Get the free California Resident Income Tax Return

Get, Create, Make and Sign california resident income tax

How to edit california resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california resident income tax

How to fill out california resident income tax

Who needs california resident income tax?

Everything You Need to Know About the California Resident Income Tax Form

Understanding the California Resident Income Tax Form

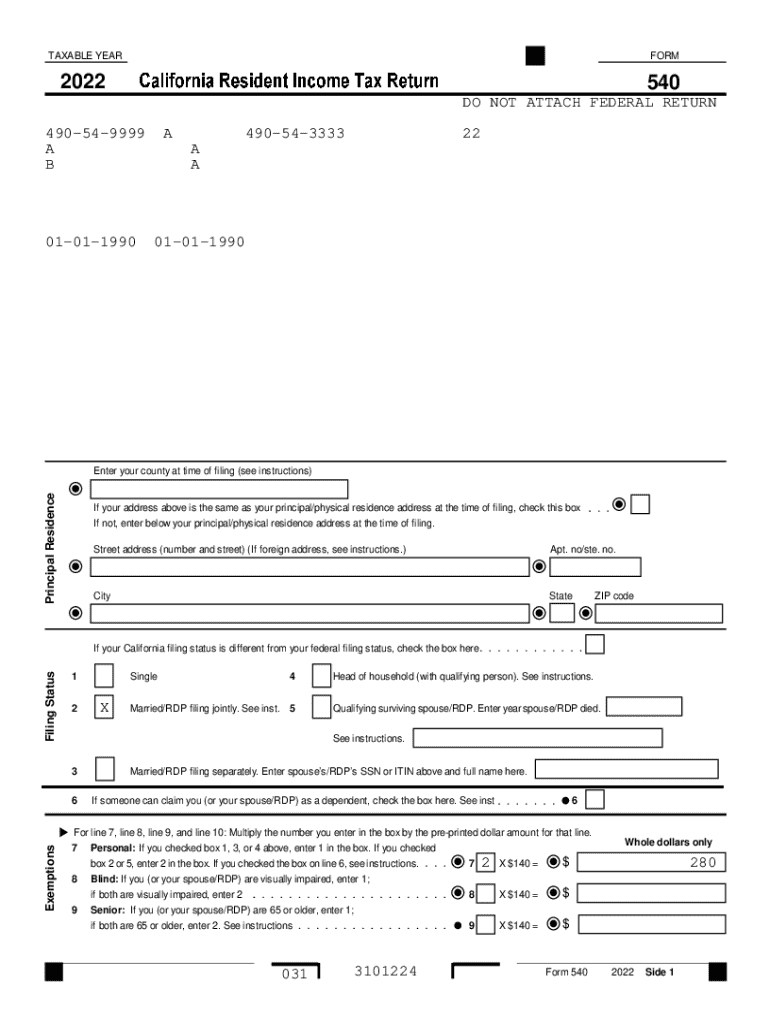

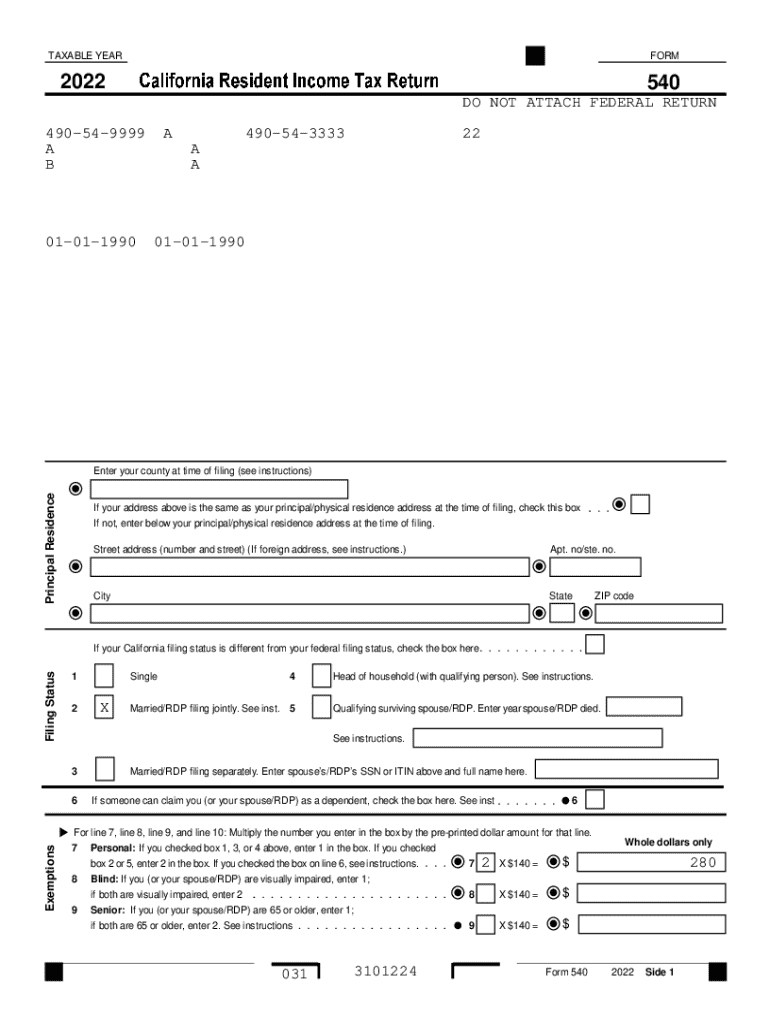

The California Resident Income Tax Form, commonly known as Form 540, is a critical document for individuals and families living in California to report their taxable income to the California Franchise Tax Board (FTB). This form helps determine the amount of tax owed or the refund due based on the income earned throughout the year.

