Get the free Char500 Annual Filing for Charitable Organizations

Get, Create, Make and Sign char500 annual filing for

Editing char500 annual filing for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out char500 annual filing for

How to fill out char500 annual filing for

Who needs char500 annual filing for?

A comprehensive guide to Char500 annual filing for form

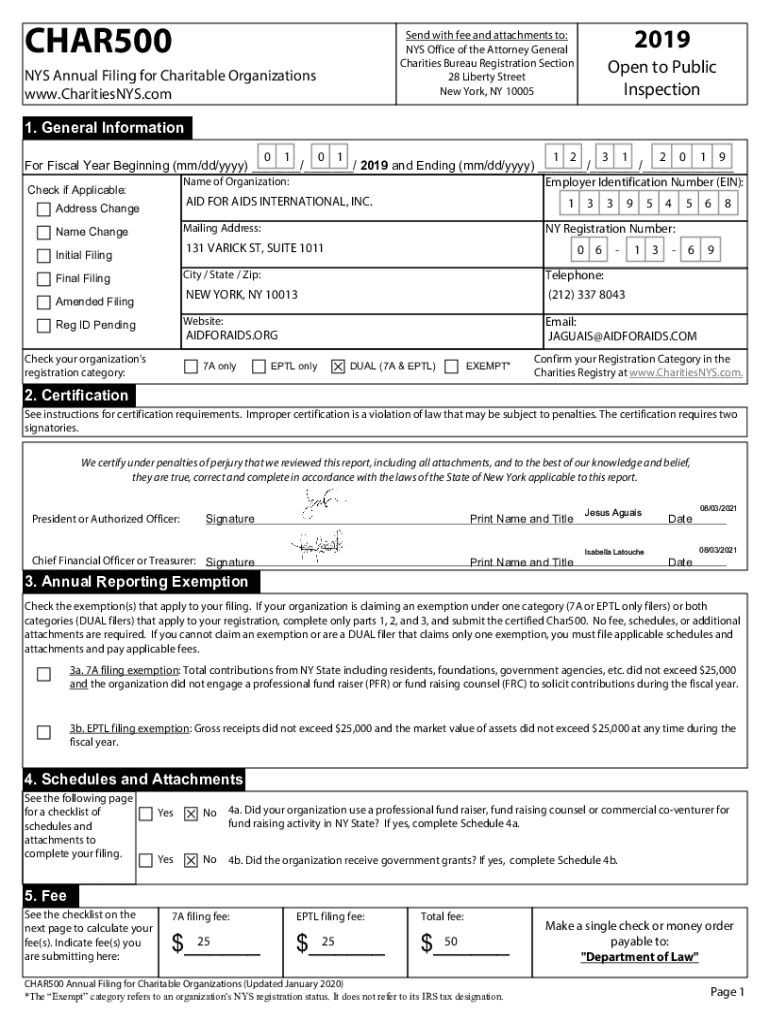

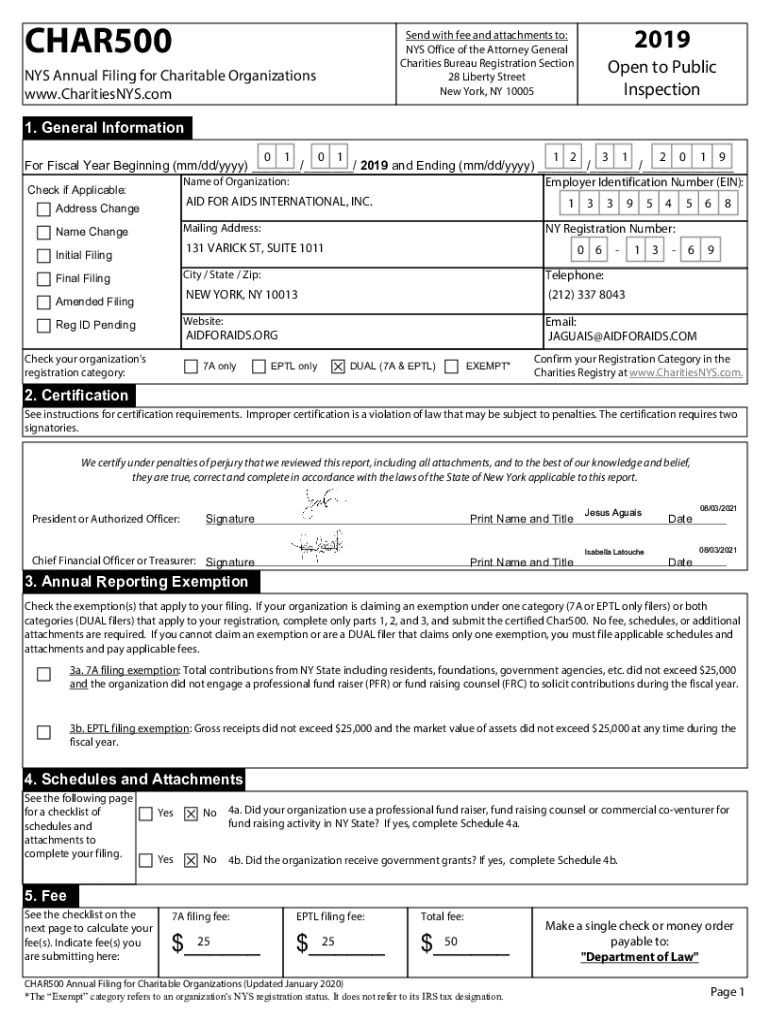

Overview of Char500 annual filing

The Char500 annual filing is a crucial requirement for certain organizations in New York to provide a snapshot of their operations, financial status, and accountability to the public and state authorities. Established under New York's Not-for-Profit Corporation Law, this filing serves not only as a compliance measure but also as a means for organizations to demonstrate transparency and build trust within their communities.

