Get the free Contingent Hull & Liability Insurance Application

Get, Create, Make and Sign contingent hull liability insurance

Editing contingent hull liability insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contingent hull liability insurance

How to fill out contingent hull liability insurance

Who needs contingent hull liability insurance?

Comprehensive Guide to Contingent Hull Liability Insurance Form

Understanding contingent hull liability insurance

Contingent hull liability insurance serves as an essential safety net for aircraft owners and operators. It provides coverage for any potential liability arising from damages related to aircraft hulls that are not directly owned by the insured individual or entity. This form of insurance plays a vital role in the aviation industry, especially as it mitigates risks associated with aircraft operations.

For those engaged in the aviation sector, understanding and obtaining contingent hull liability insurance can significantly impact financial risk management. The insurance allows operators to comfortably conduct their business, knowing they possess a safety regime in case of unforeseen incidents. Without this coverage, operational risks can escalate quickly, leading to costly liabilities.

Who needs this insurance?

Various individuals and groups may find contingent hull liability insurance beneficial. Primarily, this includes aircraft owners, charter operators, flight schools, and leasing companies. Each of these entities utilizes aircraft that may not necessarily be under their ownership, increasing their exposure to liability claims.

Consider a scenario where a flight school conducts training sessions involving leased aircraft. If an incident occurs during a flight, the school could face substantial liability claims. Similarly, charter companies are often exposed to third-party risks, particularly when their operations involve borrowed aircraft. In these cases, contingent hull liability insurance becomes vital in safeguarding against financial repercussions.

