Get the free California Resident Income Tax Return 540 2ez

Get, Create, Make and Sign california resident income tax

How to edit california resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california resident income tax

How to fill out california resident income tax

Who needs california resident income tax?

Your Complete Guide to California Resident Income Tax Form (Form 540)

Understanding the California Resident Income Tax Form (Form 540)

The California Resident Income Tax Form, known as Form 540, is a crucial document for individuals who earn income in California. This form must be completed annually to report all taxable income, claim deductions, and calculate any taxes owed to the state.

Filing Form 540 is not only a matter of legal obligation for California residents but also provides numerous benefits. By reporting your income accurately, you avoid potential penalties and ensure compliance with state tax regulations. Additionally, filing allows you to claim various deductions and credits that can significantly reduce your tax liability.

Who needs to file Form 540?

Eligibility to file Form 540 generally extends to all California residents who have an income above certain thresholds. Factors such as your age, filing status, and income level determine whether you must file this tax form.

For instance, single filers under 65 must file Form 540 if they earn $19,310 or more. Those over 65 have a higher threshold of $20,325. It's important for part-year residents or nonresidents working in California to understand their specific requirements, as they may need to file different forms, like Form 540NR.

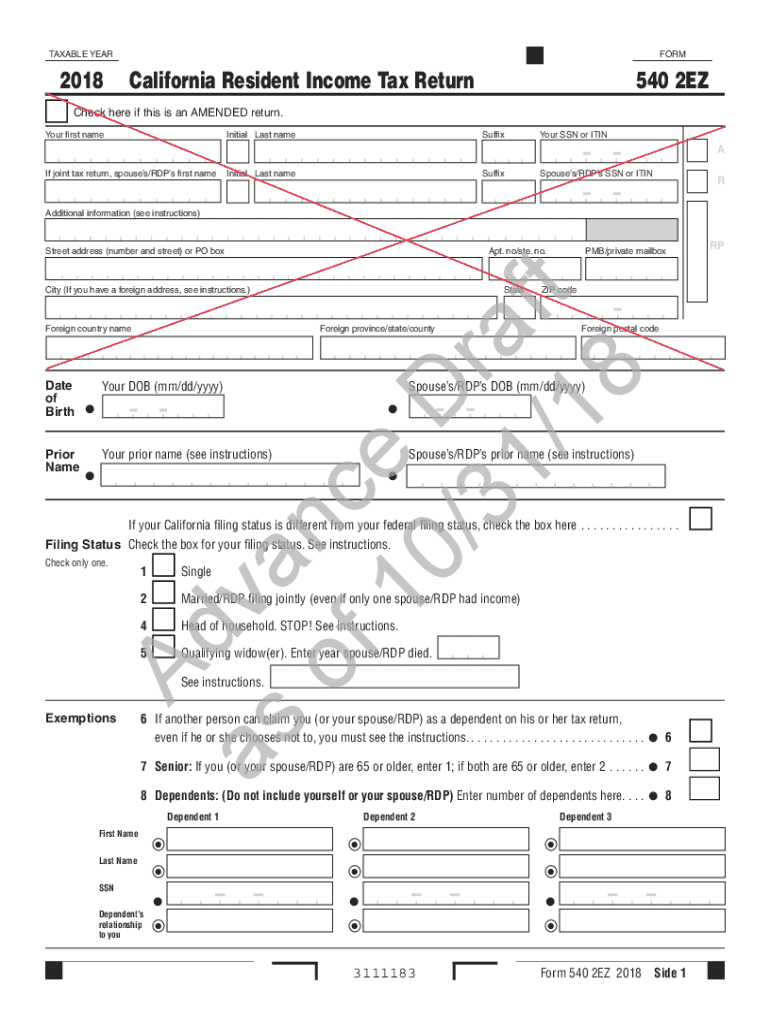

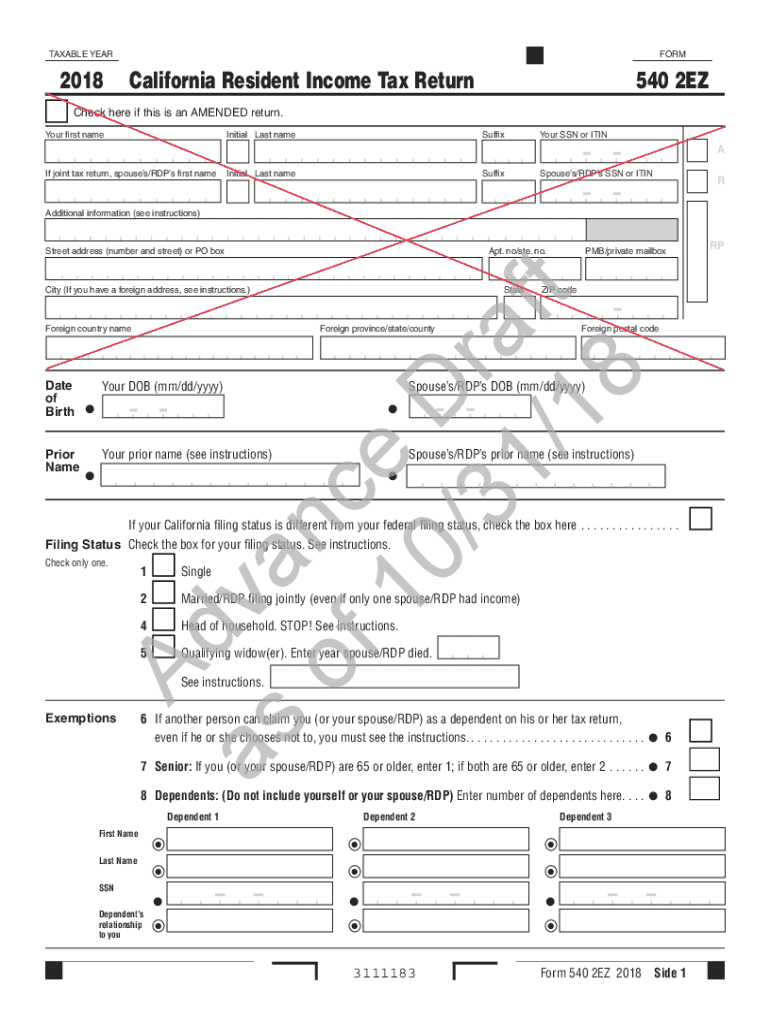

Key components of the California Resident Income Tax Form

Form 540 encompasses several key sections that must be filled out correctly to ensure accurate processing. The form begins with personal information, including your name, address, and Social Security number.

Next, you'll report all sources of income, which can include wages, self-employment income, and interest. The form also allows you to claim deductions and tax credits that can lower your taxable income.

An important aspect of Form 540 is Schedule CA (540), where taxpayers can report adjustments to federal income due to differences in state and federal tax laws.

Step-by-step instructions for filling out Form 540

Filling out Form 540 may seem daunting, but breaking it down into manageable steps can streamline the process. Start by collecting all necessary financial documents, such as W-2s or 1099s.

Follow these steps for accurate completion:

As you proceed, be mindful of common mistakes such as miscalculating income, overlooking deductions, or providing inaccurate information, as these can delay processing and lead to audits.

Filing options: How to submit Form 540

Once you’ve completed Form 540, it’s time to file it. There are several options available—electronic filing or traditional mailing. E-filing is recommended for its speed and convenience.

Using platforms like pdfFiller can enhance your e-filing experience with user-friendly tools. To e-file your Form 540 with pdfFiller:

