Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit application form: A comprehensive how-to guide

Understanding the importance of credit application forms

A credit application form is a crucial document that individuals and businesses use to request credit from lenders. This document serves as the foundation for assessing an applicant's creditworthiness, outlining their financial history and ability to repay debts.

These forms play a pivotal role in personal and business financing. For individuals, they allow access to loans for various purposes like home buying, vehicle financing, or personal loans. Businesses rely on these forms to secure funds necessary for growth, operations, and other financial obligations.

However, failing to complete a credit application form accurately can have serious repercussions. Errors or omissions may lead to application denial, unfavorable terms, or prolonged approval processes, underscoring the importance of diligence when filling out these forms.

Types of credit application forms

Credit application forms come in various types, primarily categorized as personal credit application forms and business credit application forms. Personal forms are typically utilized by individual consumers seeking loans or credit lines to manage personal expenses, while business forms are designed for companies looking for financing options to support operational and growth initiatives.

Each type has unique requirements and considerations. For instance, secured credit applications require collateral, such as property or assets, to back up the amount borrowed. Conversely, unsecured applications do not involve collateral but may demand higher interest rates due to increased risk.

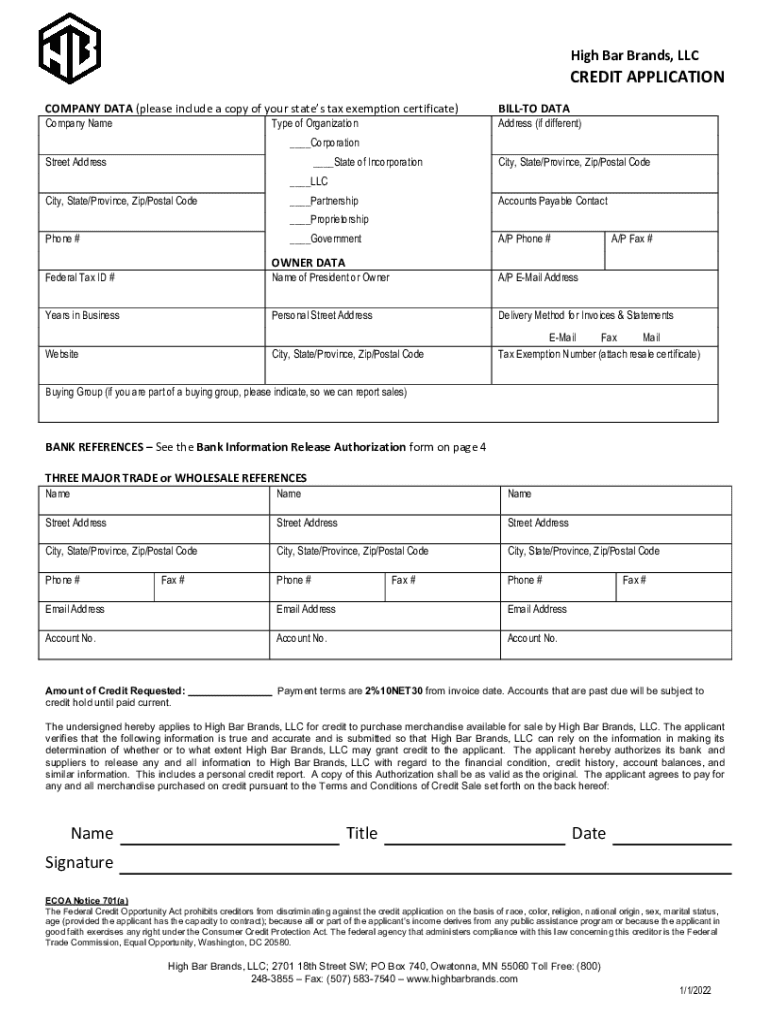

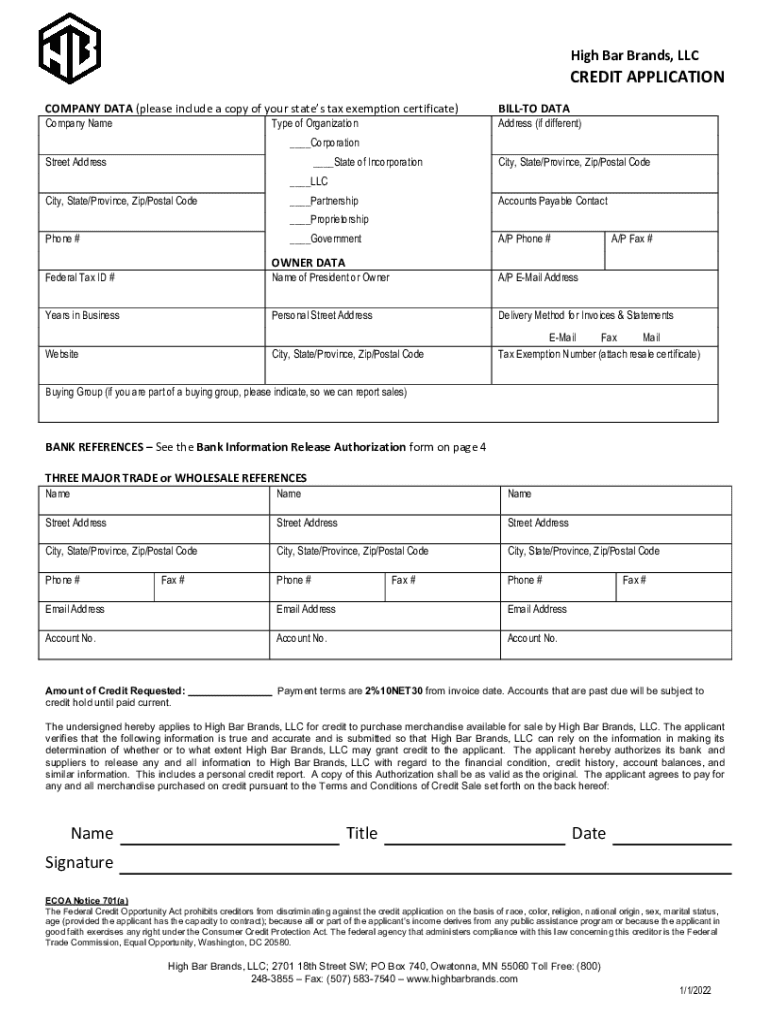

Key components of a credit application form

Key components of a credit application form include essential personal information, financial data, and any additional questions or requirements unique to the lender. The personal information section typically includes name, address, contact details, as well as social security number (for individuals) and employment information, which helps lenders assess stability and reliability.

The financial information segment is equally critical. Here, applicants disclose their income sources and amounts, existing debts and obligations, and asset details. Transparency in these areas can significantly influence approval chances.

Lastly, there may be additional requirements like co-signer information or specific lender prerequisites like minimum credit scores or income levels that applicants must meet. Understanding these elements is vital for anyone looking to secure credit.

Step-by-step guide to filling out a credit application form

Filling out a credit application form can be straightforward if approached methodically. The first step is to gather all required documents and information, including recent pay stubs, tax returns, and bank statements. Having these on hand eases the process and ensures accuracy.

Next, focus on accurately completing the personal information section. Double-check names, addresses, and social security numbers for correctness, as any errors can complicate the approval process.

The financial information section follows. Clearly present your income and debt obligations. Lenders appreciate candor, so portray your financial situation as it is, ensuring any figures you provide are recent and verifiable.

Once you've completed the form, reviewing for any errors is crucial. Pay attention to common pitfalls, such as typos or omitted information. Lastly, be mindful of submission protocols; digital submissions might require different formatting compared to physical copies.

Interactive tools for completing your credit application

Utilizing interactive tools can significantly enhance your experience when filling out a credit application form. pdfFiller offers a range of editing tools that simplify the process. From auto-fill functions that save time to collaboration capabilities that allow you to assist or receive guidance from advisors or partners, these features enhance efficiency.

