Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Everything You Need to Know About Credit Application Forms

Understanding credit application forms

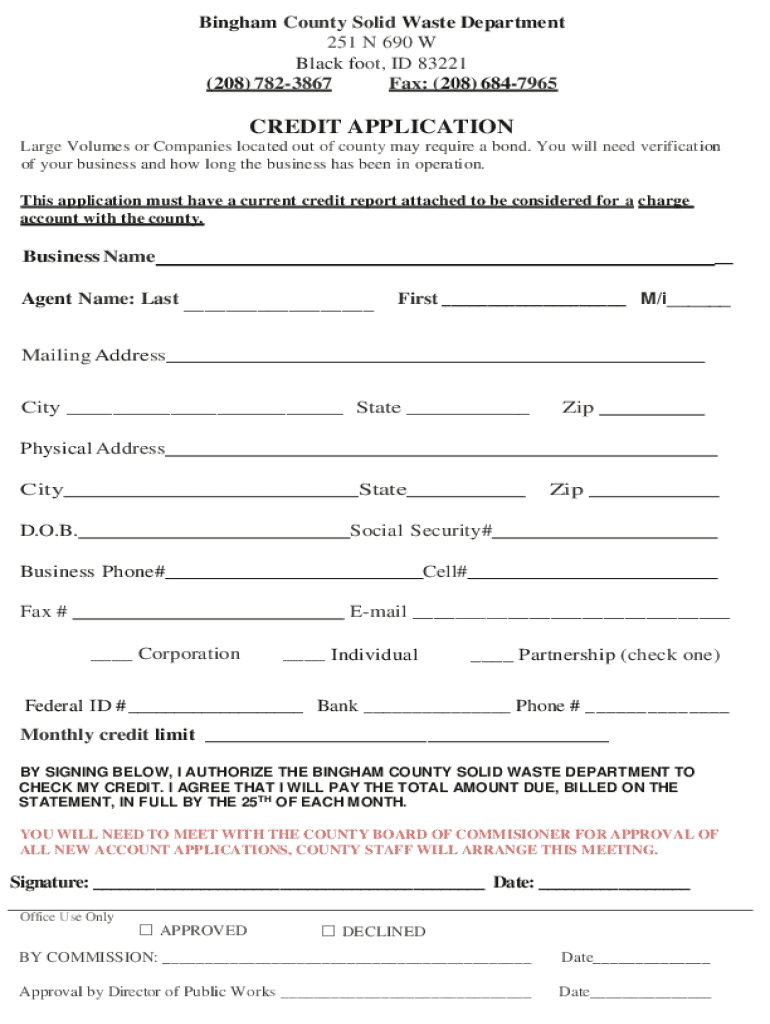

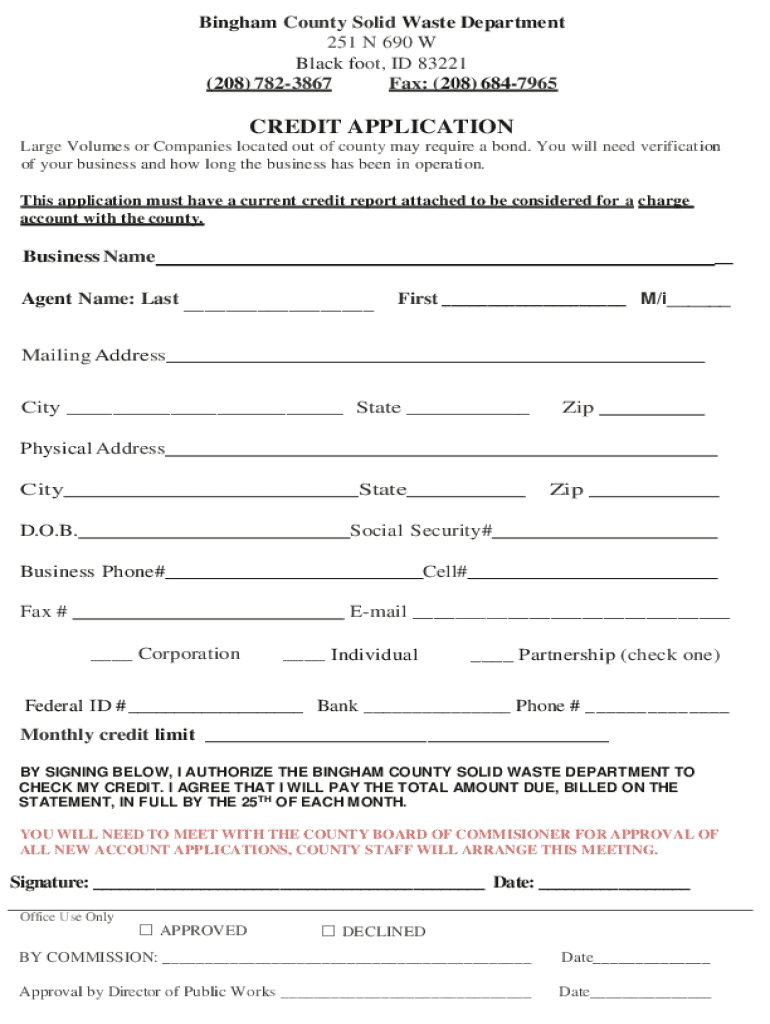

A credit application form is a crucial document used by lenders to assess the creditworthiness of individuals or businesses seeking loans or credit. This form acts as a gateway for potential borrowers, providing lenders with necessary information to evaluate the risk associated with the extension of credit. Understanding the importance and purpose of a well-structured credit application form ensures that the right data is collected, enhancing the likelihood of an approval.

Choosing the correct credit application form is essential because it aligns the application with the lending criteria and regulations relevant to a specific loan type—whether personal, business, or specialized financing. There are distinct differences between consumer and business credit application forms, both in the information required and the evaluation process. Recognizing these differences can foster more efficient loan processing.

Key components of a credit application form

A comprehensive credit application form must capture various types of information. Personal information serves as the foundational data, requiring the applicant's name, contact details, and social security number for identity verification. This section is crucial as it helps lenders ensure that they are dealing with legitimate applicants.

Financial information includes a detailed account of income, such as salaries, bonuses, and any additional sources of revenue. Additionally, applicants should disclose expenses, giving lenders a clear picture of their financial obligations, which directly impacts their ability to repay loans.

