Get the free Char500 Annual Filing for Charitable Organizations

Get, Create, Make and Sign char500 annual filing for

Editing char500 annual filing for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out char500 annual filing for

How to fill out char500 annual filing for

Who needs char500 annual filing for?

Comprehensive Guide to CHAR500 Annual Filing for Form

Understanding the CHAR500 annual filing

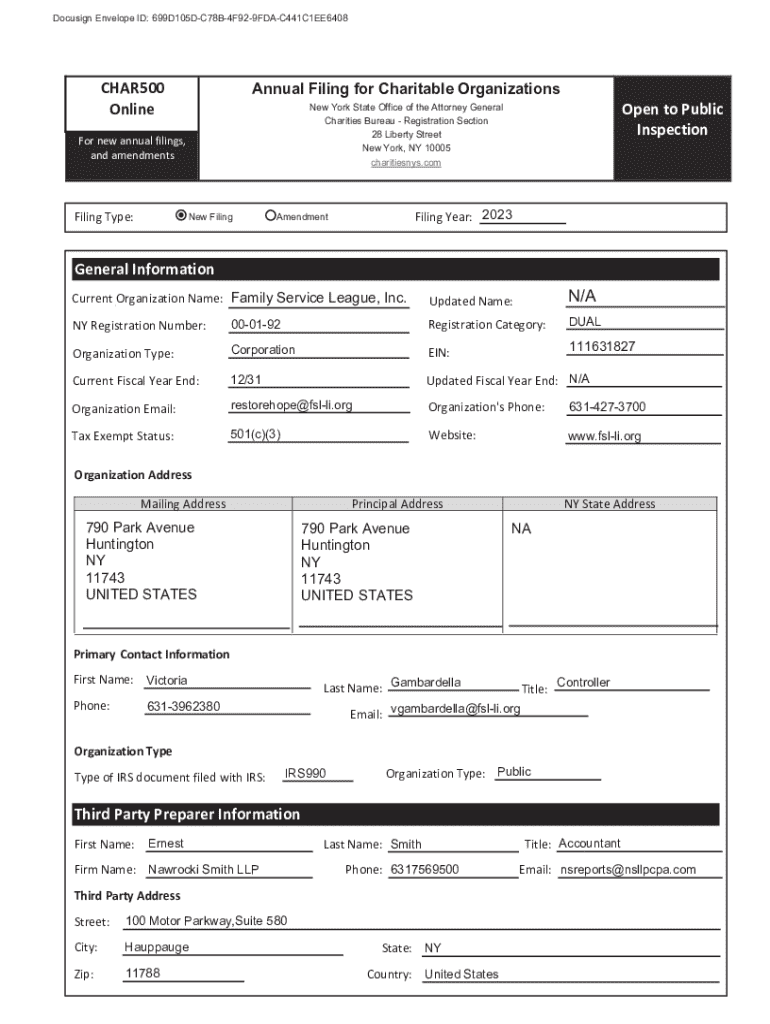

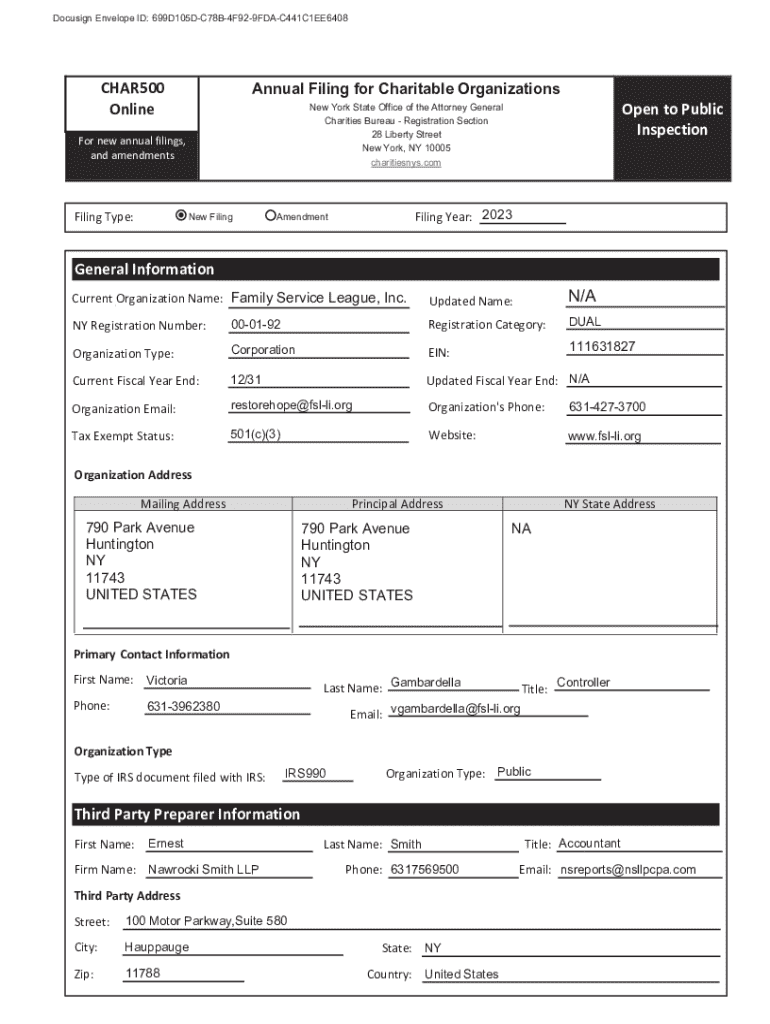

The CHAR500 form is an annual filing requirement mandated by the New York State Attorney General for nonprofit organizations, providing transparency and accountability. This form is crucial for maintaining the nonprofit's tax-exempt status and allowing the state to monitor compliance with regulations. By filing the CHAR500, organizations demonstrate their commitment to responsible governance and the effective use of funds, which is essential in fostering trust with stakeholders.

Organizations that are registered as charities in New York are required to file the CHAR500 form within four and a half months after the end of their fiscal year. This means that a nonprofit with a December 31 fiscal year-end must file by May 15. Understanding these deadlines is critical, as late filings can result in penalties and affect an organization’s standing with state authorities.

Detailed instructions for completing the CHAR500

Completing the CHAR500 form requires careful attention to detail. Here’s a step-by-step guide to help you navigate the process:

Common pitfalls include neglected sections or misreporting financial data. Ensure that all entries are accurately represented to avoid delays or penalties.

Online filing process for the CHAR500

Accessing the online filing platform for the CHAR500 is straightforward and user-friendly. Visit the designated state website where the filing is hosted, typically the New York State Attorney General's site, and navigate to the forms section.

Here’s a walkthrough of the online filing process:

For first-time users, familiarize yourself with the platform through available tutorials. A video tutorial on the CHAR500 filing process can make the experience easier, showing step-by-step how to navigate the online form effectively.

Editing and managing your CHAR500 form

Should you need to edit your CHAR500 form after filing, it’s crucial to know the process. Typically, amendments can be made online or by submitting a revised form to the designated office. Take advantage of pdfFiller’s platform for hassle-free document management, allowing you to access, edit, and save changes seamlessly from any device.

Utilizing features such as annotations and comments can greatly enhance collaboration among your team members when preparing the CHAR500. This can streamline gathering required information, minimizing the potential for errors and oversights.

Signing and eSigning the CHAR500

Digital signatures play a pivotal role in the filing process, as they ensure the authenticity and integrity of submitted documents. eSigning your CHAR500 through pdfFiller is an efficient way to finalize your filing without the need for physical signatures.

