Get the free Credit Cards 101

Get, Create, Make and Sign credit cards 101

Editing credit cards 101 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit cards 101

How to fill out credit cards 101

Who needs credit cards 101?

Credit Cards 101 Form: A Comprehensive Guide

Understanding credit cards

A credit card is a powerful financial tool that allows users to borrow funds for purchases, up to a predefined limit. This form of revolving credit empowers consumers to make immediate purchases and pay them back later, often with interest. The origins of credit cards trace back to the 1950s when the Diners Club introduced a charge card that could be used at restaurants. This paved the way for modern credit cards, which have become an integral part of personal finance.

Credit cards operate on a billing cycle where charges accumulate over the month and are charged interest if not fully paid. Key terms include credit limits, which indicate the maximum one can borrow, and interest rates, which determine the cost of borrowing. This basic understanding sets the stage for comparing credit cards with other payment methods.

Credit cards vs. other payment methods

When choosing between payment options, it’s essential to grasp the differences. Debit cards draw directly from your bank account, which prevents you from spending beyond your means. Cash, while straightforward and universally accepted, lacks the benefits of rewards and credit building associated with credit cards. The main advantages of using credit cards include the ability to build a credit history, earn rewards on purchases, and access cash in emergencies.

Types of credit cards

Credit cards come in various forms, each targeting different user needs. A basic credit card is straightforward, featuring no frills and suitable for users who prefer simplicity. Reward cards appeal to those looking to maximize their spending with points or miles, which can be redeemed for travel or cash back. Low-interest cards help those who may carry a balance, while balance transfer cards allow users to move debt from high-interest to lower-interest cards strategically.

Each type of credit card serves distinct purposes, and understanding their features can help users select the best card for their financial situation.

Reasons to get a credit card

There are numerous compelling reasons to obtain a credit card. Firstly, convenience and flexibility in payments empower users to make purchases without immediate cash availability. Additionally, credit cards are crucial for building and establishing credit history, which influences loan approvals and interest rates for larger expenses, such as buying a home or car.

Another significant benefit is access to financial rewards and perks. Many credit cards offer cash back, discounts on shopping, or benefits related to travel. For emergencies or unplanned expenses, having a credit card can provide peace of mind, allowing users to handle unexpected situations without derailing their financial stability.

Costs associated with credit cards

Understanding the costs associated with credit cards is critical to managing them effectively. Interest rates, or APRs, can vary significantly, influencing how much you'll pay if you carry a balance. Fixed rates remain constant, while variable rates fluctuate based on market conditions. The impact of carrying a balance can escalate costs quickly due to accumulating interest.

It's vital to regularly review your credit card bill, understanding each component to avoid unexpected costs.

Managing credit card use effectively

Effective management of credit card use can significantly impact your financial health. Responsible spending is crucial—budgeting and tracking expenditures helps avoid overspending. Living within your means and being aware of your credit limit empowers you to utilize credit strategically.

By implementing these practices, cardholders can enhance their financial stability and maximize the benefits of their credit cards.

Credit health and maintenance

A robust credit score is vital for financial credibility, heavily influenced by credit card usage. Maintaining a low credit utilization ratio—keeping your balance below 30% of your limit—and consistently making on-time payments are essential factors in building a strong credit score.

These measures assist users in maintaining a healthy credit profile which can broaden financial opportunities.

Advanced credit card concepts

As users become more comfortable with credit cards, understanding advanced concepts is crucial. Credit card issuer policies vary widely and understanding the fine print can prevent unpleasant surprises. For instance, knowing how to maximize cashback offers or travel rewards could enhance your card's value.

Having awareness of these advanced concepts enables users to not only protect themselves but also optimize the benefits of their credit cards.

The future of credit cards

The landscape of credit cards is rapidly evolving, with trends favoring technologies like digital wallets and contactless payment options. These innovations promise enhanced convenience and security, positioning credit cards as a leading choice for digital transactions.

Additionally, consumer behavior is shifting as younger generations increasingly embrace cashless solutions, prioritizing convenience and speed in their payment methods. Understanding these trends can help users align their financial strategies with future developments in the credit card market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit cards 101 in Chrome?

How do I edit credit cards 101 on an Android device?

How do I complete credit cards 101 on an Android device?

What is credit cards 101?

Who is required to file credit cards 101?

