Get the free Credit Card Payment Request /authorization Form

Get, Create, Make and Sign credit card payment request

Editing credit card payment request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment request

How to fill out credit card payment request

Who needs credit card payment request?

Credit card payment request form: The complete guide

Understanding credit card payment request forms

A credit card payment request form is a crucial tool for businesses looking to streamline their payment processing. This form serves as an official document where customers provide their credit card information and consent for a particular transaction. The primary purpose is to facilitate payment by securely capturing necessary details, thereby reducing barriers to completing a purchase.

Using payment request forms in business transactions is not only about efficiency; it's also about maintaining professionalism. They help in establishing trust between a business and its clients by providing transparency in the payment process. Unlike traditional invoicing or payment requests through emails, these forms standardize information, making it easier for both parties to track transactions.

The key differences between a credit card payment request form and other payment methods, such as direct bank transfers or cash payments, include the method of data collection, handling, and security features. Credit card forms allow for immediate transaction processing, while other methods might require more time to clear.

Benefits of using a credit card payment request form

Implementing a credit card payment request form provides numerous benefits, which can significantly enhance the payment experience for both businesses and customers. One of the most significant advantages is streamlined payment processing. By collecting payment details directly through a structured format, it simplifies the transaction, allowing for faster processing times.

Enhanced security features are another hallmark of issuing credit card payment request forms. These forms are designed with various security protocols, such as encryption and secure handling, to protect sensitive customer data. This focus on security not only safeguards customer information but also builds trust and reassures clients when making payments.

When to use a credit card payment request form

Certain scenarios call for the implementation of a credit card payment request form, ensuring maximum efficiency and security in transactions. Subscription services are a prime example; these services often require recurring payments, and a standardized form allows for the easy processing of repeated charges.

For one-time transactions, such as enrolling in a workshop or purchasing a product, these forms add clarity and security for both parties. Event registration and ticket sales also benefit significantly; customers can complete transactions swiftly without delays or confusion.

