Get the free Credit-eligible Capital Contribution Request Form

Get, Create, Make and Sign credit-eligible capital contribution request

How to edit credit-eligible capital contribution request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit-eligible capital contribution request

How to fill out credit-eligible capital contribution request

Who needs credit-eligible capital contribution request?

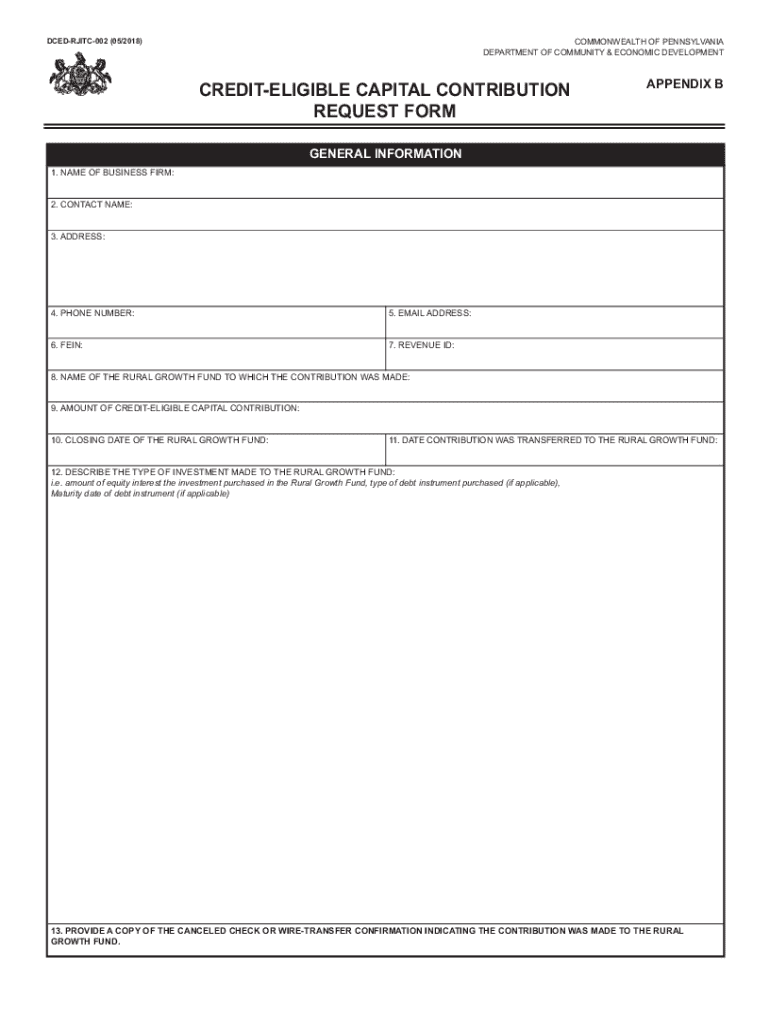

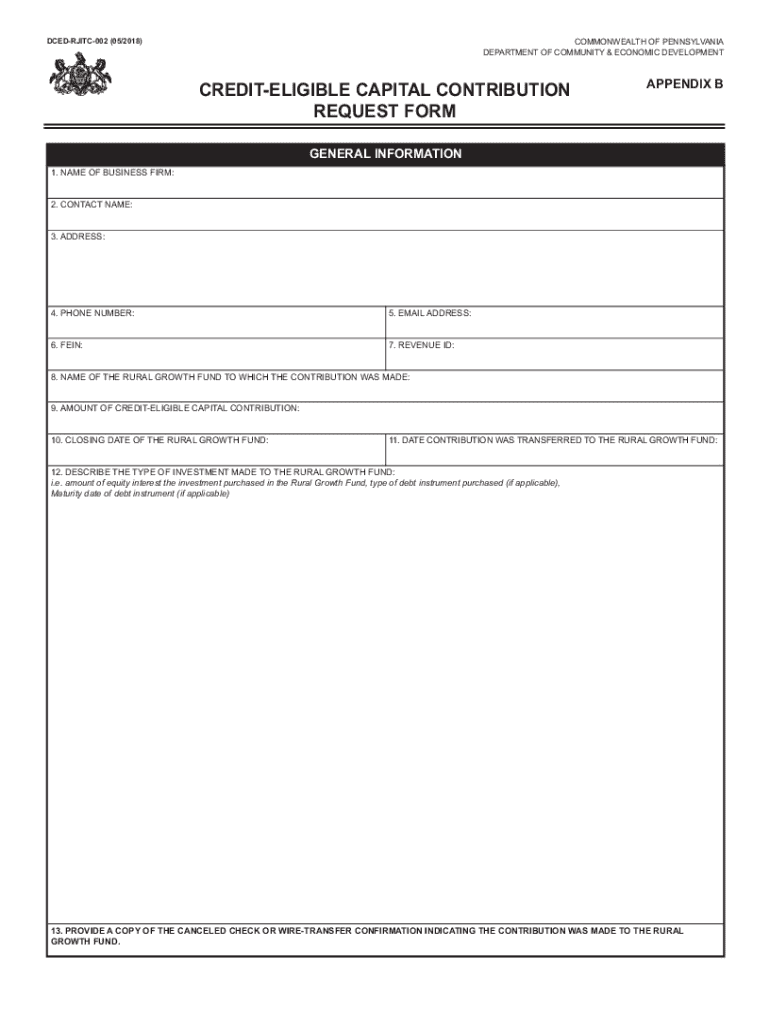

Understanding the Credit-Eligible Capital Contribution Request Form

Overview of the Credit-Eligible Capital Contribution Request Form

The credit-eligible capital contribution request form is a pivotal document used to apply for tax credits associated with capital contributions made to specific projects. Its primary purpose is to facilitate the process of claiming tax benefits for those who invest money into qualifying initiatives, such as infrastructure development or local business improvements. Understanding this form is crucial for any individual or team aiming to optimize their tax situation through strategic financial contributions.

