Get the free Charitable Contribution Worksheet

Get, Create, Make and Sign charitable contribution worksheet

Editing charitable contribution worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable contribution worksheet

How to fill out charitable contribution worksheet

Who needs charitable contribution worksheet?

Understanding the Charitable Contribution Worksheet Form

Understanding the charitable contribution worksheet form

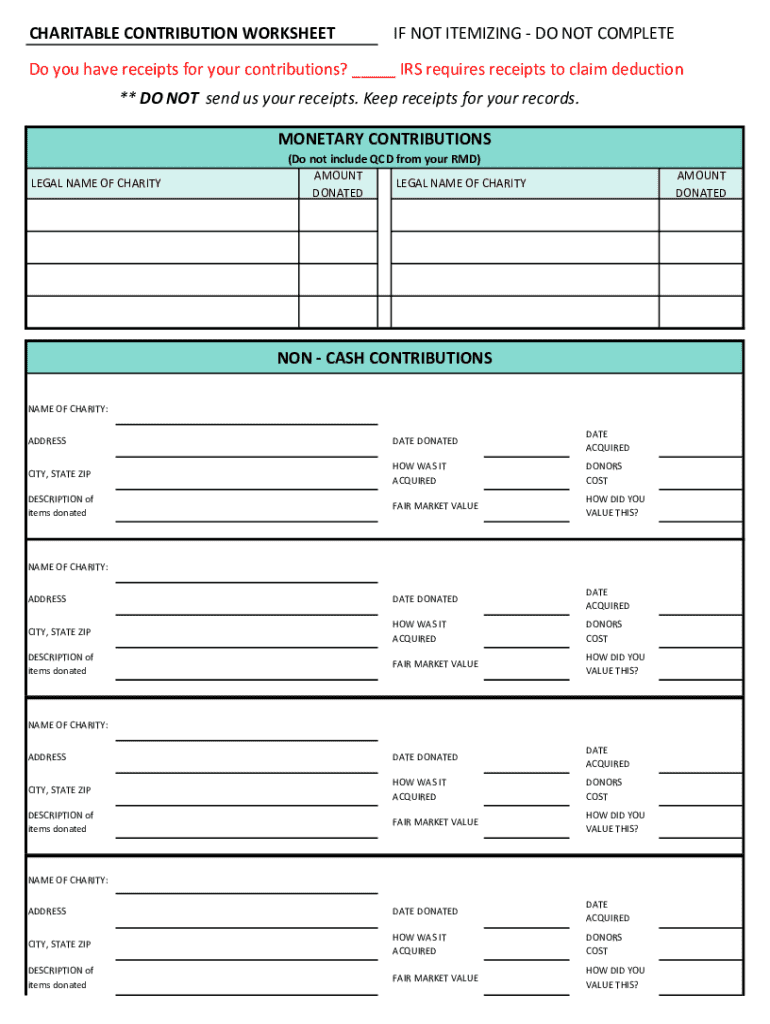

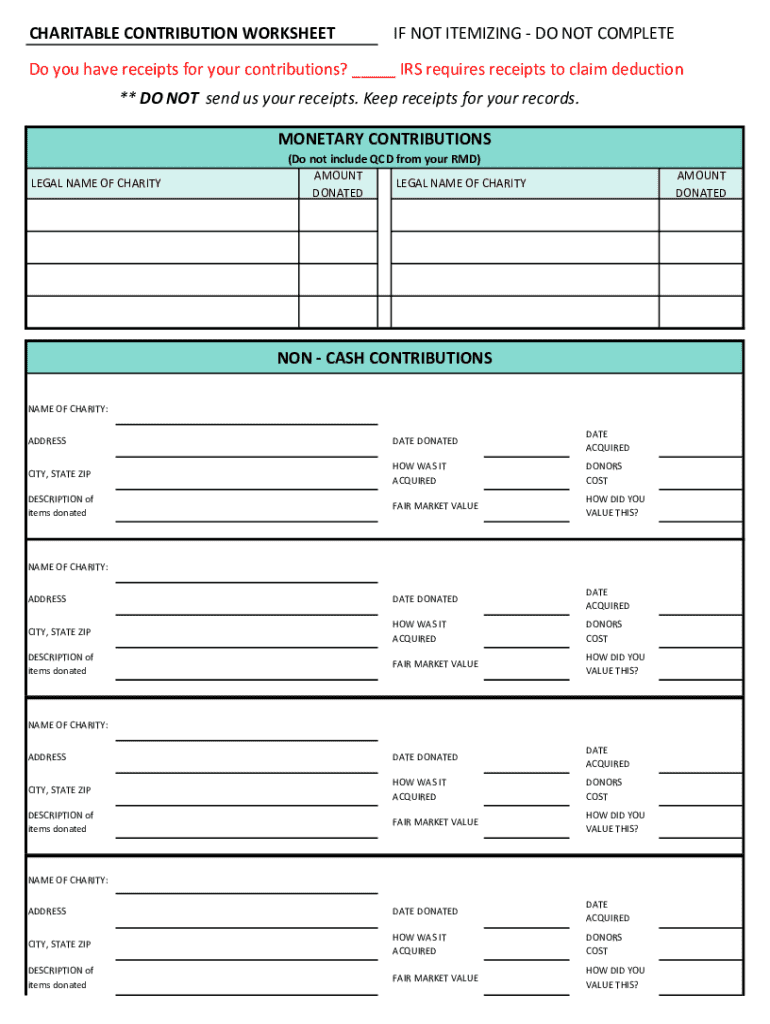

The charitable contribution worksheet form is an essential tool designed to assist individuals and organizations in documenting their charitable donations efficiently. The primary purpose of this form is to provide a structured layout that facilitates accurate reporting of contributions, whether monetary or non-monetary, to eligible charities. By maintaining a detailed record of these donations, donors not only fulfill IRS requirements but also prepare themselves for potential benefits during tax season.

