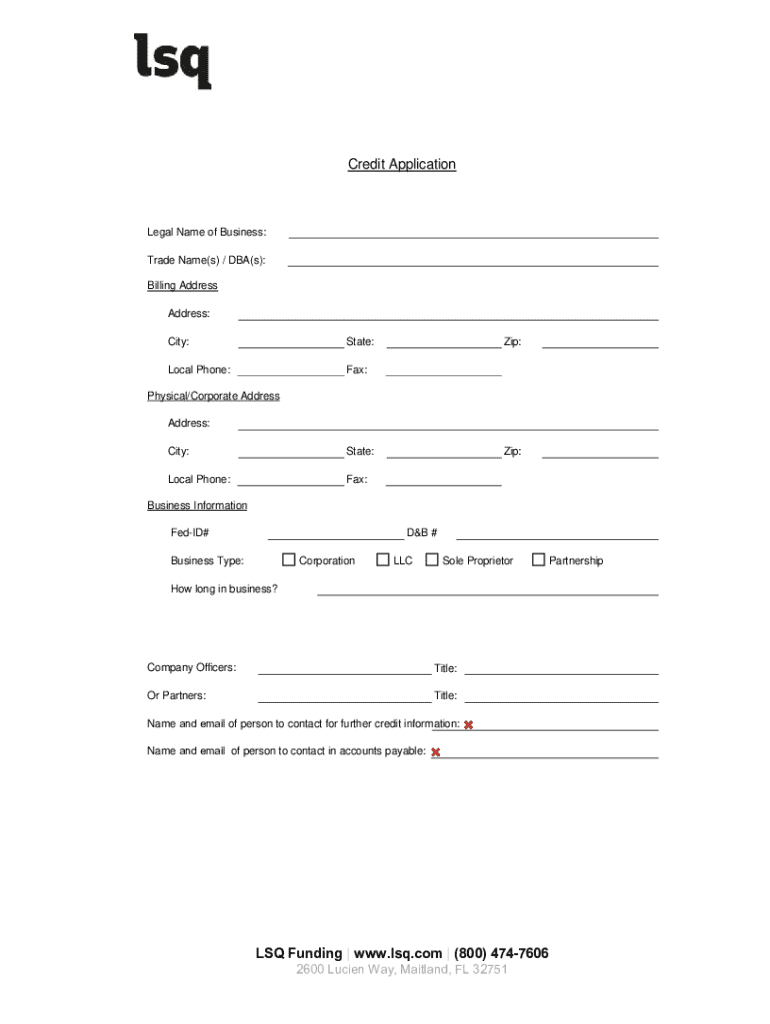

Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: A Comprehensive How-to Guide

Understanding the credit application form

A credit application form is a legally binding document that individuals and businesses fill out to request credit from lenders. This form collects essential financial and personal information to assess the applicant's creditworthiness. Credit applications play a crucial role in both personal and business finance, facilitating access to loans, credit cards, and financing options. By submitting a credit application form, applicants aim to show lenders their ability to repay borrowed funds, fostering trust and financial responsibility.

The importance of credit applications cannot be overstated; they provide lenders with a structured way to evaluate the financial risk associated with a potential borrower. A well-prepared application can enhance the likelihood of approval, while a poorly crafted one may lead to rejections or unfavorable terms.

Types of credit application forms

Key components of a comprehensive credit application

To ensure a credit application form is complete and effective, it’s vital to include essential information that helps lenders gauge the applicant's financial stability. Key components include personal and business information, financial history, and credit references that provide a snapshot of past borrowing behavior.

Additionally, it’s important to articulate the requested credit limit and justify why that amount is needed, providing insights into how it will be used to generate revenue or improve personal finances.

Supplementary documents for enhanced credibility

Steps for completing a credit application form

Before filling out a credit application form, borrowers should prepare their information in advance to streamline the application process. This preparation involves creating a necessary documentation checklist, organizing financial records, and gathering all relevant financial information. Having these details ready can help prevent errors and omissions on the application.

Filling out the form: A step-by-step approach

When filling out the credit application form, it’s essential to follow a systematic approach. Start with the personal or business information section, ensuring accuracy in your name, address, and contact details. Next, address financial history by listing any existing debts alongside the structure and purpose of those debts.

For each specific section, provide clear and truthful information. Misrepresentation can not only lead to denial but might also harm your credit history. Critical tips include double-checking numbers and being transparent about your financial situation.

Common mistakes to avoid

Evaluating creditworthiness: What lenders look for

Lenders evaluate several key criteria to determine an applicant's creditworthiness. The first and most important factor is the credit score, which reflects the applicant's credit history and financial behavior. A higher credit score typically results in more favorable lending terms.

Another critical component is the debt-to-income ratio, a calculation that compares the applicant’s total monthly debt payments to their gross monthly income. This ratio helps lenders ascertain the capacity of the applicant to manage additional debt based on their current obligations.

Understanding red flags in a credit application

The processing timeline: What to expect

Once a credit application form is submitted, applicants should be aware of the typical review periods, which can vary based on the lender and complexity of the application. Generally, assessment can take from a few hours to several weeks. Factors extending this timeline may include the need for additional documentation or further checks into credit history.

Understanding notifications and follow-ups

Lenders inform applicants of their decisions via email or phone, typically providing clear details on the outcome. If a credit application is denied, it’s crucial to understand the reasoning, as this information can guide improvements in future applications.

Best practices for a successful credit application

To enhance the quality of your credit application, employ strategies that emphasize thoroughness and professionalism. Take time to review every section meticulously and ensure that all financial documentation is present and accurate.

Timing the application is also critical; applying during favorable market conditions or when personal finances are robust can significantly influence the outcome. Awareness of seasonal trends in lending could give applicants an added advantage.

The role of automation in credit application management

Embracing online platforms offers significant advantages when managing credit application forms. These platforms streamline application processes, making them faster and more efficient. Key functionalities, such as real-time document editing and collaboration allow for accurate representation of financial information.

How pdfFiller simplifies the credit application process

pdfFiller empowers users by allowing them to edit PDFs seamlessly, eSign documents, and manage all forms from a single cloud-based platform. This ease of use is especially beneficial for users preparing credit application forms, as they can ensure accuracy and compliance without complex software.

Frequently asked questions (FAQs)

Resources for further learning

To enhance your understanding of credit management, there are numerous educational resources available. Articles and eBooks focusing on improving credit scores can be tremendously helpful for refining financial habits.

Additionally, interactive tools such as credit calculators and comparison tools provide practical insight into assessing creditworthiness. Accessing sample credit application forms can also guide preparation, whether for personal or business needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application to be eSigned by others?

How do I execute credit application online?

How do I complete credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.