For B2B applications, business information is critical. Details such as company name, tax ID number, and trade references allow lenders to assess the legitimacy and creditworthiness of the business. Additionally, credit history inquiries are crucial for understanding an applicant's past credit behavior, which serves as a predictive measure of future borrowing reliability.

Ensuring compliance and legal requirements

Compliance with consumer protection laws, such as the Equal Credit Opportunity Act (ECOA), is paramount when handling credit application forms. These regulations ensure fair treatment of all applicants, prohibiting discrimination based on race, gender, or other factors. Adherence to these rules protects both lenders and borrowers, fostering a fair credit landscape.

Data privacy is another critical aspect; all personal and financial information must be securely stored and managed to prevent identity theft or data breaches. Lenders should implement secure storage and encryption methods, safeguarding sensitive information. Moreover, including authorization clauses and signature requirements on credit applications confirms that applicants consent to credit checks and other necessary evaluations.

The credit application process: step-by-step

The credit application process begins with pre-application considerations, wherein potential borrowers should assess their creditworthiness. This self-assessment involves checking one’s credit report for inaccuracies and understanding credit scores. Gathering required documents—such as proof of income, identification, and other relevant financial paperwork—streamlines the application process.

Next comes filling out the application. Accuracy and completeness are paramount; mistakes or missing information can delay approval or result in automatic denials. Once the form is filled out, the applicant can submit it through either online or paper submission methods. Digital submissions are often faster and enable tracking, whereas paper submissions can take longer due to postal delays.

