Get the free Certificate of Insurance Request

Get, Create, Make and Sign certificate of insurance request

Editing certificate of insurance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance request

How to fill out certificate of insurance request

Who needs certificate of insurance request?

A comprehensive guide to the certificate of insurance request form

Understanding the Certificate of Insurance (COI)

A Certificate of Insurance (COI) serves as proof that a business or individual carries specific types of insurance coverage. It is typically issued by an insurance company and summarizes the essential details of the policy, including coverage limits, policy numbers, and the effective dates of the insurance. For businesses, having a COI is crucial as it protects them from various liabilities that can arise during operations.

In business transactions, COIs play an essential role in risk management and compliance. They assure clients and vendors that the parties involved are appropriately insured, mitigating potential financial losses resulting from accidents or damages. However, misconceptions abound regarding COIs, such as the belief that having a COI eliminates all risks or that all insurance policies are equivalent in their protection levels.

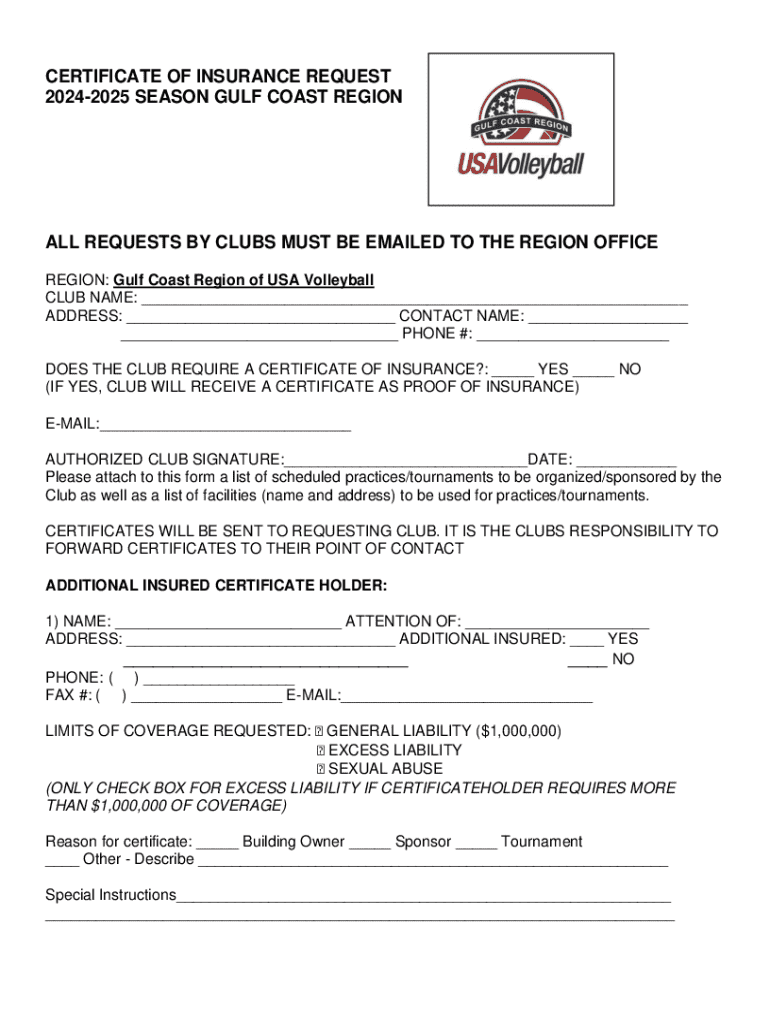

What is a Certificate of Insurance Request Form?

The Certificate of Insurance Request Form is a standardized document utilized by businesses to request a COI from their insurance provider or vendor. This document outlines specific details that are necessary for obtaining the COI, streamlining communication and ensuring all parties have the required coverage. By specifying the purpose and necessary details in one place, this form prevents misunderstandings.

Key components of the form often include the requesting party's contact information, the type of insurance needed, coverage limits, effective dates, and specific entities to be listed as additional insured, if applicable. This formalization aids in both tracking requests and maintaining a professional relationship across transactions.

Why request a Certificate of Insurance?

Requesting a Certificate of Insurance is pivotal for several reasons. Firstly, it protects both the business requesting the COI and the parties involved against potential liabilities. By having valid proof of insurance, a business can shield itself from lawsuits or damages that could arise from business operations. It demonstrates due diligence in risk management.

