.

Troubleshooting common issues with check request forms

Despite the benefits, issues can arise during the check request process. Missing information can lead to delays, so it's crucial to double-check all fields before submission. Additionally, submitting forms to incorrect recipients can cause unnecessary bottlenecks in approval processes. To mitigate these challenges, individuals should carefully follow submission protocols and ensure clarity when filling out their forms.

Real-life scenarios for check request forms in action

Case studies highlight the importance of effectively utilizing check request forms in diverse organizational settings. For instance, a non-profit organization used these forms to simplify its funding processes, leading to quicker sponsorship approvals and enhanced donor engagement. Conversely, a small business struggled due to unclear submission processes, leading to financial tracking pitfalls. Learning from these examples sheds light on best practices and the potential challenges organizations might face.

Future trends in financial document management

The landscape of financial document management is set to evolve with the advancement of technology. Machine learning and automation will likely play pivotal roles in streamlining processes further. Advanced analytics may provide insights that enhance decision-making surrounding budgets and financial planning, while enhanced security protocols will be necessary to safeguard sensitive information. Organizations that adopt these trends early can expect significant advantages in efficiency and operational effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit check request form online?

Can I create an electronic signature for the check request form in Chrome?

Can I create an eSignature for the check request form in Gmail?

What is check request form?

Who is required to file check request form?

How to fill out check request form?

What is the purpose of check request form?

What information must be reported on check request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.