Get the free Chapter 313 Annual Eligibility Report Form

Get, Create, Make and Sign chapter 313 annual eligibility

Editing chapter 313 annual eligibility online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 313 annual eligibility

How to fill out chapter 313 annual eligibility

Who needs chapter 313 annual eligibility?

Understanding the Chapter 313 Annual Eligibility Form: A Comprehensive Guide

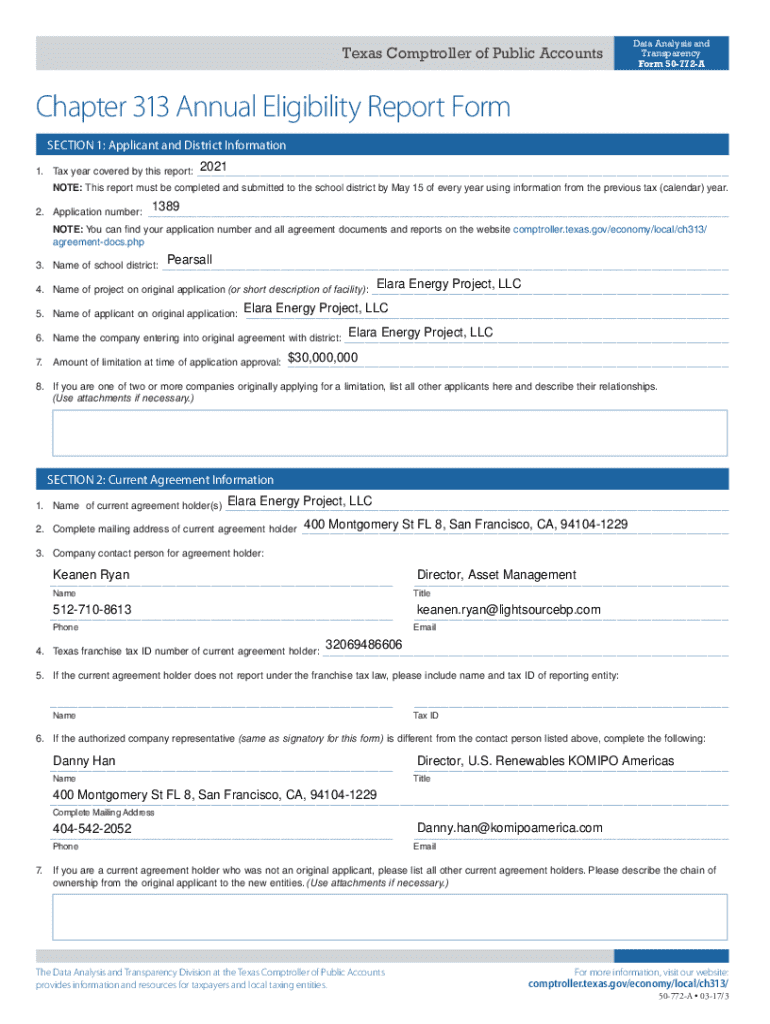

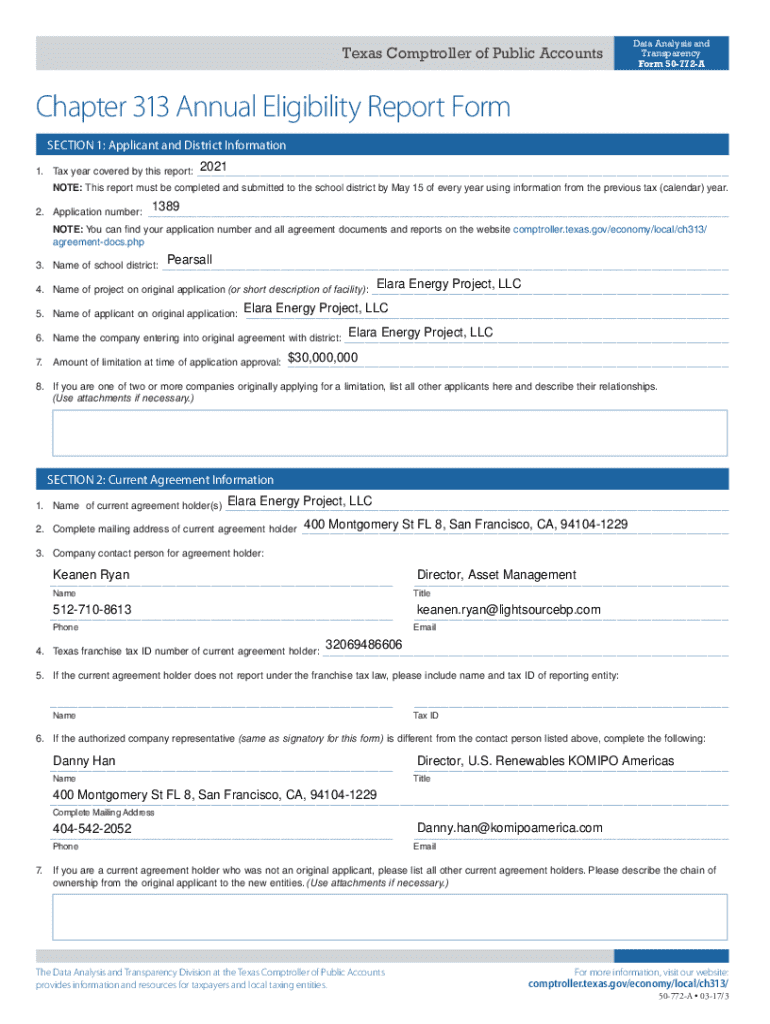

Understanding the Chapter 313 annual eligibility form

The Chapter 313 Annual Eligibility Form plays a crucial role in Texas's economic strategy, enabling businesses to apply for significant tax incentives aimed at attracting investment and stimulating job creation. This program, officially known as the Texas Economic Development Act, encourages qualified businesses to invest in property and operations within the state. By completing the annual eligibility form, companies can potentially reduce their property taxes for a period of up to 10 years.

