Get the free FHA - Knowledge On Loan

Show details

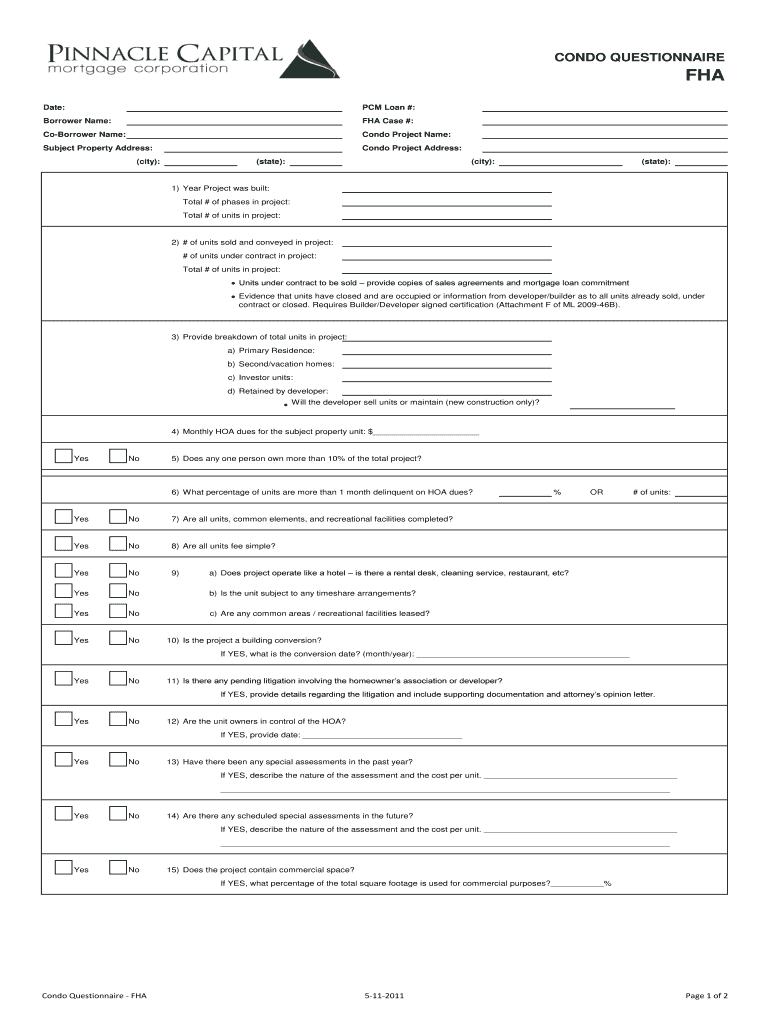

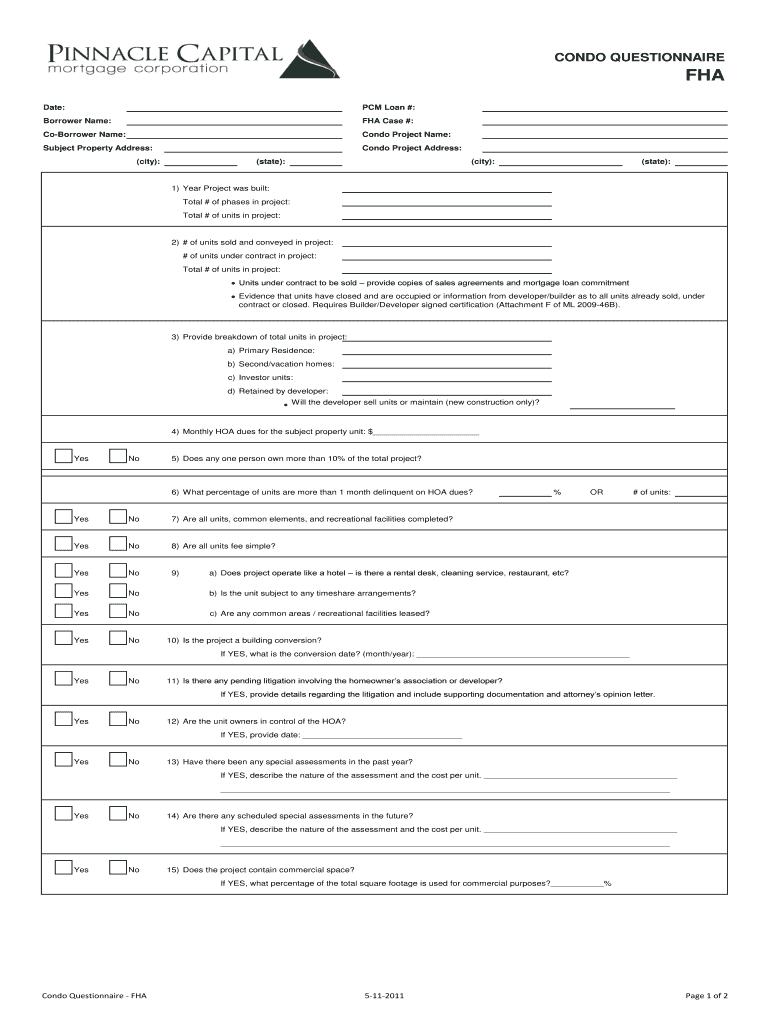

CONDO QUESTIONNAIRE FHA Date: PCM Loan #: Borrower Name: FHA Case #: Borrower Name: Condo Project Name: Subject Property Address: Condo Project Address: (city): (state): (city): (state): 1) Year Project

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha - knowledge on

Edit your fha - knowledge on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha - knowledge on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha - knowledge on online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fha - knowledge on. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha - knowledge on

How to Fill Out FHA - Knowledge On:

01

Gather all necessary documentation: Before starting the FHA application process, make sure you have your financial records, employment information, and any other required documents readily available. This will make the process smoother and prevent unnecessary delays.

02

Complete the application form: The FHA application form will require you to provide personal information such as your name, address, Social Security number, and details about your current employment. Make sure to double-check the form for accuracy before submission.

03

Provide financial information: The FHA application will require you to disclose your income, assets, and liabilities. Be prepared to provide documentation such as pay stubs, bank statements, and tax returns to support your financial status.

04

Understand the credit requirements: FHA loans have more lenient credit requirements compared to conventional loans, but it's vital to understand the necessary credit score and history. If your credit is less than perfect, you might need to take steps to improve it before applying.

05

Complete the property information section: If you already have a property identified, provide the necessary details such as its address, value, and any outstanding liens or mortgages. Additionally, you'll need a home appraisal before final approval.

06

Attend a mandatory counseling session: FHA loan applicants are required to attend a counseling session to better understand the responsibilities and requirements of homeownership. The counseling can be done in person or online and aims to provide buyers with the necessary knowledge for successful homeownership.

07

Submit the application: Once you have completed all sections of the FHA application form and gathered the required supporting documents, it's time to submit your application. Be sure to follow the specific instructions provided by the FHA lender and submit the application within the designated timeline.

Who needs FHA - Knowledge On:

01

First-time homebuyers: FHA loans are often sought by individuals or families purchasing their first home. Understanding the FHA loan application process and requirements is crucial for these newcomers to the housing market.

