Get the free Credits for Employers in the Aerospace Sector

Get, Create, Make and Sign credits for employers in

How to edit credits for employers in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credits for employers in

How to fill out credits for employers in

Who needs credits for employers in?

Credits for employers in form: A comprehensive guide

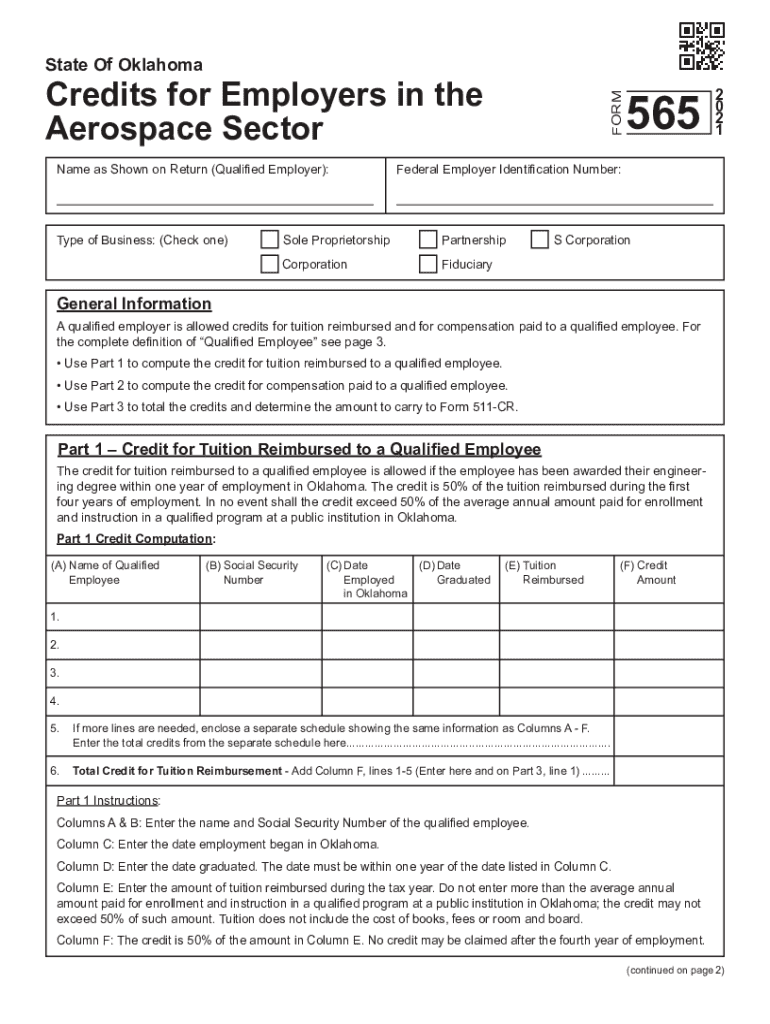

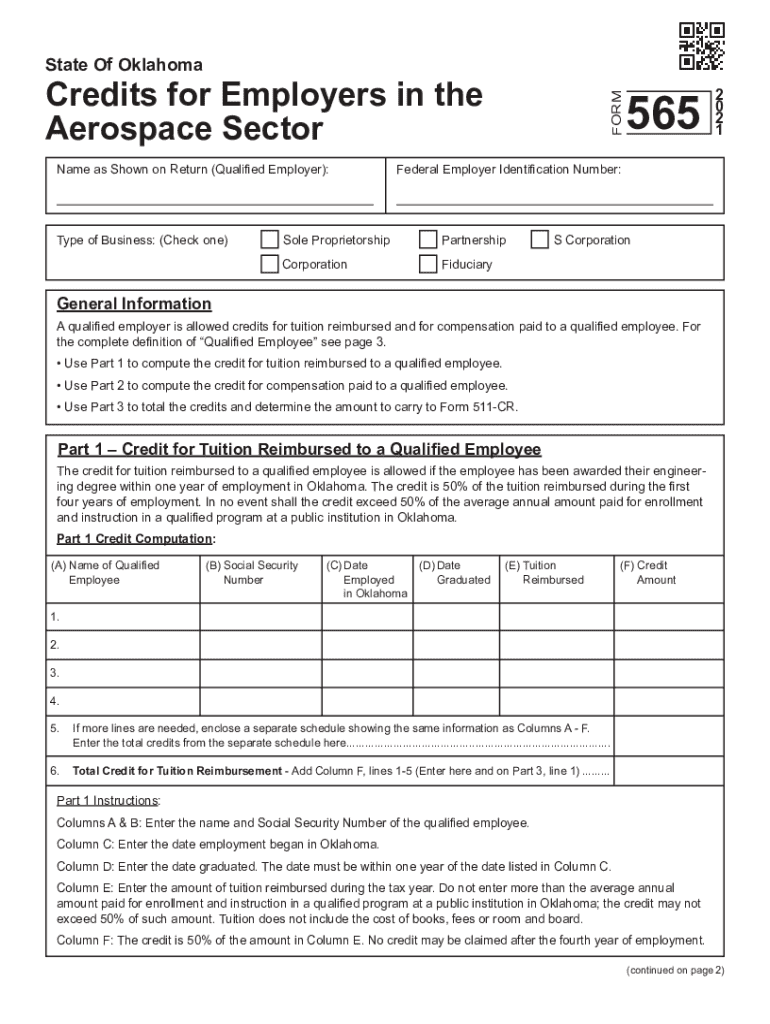

Understanding employer credits

Employer credits are financial incentives granted to businesses for hiring or retaining specific groups of employees. These credits can significantly reduce tax liabilities, providing essential capital for operations. By understanding and applying for these credits, employers can optimize their financial performance while contributing positively to workforce diversity.

It’s critical for employers to stay informed about available credits, as they often vary by region and change based on new laws. Leveraging these credits can offer not only tax relief but also strengthen a company’s commitment to social responsibility, improving overall corporate reputation.

Types of employer credits

Employer credits primarily fall into two categories: federal tax credits and state-specific credits. Each type serves to facilitate employment opportunities while providing financial relief to businesses.

Eligibility criteria

Eligibility for these employer credits often hinges on various factors, including the demographics of employees and the specific programs' requirements. Understanding the general eligibility criteria is vital for employers to ensure they qualify for potential savings.

Benefits of employer credits

Harnessing employer credits can yield substantial benefits, the most immediate being tax savings. These tax incentives can translate to significant reductions in tax liabilities, increasing available capital for businesses.

Moreover, diversifying the workforce while leveraging such credits can enhance an organization’s public image, supporting the notion of second-chance hiring and the inclusion of marginalized groups. This aligns with corporate social responsibility goals while attracting customers who value equitable hiring practices.

Application process for employer credits

The application process for employer credits may seem daunting, but with a structured approach, it can be manageable. Below are steps to follow for key credits.

