Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: How-to Guide Long-Read

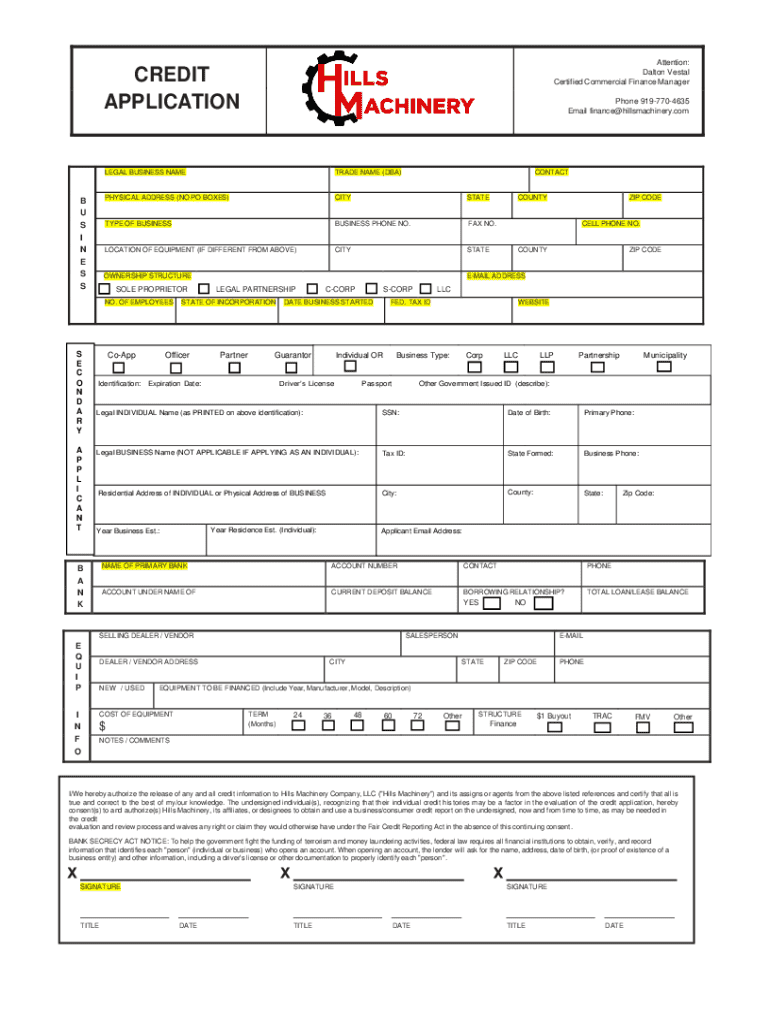

Understanding the credit application form

A credit application form is a crucial document utilized by businesses and financial institutions to assess an applicant's creditworthiness. This form collects essential personal and financial details from individuals or businesses requesting credit. By providing this critical information, applicants allow lenders to evaluate their risk profiles and decide whether to extend credit.

Understanding the significance of a credit application form cannot be overstated. It serves a pivotal role in assessing an applicant's ability to repay borrowed funds. For lenders, it is a vital tool for risk management, as it helps them mitigate the chances of default.

Different types of credit application forms exist, each tailored to specific needs. B2B (Business-to-Business) forms differ from B2C (Business-to-Consumer) forms, focusing on the unique factors relevant to businesses compared to individuals. Additionally, various industries may require specific information, ensuring the form suits their lending parameters.

Key elements of an effective credit application form

Creating an effective credit application form necessitates including essential information for accurate assessment. Critical elements often found on the form include personal information like full name, address, and contact details, along with business information if applicable. Financial history plays a significant role, requiring details such as income, debts, and previous borrowing history.

Common mistakes to avoid while completing a credit application form revolve around omissions or inaccuracies. Submitting an incomplete application can lead to delays or outright denial of credit. Therefore, applicants must ensure that all required fields are filled out and that they provide necessary documentation, such as proof of income and identification.