Capital contributions not only play a significant role in funding essential projects, but they also provide substantial tax shelters for contributors. By leveraging this form effectively, stakeholders can navigate the complexities of tax credit applications, maximizing their financial benefits. A streamlined management process through platforms like pdfFiller empowers users to submit their requests efficiently, ultimately overcoming bureaucratic hurdles that often accompany form submissions.

Understanding the capital contribution tax credit

Capital contribution tax credits are incentives provided by various government entities to encourage investment in designated projects. The mechanism behind these credits ensures that contributors can effectively reduce their taxable income by a percentage of their contribution. This motivates investments in sectors that often require significant funding, fostering economic growth and community development.

Eligibility for claiming these credits usually requires that the project meets certain predefined criteria. Generally, projects focused on improving public infrastructure or supporting high-impact community initiatives qualify. Various factors determine eligibility, including the nature of the project, the scale of investment, and compliance with set timelines. Understanding these criteria is essential for maximizing potential benefits and ensuring compliance with applicable regulations.

Steps to complete the credit-eligible capital contribution request form

Completing the credit-eligible capital contribution request form may seem daunting, but breaking it down into manageable steps simplifies the process significantly. There are several key steps to successfully navigate this form using pdfFiller, ensuring that users can submit their requests accurately and on time.

Step 1: Accessing the form

To begin, you can find the form directly on pdfFiller by searching for the term 'credit-eligible capital contribution request form.' The platform offers an intuitive interface that guides users to the right resources quickly. Tips for navigating include utilizing the search bar and filtering options for enhanced efficiency.

Step 2: Filling out the form

In this step, you'll need to provide essential information across various sections. Each part of the form requires specific data, including personal details, project descriptions, and precise financial information regarding the capital contribution. It is crucial to review the guidelines associated with each section.

Avoid common pitfalls such as omitting crucial information or failing to double-check figures to ensure accuracy. Missteps in this stage can lead to unnecessary delays or denial of your request.

Step 3: Reviewing and editing your request

Once the form is filled, take advantage of pdfFiller's editing features. Review your entries meticulously to spot any potential errors. Best practices include reading through the form multiple times, verifying calculations, and utilizing the platform's collaboration tools if you have a team reviewing the submissions.

Step 4: Signing the form

Finally, you’ll need to sign the document. pdfFiller offers various eSigning options that are compliant with legal standards. Digital signatures facilitate swift approval without needing physical copies, streamlining the entire submission process.

Submitting your request

Submitting the completed credit-eligible capital contribution request form can be done through multiple avenues. pdfFiller allows users to submit online directly via the platform, offering a quick turnaround time for processing. Alternatively, if you prefer traditional methods, you can print the form and mail it to the appropriate authority.

After submission, ensure that you receive confirmation of your submission from the relevant body. Tracking your request is vital for following up on processing times or addressing issues that may arise post-submission.

FAQs about the credit-eligible capital contribution request form

When dealing with the credit-eligible capital contribution request form, several common questions arise. Knowing how to navigate these inquiries can enhance your submission experience.

Maximizing your tax credits

To ensure that you receive the maximum benefit from your capital contribution tax credits, consider the following strategies. These approaches will help to optimize your overall financial health and ensure compliance with tax regulations.

Engaging with knowledgeable tax professionals can lead to discovering additional benefits, reducing liabilities, and ensuring compliance with tax laws.

Resource hub for capital contribution and related forms

For those actively pursuing capital contribution tax credits, pdfFiller serves as your resource hub. Users can access related forms easily through the platform, with guides available for various tax credit applications. Communities often share their experiences in forums, providing invaluable real-world insights and tips.

Testimonials and success stories

Users have shared numerous testimonials regarding their experiences with pdfFiller in navigating the credit-eligible capital contribution request form. Many report that the platform has greatly simplified the process, leading to successful claims and satisfied contributors.

Several case studies highlight how users, through effective usage of the form, managed to obtain substantial tax credits, contribute effectively to their communities, and streamline their financial processes. These stories serve not only as inspiration but also provide practical insights into achieving similar success.

FAQs about pdfFiller and its capabilities

As you explore pdfFiller's features, several frequently asked questions can provide clarity on the platform and its capabilities. Understanding these features can enhance your overall experience with document management.

Engaging with the platform through these features can significantly enhance productivity while navigating the complexities associated with tax-related forms and submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit-eligible capital contribution request from Google Drive?

How do I make changes in credit-eligible capital contribution request?

How do I edit credit-eligible capital contribution request in Chrome?

What is credit-eligible capital contribution request?

Who is required to file credit-eligible capital contribution request?

How to fill out credit-eligible capital contribution request?

What is the purpose of credit-eligible capital contribution request?

What information must be reported on credit-eligible capital contribution request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.