Get the free Customer Kyc Form

Get, Create, Make and Sign customer kyc form

How to edit customer kyc form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer kyc form

How to fill out customer kyc form

Who needs customer kyc form?

Customer KYC Form - How-to Guide

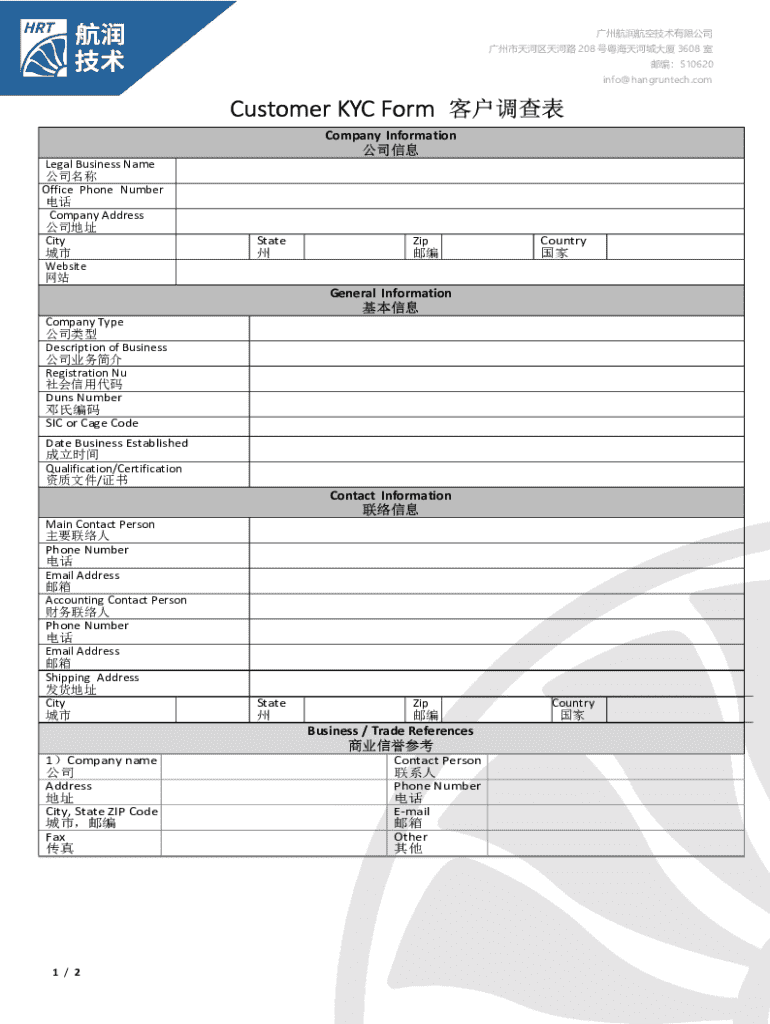

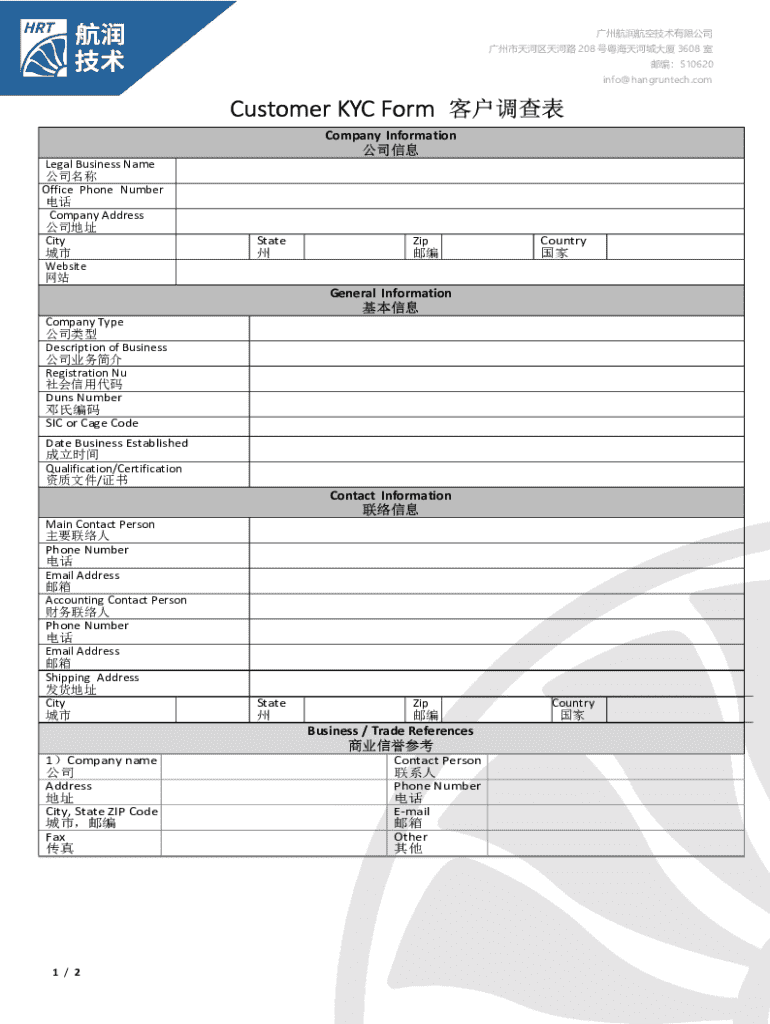

Understanding the customer KYC form

The Customer KYC (Know Your Customer) form is a critical component of compliance for businesses across various sectors, particularly in finance, insurance, and real estate. This form serves to verify the identity of clients, helping organizations comply with legal regulations and prevent fraud, money laundering, and terrorist financing.

The KYC process establishes a link between the individual and their financial activities, aiding institutions in understanding clients better. By collecting and verifying essential data, organizations can not only protect themselves from criminal activities but also foster a trust-based relationship with compliant clients.

Key objectives of KYC compliance include preventing identity theft, safeguarding financial systems, and ensuring accountability in transactions. A robust KYC process builds a foundation of credibility for businesses while enhancing overall operational risk management.

The essential components of a KYC form

A well-structured Customer KYC form typically comprises various sections gathering comprehensive information about the client. Collecting accurate details is paramount for verification and compliance purposes.

Ways to complete your KYC form

There are multiple ways to complete a Customer KYC form, catering to varying preferences and needs. Users can choose to submit their information online or adhere to traditional methods.

Online submission options

Completing KYC forms online through platforms like pdfFiller streamlines the process with numerous advantages, including time efficiency and ease of access.

Manual submission process

For those who prefer offline methods, a manual submission process is also available, allowing users to download, fill, and send their KYC forms physically.

Security measures to protect your information

As KYC processes involve sensitive information, data protection is paramount. Safeguarding client data not only complies with regulations but also builds trust with customers.

pdfFiller employs advanced security measures to ensure the confidentiality of documents. For instance, they integrate encryption standards that meet industry compliance requirements.

Moreover, continuous monitoring and auditing practices are implemented to detect any unauthorized access, ensuring the integrity and security of every transaction and data piece.

The benefits of using pdfFiller for KYC forms

Using pdfFiller for managing Customer KYC forms offers numerous advantages, making the KYC process smoother and more efficient for both individuals and organizations.

Common challenges when filling out KYC forms