The credit application process explained

Completing a credit application form involves a systematic approach to ensure completeness and accuracy. First, applicants should gather all necessary information, such as personal identification, financial statements, and employment records. Next, filling out the application is crucial, where applicants should proceed field by field, ensuring each piece of information is correct and up to date.

After submission, the review and verification of the information provided will occur. Lenders typically take a few days to a couple of weeks to process the application, depending on their workload and policies. Post-submission, applicants can expect varying responses, including potential follow-up questions or requests for additional documentation.

Enhancing success with your credit application

To increase the chances of approval, applicants should embrace expert tips for filling out their credit application forms. Providing clear and accurate responses is paramount; vague or inaccurate answers can trigger red flags during the assessment process. Additionally, including supporting documents, such as financial statements or letters of credit history, can bolster the application.

Recognizing signs of red flags on a credit application can avert potential issues. For example, inconsistencies between the provided information can create skepticism among lenders. An absence of key financial documentation can also undermine credibility, making it crucial for applicants to present a thorough and aligned set of information.

Common challenges and solutions in the manual credit application process

Manual processing of credit applications can present various challenges, primarily due to inefficiencies and the potential for human error. The time consumed in reviewing applications coupled with the risk of inaccuracies can significantly delay decisions, affecting both lenders and applicants alike.

To overcome these challenges, adopting strategies such as using templates and checklists can streamline the application process. Rather than starting from scratch, applicants can rely on predefined formats to ensure all necessary information is accounted for. Additionally, leveraging technology to submit and track applications can enhance efficiency.

The power of automation in credit application processing

Automating credit application processes carries significant benefits, primarily by reducing processing times and increasing accuracy. Digital tools can facilitate quick information capture, making it easier for applicants to complete forms without risk of common manual errors.

To implement automation effectively, businesses can explore various tools and technologies, such as pdfFiller, which offers robust features for document creation and management. Implementation steps include transitioning existing forms into digital formats and training staff on how to utilize automated systems efficiently.

FAQs about credit application forms

When submitting a credit application, applicants often have questions about the next steps. Typically, after submission, the application undergoes a review process where lenders evaluate the provided details, aiming to ascertain their creditworthiness. The timeline for this review can range from several days to weeks, depending on the lender's policies and workload.

In cases where an application is denied, it’s crucial for applicants to understand the reasons behind the decision. They may benefit from seeking clarification and following up with the lender on potential solutions or ways to improve their application for future attempts.

Advanced strategies for credit risk management

For businesses, managing credit risk proactively is vital for sustained success. Creating an action plan to mitigate risks involves assessing each applicant's credit history and establishing effective monitoring practices for ongoing credit limits. By staying vigilant, businesses can adjust credit terms in real-time based on changing financial conditions.

Integrating the credit application form into the overall onboarding process is also essential. This practice not only helps establish clear financial expectations with new customers but also facilitates timely follow-ups and communication, which can foster strong relationships and encourage responsibility in managing credit.

Resources for completing your credit application form

Various resources are available to assist applicants in successfully completing their credit application forms. Downloadable templates and samples can provide guidance on formatting and expectations, ensuring all essential information is included without omissions.

Additionally, interactive tools like pdfFiller can enhance the user experience by offering features that guide applicants through filling out forms, enabling easy editing, e-signing, and effective document management capabilities.

Contacting an expert for assistance

Certain circumstances warrant seeking professional help regarding credit applications. Complex business cases, for example, may require Legal review or compliance checks to ensure all aspects adhere to financial regulations. Engaging a qualified financial advisor can also provide valuable insights into improving credit opportunities.

Finding the right financial advisor is crucial. Applicants should consider professionals who specialize in credit management and have a proven track record. Furthermore, leveraging additional services related to credit management can simplify the application process, particularly when utilizing platforms like pdfFiller to manage documents seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out credit application using my mobile device?

Can I edit credit application on an iOS device?

Can I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.