Eligibility for participation hinges on specific criteria. First, business entities must meet the requirements tailored to different types of companies, including corporations, partnerships, and limited liability companies. The main stipulations involve the nature of the business, its location, and its investment in Texas. Importantly, eligible businesses must also demonstrate that they contribute to the economic enhancement of the state through job creation and capital investment.

Additionally, geographic considerations determine eligibility. The program is predominantly aimed at businesses operating in designated areas of Texas that the state has earmarked for investment and growth. This results in potential tax savings that are tailored to regional economic goals.

Completing the annual eligibility form is not merely a formality—it spells out significant financial benefits. Businesses that successfully navigate this process can unlock substantial tax incentives, leading to savings that enhance their profitability and support long-term planning. These benefits can lead to reinvestment opportunities and job growth, creating a positive ripple effect throughout the local economy.

Importance of the Chapter 313 annual eligibility form in tax reporting

Tax reporting obligations for businesses are expansive, but the Chapter 313 annual eligibility form ensures that companies maintain compliance while maximizing their tax savings. Businesses must stay vigilant about filing deadlines, which are typically tied to the end of the tax year. Timely submission is essential to avoid penalties and ensure eligibility for the full range of available tax incentives.

Submitting this form connects businesses directly with state tax incentives, allowing for tangible benefits that can influence overall financial health. Companies that utilize these incentives can significantly impact their operating costs. Thus, integrating the annual eligibility form into routine tax reporting practices is key for financial health and compliance.

Detailed instructions for completing the form

Understanding how to fill out the Chapter 313 annual eligibility form properly is crucial for securing tax benefits. Here’s a streamlined guide to get started:

By methodically approaching each part of the form, businesses can enhance their chances of successful submission. Consulting experts or utilizing platforms like pdfFiller can add value by providing editable templates that reduce the risk of errors.

Tools and resources for facilitating form submission

Utilizing technology can streamline the process of completing the Chapter 313 annual eligibility form. Online platforms like pdfFiller offer a cloud-based solution that allows users to create, manage, and edit documents seamlessly.

pdfFiller’s interactive features enhance the user experience, enabling businesses to fill out forms quickly through its intuitive interface. The platform also offers collaboration tools that are essential for teams involved in the form submission process. Stakeholders can easily share documents, collaborate in real-time, and maintain version control to ensure that everyone is on the same page.

Post-submission considerations

Once the Chapter 313 annual eligibility form has been submitted, businesses enter a new phase in the process. Understanding what happens next is vital for effective tax planning. Generally, tax authorities will review submissions to verify compliance with eligibility criteria.

Businesses should keep an organized record of their submission, including confirmation emails and any supporting documents. This documentation is crucial for future reference and for addressing any follow-up inquiries from tax authorities that may arise.

Maintaining compliance for future years

Ongoing eligibility for tax benefits under Chapter 313 requires businesses to stay informed about changes in legislative requirements and maintain documentation annually. Each year, businesses must complete the annual eligibility form to demonstrate their continuing compliance with program requirements.

Businesses can enhance their standing by actively engaging with new legislative updates that may affect their eligibility or benefits. Keeping track of such changes not only helps secure tax advantages but also positions a business for sustainable long-term growth.

FAQs about the Chapter 313 annual eligibility form

Addressing common queries surrounding the Chapter 313 annual eligibility form can demystify the application process. For instance, applicants often wonder about the specific eligibility criteria, including the types of businesses that qualify and the geographical requirements.

Other frequent questions involve myths about the complexity of the form or the risk of penalties. Engaging with resources or forums related to tax inquiries can help businesses gain clarity on these issues, ensuring they are well-prepared for the submission process.

For additional support, businesses can access relevant state resources or contact local tax offices for guidance.

Case studies and real-life examples

Numerous businesses across Texas have benefitted from investing the time to complete the Chapter 313 annual eligibility form. Success stories often highlight significant tax savings and increased job creation that followed their participation in the program.

By comparing financial outcomes before and after submission, companies can assess the tangible impact of these incentives. Real-life examples play a critical role in encouraging other businesses to explore these opportunities, illustrating that proactive engagement can lead to substantial economic benefits.

Interactive tools for enhanced understanding

Incorporating interactive tools can greatly enhance understanding when completing the Chapter 313 annual eligibility form. A form preview allows users to visualize each section, while an interactive walkthrough can guide them through the filling process step-by-step.

Moreover, creating checklists for preparing submissions ensures no critical details are overlooked. Visual aids like infographics can simplify complex information, making the process more approachable for users.

Engaging with the community

Networking with other businesses through forums and discussion groups can provide valuable insights into navigating the Chapter 313 annual eligibility form. Learning from shared experiences can help to capitalize on best practices and avoid common pitfalls.

Additionally, participating in webinars and workshops lays the groundwork for ongoing education regarding tax laws and incentive programs. These platforms not only foster knowledge-sharing but also create support networks for businesses seeking to maximize their benefits from the Chapter 313 program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my chapter 313 annual eligibility directly from Gmail?

How can I send chapter 313 annual eligibility to be eSigned by others?

How do I complete chapter 313 annual eligibility online?

What is chapter 313 annual eligibility?

Who is required to file chapter 313 annual eligibility?

How to fill out chapter 313 annual eligibility?

What is the purpose of chapter 313 annual eligibility?

What information must be reported on chapter 313 annual eligibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.