Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign Finance Receipts and Form - A Comprehensive How-to Guide

Understanding campaign finance receipts

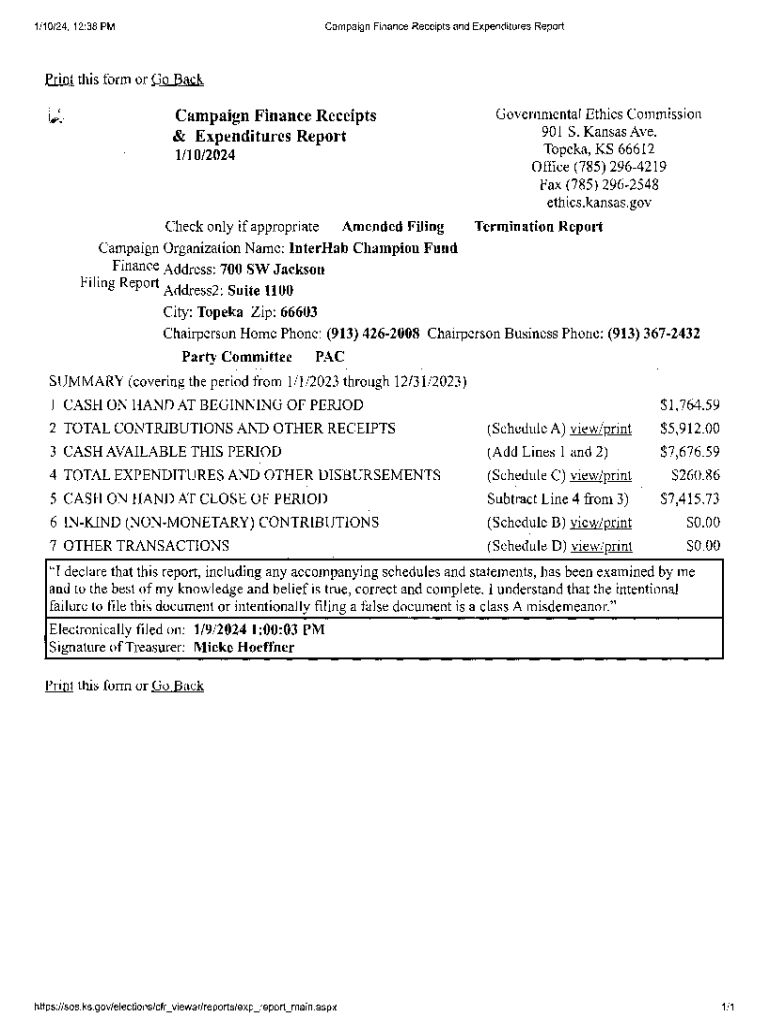

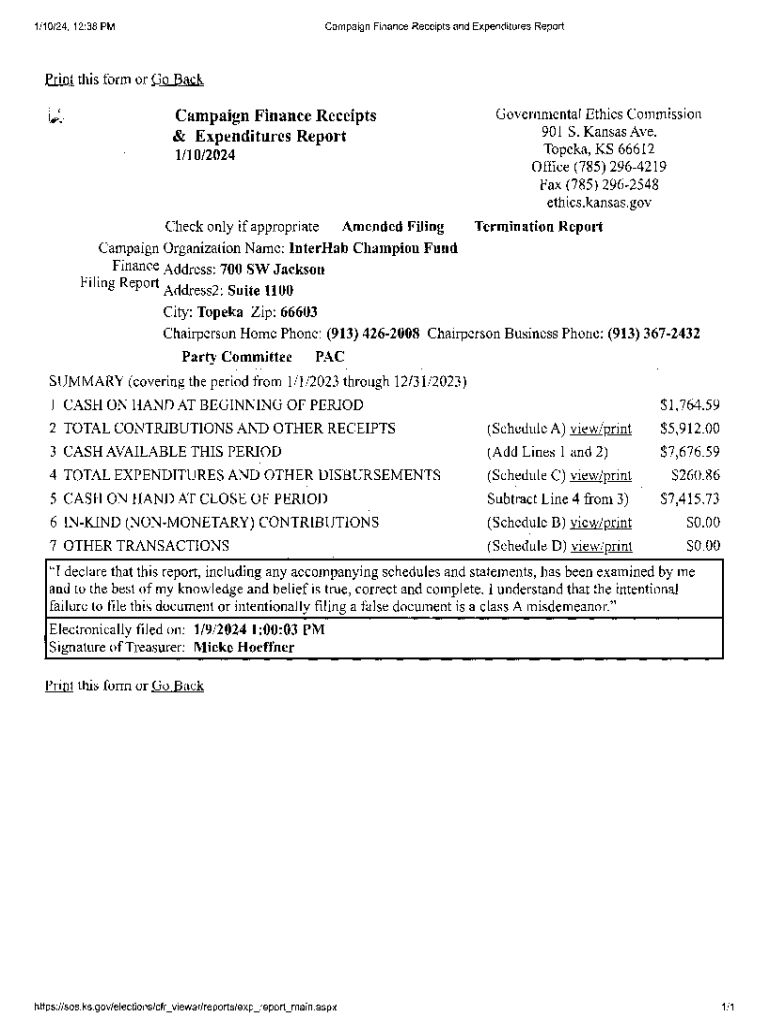

Campaign finance receipts are financial documents that report the money received by a political campaign from various sources, such as donations and fundraising events. They serve as a crucial part of the campaign finance system, ensuring transparency and accountability in the political process. Accurate tracking of campaign finance receipts is vital for compliance with election laws, which regulate how much individuals and entities can contribute, and require detailed reporting of these funds.

The importance of these receipts extends beyond just legal compliance; they also play a significant role in the strategic planning of a campaign. Understanding where funds come from can help campaigns allocate resources more effectively, identify potential supporters, and gauge the overall financial health of the campaign. Regulatory requirements often mandate regular reporting of campaign finance receipts, making it essential for campaign teams to maintain accurate records.

Overview of campaign finance forms

Navigating the world of campaign finance forms can be daunting, as various forms exist at both federal and state levels, each with distinct regulations and requirements. Federal forms, such as those provided by the Federal Election Commission (FEC), govern campaigns running for federal office, while state forms address local and state-level candidates. Understanding the types of forms required is critical to ensuring compliance and effective financial management.

When considering the differences between federal and state forms, it’s essential to note that federal forms usually have more stringent reporting requirements, given the higher stakes of national elections. For instance, federal campaigns are required to disclose contributions over a specific threshold, while some state campaigns may have more lenient rules. Deadlines for these forms can vary widely, so keeping a calendar of filing dates is crucial to avoid penalties.

Navigating the campaign finance filing process

Filing campaign finance forms may seem overwhelming at first, but following a structured process can simplify the task considerably. Below is a step-by-step guide to aid you in filing your campaign finance forms accurately and on time.

It's important to avoid common pitfalls, such as missing deadlines or leaving forms incomplete, as these errors can lead to rejected submissions or penalties. Double-checking entries and submitting forms early can help mitigate these risks.

Interactive tools for managing campaign finance documents

To ease the stress of managing campaign finance documents, tools like pdfFiller offer interactive solutions that facilitate editing, signing, and collaboration. With pdfFiller, users can access their documents from anywhere, ensuring that all team members stay aligned on financial data and compliance requirements.

