Get the free Credit Application and Credit Agreement

Get, Create, Make and Sign credit application and credit

How to edit credit application and credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application and credit

How to fill out credit application and credit

Who needs credit application and credit?

Credit application and credit form: A comprehensive how-to guide

Understanding credit applications

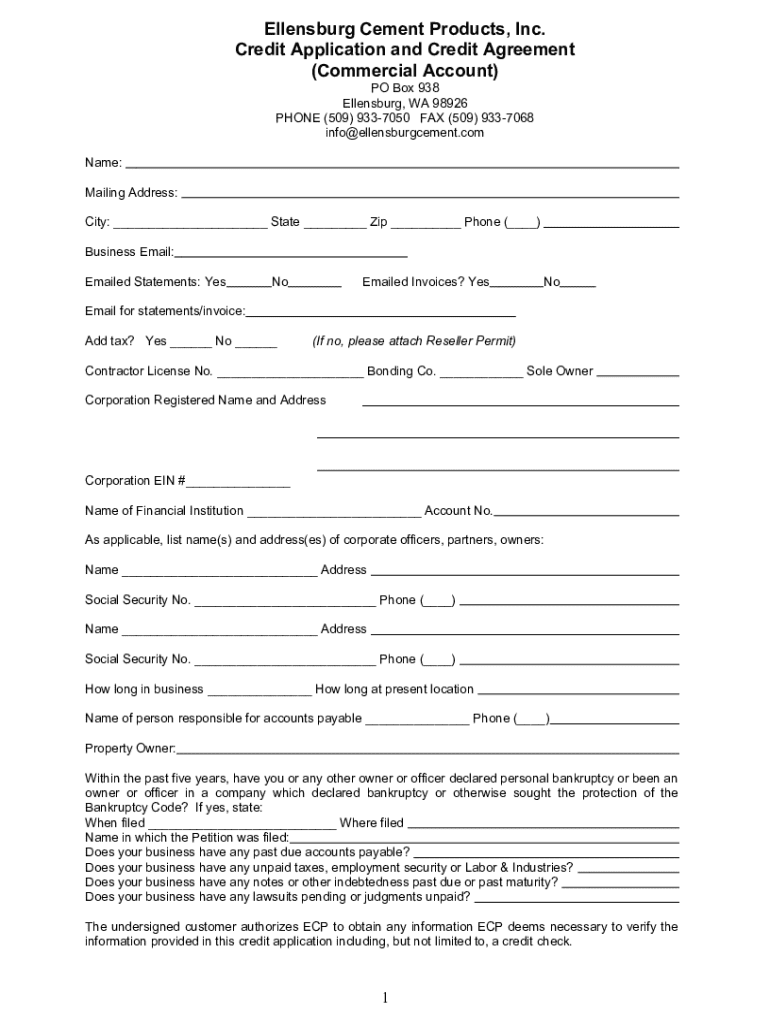

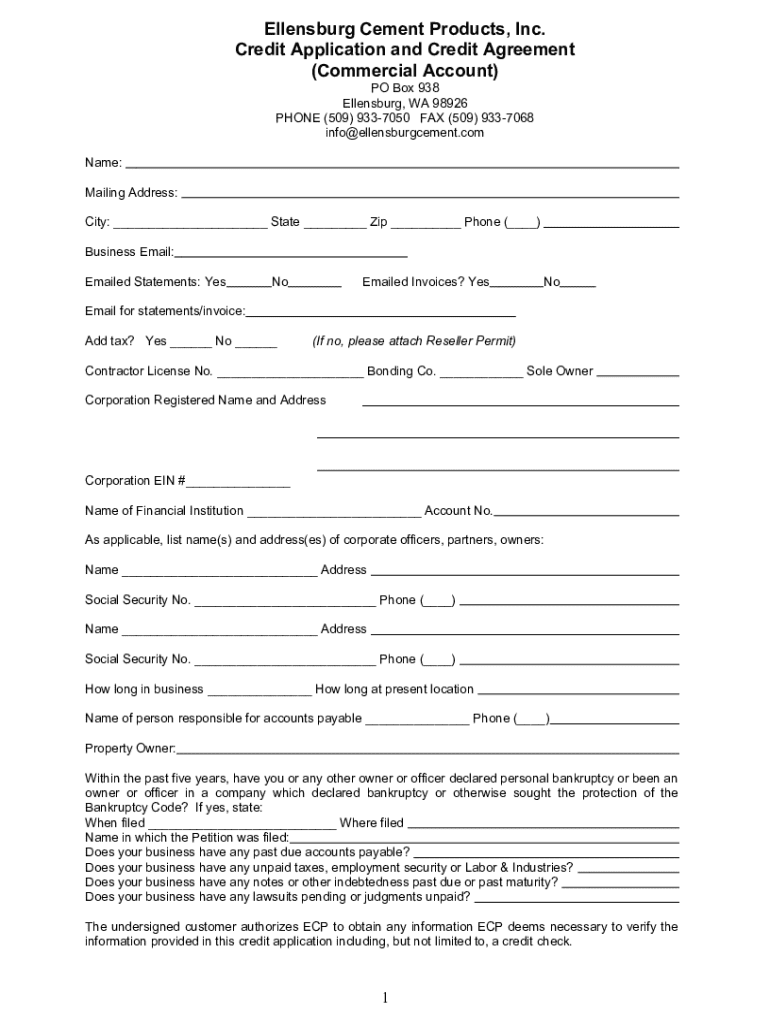

A credit application is a formal request submitted to a lender or financial institution to obtain credit. This document plays a crucial role in financial transactions, as it provides lenders with the necessary information to assess the applicant's creditworthiness. Understanding what constitutes a credit application is essential for anyone seeking financing.

The importance of credit applications cannot be overstated. They serve as the first step in obtaining credit, whether for personal loans, mortgages, or business financing. Lenders review these applications to determine if the applicant is a good risk based on various factors, such as income, financial history, and other obligations.

Familiarity with key terms involved in the credit process enhances the applicant’s ability to complete their application successfully. 'Creditworthiness' refers to an individual's ability to repay borrowed money while 'credit scores' are numerical representations of this ability. Additionally, understanding the differences between business-to-business (B2B) and business-to-consumer (B2C) credit is vital, as each has separate requirements and evaluation metrics.

Types of credit application forms

There are several types of credit application forms, each tailored for different financial needs and scenarios. This variety ensures that applicants submit the appropriate information for their unique situations.

Each form has unique requirements. Some lenders may only accept printable forms, while others enable secure online submissions. Choosing the appropriate method can enhance the application experience.

The credit application process

Submitting a credit application involves several steps. Each phase is critical for ensuring that the lender receives all necessary information to make an informed decision.

Approval or rejection hinges on several key factors including your credit score, income, and any past delinquencies. Common pitfalls to avoid include providing incomplete information, failing to verify your identity, or neglecting to follow up with the lender after submission.

