Get the free Crest Depository Interests (cdis) - Deposit Form

Get, Create, Make and Sign crest depository interests cdis

How to edit crest depository interests cdis online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crest depository interests cdis

How to fill out crest depository interests cdis

Who needs crest depository interests cdis?

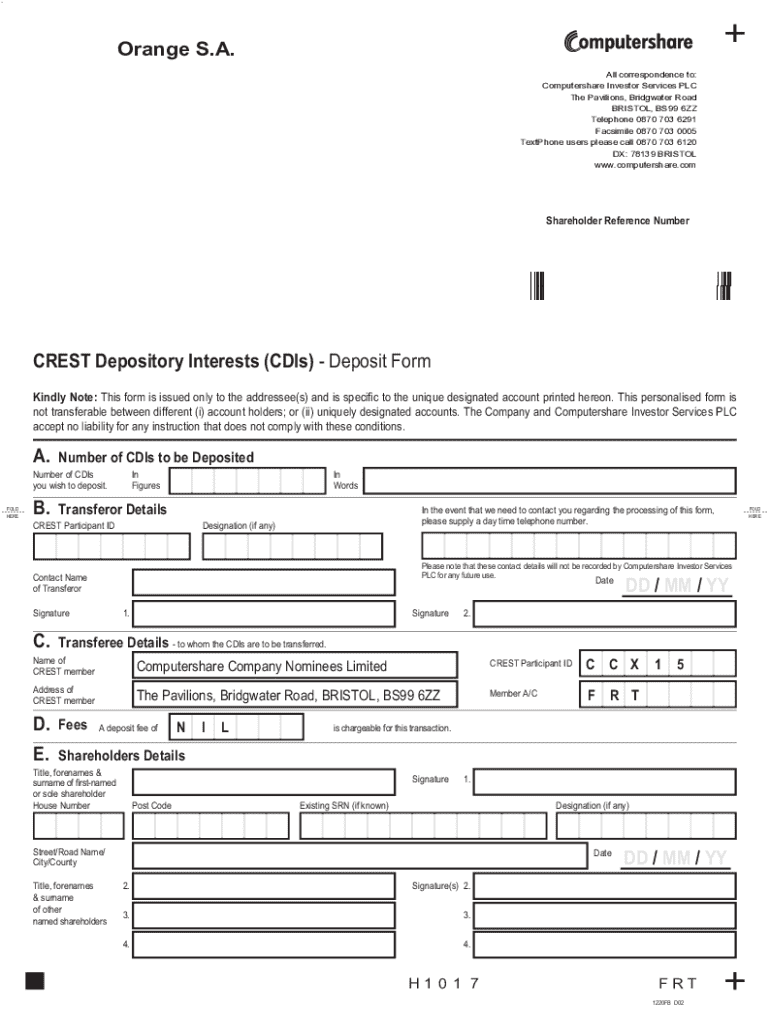

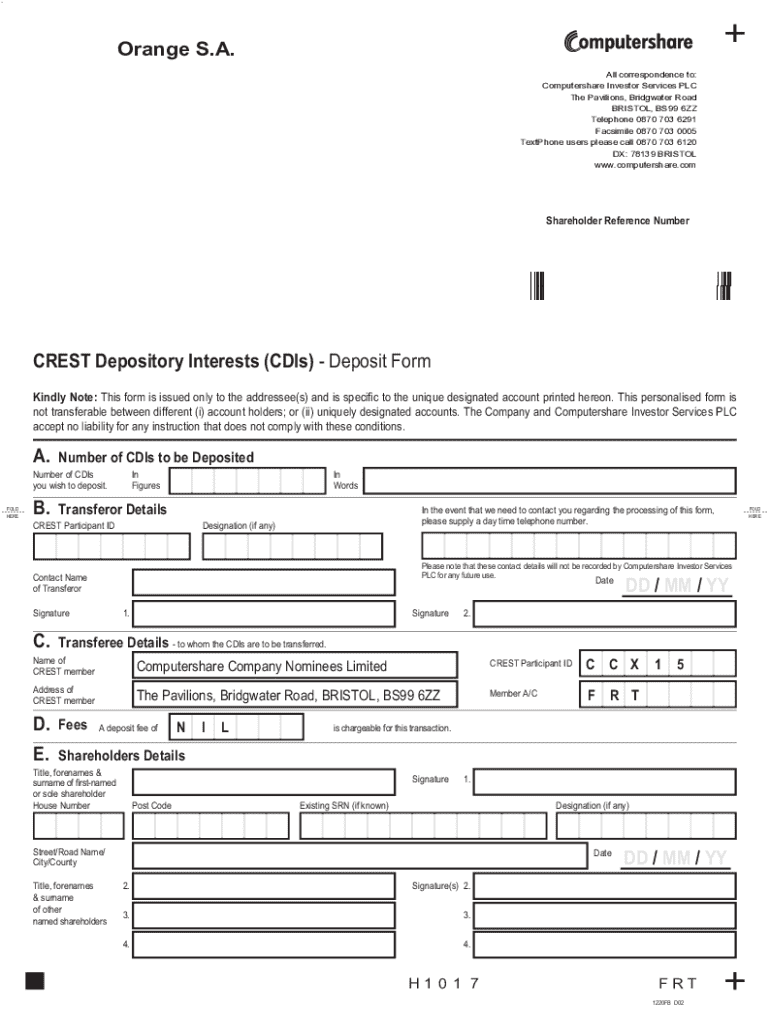

Understanding Crest Depository Interests (CDIs) Form

Understanding Crest Depository Interests (CDIs)

Crest Depository Interests (CDIs) allow investors in the UK to access overseas shares through a simplified process. Essentially, CDIs represent a share in a foreign company, but the share is held in a custodian’s account rather than the investor's name. This structure enables UK investors to own shares in non-UK companies without the complexities typically associated with foreign share ownership.

CDIs provide a mechanism for UK residents to gain exposure to international markets while adhering to British regulations. They facilitate investment in foreign companies by converting shares into a British form that's more accessible and manageable. The holding process and transaction rules for CDIs remain compliant with UK verification requirements, enabling smoother operations for investors.

The CDI process involves several steps: establishing a relationship with your broker, completing the required CDIs form, and maintaining ongoing communications regarding dividends and corporate actions through the custodian.

What Does the CDIs Form Entail?

The CDIs form is crucial for investors who wish to hold these interests in their portfolios. It is detailed and requires specific information to ensure compliance and facilitate ownership. The form generally comprises various sections aimed at collecting personal details and identification specifics.

Every section plays a vital role in the notification of proper ownership and enacting rights associated with those shares. Completeness and accuracy in filling out the form helps safeguard against potential legal issues later.

How to fill out the CDIs form

Filling out the CDIs form is straightforward if you follow systematic steps. Begin by gathering all relevant documents to ensure you complete each section accurately, preventing unnecessary delays or rejections due to errors.