Step-by-step instructions for filling out key campaign finance forms

Understanding specific forms can greatly enhance your filing process. Below are detailed instructions on how to fill out key federal forms.

FEC Form 1: Organizational Structure

FEC Form 1 is used to disclose the organizational structure of a political committee. This includes providing details about the officers, the committee's purpose, and its connected organizations. Ensuring that all information is accurate and up-to-date is crucial to maintaining compliance.

FEC Form 3: Report of Receipts and Disbursements

FEC Form 3 requires detailed reporting of all receipts and disbursements for the campaign. Here’s a breakdown of how to manage each section:

Filling out state-specific forms can differ significantly, emphasizing the need to familiarize yourself with local regulations. Always check the state election office for precise requirements.

Troubleshooting common issues

Even the most diligent campaigners can encounter issues when submitting forms. Common errors include miscalculating totals, neglecting to sign forms, or failing to meet state-specific submission requirements.

If your campaign finance forms are rejected or require amendments, quickly reaching out to the relevant regulatory body can provide clarity on the next steps. Maintaining open lines of communication can often alleviate concerns and help rectify issues before they escalate into significant problems.

Best practices for tracking campaign finance receipts

An organized system for managing campaign finance receipts is pivotal. You can choose between digital and paper records, but many campaigns find that digital solutions offer superior efficiency and ease of access.

Accurate financial records are crucial not just for compliance but also for preparing for potential audits or compliance checks. A regular review of your receipts against your reports can help identify discrepancies early on.

Utilizing technology for enhanced campaign finance management

Incorporating technology into your campaign finance management not only streamlines the process but enhances security and accessibility. Cloud-based solutions, such as pdfFiller, simplify the management of campaign finance documents.

Frequently asked questions (FAQs) about campaign finance receipts

The complexities of campaign finance can lead to many questions. Below are some frequently asked questions that can clarify common concerns.

Recap of key takeaways and resources

Understanding campaign finance receipts and forms is essential for running compliant and successful political campaigns. Keeping track of deadlines, utilizing technology, and maintaining accurate and organized financial records can prevent costly mistakes. Ensuring clarity surrounding filing requirements and available resources can greatly enhance the overall efficiency of campaign finance management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the campaign finance receipts and in Gmail?

How do I fill out campaign finance receipts and using my mobile device?

Can I edit campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.