Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

How to Fill Out a Credit Application Form

Understanding the credit application form

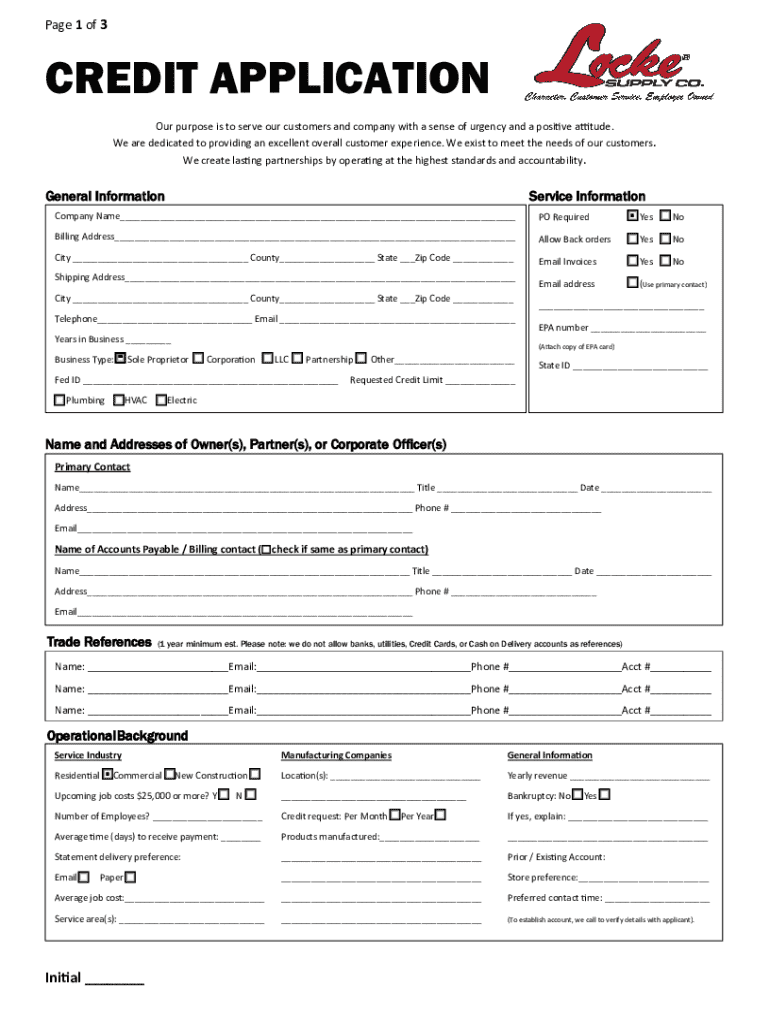

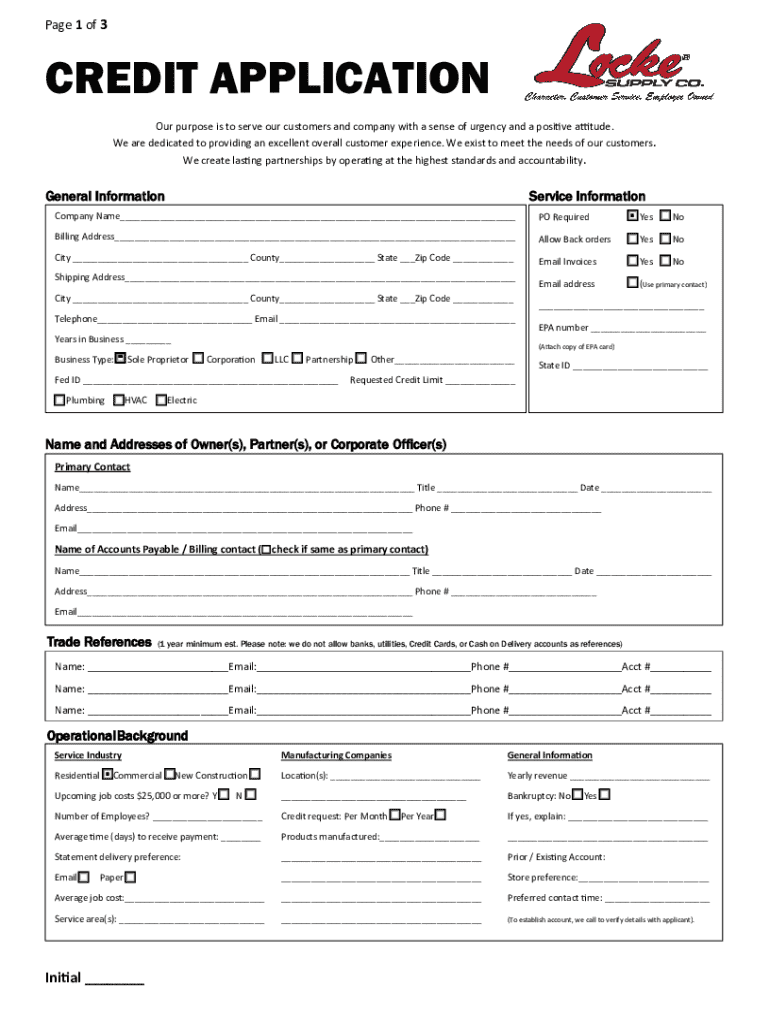

A credit application form is a document used by lenders to collect essential information from borrowers before providing a loan or financing. This form plays a pivotal role in the lending process, serving not just as a means of gathering data but also as a tool to assess the borrower's creditworthiness. The importance of completing this form accurately cannot be overstated, as it influences the lender's decision significantly.