Best practices for filling out credit applications

When completing a credit application, it's vital to present accurate and comprehensive financial information. Preparing for this step can be the difference between approval and rejection.

Accurate records and clear communication can significantly enhance reliability in your application.

Optimizing your application for faster processing

In a world where speed matters, optimizing your credit application for quick processing can offer great advantages. Automation is reshaping how applications are handled.

If your application experiences delays, promptly reach out to the lender to inquire about status, ensuring you're not left in the dark.

Special considerations

While submitting a credit application, certain pitfalls can raise red flags for lenders. Understanding these beforehand can save you time and trouble.

Recognizing and addressing these factors can greatly enhance your application's credibility.

Frequently asked questions (FAQs)

Navigating the credit application landscape can raise several questions. Here are some frequently asked queries to further clarify the process.

Resources for further learning

Expanding your understanding of credit applications can help you make well-informed decisions. Utilize the following resources to improve your knowledge and optimize your applications.

Closing thoughts on effective credit application management

Effectively managing your credit application process requires preparation and attention to detail. A well-prepared application can significantly enhance your chances of approval.

Continuously learn about trends in the credit application process, as understanding current best practices can provide a competitive edge. Leveraging technology through platforms like pdfFiller for document management helps streamline processes and improves overall efficiency when handling credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application and credit for eSignature?

How can I get credit application and credit?

Can I edit credit application and credit on an iOS device?

What is credit application and credit?

Who is required to file credit application and credit?

How to fill out credit application and credit?

What is the purpose of credit application and credit?

What information must be reported on credit application and credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.