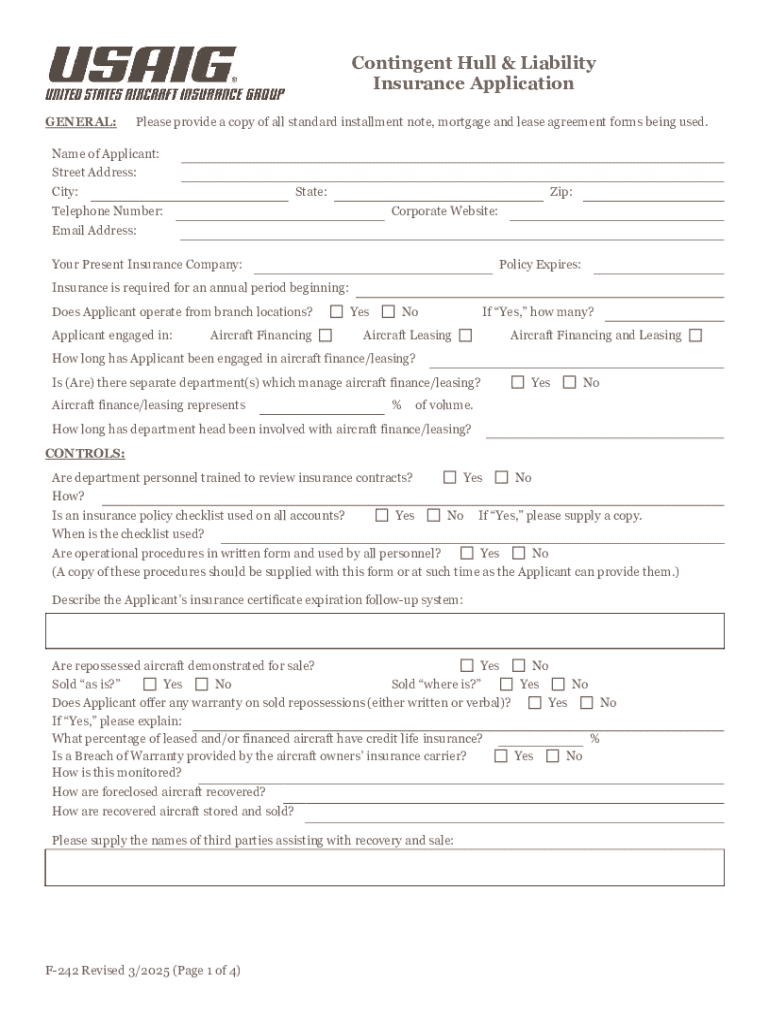

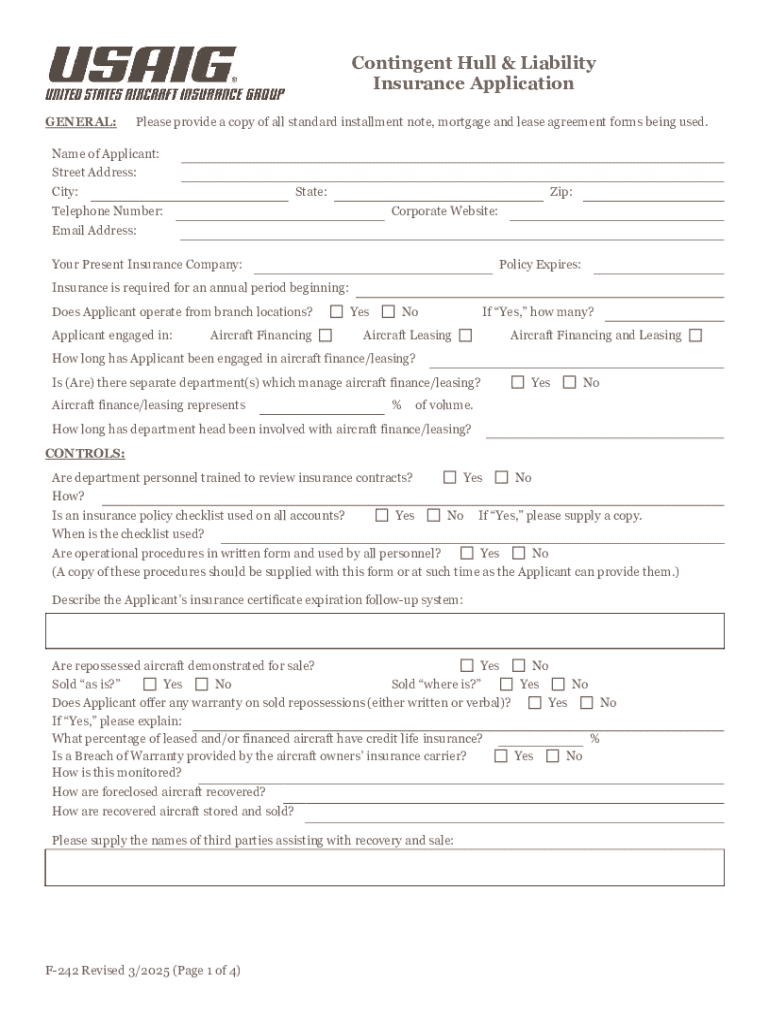

Overview of the contingent hull liability insurance form

The contingent hull liability insurance form is designed to collect critical information required by insurance companies to issue a policy. Its primary objective is to ensure that all relevant details about the insured aircraft, the operating entity, and desired coverage options are accurately captured to avoid any coverage gaps.

Completing this form meticulously is crucial, as even minor errors can lead to complications during claims processes. This form encapsulates not just the technical specifications of the aircraft but also the intricacies of the operations that the insured will undertake. Understanding its structure can significantly streamline the application and approval processes.

Key elements of the form

Step-by-step guide to filling out the form

Filling out the contingent hull liability insurance form requires careful attention to detail. Begin by gathering all necessary documentation, which typically includes aircraft registration documents, previous insurance policies, and operational history reports. Having these on hand ensures a smooth completion process.

Next, input personal details carefully. Verify that names and addresses match official records to prevent submission issues. When providing aircraft details, double-check the aircraft's make, model, and registration number. Accurate identification is pivotal for the insurance provider's records.

Specific insurance coverage options

The form will present various coverage options. Understanding these options is essential for tailoring the policy to fit your operational needs. Essential levels of coverage include basic liability coverage, hull coverage, and provisions for environmental liability. Each option has implications on the premium and overall protection level.

Customize your coverage based on flight operations. For instance, if regularly flying in diverse weather conditions or high-traffic airspaces, consider higher limits to cover potential liabilities effectively.