02

Individuals with low credit scores: As mentioned earlier, FHA loans are more flexible when it comes to credit requirements. Individuals with low credit scores or little credit history can benefit from FHA loans. However, they still need knowledge on how to navigate the FHA application process effectively.

03

Low-to-moderate income borrowers: FHA loans were designed to help individuals with lower incomes achieve homeownership. Those who fall into this category should familiarize themselves with the FHA loan process to take advantage of the programs and benefits available to them.

04

Homeowners looking to refinance: FHA loans also offer refinancing options, allowing homeowners to lower their interest rates or switch from an adjustable-rate mortgage to a fixed-rate mortgage. Homeowners considering refinancing should educate themselves on the FHA refinancing requirements and process.

05

Real estate professionals: Agents, brokers, and other real estate professionals should have knowledge of FHA loans to better serve their clients. Understanding the FHA loan program can help them guide potential buyers and sellers through the process and provide valuable advice.

In summary, anyone interested in applying for an FHA loan, especially first-time homebuyers, individuals with low credit scores, low-to-moderate income borrowers, homeowners looking to refinance, and real estate professionals, needs to have knowledge of how to fill out an FHA application. Being well-informed will ensure a smoother application process and increase the chances of obtaining an FHA loan successfully.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fha - knowledge on for eSignature?

When you're ready to share your fha - knowledge on, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in fha - knowledge on without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing fha - knowledge on and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit fha - knowledge on on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit fha - knowledge on.

What is fha - knowledge on?

FHA stands for Federal Housing Administration.

Who is required to file fha - knowledge on?

Lenders and borrowers involved in FHA-insured mortgages are required to have knowledge about FHA rules and regulations.

How to fill out fha - knowledge on?

One can gain knowledge on FHA through online resources, training programs, and consulting with FHA experts.

What is the purpose of fha - knowledge on?

The purpose of having knowledge on FHA is to ensure compliance with FHA guidelines, rules, and regulations.

What information must be reported on fha - knowledge on?

Information related to FHA loan processes, requirements, eligibility criteria, and regulations must be reported on FHA knowledge.

Fill out your fha - knowledge on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha - Knowledge On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.