When eSigning, make sure to follow these steps:

Troubleshooting common issues

There’s always a possibility of encountering issues during your filing process. If you face technical difficulties or filing errors, first consult the help section on the filing platform, which often provides solutions for common challenges.

Should further assistance be needed, contacting support is the next step. Utilize support contact details available on the website to get in touch with a representative who can guide you through resolving your issues effectively.

Frequently asked questions (FAQs)

As you prepare for the CHAR500 filing, here are some common questions that arise:

Insights and trends in nonprofit filing

Nonprofits face various challenges in meeting annual filing requirements like the CHAR500. Some common obstacles include keeping detailed financial records, understanding regulatory changes, and finding time for compliance amid various operational demands.

As filing practices evolve, staying updated on prospective changes to requirements and technologies will be crucial for effective management of CHAR500 submissions. Engaging with peers or joining forums can provide valuable insights and strategies from organizations that have successfully navigated these processes.

Related documentation

When filing the CHAR500, it’s essential to ensure that all associated forms and required attachments are included. This might consist of previous filings, financial statements, and other relevant disclosures. Resources with downloadable templates and guidelines for these documents can streamline your filing process.

Networking within the nonprofit community also plays a vital role in sharing resources and experiences. Joining local nonprofit organizations or digital forums can open up opportunities for collaboration and support in managing documentation effectively.

Conclusion

As organizations navigate the CHAR500 annual filing for form, utilizing platforms like pdfFiller offers a remarkable advantage. With its features enabling seamless document editing, eSigning, and collaborative tools, the experience becomes efficient and effective. By staying informed of filing processes and compliance obligations, nonprofits can focus their efforts on fulfilling their missions while ensuring regulatory adherence.

Interactive features and tools

Explore our interactive chart for form completion, complete with timelines and checklists available for download. Sharing experiences and tips about the CHAR500 in our community can also facilitate best practices among peers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete char500 annual filing for online?

How do I make changes in char500 annual filing for?

How do I complete char500 annual filing for on an Android device?

What is char500 annual filing for?

Who is required to file char500 annual filing for?

How to fill out char500 annual filing for?

What is the purpose of char500 annual filing for?

What information must be reported on char500 annual filing for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.