Documenting charitable contributions is crucial for a variety of reasons. It ensures accountability both for the donor and the receiving organization while establishing trust within the community. Furthermore, proper documentation allows donors to maximize tax deductions as permitted by law, thereby encouraging more philanthropic behavior. Various tax benefits are associated with charitable donations, such as the ability to deduct contributions from taxable income on federal tax returns, which can significantly lower overall tax liability.

Who should use the charitable contribution worksheet form?

The charitable contribution worksheet form is invaluable for several groups. Individuals making charitable donations benefit greatly from utilizing this form, as it allows for precise tracking of their contributions throughout the year. This record is not only useful during tax preparation but also encourages sustained charitable giving by illustrating the impact of their contributions.

Nonprofits and organizations can also leverage this worksheet to promote transparency and accountability. By documenting incoming charitable contributions meticulously, organizations strengthen their financial integrity. Furthermore, accountants and tax professionals assisting clients with their tax filing can find this worksheet particularly useful as it provides all necessary details in a consolidated format, streamlining the process and eliminating chances for errors.

Key features of the charitable contribution worksheet form

The charitable contribution worksheet form stands out due to several key features designed for ease of use and functionality. Its interactive and user-friendly design allows individuals of all technological backgrounds to navigate the form easily, ensuring that all pertinent information is captured accurately. Furthermore, the access to a cloud-based platform means that users can edit and manage their documentation from anywhere, providing systemic convenience.

One of the most advantageous features available on platforms like pdfFiller is the eSigning capability. This saves users time and effort by simplifying the process of validating documents without the need for physical signatures. Collectively, these features make the charitable contribution worksheet form a robust tool for both donors and tax professionals alike.

How to obtain the charitable contribution worksheet form

Obtaining the charitable contribution worksheet form is a straightforward process. Users can easily download the form from pdfFiller's website, a platform that specializes in document management and form filling. With options for accessing this form digitally, users can edit, save, or share the document with ease, ensuring that important deadlines are not missed.

Additionally, pdfFiller offers a range of related templates and forms for broader charitable giving documentation. Users can explore and access these forms to meet their specific needs, ensuring compliance with IRS guidelines and maximizing the potential for tax deductions on charitable contributions.

Step-by-step guide: filling out the charitable contribution worksheet form

Filling out the charitable contribution worksheet form requires careful attention to detail. Below is a step-by-step guide to help users complete the process accurately.

Tips for accurate documentation

Accurate documentation of charitable contributions requires adherence to record-keeping best practices. Keep a thorough account of all donations, including keeping copies of receipts, acknowledgment letters from charities, and any other supporting documents. This systematic approach enables better management of your contributions and simplifies the filing process.

Common pitfalls include underreporting donations, failing to categorize contributions correctly, or neglecting to value non-cash donations accurately. By adhering to record-keeping best practices, donors can avoid these common mistakes and ensure that all information on the charitable contribution worksheet form reflects reality. Innovations such as cloud storage solutions can help in securely filing these records as well.

Frequently asked questions

Many people have questions concerning the charitable contribution worksheet form, which can affect their charitable giving strategies. Here are answers to some common queries.

Related documentation and resources

In addition to the charitable contribution worksheet form, users may benefit from exploring other donation worksheets provided on platforms like pdfFiller. These worksheets can offer additional functionalities tailored to specific types of contributions or industries.

Moreover, understanding IRS guidelines on charitable contributions is imperative for maximizing potential tax deductions. Various online resources and tax-filing aids can further assist users in comprehending and satisfying tax rules related to charitable donations, ensuring compliance while optimizing the benefits of their generosity.

Enhancing your experience with pdfFiller

Using pdfFiller extends beyond merely filling out the charitable contribution worksheet form. The platform offers a variety of features that streamline document management, from eSigning to collaborative tools that are particularly useful for teams working on charitable initiatives.

Incorporating a centralized document management system like pdfFiller allows users to store, edit, and share their documents securely, reducing the likelihood of lost information. Transitioning to cloud-based solutions also ensures that resources are accessible from anywhere, enhancing convenience and fostering more effective teamwork when working towards charitable goals.

Contact and support information

For individuals seeking further assistance with the charitable contribution worksheet form or any other features on pdfFiller, help is readily available. Users can reach pdfFiller's support team through various channels, including email and live chat options, ensuring swift responses to any questions they may have.

Additionally, community forums and user support channels on the pdfFiller platform offer valuable insights and shared experiences from fellow users. Exploring links to helpful blog posts and webinars on charitable giving can also deepen users’ understanding, ultimately enriching their charitable efforts and educational journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit charitable contribution worksheet online?

Can I create an eSignature for the charitable contribution worksheet in Gmail?

How do I fill out the charitable contribution worksheet form on my smartphone?

What is charitable contribution worksheet?

Who is required to file charitable contribution worksheet?

How to fill out charitable contribution worksheet?

What is the purpose of charitable contribution worksheet?

What information must be reported on charitable contribution worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.