After submission, there is usually a review process that varies by lender. Applicants should anticipate a waiting period that can range from a few hours to several weeks, depending on the complexity of the application and the lender’s internal processes. During this time, lenders verify the information provided, assess the applicant’s credit history, and arrive at a decision.

Common pitfalls to avoid

One significant pitfall is submitting an incomplete application. Details matter; missing information can result in a delay or denial of the application. It is vital for applicants to read through their submissions carefully, ensuring that every required field is filled completely and correctly.

Another common issue is the misinterpretation of financial terms. Applicants should fully understand what is being asked, especially in sections concerning income, debts, and expenses to avoid providing misleading information. Lastly, failing to disclose necessary information, such as additional debts or co-signers, can lead to unfavorable outcomes during the review process.

The role of technology in credit application management

The rise of digital solutions has revolutionized the credit application process. Platforms like pdfFiller enable users to create, edit, and manage credit application forms effortlessly. With features such as real-time editing capabilities and eSigning functionalities, documents can be filled out and signed swiftly, greatly enhancing efficiency without compromising security.

Additionally, integrating automated credit scoring systems with these platforms allows lenders to quickly assess applications and make informed decisions. Document tracking and management via cloud solutions further streamline the workflow, allowing for easy access and storage of all application materials across devices, thus meeting the needs of individuals and teams seeking a comprehensive, access-from-anywhere solution.

Frequently asked questions (FAQs)

What do lenders look for in a credit application? Lenders assess creditworthiness primarily through income verification, credit history, debt-to-income ratio, and specifics related to personal and financial information.

How can businesses improve their chances of approval? Businesses can improve approval chances by maintaining accurate financial records, presenting a strong business plan, addressing any past credit issues, and preparing a comprehensive credit application that outlines their stability and growth potential.

What should I do if my credit application is denied? If an application is denied, review the lender's explanation for the decision, correct any inaccuracies in your application, and consider improving your creditworthiness before reapplying.

Why is a credit application important for businesses? For businesses, a credit application serves not only as a gateway for obtaining necessary financing but also provides valuable insights into their financial health and credit standing.

Best practices for submitting a credit application

Preparing your financials in advance is a best practice that significantly increases the likelihood of approval. Organizing necessary documents related to income, credit history, and financial obligations allows for a smoother application experience.

Knowing your credit history and addressing any discrepancies before submission also enhances credibility. After submitting the application, following up with the lender can display initiative and resolve any lingering questions they may have.

Related resources and next steps

Individuals and businesses seeking further information on credit management can explore various articles on the pdfFiller website that cover financial best practices. Additionally, downloadable templates and tools for creating and managing credit applications are readily available.

For those interested in expanding their knowledge, pdfFiller also offers upcoming webinars focusing on financial education and the nuances of completing credit applications accurately and confidently.

Interactive tools and solutions offered by pdfFiller

pdfFiller provides several templates for credit applications tailored to specific needs. This customizability allows users to adjust the forms to reflect the unique requirements of different lenders or loan types.

A thorough walkthrough of pdfFiller’s features—such as editing templates, collaborating with team members, and secure signing of documents—highlights how this cloud-based platform can simplify the credit application process for individuals and businesses alike.

Conclusion

A comprehensive credit application form is indispensable for both lenders and borrowers. It plays a pivotal role in evaluating creditworthiness and ensuring a fair lending process. By leveraging technology and understanding the intricacies of the application, users can streamline their experiences and increase their chances of approval while keeping sensitive information secure and compliant with legal requirements.

The use of platforms like pdfFiller not only empowers users to manage their credit applications efficiently but also equips them with essential resources and tools to navigate the credit landscape effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application for eSignature?

How can I get credit application?

Can I sign the credit application electronically in Chrome?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.