Get the free Croprevenue Coverage Premium Calculation Worksheet

Get, Create, Make and Sign croprevenue coverage premium calculation

Editing croprevenue coverage premium calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out croprevenue coverage premium calculation

How to fill out croprevenue coverage premium calculation

Who needs croprevenue coverage premium calculation?

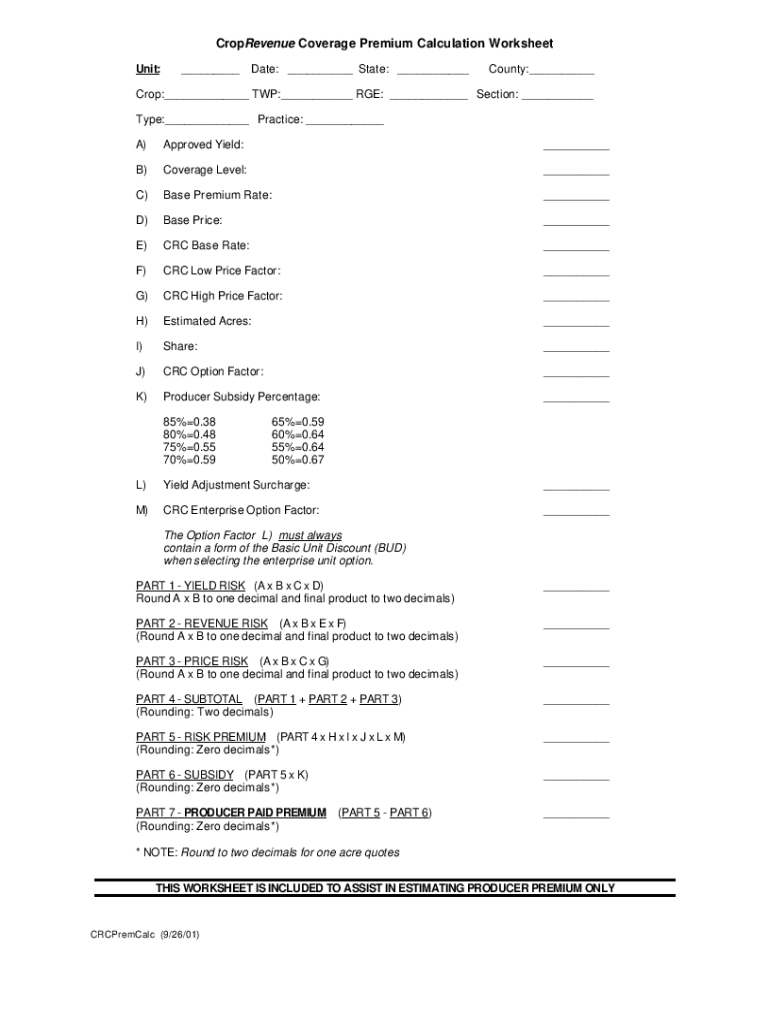

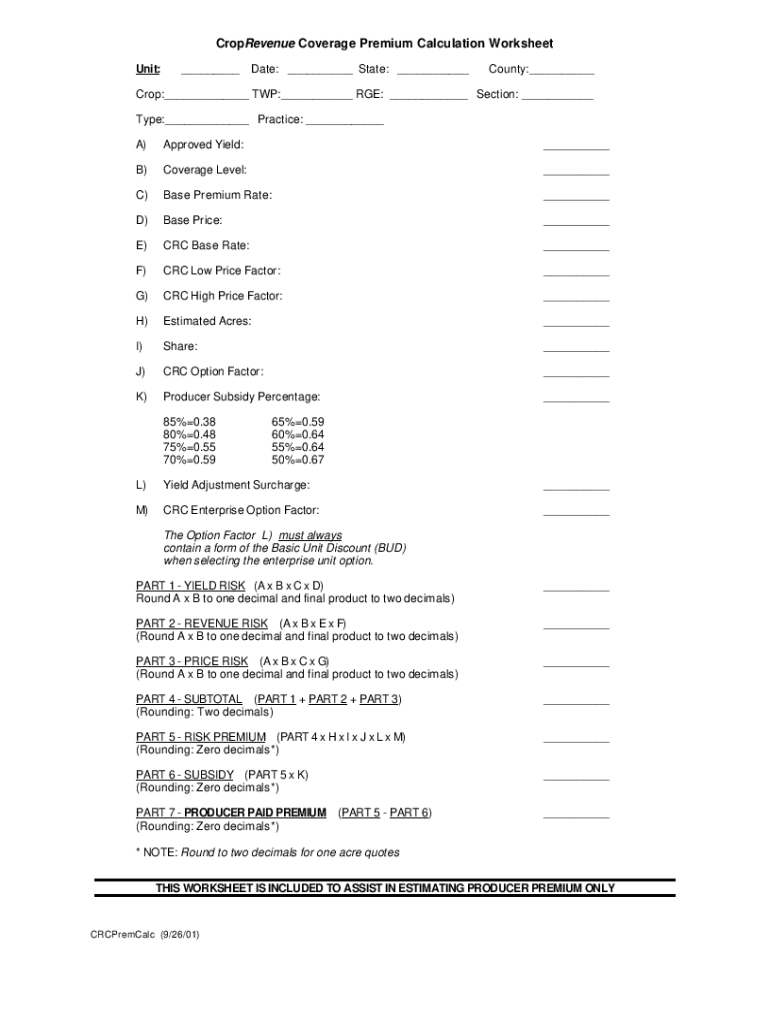

Understanding the Crop Revenue Coverage Premium Calculation Form

Understanding crop revenue coverage

Crop Revenue Coverage (CRC) is an insurance option that allows farmers to protect their revenue based on their expected yield and market prices. It's designed to offer a safety net against the unpredictable nature of agricultural production, which can be influenced by weather conditions, pests, and market fluctuations. For agricultural stakeholders, having a strong grasp of CRC is crucial as it ensures financial stability and ongoing viability within the farming sector.