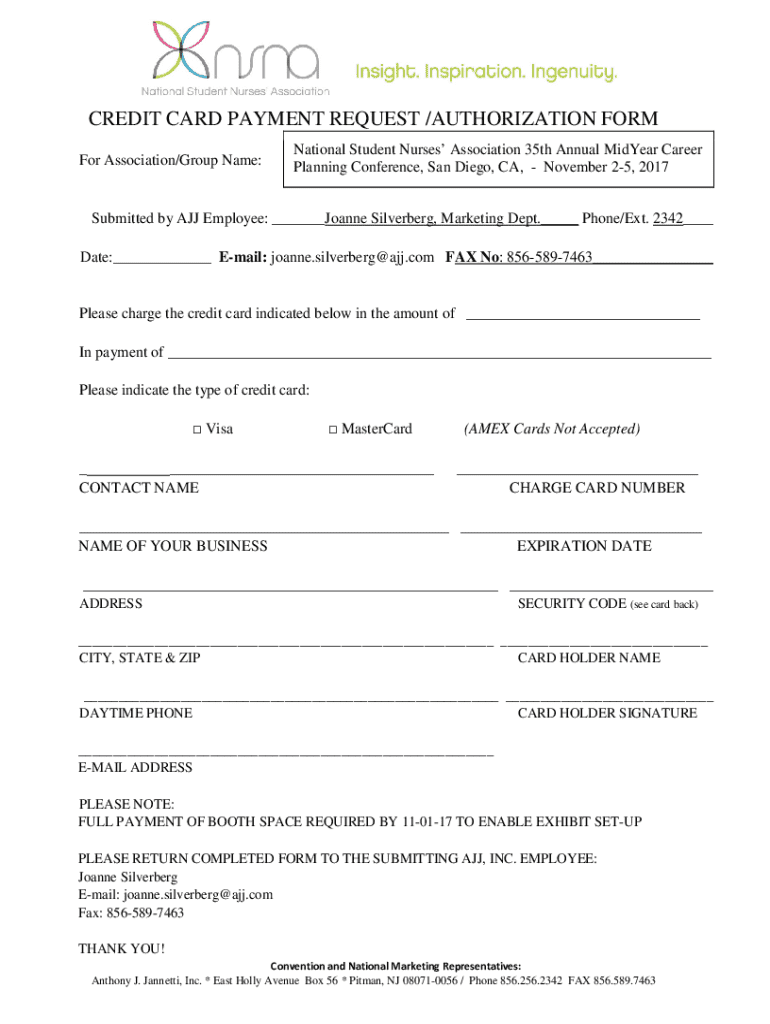

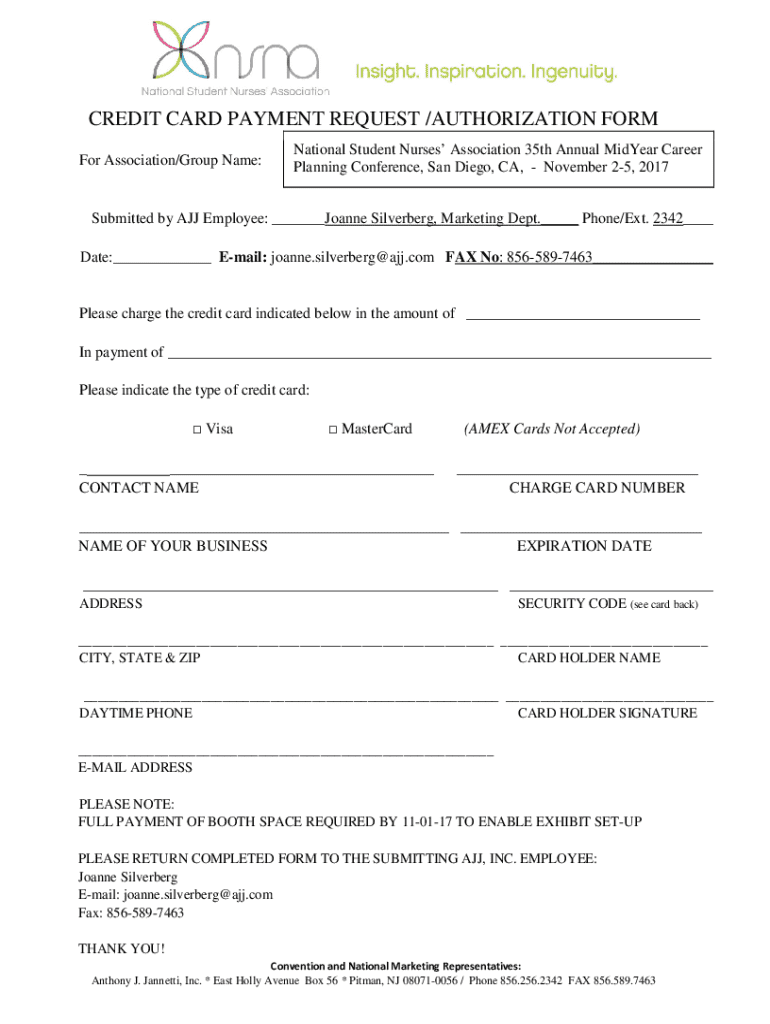

Key components of a credit card payment request form

To ensure the effectiveness of a credit card payment request form, specific mandatory components must be included. Customer details are essential, encompassing full name, billing address, and contact information. The payment amount must be clearly stated, eliminating any ambiguity about what the customer is being charged for.

Credit card information is another crucial element, though it must be handled with utmost care due to security implications. Optional elements could enhance the experience, such as a description of products or services being provided, which can add more context to the transaction and help the customer understand what they are paying for. An authorization statement clearly stating the customer’s agreement to facilitate the charge can also strengthen the validity of the form.

How to fill out a credit card payment request form

Completing a credit card payment request form can be straightforward if you follow a clear process. First, start by entering customer information accurately, including their full name and contact details. This step is critical because it helps prevent any mix-ups in processing payments.