Additional information and customization

Lastly, use the additional comments section to note any extenuating circumstances that may affect your coverage—such as operating experimental aircraft or specific leasing agreements. Providing comprehensive information enhances the likelihood of a seamless processing experience.

Navigating form submission options

Once the contingent hull liability insurance form is completed, the next step is submission. pdfFiller offers efficient electronic submission options, where you can utilize the pdfFiller platform for an easy online process. This enables applicants to submit forms quickly and securely while tracking the status in real-time.

For those preferring traditional methods, you can also print and mail your completed form. Make sure to send it via a reliable postal service to avoid delays. After submission, you can typically expect initial feedback or confirmation within a few days. Tracking status through pdfFiller adds visibility during this wait period.

Common issues and solutions

Errors in form completion can lead to unnecessary delays. Common mistakes include omitting required information or providing incorrect policyholder details. To prevent this, cross-reference the submitted data with the insurance guidelines before sending.

For electronic submissions, issues might occur due to unsupported file formats or technical glitches within the platform. If such problems arise, it’s advisable to ensure your document is saved in a compatible format and try again. Additionally, the pdfFiller support team can assist with technical queries.

Contacting support

In instances where form completion becomes overwhelming, or if you encounter any roadblocks, the pdfFiller support team is available to provide assistance. They can guide you through the process or clarify doubts regarding the contingent hull liability insurance form.

Managing your contingent hull liability insurance

Managing your contingent hull liability insurance is an ongoing process that extends beyond the initial setup. After submission, you can track your application status through the pdfFiller platform, which provides insights into where your form is in the review process.

If any changes occur in your operations or if your aircraft specifications vary, modifying your coverage is essential. Regularly reviewing and renewing your policy ensures continued protection, preventing any gaps in coverage as your needs evolve.

Renewals and ongoing management

For long-term management of your contingent hull liability insurance, maintaining open lines of communication with your insurance provider is crucial. This ensures you are informed about renewal dates, changes in premiums, or any adjustments necessary for coverage extensions.

Expert insights on insuring your aircraft

Engaging with professionals in aviation insurance can significantly enhance your policy’s effectiveness. Consulting with experts brings invaluable industry insights, allowing policyholders to make informed decisions about coverage options tailored to specific needs.

Moreover, utilizing collaborative tools offered by pdfFiller can facilitate discussions among stakeholders, further optimizing the insurance experience. Whether bringing in advisors or sharing documents for review, these resources add clarity and confidence in the documentation process.

Related documents and templates

In addition to the contingent hull liability insurance form, various other documents may aid aircraft owners and operators in managing their insurance. These might include liability waivers, maintenance logs, and flight operation agreements.

Through pdfFiller, users can easily access templates for these essential documents, streamlining the documentation process and ensuring compliance. Utilizing pre-designed templates saves time while ensuring nothing is overlooked during the insurance application process.

Tailored insurance solutions

The effectiveness of contingent hull liability insurance is greatly maximized by customizing coverage based on individual needs. By evaluating operations and unique risk factors, policyholders can adjust their coverage accordingly.

Taking the time to tailor your insurance not only enhances protection but also instills greater peace of mind, knowing your policy aligns with your specific operational realities.

Frequently asked questions (FAQs)

Navigating the contingent hull liability insurance form may bring forth several queries. Common questions often revolve around the documentation required, the extent of coverage, and how claims are processed.

Certain technical terms may also pose challenges. For instance, understanding industry jargon like ‘hull value’ or ‘liability limits’ is crucial for interpreting your policy effectively.

Feedback and continuous improvement

After completing the contingent hull liability insurance form, consider providing feedback regarding your experience. This input is invaluable for enhancing the form and overall user interaction on the pdfFiller platform.

Highlighting any points of confusion or suggesting improvements can significantly shape future iterations of the form, ensuring that it remains user-friendly and aligned with the needs of policyholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in contingent hull liability insurance?

How do I make edits in contingent hull liability insurance without leaving Chrome?

How do I edit contingent hull liability insurance on an iOS device?

What is contingent hull liability insurance?

Who is required to file contingent hull liability insurance?

How to fill out contingent hull liability insurance?

What is the purpose of contingent hull liability insurance?

What information must be reported on contingent hull liability insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.