The importance of CRC extends beyond mere insurance; it affects the premium calculations that farmers must consider during the enrollment process. Premium costs are determined based on several factors, including historical yield data, local market conditions, and the specific crops being insured. Understanding CRC is thus integral in making informed decisions when selecting coverage levels and calculating potential premiums.

Key components of crop revenue coverage premium calculation

The calculation of CRC premiums hinges on several key components. First, base revenue relates to the estimated income from a specific crop at historical prices. It's a foundational factor in ensuring farmers understand what their potential earnings could be before factoring in any variable conditions.

Actual revenue is equally significant, as it depicts the real income generated by the crop during a given year. This revenue can fluctuate based on prevailing market prices, making it essential for farmers to remain aware of market conditions. Both these revenue types directly influence the coverage farmers opt for and, subsequently, the premium rates they must pay.

Yield history and its role in calculations

Yield history plays a pivotal role in determining risk levels related to CRC. Having accurate and comprehensive historical yield data helps insurance companies assess the risks associated with particular crops in specific regions. This data can often be gathered from agricultural extension offices, previous insurance claims, or self-reported statistics, but it's crucial to ensure all data is verified for accuracy.

Market prices and price elections

Understanding market prices and selecting the appropriate price election for each crop is invaluable in the premium calculation process. By analyzing market price trends, farmers can better anticipate price shifts and make informed decisions on their coverage levels. Every crop has unique market factors that could impact profitability differently, which can ultimately influence the premium paid for coverage.

The crop revenue coverage calculation process

Calculating your CRC premium can seem complex, but it’s manageable when broken down into clear steps. Follow this guide to ensure you gather all necessary information and accurately assess your premium.

Utilizing the crop revenue coverage premium calculation form

Utilizing a dedicated crop revenue coverage premium calculation form can significantly streamline your premium calculation process. This form includes interactive elements like data input fields and price selection options that simplify the previously daunting task.

You can enhance accuracy in your calculations by observing how each data input reflects changes in potential premiums. Live calculation examples foster a clearer understanding of how varying factors affect your final insurance premium, allowing for more informed decision-making.

Factors influencing premium costs

Premium costs are not universally fixed; they fluctuate based on various factors, particularly geographic location. Local market conditions, including commodity prices and local demand, can significantly influence the rates offered. For example, crops grown in high-demand regions might have varying premiums compared to those in less favorable markets.

The type of crop also impacts the risk assessment done by insurance providers. Certain crops might be deemed less risky due to historical yield consistency, thus attracting lower premiums. Additionally, insurance regulations frequently change; remaining updated on legislative modifications is crucial as they can alter insurance costs and terms.

Common mistakes in premium calculations

Farmers need to be aware of common mistakes that can affect premium calculations. One frequent error is the miscalculation of historical yields, leading to mismatched revenue expectations. Additionally, overlooking local market factors or failing to update yield data regularly can provide a skewed understanding of potential earnings.

Employing strategies such as regularly consulting market analyses and utilizing the crop revenue coverage premium calculation form can help sidestep these pitfalls.

Real-world applications and case studies

Examining real-world applications of CRC can showcase its effectiveness in practice. Case studies highlight different coverage levels and their various outcomes for farmers faced with yield losses or price drop-offs. For instance, a farmer in the Midwest utilizing CRC on corn might document recovery from unexpected droughts, essentially stabilizing their revenue and protecting their investments.

Such success stories can serve as a motivational guide for new participants in CRC, illustrating how the right choices at the premium calculation stage can lead to advantageous outcomes even in challenging circumstances.

Frequently asked questions

Understanding the premium calculation process can lead to additional questions. One common query is about how external factors, such as weather events and economic shifts, can modify premium costs. In essence, adverse conditions may increase the perceived risk by insurers, leading to higher premiums.

Another frequent question revolves around the financial implications of choosing different coverage levels. Evaluating personal risk tolerance against potential economic downturns will assist in aligning the right coverage choice with long-term agricultural goals.

Resources for further understanding

To gain deeper insights and better manage the crop revenue coverage premium calculation process, utilizing available resources is essential. Websites like pdfFiller provide tools, calculators, and educational articles on crop insurance that can help clarify complex topics.

Engaging with crop insurance experts

Consulting with industry specialists is invaluable when navigating the complexities of crop insurance and CRC. By engaging in discussions with professionals, farmers can uncover nuanced insights into their unique circumstances and gain confidence in their premium calculation decisions.

Using platforms like pdfFiller enhances this collaboration, allowing users to seamlessly edit PDFs, eSign, and manage documents from anywhere, supporting overall efficiency in the insurance enrollment process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify croprevenue coverage premium calculation without leaving Google Drive?

Can I create an eSignature for the croprevenue coverage premium calculation in Gmail?

How do I fill out the croprevenue coverage premium calculation form on my smartphone?

What is croprevenue coverage premium calculation?

Who is required to file croprevenue coverage premium calculation?

How to fill out croprevenue coverage premium calculation?

What is the purpose of croprevenue coverage premium calculation?

What information must be reported on croprevenue coverage premium calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.