Next, specify the payment details, including the total amount due and any applicable taxes or fees. It’s also crucial to double-check this information for accuracy to avoid complications later on. Finally, review and confirm the authorization statement, ensuring that the customer understands and agrees to the terms of the transaction before submitting the form.

Editing and modifying your credit card payment request form

Customizing your credit card payment request form can significantly enhance its effectiveness and align it with your brand. Utilizing pdfFiller, users can easily add logos, change colors, and modify text to suit specific business needs. This capability allows you to create a form that not only meets functional requirements but also reflects your company’s identity.

Additionally, regularly updating your form is vital. Payment terms and conditions may change, or you might adjust pricing models, which necessitates reflecting these changes in your forms. Keeping your form current not only helps in maintaining clarity but also reinforces the credibility of your business.

Signing and securing your credit card payment request form

Electronic signatures are increasingly becoming standard for validating transactions in today’s digital marketplace. Implementing eSignatures with pdfFiller makes the entire process seamless and secure. Using electronic validation not only speeds up the transaction process but also adds an additional layer of security, ensuring that consent is documented.

Compliance with legal standards is crucial for maintaining the integrity of businesses. Ensuring your forms comply with regulations protects your business from potential disputes. Familiarity with local and industry-related laws is necessary to guarantee your forms are adhered to.

Managing your credit card payment request forms

Effectively managing your credit card payment request forms is as important as creating them. Best practices include securely storing completed forms to protect sensitive information. Utilizing pdfFiller’s cloud-based storage solutions ensures that documents are accessible from anywhere while maintaining security.

Tracking payment requests is another critical aspect. Setting up a systematic follow-up process helps maintain communication with clients while confirming payments have been processed. pdfFiller offers tools that can help in tracking these forms and notifying you of any pending submissions or acknowledgments.

Frequently asked questions about credit card payment request forms

Understanding the security measures in place to protect customer data is crucial when using credit card payment request forms. Solutions like encryption and secure connections help keep sensitive data safe during transactions. Regular audits should be conducted to ensure compliance with security protocols and regulations.

Retaining completed forms for a predefined period is essential. Typically, businesses should maintain these forms for a minimum of three to seven years, depending on jurisdiction and internal policies. This retention helps in managing potential disputes and audit requirements effectively.

Advanced features of pdfFiller for credit card payment request forms

pdfFiller offers advanced interactive tools that help enhance user experience when dealing with credit card payment request forms. Features like fillable fields and dropdowns facilitate easy navigation and ensure that users don’t miss any mandatory information. Interactive elements can make forms mobile-friendly, accommodating users across varies devices.

Collaborative features allow teams to work efficiently on shared forms, making it easy to edit and track changes collectively. Moreover, analytics and reporting features enable businesses to monitor payment trends, helping them make informed decisions about pricing, services, and customer engagement.

Related topics and further reading

For businesses looking to delve deeper into the financial side of their operations, understanding chargebacks and how to prevent them is critical. It is equally important to comprehend the role of payment gateways in online transaction management, as they serve as intermediaries in financial interactions.

Moreover, exploring alternative payment solutions can provide businesses with insights into more flexible payment options that cater to different customer preferences, thus enhancing the overall transaction experience.

Testimonials and case studies

Numerous businesses have benefited significantly from implementing credit card payment request forms. Companies that have adopted structured forms report a noticeable improvement in payment processing times and customer satisfaction rates. By switching to a user-friendly format, organizations can make transactions easier for their clients while protecting sensitive data.

Users have expressed appreciation for pdfFiller’s document management solutions, highlighting the ease of filling out forms, executing electronic signatures, and tracking submissions. These tools empower businesses to maintain efficiency in their operations while maximizing security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card payment request?

Can I create an eSignature for the credit card payment request in Gmail?

How do I fill out credit card payment request on an Android device?

What is credit card payment request?

Who is required to file credit card payment request?

How to fill out credit card payment request?

What is the purpose of credit card payment request?

What information must be reported on credit card payment request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.