Get the free Check Request Form

Get, Create, Make and Sign check request form

Editing check request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request form

How to fill out check request form

Who needs check request form?

Understanding the Check Request Form: A Comprehensive Guide

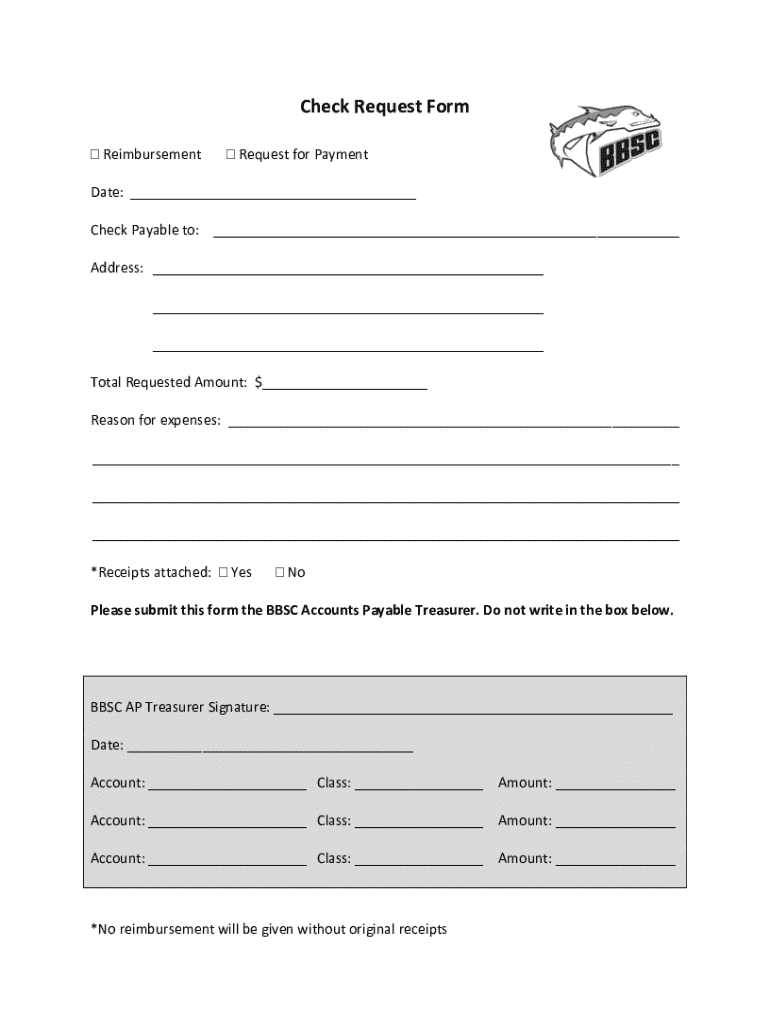

What is a check request form?

A check request form is a critical financial document used to request the issuance of a check, typically for payment to vendors, employees, or other entities requiring compensation for goods or services. These forms serve as an official record documenting the need for funds while providing essential details like recipient information, payment amount, and the purpose behind the request.

Widely utilized by various individuals and teams within departments—ranging from administrative staff and accounting teams to project managers and procurement officers—check request forms ensure that financial procedures adhere to organizational policies. By requiring a standardized form, companies promote accountability and facilitate smoother processing of financial transactions.

Importance of using check request forms

Utilizing check request forms is imperative for organizations aiming to maintain transparency and control over their financial transactions. These forms play a vital role in documenting requests for funds, which is crucial for maintaining an accurate budget and auditing processes. By providing a structured approach to handling expenses, these forms enhance clarity and minimize the risk of unauthorized payments.

Moreover, check request forms streamline the approval process, ensuring that all expenditures are reviewed and sanctioned by designated authority figures within the organization. This structured approach fosters trust among team members and departments while reducing the chances of errors during financial processing. Organizations that implement these forms can better manage their cash flow and guarantee that all spending aligns with budgetary constraints.

Types of check request forms

Organizations may implement various types of check request forms to accommodate different payment scenarios. Understanding the distinct categories can further streamline the process of managing funds. The following outlines common types of check request forms:

How to fill out a check request form

Filling out a check request form accurately is critical to ensure efficient processing and avoid unnecessary delays. Follow these four steps to correctly complete the form:

Step 1: Gather required information

Before completing the form, collect essential information such as the payment amount, recipient details, payment purpose, and any supporting documentation—like invoices or receipts. Ensuring all required materials are in place simplifies the process significantly and ensures all necessary information is readily available.

Step 2: Complete the form

Once you have the pertinent information, proceed to fill out each section of the check request form clearly and accurately. Ensure you input the date of the request, the name of the payee, the amount requested, and the specific purpose of the payment. Providing comprehensive details can prevent miscommunication and misallocation of funds.

Step 3: Review for accuracy

Before submitting the form, take a moment to review it for accuracy. Check for any missing or incorrect information, as these errors can cause delays in processing. A practical checklist could include verifying the amount, confirming the payee's name spelling, and ensuring all supporting documents are attached.

Step 4: Submit the form

Finally, submit the completed check request form to the appropriate authority. Depending on your organization's protocol, this could be done online through a dedicated platform like pdfFiller, via email, or in person. Always confirm the submission method and track the request to avoid potential delays.

Sample check request form templates

When creating or adapting a check request form, templates can provide a robust starting point. Platforms like pdfFiller offer various customizable templates tailored to specific needs, allowing users to modify fields and ensure compliance with organizational protocols.

Some templates include interactive features that facilitate easy editing, eSigning, and collaboration. Leverage the resources available on pdfFiller to find a template that best fits your organization's requirements, ensuring all relevant information is captured effectively.

Benefits of using check request forms

Implementing check request forms comes with numerous advantages that improve financial management within organizations. These benefits include better tracking of financial transactions and enhanced accountability over spending. By having a detailed written record of requests, organizations can retrospectively assess their expenditure patterns and make informed budgeting decisions.

Additionally, check request forms reduce the risk of unauthorized expenditures by establishing a formal approval process. With all requests requiring authorization, discrepancies can be tracked and dealt with efficiently, enhancing overall financial discipline. Ultimately, using check request forms leads to improved financial health and operational efficiency.

Common mistakes to avoid

While check request forms are designed to simplify financial processes, errors created during completion can lead to complications. Here are common pitfalls to avoid:

Best practices for managing check requests

Efficient management of check requests can significantly enhance a company's financial processes. Here are best practices to consider:

Key takeaways

Utilizing check request forms is an essential practice that contributes significantly to the financial health of organizations. By ensuring that expenditures are tracked and processed in a structured manner, companies benefit from enhanced transparency, control, and accountability over their finances.

As you seek to optimize your document management, consider leveraging pdfFiller’s robust platform. With features designed to simplify the process of creating, editing, signing, and managing check request forms, pdfFiller empowers individuals and teams to maintain a seamless workflow—all from a single, accessible, cloud-based solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit check request form from Google Drive?

How do I fill out check request form using my mobile device?

How do I complete check request form on an iOS device?

What is check request form?

Who is required to file check request form?

How to fill out check request form?

What is the purpose of check request form?

What information must be reported on check request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.