Annual filings are pivotal in highlighting an organization's achievements, financial health, and adherence to regulatory requirements. By submitting the Char500, organizations can portray their commitment to responsible management and effective service delivery, which are vital for securing ongoing support from donors, stakeholders, and the community.

Who needs to file the Char500?

The Char500 form is required for all nonprofit organizations registered in New York that are exempt from federal taxes under section 501(c)(3), and those that receive more than $25,000 in public funds. Additionally, private foundations and charitable organizations that have had charitable contributions exceeding $250,000 must also submit this form. Understanding your filing obligations is essential to remain compliant and avoid penalties.

A common misconception is that all nonprofits must file the Char500 regardless of their revenue. In reality, not all organizations have the same requirements, and smaller nonprofits with limited revenue may be eligible for simpler reporting or exemptions. Familiarizing yourself with the eligibility criteria helps in determining whether your organization is required to file.

Key components of the Char500 form

The Char500 form is divided into several key sections that encompass a wealth of information about the organization. These sections include:

Understanding the terminology used in the Char500 is also crucial, as terms like 'unrestricted funds,' 'net assets,' and 'revenue sources' are central to accurately completing the form. Providing clarity on these terms ensures that stakeholders can understand the financial and operational narrative presented.

Step-by-step instructions for completing the Char500 form

Completing the Char500 can seem daunting, but breaking it down into manageable steps simplifies the process. Here’s a detailed guide:

Filing options for the Char500 form

Organizations can submit the Char500 through online filing or paper submission. The online route is increasingly popular due to its convenience and efficiency, especially through platforms like pdfFiller. Online submission saves time and reduces the risk of errors as users can edit their forms easily before submission.

To file online via pdfFiller, users should create an account, navigate to the Char500 form, and fill it out digitally. This process includes features that allow for easy collaboration among team members, ensuring that everyone involved can contribute. Tips for successful submission include confirming the completion of each section and ensuring file attachments are in the correct format.

Common challenges and solutions

While the Char500 filing process is designed to be straightforward, organizations often face hurdles. Common issues include difficulty accessing the online form, navigating the complex instructions, and uncertainty in financial reporting. Having a plan to overcome these challenges is essential.

For instance, if accessing the form proves problematic, ensure your internet connection is stable and consider using different browsers. If instructions are unclear, referring back to the guidelines provided by the nonprofit office and using resources available through pdfFiller can clarify ambiguities.

Resources for assistance

Seeking help can make the Char500 filing process less intimidating. Many resources are available, including:

FAQs about Char500 annual filing

As organizations prepare their filings, several questions often arise. Here are answers to some of the most frequently asked:

Additional tools and features on pdfFiller for Char500 filings

pdfFiller enhances the Char500 filing experience with a variety of interactive tools. Users benefit from document management capabilities that allow for easy editing, e-signing, collaboration, and cloud storage.

These features facilitate team collaboration and provide a streamlined approach to filling out complex forms. The e-signature feature, for example, enables quick approval from board members or stakeholders, thereby expediting the filing process.

Related documents and resources

In addition to the Char500, organizations may find themselves needing to consider other relevant forms. These can include forms for charitable organizations and other nonprofit filings. Comparing these forms may provide insights into how your organization fits within the broader regulatory framework.

Additional guides for managing organizational compliance can also be invaluable. They can provide detailed information and best practices for various filing requirements and organizational governance.

Keeping track of changes in filing requirements

Change is a constant in the nonprofit sector, especially regarding filings. Organizations should stay updated on any forthcoming changes to the Char500 filing process to maintain compliance. Regular review of the New York State Office of Charities website or subscribing to newsletters from regulatory bodies ensures that you are informed.

pdfFiller’s updates and newsletters are a valuable resource for staying informed on any modifications in the filing requirements, ensuring that your organization is always up-to-date and compliant.

Summary of key takeaways

Timely and accurate filing of the Char500 is critical for maintaining organizational compliance. Leveraging tools like pdfFiller streamlines the filing process, making it easier for organizations to focus on their mission rather than paperwork.

The importance of having a robust support system that includes resources and contacts for assistance cannot be overstated. By adopting a proactive approach to compliance and utilizing available platforms, organizations can enhance their operational effectiveness and community trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my char500 annual filing for directly from Gmail?

How do I edit char500 annual filing for online?

How do I fill out the char500 annual filing for form on my smartphone?

What is char500 annual filing for?

Who is required to file char500 annual filing for?

How to fill out char500 annual filing for?

What is the purpose of char500 annual filing for?

What information must be reported on char500 annual filing for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.