Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit application form: How-to guide

Understanding the credit application form

A credit application form is a vital document utilized by lenders to assess the creditworthiness of borrowers seeking financing. Its primary purpose is to gather essential details that allow the lender to evaluate the applicant's ability to repay the loan.

The importance of a credit application form in the financial process cannot be overstated. It serves as a foundation for the lender's decision-making process. By providing necessary information about both personal and financial circumstances, applicants facilitate a smoother evaluation. This form is particularly crucial during significant transactions like applying for a mortgage, auto loan, or business credit.

Situations requiring a credit application include personal loans for unexpected expenses, mortgages for new homes, and business loans for expansion or operations. Each of these scenarios demands a thorough understanding of one’s financial health, making the credit application form a necessary step.

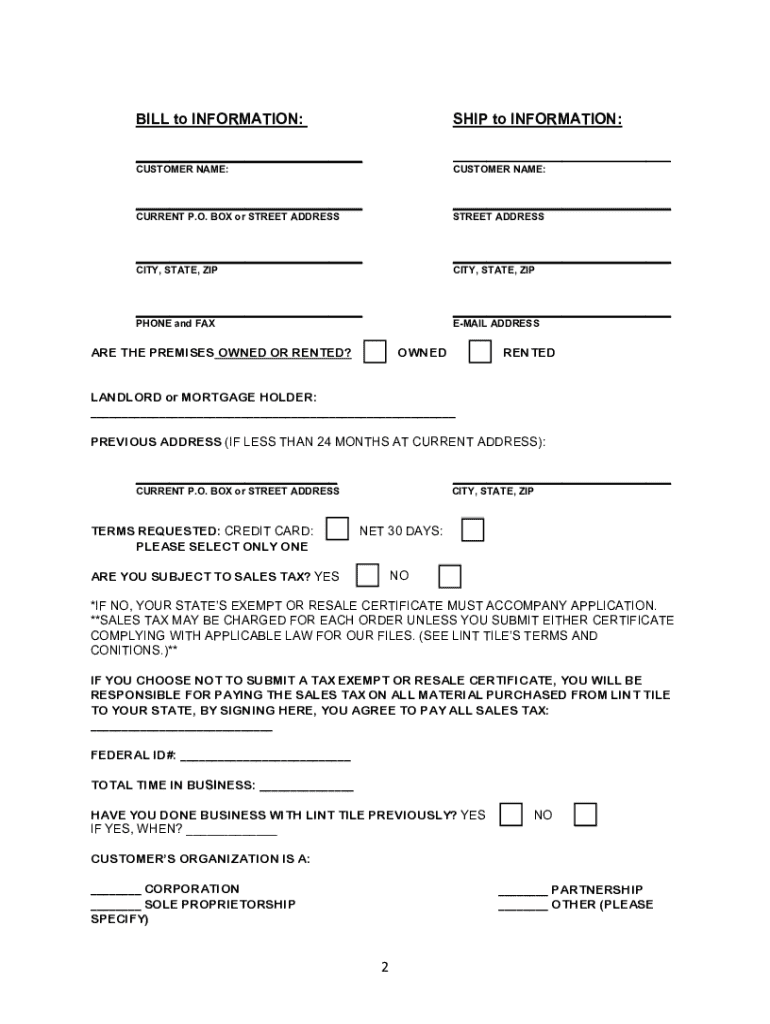

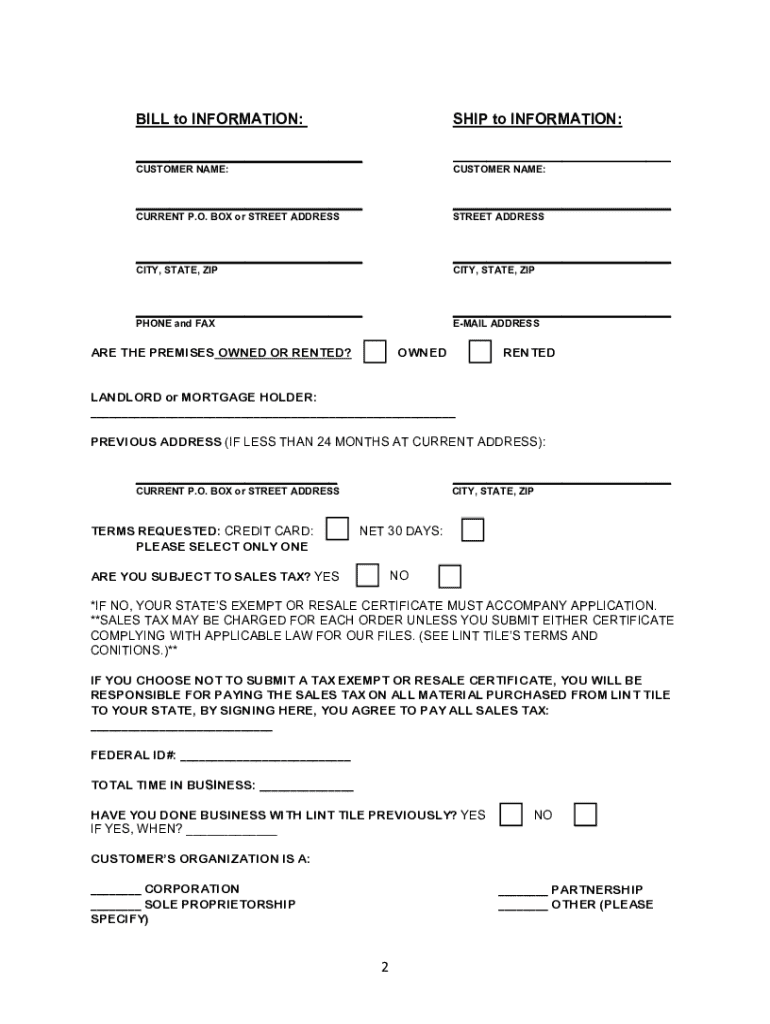

Key elements of a credit application form

A credit application form is generally structured into several key sections to elicit comprehensive information from the applicant. Each section plays a significant role in crafting a complete financial picture.

Step-by-step guide to filling out a credit application form

Filling out a credit application form accurately is crucial in ensuring an efficient review process and potentially a positive outcome. Below are the detailed steps to assist applicants in completing the form correctly.

Common mistakes to avoid in credit applications

Completing a credit application form may seem straightforward, but many applicants encounter pitfalls that can jeopardize their chances of approval. Being aware of these common mistakes can save time and effort.

The role of technology in streamlining credit applications

Advancements in technology have significantly modernized how credit applications are submitted and managed. Online platforms provide tools immensely beneficial for applicants.

The benefits of online applications over traditional paper forms include enhanced accessibility, speed, and convenience. With the click of a button, users can input their information and submit applications without paperwork.

Interactive tools further enhance applicant experience by enabling auto-fill options, reminders for missing information, and comprehensive tracking of application statuses.

The review process: What happens after submission?

Once a credit application form is submitted, it enters a thorough review process. Understanding what happens next is crucial for applicants.

Enhancing your creditworthiness

Before even submitting a credit application form, working on improving one’s creditworthiness is beneficial. This proactive approach maximizes the chances of approval.

Frequently asked questions about credit application forms

Understanding common concerns regarding credit application forms can alleviate applicant anxiety and promote accountability.

Resources for further assistance

To further aid in the completion and understanding of credit application forms, utilizing available resources can provide significant benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application from Google Drive?

How do I edit credit application on an iOS device?

How do I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.