Filing this form is essential for California residents as it is not just a legal requirement but also a part of civic responsibility. It aids in funding state programs ranging from education to public safety. Failing to file could lead to penalties and interest on unpaid taxes.

Key components of Form 540

Form 540 consists of several sections designed to capture essential information for accurate tax computation. Key elements include personal identification details, filing status, total income, deductions, and credits that can lower tax liability.

Among its various parts, the schedule detailing how income is computed and what adjustments apply is particularly important. Understanding these sections not only increases accuracy but also ensures taxpayers maximize their eligible deductions.

Schedule CA (540) explained

Schedule CA is an integral component of California’s tax filing process. It allows taxpayers to make necessary adjustments to their federal income, reflecting their state-specific income before calculating California taxes.

Taxpayers need to use this schedule when their income differs from federally reported figures due to California-specific deductions or credits. Common adjustments may include state-specific deductions, differences in capital gains, and more.

Step-by-step instructions for completing Form 540

Completing Form 540 starts with gathering all necessary documents, like W-2s, 1099s, and receipts for deductions. Having these organized will simplify the filing process. Also, ensure that all personal information is accurate and up-to-date.

When it comes to filling out the form, begin with basic details before methodically reporting your income, followed by calculating eligible deductions and credits. Each section is designed to guide you through the various components of your financial situation.

In today’s digital age, consider electronic filing as an option. E-filing your California Resident Income Tax Form through platforms like pdfFiller not only expedites the process but also minimizes errors and offers instant confirmation.

Common issues and solutions

Filing taxes can sometimes lead to confusion or errors. It's essential to address common issues efficiently to avoid complications. Most taxpayers face similar questions, particularly regarding how to amend mistakes, handle missing deadlines, or address identity theft.

Correcting mistakes is straightforward: simply fill out a new form indicating the correct information, mark it as an amended return, and submit it to the FTB. If the deadline is missed, taxpayers should file as soon as possible to mitigate penalties.

Additional forms related to California tax filing

Filing taxes can require multiple forms, especially if additional credits or specific situations apply. Understanding these related forms is crucial for comprehensive tax reporting.

While Form 540 covers the basics, forms like 540 ES for estimated taxes or Form 3514 for credits related to the Child and Dependent Care Expenses cater to more specialized needs. Familiarity with these forms can enhance your overall tax strategy.

Tools and resources available through pdfFiller

pdfFiller provides several resources for documenting, filling, and managing taxes. Its platform allows users to edit the California Resident Income Tax Form seamlessly, ensuring all entries are accurate and compliant with state regulations.

With pdfFiller, adding electronic signatures to documents is easy, expediting the filing process significantly. Additionally, the tool allows for sharing and collaborating on tax-related documents, making it an excellent choice for teams filing jointly or needing multiple approvals.

Expert insights on navigating California taxes

Navigating the complex landscape of California taxes can be daunting. However, insights from tax professionals can shed light on best practices and common pitfalls. They emphasize staying informed about tax obligations tailored to your specific circumstances.

Organized resources, such as a detailed checklist of documents and deadlines, can streamline the filing process. For residents seeking additional help, many local programs offer support for tax preparation, making it easier to file accurately.

Understanding your rights and responsibilities as a taxpayer

As a taxpayer in California, you have specific rights which protect you during the tax filing process. These include the right to be informed about your tax obligations and to appeal decisions made by the FTB if you disagree with them.

Understanding these rights empowers you to file with confidence and seek assistance if issues arise. Resources are available through the California Franchise Tax Board for resolving disputes and answering taxpayer queries.

State tax trends and updates

California's tax laws are continually evolving. Recent changes may affect tax rates, credits, and allowable deductions, impacting residents as they prepare for upcoming tax seasons. Staying updated on these changes is crucial for effective tax planning.

It's advisable to regularly check the California Franchise Tax Board’s website for announcements regarding tax reforms and what they mean for your filings. Anticipated developments may further simplify the filing process or introduce new forms altogether.

Popular tax filing tools and formats

Choosing the right tools for filing your taxes can significantly improve accuracy and save time. Various tax filing software options exist, each catering to different user preferences. Comparing online filing versus traditional paper forms is often beneficial.

Options such as pdfFiller combine online formats with intelligent editing features, making it an accessible choice for many taxpayers. Assess your specific needs and consider ease of use, support, and features when deciding.

Accessing help and support

When facing challenges in completing the California Resident Income Tax Form, seeking assistance is crucial. The FTB provides various avenues for help, including online resources and hotlines to address common queries.

pdfFiller also offers interactive resources to aid you further. Their live chat features and extensive help articles assist users in navigating tax forms confidently. Harnessing these resources can bridge gaps in knowledge and ensure accurate submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california resident income tax?

How do I make changes in california resident income tax?

How do I fill out the california resident income tax form on my smartphone?

What is california resident income tax?

Who is required to file california resident income tax?

How to fill out california resident income tax?

What is the purpose of california resident income tax?

What information must be reported on california resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.