Get the free Credit Application for a Business Account

Get, Create, Make and Sign credit application for a

How to edit credit application for a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application for a

How to fill out credit application for a

Who needs credit application for a?

Credit application for a form: A comprehensive guide

Understanding credit applications

A credit application is a formal request submitted by individuals or businesses seeking approval for a line of credit from a financial institution or supplier. The application serves as a vital document that outlines the applicant's financial history, existing obligations, and overall creditworthiness. It's essential in determining whether to extend the requested credit based on the risk involved.

In financial transactions, credit applications are significant because they provide a structured way to assess the risk taken by lenders or suppliers. They help establish trust and transparency in financial dealings, ensuring that both parties are aware of the obligations involved.

Types of credit applications

There are two primary types of credit applications—B2B (business-to-business) and B2C (business-to-consumer). The distinctions between these types primarily revolve around the nature of the applicant and the context of the application.

B2B credit applications often require more comprehensive financial details, including company financials and credit history. Conversely, B2C applications generally assess individual income, credit scores, and personal financial habits.

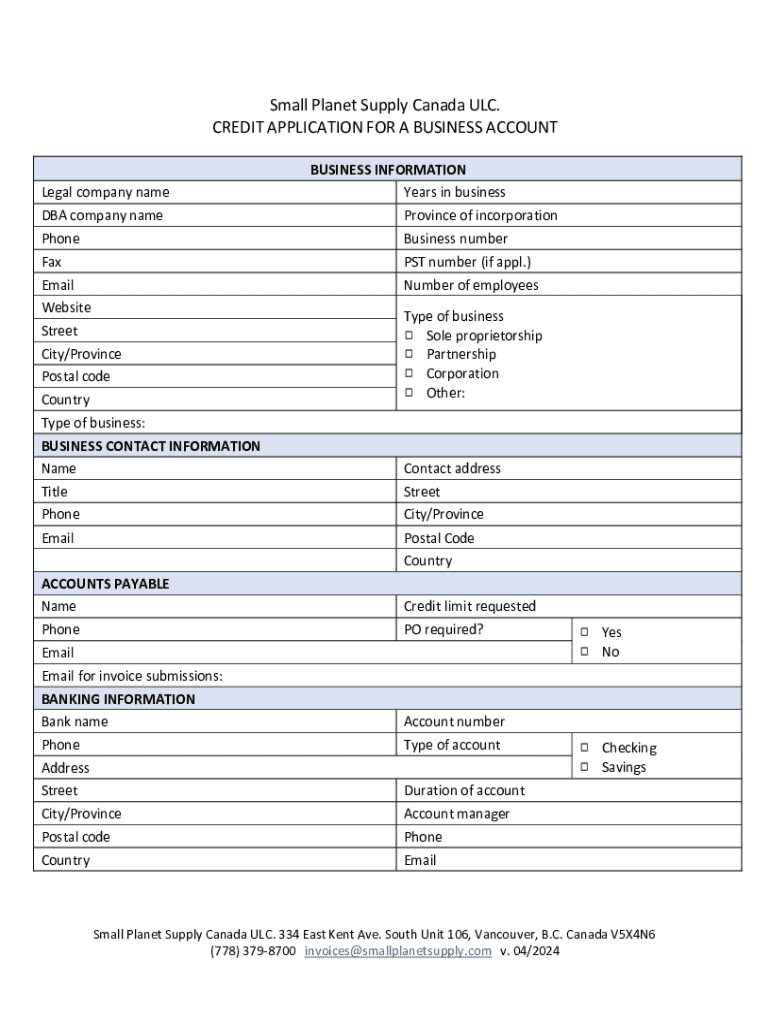

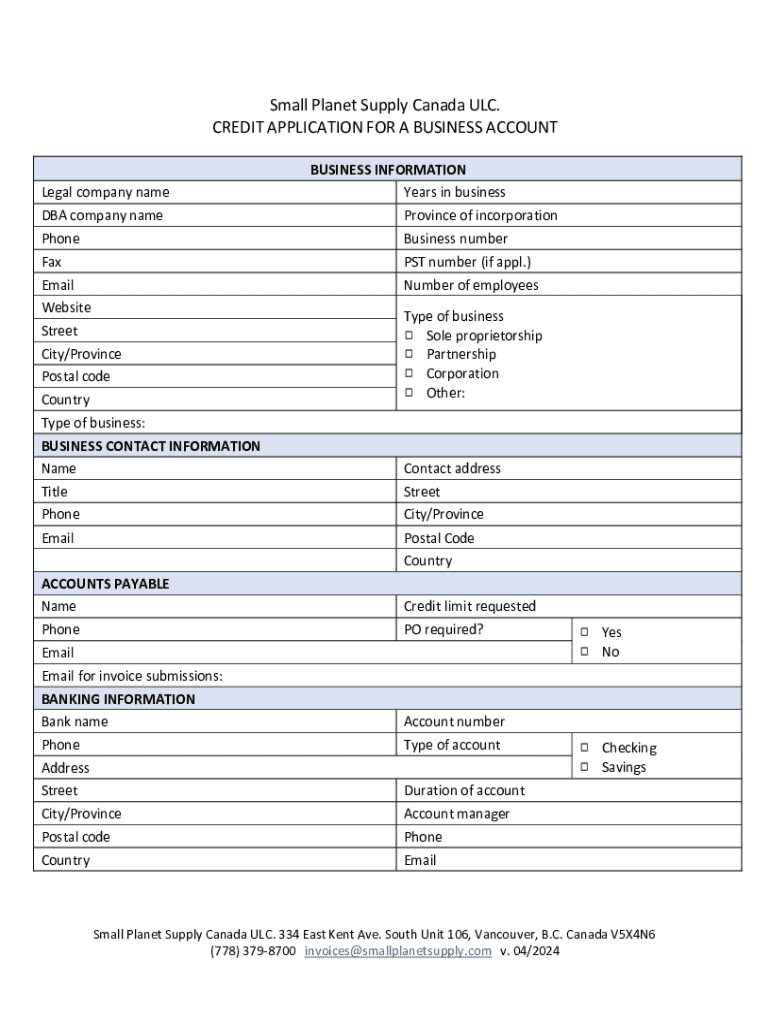

Key elements of an effective credit application

An effective credit application must include specific key elements to ensure comprehensive assessment. Essential information includes company details, such as the legal name, contact information, and tax identification number, alongside financial information like revenue, net income, and existing liabilities.

Moreover, the ownership structure and management details are crucial as they provide context on who is overseeing the financial activities. Customer consent and acknowledgment of the application terms must also be included to protect the lender's interests.

Step-by-step guide to completing a credit application

Completing a credit application requires careful preparation. Start by gathering all necessary documentation, such as financial statements, tax returns, and identification. This will ensure you have all the relevant information in one place when filling out the application form.

When filling out the application, pay special attention to accuracy and completeness. Use consistent terms and data as inconsistencies can lead to delays or even rejection of your application. After completing the form, ensure you submit it via the preferred method: online, by mail, or by fax, based on what the lender or supplier indicates.

Common challenges in the credit application process

Many applicants encounter challenges during the credit application process, particularly with incomplete applications. Missing sections or unclear information may lead to delays or denial. It's also common for there to be miscommunication, especially if the applicant isn't fully aware of the requirements or the consequences of providing inconsistent data.

Furthermore, delays often stem from missing information that requires follow-up. These challenges can be mitigated by understanding the requirements and ensuring all necessary details are provided upfront.

The benefits of automating credit applications

Automating credit applications brings substantial benefits to both lenders and applicants. By streamlining the application process, businesses can significantly reduce manual errors and inconsistencies that often plague traditional methods. An automated system also enhances customer experience through faster processing times, allowing approvals to happen quickly, often within the same day.

Additionally, using platforms like pdfFiller empowers businesses to manage documents efficiently, enabling collaboration and real-time updates which further enhances efficiency.

Risk mitigation through credit applications

Credit applications also serve as a tool for assessing creditworthiness. Lenders carefully evaluate applicants' financial history and capacity to repay to mitigate risks associated with granting credit. During this evaluation process, identifying red flags is critical. Signs such as frequent negative credit records or high debt-to-income ratios can indicate potential issues.