Common scenarios requiring a credit application include individual loans for personal use, such as securing a car or mortgage, as well as business financing for entrepreneurial ventures. In both instances, the information provided will determine the amount of credit offered, the interest rates applied, and the specific terms of repayment.

Key elements of a credit application form

When filling out a credit application form, several key elements are typically required. The first section includes personal information that identifies the applicant. This includes full name, contact details, and a Social Security number or Tax ID, crucial for verification purposes.

Next, financial information is an overview of the applicant's employment and income details, along with their assets and liabilities. This information provides lenders with a sense of the applicant's financial health. In the credit information section, borrowers must detail their previous credit history and authorize the lender to conduct a credit check, which will further inform the lender's decision.

Advantages of using a digital credit application form

Transitioning to a digital credit application form offers several advantages over traditional paper forms. Firstly, there is ease of access and convenience, as applicants can fill out and submit the form from anywhere, eliminating the need for physical copies. This is especially beneficial for individuals or teams who require quick access to financing.

Enhanced collaboration is another key benefit, allowing multiple users to work on a single application efficiently. Security also improves significantly; digital platforms often employ encryption, safeguarding sensitive personal and financial information from unauthorized access. Additionally, applicants can enjoy real-time tracking of their submission and approval status, keeping them informed throughout the process.

Step-by-step guide to filling out your credit application form

Gathering necessary documentation is crucial before completing a credit application form. Applicants should collect identification such as a driver’s license or passport and proof of income, including pay stubs, bank statements, or tax returns, to substantiate their financial claims.

When completing the form, it’s essential to ensure accuracy in all provided information. Missteps can lead to delays or even denials in the application process. Applicants should strive to give detailed responses, as vague answers may raise red flags with potential lenders. Once the form is completed, it's important to conduct a final review, checking for any errors or omissions, and ensuring clarity in all responses.

Interactive tools for filling out credit application forms

Utilizing tools like pdfFiller can significantly streamline the process of filling out a credit application form. For instance, pdfFiller allows users to edit and customize their forms easily. The platform provides step-by-step instructions for editing PDF documents, facilitating a straightforward and user-friendly experience.

Additionally, users can electronically sign their credit application, simplifying the process further. The tool provides an easy way to add your signature digitally, which can often be required for finalizing credit applications. Collaboration is made simple as well; pdfFiller enables sharing options for teamwork and input, allowing multiple team members to contribute to or review the application efficiently.

Common mistakes to avoid when completing a credit application form

While filling out a credit application form, there are prevalent mistakes that applicants should strive to avoid. One common error is providing inaccurate or incomplete information. Lenders rely heavily on the details supplied, and discrepancies can weaken the application’s credibility.

Moreover, failing to review the application thoroughly before submission can lead to overlooked errors that may result in delays or denials. Lastly, misunderstanding the specific requirements based on the lender’s criteria is a frequent pitfall. Each financial institution may have different prerequisites, so it is crucial to read the fine print and meet all outlined conditions.

What happens after you submit a credit application?

After the submission of a credit application form, it enters an evaluation process where the lender reviews the applicant's information rigorously. This assessment typically includes checking credit history and financial standing. The timeline for approval can vary drastically depending on the lender’s policies and the completeness of the application; it can take anywhere from a few minutes to several days.

Potential outcomes of the application can include outright approval, which is the most favorable, or a request for additional information if something is unclear. Conversely, there’s the possibility of denial, which can stem from various reasons such as poor credit history or an insufficient income-to-debt ratio.

FAQs about credit application forms

There are various types of credit application forms that exist, catering to different lending scenarios, including personal loans, auto financing, and business loans. Understanding how a credit application can help in mitigating financial risk is also vital; lenders utilize the information to assess whether the applicant poses a manageable risk before granting credit.

Additionally, red flags that might lead to a rejection of a credit application can include inconsistencies in information, too much debt compared to income, or a lack of credit history. The processing time for a credit application generally varies, with many lenders providing feedback within one to five business days when all information is in order.

Advanced considerations for businesses

Businesses often face different requirements than individuals when filling out a credit application form. The distinctions between B2B (Business-to-Business) and B2C (Business-to-Consumer) credit applications can significantly affect how each application is structured. For example, B2B applications often require more detailed financial statements and business plans.

Furthermore, integrating automated credit scoring into the application process can streamline decisions for lenders and help businesses receive faster responses. Utilizing credit application data analytics can also provide strategic insights for businesses, assisting them not only in securing funding but also in shaping future financial strategies.

Best practices for managing credit application forms

Efficient document management strategies are crucial when handling credit application forms. Proper organization allows for easier retrieval of past applications, which can be useful in future financial endeavors. It's essential to store these applications securely, employing cloud storage solutions that offer robust security features.

Learning from past applications can greatly improve future submissions. By reviewing past successes and failures, applicants can refine their approach, ensuring they meet all requirements and provide comprehensive information, ultimately enhancing their chances of approval in subsequent applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application?

How do I make edits in credit application without leaving Chrome?

Can I create an eSignature for the credit application in Gmail?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.