Get the free Check Request and/or Additional Funds Request Form

Get, Create, Make and Sign check request andor additional

Editing check request andor additional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request andor additional

How to fill out check request andor additional

Who needs check request andor additional?

Check Request and Additional Form: A Comprehensive Guide for Streamlined Financial Management

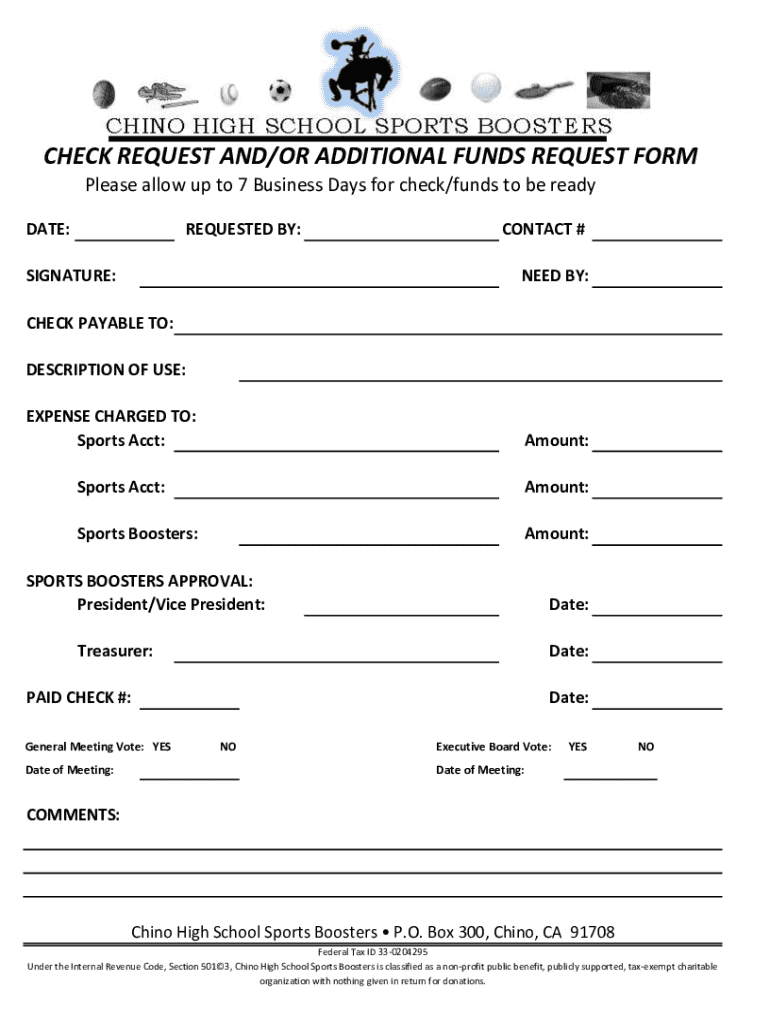

Understanding the check request process

A check request is a formal request made within an organization to authorize payment through a check. This process is essential for maintaining organized financial transactions, ensuring that funds are released only for approved expenses. Check requests are typically used for operational costs such as vendor payments, employee reimbursements, and service fees.

The primary purpose of check requests in financial management is to provide a documented approval mechanism that ensures accurate and timely payments. This helps organizations mitigate the risk of unauthorized transactions, instilling a culture of accountability within the financial framework.

It’s important to differentiate check requests from other payment methods, such as credit card transactions or direct bank transfers. Unlike these methods, which may be processed in real-time, check requests often involve a more rigorous approval and documentation process, thereby necessitating additional steps and time for processing.

Types of check requests

Check requests can generally be categorized into two main types: standard check requests and additional forms for special circumstances. Understanding these categories is crucial for ensuring that the correct process is followed.

A standard check request is commonly used for regular expenses that fit within typical organizational protocols. These requests typically follow a standard template and require basic information such as the payee's name, the amount, and the purpose of the payment. They are often employed for routine expenses like utility payments, payroll, and office supplies.

In contrast, additional forms may be required for special circumstances. For instance, when payments involve sensitive or specialized transactions—like legal fees or international payments—additional documentation or justification might be necessary to process the request appropriately. Utilizing these additional forms ensures compliance with financial regulations and organizational policies.

Step-by-step guide to completing a check request

Completing a check request efficiently can save time and reduce errors. Here’s a step-by-step guide to navigate this process effectively.

Gathering necessary information

Start by collecting all necessary information. Each check request typically requires the following identifying details: date, payee name, payment amount, and the reason for the check. Supporting documentation, such as invoices or receipts, should also be collected to substantiate the request and ensure it complies with your organization's financial procedures.