For the Federal Bonding Program, the process involves applying through state workforce agencies to obtain the necessary bonds to protect against theft and losses.

Managing and tracking credits

After securing employer credits, effective management and tracking is crucial for maximizing benefits. Maintaining proper documentation of employee eligibility helps ensure compliance and facilitates future applications.

Utilizing pdfFiller, employers can not only manage forms effectively but also collaborate with their teams to ensure efficient application processes.

Common mistakes to avoid

Navigating employer credits can come with pitfalls. Understanding common errors can save time and enhance the chance of successful applications.

Success stories: Employers who capitalized on credits

Many organizations have successfully navigated the intricacies of employer credits. These case studies illustrate the tangible benefits these credits provide.

Each case reflects the impact of smart utilization of credits, highlighting lessons for other employers to follow.

Resources for employers seeking additional support

As navigating employer credits can be complex, seeking additional resources is beneficial. Professional consultants are available to guide firms through the intricacies of applying for these credits.

Related topics worth exploring

Related incentives can also enhance an employer's ability to save money and expand their workforce effectively. Understanding how credits overlap and complement other benefits is instructive for businesses.

Interactive tools and features on pdfFiller

pdfFiller offers a range of tools designed to help employers efficiently manage their documentation processes related to employer credits. These resources streamline everything from application to tracking.

Contact information for further assistance

Employers seeking additional help can explore a variety of resources offered by pdfFiller. There are channels available to connect with tax experts who can provide guidance tailored to your unique situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credits for employers in in Gmail?

How can I get credits for employers in?

How do I edit credits for employers in straight from my smartphone?

What is credits for employers in?

Who is required to file credits for employers in?

How to fill out credits for employers in?

What is the purpose of credits for employers in?

What information must be reported on credits for employers in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.