The intuitive interface of pdfFiller means you can focus on ensuring accuracy rather than grappling with complex formatting issues or confusion regarding manual entry. These tools provide a seamless user experience tailored to empower users in managing their documents effectively.

Tips for a successful credit application process

Understanding your credit score is essential as it significantly impacts your credit application outcome. Lenders typically prefer applicants with scores above 700. This means monitoring your score and addressing any discrepancies proactively can enhance your chances of approval.

Timing your application can also play a crucial role. Avoid submitting during stressful financial periods or just after a major credit inquiry. Lenders are more favorable towards applicants with stable financial histories. Moreover, knowing what lenders look for—such as stable income, employment, and low debt-to-income ratios—can help you tailor your application accordingly.

Post-submission: What happens after you apply?

After submitting a credit application form, the approval process begins. Lenders evaluate your information, which might include a credit history check, employment verification, and financial assessment. Typically, this process takes anywhere from a few hours to several days, depending on the lender's policies.

Potential outcomes include approval or denial. Approval may come with conditions, such as interest rates or payment terms, whereas denial can stem from various reasons like poor credit history or high debt levels. Knowing how to address each scenario can alleviate frustration, with prominent lenders often providing guidance on improving your creditworthiness.

Using tools like pdfFiller helps you keep track of your application status, allowing for organized and efficient follow-ups with lenders when necessary.

Managing your credit application forms for future use

Managing your credit application forms is key to efficiency for future requests. Digital documentation platforms like pdfFiller allow you to save and organize forms in the cloud, making them accessible from anywhere. This is particularly beneficial for businesses or individuals regularly engaging with multiple lenders.

Additionally, modifying existing applications rather than starting anew can save time. Using pdfFiller's editing capabilities simplifies the process of updating information or adjusting data according to lender requirements.

Adopting a digital document management system provides advantages such as streamlined organization and easier modification while also reducing physical clutter from paperwork.

FAQs about credit application forms

Common questions surrounding credit application forms typically revolve around their complexity and potential pitfalls. A major misconception is that the application must be completed without any guidance. While it is essential to provide accurate information independently, consulting with financial advisors or using interactive tools like pdfFiller can clarify uncertainties.

Another frequent inquiry involves the permanence of credit applications; many applicants worry about negative impacts from denials. Understanding that not all applications impact your credit score can alleviate concerns—that typically applies only to hard inquiries. These insights can empower applicants to approach the credit application process with greater confidence.

Best practices for using and storing credit application forms

When managing your credit application forms, securely storing personal information is paramount to protect against identity theft. Utilizing features provided by pdfFiller to ensure documents are encrypted and passwords are enforced can provide peace of mind.

Effectively managing multiple applications also involves keeping detailed records of submission dates, lender details, and application statuses. Creating an organized system helps keep your financial matters in order and allows for strategic follow-up where needed.

Finally, being proactive about protecting yourself from fraud by employing best practices such as regularly updating passwords and monitoring bank statements can significantly mitigate risks associated with credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application in Gmail?

Where do I find credit application?

How do I edit credit application straight from my smartphone?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.