Filling out the check request form

Once you have your information, proceed to fill out the check request form. Emphasize accuracy in each section: for instance, double-check the spelling of names and confirmation of amounts. Common errors to avoid include omitting necessary signatures and mislabeling payment purposes, which could lead to delays.

Submitting the check request

Next, submit your check request. This can typically be done through various methods, such as digital submission via platforms like pdfFiller or physical submission to the finance department. Ensure you follow the preferred channel to avoid any issues.

Follow-up procedures

After submitting your request, it’s essential to track its status. pdfFiller provides tools to monitor your request's progress. If you experience unexpected delays, reach out to the finance department for clarification and ensure your request hasn’t encountered any administrative hurdles.

Navigating additional forms for check requests

In circumstances where a simple check request does not suffice, different additional forms may be required. These forms are tailored to address specific needs or compliance requirements that standard check requests do not cover.

Overview of common additional forms

Some common additional forms may include: vendor service agreement forms, travel reimbursement forms, or foreign payment request forms. These will often demand more detailed information and supporting documentation to justify the requests.

How to access additional forms via pdfFiller

Users can conveniently access various forms through pdfFiller. The platform allows you to search for specific additional forms based on the type of request needed and provides a user-friendly interface for downloading these forms.

Tips for completing additional forms

When completing these forms, be diligent about including all key details. Missing any required information can result in processing delays or outright denials. Examples of completed forms can often be found within pdfFiller’s resources, which provide a helpful reference for how to correctly fill out complex forms.

Interactive tools and resources

Utilizing interactive tools can significantly streamline the check request process. pdfFiller offers an interactive check request template that features user-friendly design and functionalities for easy completion.

Using pdfFiller's interactive check request template

This template allows users to input information directly into the fields, reducing common errors associated with handwritten submissions. Furthermore, features like e-signatures and document collaboration enhance the speed and efficiency of the process.

FAQs about check requests and additional forms

As with any formal process, questions may arise regarding check requests and additional forms. Common inquiries include clarification on necessary signatures, required documentation, and timelines for processing. pdfFiller addresses these FAQs to empower users with knowledge, ultimately making the process easier and more consistent.

Tips for managing documents related to check requests

Efficient document management is vital for maintaining smooth financial operations. Here are some best practices to follow.

Best practices for document organization

Organizing check request materials can facilitate easier retrieval and reference. Utilize a systematic naming convention for files and maintain a designated folder structure for different types of request materials. pdfFiller’s document management features, such as cloud storage and tagging, further enhance your ability to keep materials organized.

Collaboration tips for teams

For teams handling multiple check requests, collaboration becomes key. Foster clear communication among team members dealing with requests. Tools within pdfFiller, such as shared workspace capabilities, allow for real-time collaboration and shared edits on documents, ensuring everyone is on the same page and improving the overall efficiency of the process.

Ensuring compliance and accuracy in check requests

Maintaining compliance in financial documentation is non-negotiable for organizational integrity. Adhering to regulatory requirements ensures that all financial activities are above board and reduces the likelihood of costly errors.

Understanding compliance requirements

These requirements often dictate the type of information necessary for documentation and how it should be recorded. Familiarizing yourself and your team with these guidelines can mitigate risks associated with non-compliance, such as financial penalties or damaged reputations.

Auditing your check requests

Regular audits of check requests can help identify patterns of errors and streamline necessary adjustments in processes. Self-auditing your completed requests involves checking forms against submissions comprehensively. Utilizing pdfFiller allows for easy retrieval of completed documents for this purpose, making the audit process less burdensome.

Troubleshooting common issues

Even with careful planning, you may encounter challenges during the check request process. Here’s how to troubleshoot.

Handling denied check requests

A denied check request can be frustrating. Common reasons for denial include incomplete documentation or failure to meet compliance standards. If faced with a denial, understand the specific reasons and explore the possibility of appealing that decision, ensuring you address any gaps in your submission.

Managing errors in submitted forms

If you spot a mistake in a submitted form, don't panic. pdfFiller’s editing tools allow for quick corrections. Check with the finance department regarding the preferred method for submitting corrected documents, as procedures may vary from one organization to another.

User testimonials and success stories

Many organizations have experienced significant improvements in efficiency by utilizing pdfFiller’s solutions. Feedback from users highlights their success in streamlining the check request process, reducing turnaround times, and enhancing compliance through automated features.

Users report that pdfFiller's document management capabilities have not only improved their workflow but also fostered better collaboration across teams handling financial documentation. By resolving complex transaction approvals seamlessly, pdfFiller has become an indispensable tool for many organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the check request andor additional in Gmail?

How can I edit check request andor additional on a smartphone?

How can I fill out check request andor additional on an iOS device?

What is check request andor additional?

Who is required to file check request andor additional?

How to fill out check request andor additional?

What is the purpose of check request andor additional?

What information must be reported on check request andor additional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.