Filling out Customer KYC forms can sometimes prove to be challenging. Common hurdles include misunderstanding the requirements and making errors in the submitted information, which can later result in delays.

To ensure accurate and timely KYC submissions, consider carefully reviewing all instructions, verifying details before submission, and utilizing available resources to clarify any doubts during the process.

Next steps after submission of your KYC form

After submitting your Customer KYC form, it's essential to know what to expect during the subsequent processes. Organizations typically carry out verification to ensure submitted information aligns with other data sources.

One of the most convenient features of pdfFiller is the ability to check the status of your KYC application directly through the platform, providing real-time updates on your submission.

Additionally, for any inquiries or assistance required during the process, accessing customer support allows for quick resolutions to potential concerns.

Future of KYC: eKYC and technology integration

The emergence of electronic KYC (eKYC) methods has revolutionized how customer verification occurs. With advancements in technology, eKYC allows for faster and more secure identity verification straight from users' devices.

Benefits of eKYC methods include facial recognition and digital verification, which significantly enhance customer onboarding processes, reducing the time taken to verify identities.

The incorporation of technology in KYC practices not only boosts efficiency but also provides higher accuracy in client verification, reducing the potential for human error.

Case studies: Successful KYC implementations

Numerous industries have reported operational efficiency through effective KYC implementations. For instance, in banking, compliance with KYC regulations has streamlined the customer onboarding process, enhancing customer experience.

Analyzing case studies from sectors such as fintech and insurance, businesses have gained insights into how optimizing KYC processes can lead to reduced costs, faster service delivery, and improved customer satisfaction. Key takeaways include the importance of using technology and effective communication strategies with clients.

FAQs about the customer KYC form

As users navigate the intricacies of the Customer KYC form, questions often arise regarding requirements, submission processes, and document validation.

By addressing these common concerns, individuals can feel more empowered and informed as they embark on the KYC submission journey, thus minimizing potential pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the customer kyc form in Gmail?

How do I edit customer kyc form straight from my smartphone?

How do I edit customer kyc form on an iOS device?

What is customer kyc form?

Who is required to file customer kyc form?

How to fill out customer kyc form?

What is the purpose of customer kyc form?

What information must be reported on customer kyc form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.