Understanding these warning signals can guide lenders in making informed decisions, thereby lowering their risk exposure.

Frequently asked questions about credit applications

Many potential applicants have questions about the credit application process. After submitting a credit application, the next steps typically include verification of the provided information and assessment of the applicant's financial history. The review process duration may vary, but it commonly takes a few days. Common reasons for denial often stem from poor credit histories, insufficient income, or discrepancies in the information provided.

Additionally, lenders often verify information such as employment status and income levels to ensure accuracy.

Enhancing your credit application process

To streamline your credit application process, adopting best practices is essential. Ensuring completeness and accuracy is paramount—every detail counts. Tools such as pdfFiller can significantly simplify application management by providing features for editing, signing, and collaborating on forms directly. This not only improves efficiency but also helps prevent errors that could lead to application rejection.

By embracing technology, businesses can enhance their operations and create a more seamless experience for applicants.

Specific guidelines for certain industries

Different industries may have unique requirements when it comes to credit applications. For instance, retail and consumer credit applications often focus on personal credit histories and repayment performance, while business credit applications in service industries may prioritize cash flow and contract terms.

In construction and manufacturing, credit applications place significant emphasis on project scopes, timelines, and financial conditions of projects to assess risk more accurately. Adapting the application process to fit these specific industrial standards can lead to better-informed decisions.

Resources for better credit management

To enhance your credit management processes, several resources are available. Credit application templates and sample forms can serve as valuable references when creating your documents. Furthermore, utilizing tools for tracking applications and maintaining communication with clients ensures that both parties stay informed throughout the process, thus reducing the likelihood of misunderstandings.

Real-world case study: Successful implementation of a credit application process

In a case study of a company that transitioned to an automated credit application system, notable improvements were observed. The company implemented pdfFiller to streamline their processes. The outcome included a significant reduction in processing time and errors, with positive feedback from users highlighting the ease of access to documents and quicker decision-making capabilities.

This success story reflects the potential benefits of automating credit applications, underscoring how technology can lead to operational efficiencies.

Next steps

To improve your credit application process, consider accessing pdfFiller's credit application templates designed to cater to various needs. Scheduling a demo gives teams the opportunity to explore the pdfFiller platform for document management, offering ways to enhance workflows and streamline operations.

Additional tools and features

Integrating with electronic invoicing portals can streamline financial transactions, while analytics and reporting capabilities can provide insights into application trends. These tools are vital for staying ahead in an increasingly competitive environment and ensuring that organizations can respond promptly to changes in credit management needs.

Glossary of terms related to credit applications

Understanding the terminology surrounding credit applications enhances clarity and accuracy in the process. Here are some commonly used terms:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application for a?

Can I create an electronic signature for signing my credit application for a in Gmail?

How do I complete credit application for a on an iOS device?

What is credit application for a?

Who is required to file credit application for a?

How to fill out credit application for a?

What is the purpose of credit application for a?

What information must be reported on credit application for a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.