If you prefer to file by mail, ensure you send it to the appropriate address for the California Franchise Tax Board based on whether you are expecting a refund or owe taxes.

Important deadlines and extensions for Form 540

Timely filing of Form 540 is essential to avoid penalties and interest. Generally, the deadline for filing is April 15 for most taxpayers, but it can vary depending on weekends or holidays.

If you need extra time, California grants automatic six-month extensions. However, this extension only provides additional time to file—not to pay any taxes due. Be aware that failing to file or pay can lead to penalties and accruing interest.

Frequently asked questions (FAQs) about Form 540

Navigating tax filing can generate many questions. Here are some common inquiries regarding Form 540:

Related documents and additional forms

In addition to Form 540, there are related documents and forms that may be necessary for your tax situation. For instance, if you have capital gains, you will need Schedule D to report these.

If you anticipate owing taxes throughout the year, utilizing Form 540-ES for estimated tax payments can be useful.

Help and support for completing your tax return

Utilizing pdfFiller's features can substantially ease the document management process while preparing your tax return. With collaborative capabilities, teams can work together to ensure thorough completion.

For individual users, personalized support is available through tools and guides provided by pdfFiller. External resources like the California Franchise Tax Board website serve as additional support, offering valuable tax-related information.

Special considerations for unique tax situations

Certain individuals may face unique tax situations that necessitate additional considerations. For example, international students and scholars must adhere to specific forms and regulations concerning their visa statuses.

Moreover, residents working outside California should also be aware of state tax guidelines that pertain to them, especially regarding income sourced from California or other states.

Popular tax topics related to Form 540

Several additional topics often intersect with the filing of Form 540 that may be pertinent to California residents. For instance, gig economy workers are subject to specific tax implications that they should be aware of when reporting income.

It's also critical to stay updated on any changes to tax legislation affecting Form 540 filers, as these changes can impact filing strategies and what deductions are available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit california resident income tax straight from my smartphone?

How do I fill out the california resident income tax form on my smartphone?

How do I complete california resident income tax on an iOS device?

What is california resident income tax?

Who is required to file california resident income tax?

How to fill out california resident income tax?

What is the purpose of california resident income tax?

What information must be reported on california resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.