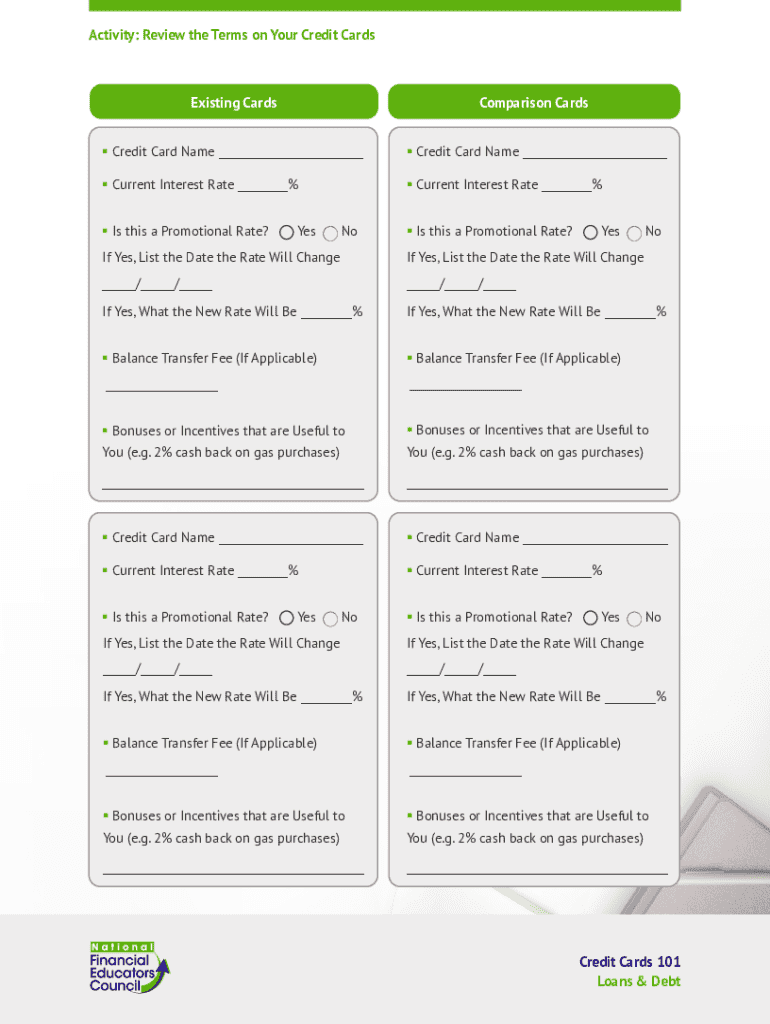

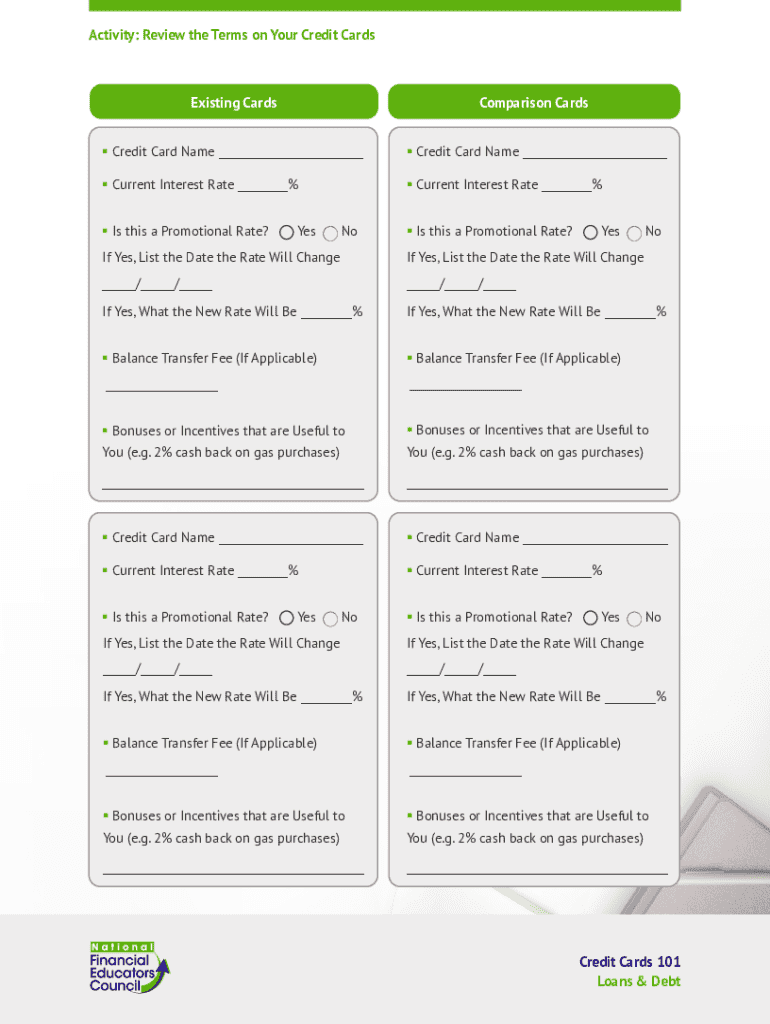

How to fill out credit cards 101?

What is the purpose of credit cards 101?

What information must be reported on credit cards 101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.