Moreover, requesting a COI signals professionalism and reliability to clients and vendors. It builds essential trust and respect in business relationships. By ensuring that all parties maintain adequate insurance coverage, businesses can minimize disruptions that result from unforeseen events.

The process of requesting a Certificate of Insurance

The process of requesting a Certificate of Insurance can be divided into several systematic steps to ensure clarity and accuracy.

Effective communication is essential throughout the process. When reaching out to vendors or insurance providers, be direct about your needs, and clarify any specifics regarding coverage requirements or additional insured parties. For instance, using a sample email template can help present your request professionally. When completing the Certificate of Insurance Request Form, pay attention to details such as the policy number and coverage limits, as inaccuracies can lead to delays or complications.

Common errors to avoid when filling out the form include omitting crucial details, providing incorrect information about coverage, or failing to specify the purpose of the request clearly.

Interactive tools to manage COI requests

pdfFiller offers specialized tools that greatly simplify the management of Certificate of Insurance requests. With its cloud-based platform, users can create, edit, and electronically sign COI request forms with ease.

Key features include user-friendly templates that can be customized based on specific needs, allowing for rapid creation of tailored forms. Collaboration tools enhance teamwork, enabling multiple team members to engage in requests and approvals seamlessly. Users can sign and share documents instantaneously, which accelerates the request process.

Certificate of insurance requirements by industry

Certificate of Insurance requirements can vary significantly based on industry standards and local regulations. For instance, in the construction industry, COIs are often required to prove general liability insurance before beginning projects. Similarly, healthcare providers may need to provide COIs showcasing professional liability coverage to ensure compliance with state regulations.

Events and entertainment industries also mandate COIs to cover potential risks associated with large gatherings or productions. It's important to stay informed about state regulations, as these can influence the necessary coverage types and minimum limits required by law. Businesses should always verify specific insurance obligations before engaging with vendors or clients.

COI management best practices

Effective COI management is critical for maintaining compliance and safeguarding your business against unforeseen liabilities. Best practices include establishing a systematic method for tracking and filing COIs, ensuring that you can easily access proof of insurance when needed.

By adopting these practices, businesses can avoid common pitfalls associated with COI compliance, resulting in a more secure operating environment.

Case studies on COI management challenges

Numerous real-world scenarios illustrate the consequences of inadequate COI management. For instance, a contractor was severely penalized for not verifying a subcontractor's insurance coverage which resulted in significant liabilities due to an accident on-site. Such cases emphasize the importance of thorough verification and adherence to COI standards.

Lessons learned from these incidents include the necessity of maintaining up-to-date records and the critical importance of requesting and reviewing COIs from all engaged parties. Implementing detailed and structured verification processes can prevent similar challenges.

The future of Certificate of Insurance management

As technology continues to evolve, the landscape of COI management is also transforming. Trends indicate a growing reliance on technology for tracking and managing COIs, with innovations focused on automation streamlining processes.

AI and automated systems are emerging as essential tools for verifying insurance coverage, allowing businesses to manage risk proactively. Over the next few years, we anticipate that COI request forms will become even more integrated into broader document management systems, enhancing their functionality and user-friendliness.

Engaging with your document management platform

pdfFiller’s cloud-based document solutions provide a robust platform for managing COI requests. Users can leverage its features to optimize the form completion process, ensuring swift access to necessary documentation.

By using pdfFiller, teams can enhance collaboration, easily share documents, and receive specialized support tailored to their needs while managing COI requests efficiently. These capabilities ultimately empower users to streamline their document workflows while ensuring compliance.

Frequently asked questions about COIs

Several common queries arise regarding Certificates of Insurance, reflecting widespread concerns among businesses. Here are some answers to the most frequently asked questions:

Related resources and tools

For comprehensive management of insurance documents, additional resources are invaluable. Tools such as dedicated document management software can aid in compliance and regulatory updates.

Accessing software dedicated to tracking COI compliance can streamline processes, while staying updated on industry regulations ensures that businesses operate within legal parameters. Consistent engagement with relevant content and resources paves the way for proactive management of insurance documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of insurance request to be eSigned by others?

Can I create an eSignature for the certificate of insurance request in Gmail?

How do I fill out certificate of insurance request using my mobile device?

What is certificate of insurance request?

Who is required to file certificate of insurance request?

How to fill out certificate of insurance request?

What is the purpose of certificate of insurance request?

What information must be reported on certificate of insurance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.