Ensuring compliance can be as easy as reviewing the requirements and checking each part against the guidelines provided with the form. Even small details count, so pay careful attention.

Filling out the CDIs form: key considerations

When filling out the CDIs form, consider the implications of incorrect information carefully. Minor errors can lead to significant processing delays or even affect your ownership rights.

Engaging with the process in a timely manner and with diligence is key to navigating the often-complex world of international investments.

Editing and managing your CDIs form

After completing your CDIs form, you may need to edit or manage it for various reasons. Whether correcting information or updating your details, utilizing tools can streamline your interactions.

Saving and sharing your completed form is seamless with pdfFiller, allowing you to stay organized and connected to your investment manager or broker.

Submission process for the CDIs form

Once you have completed the CDIs form, the next crucial step is submission. Understanding where and how to submit the form can help ensure that your transaction is processed efficiently.

Understanding these processes can alleviate concerns and ensure you remain informed about the status of your investments.

Frequently asked questions (FAQs)

Investing in Crest Depository Interests can lead to several inquiries. Below are common questions about CDIs that potential investors often have:

These answers can help clarify the practical aspects of investing in CDIs, aiding in smoother transactions.

Additional information for shareholders

As a CDI holder, staying informed and organized is key to maximizing your investment potential. Tracking transactions and being aware of your rights can significantly enhance your investment experience.

Staying vigilant in these areas can help safeguard your investments and allow for proactive decision-making.

Contacts for shareholders

Effective communication is essential for shareholders managing their CDIs. Connecting with the right parties ensures you get the assistance needed.

Establishing a relationship with your financial advisor can enhance your experience and provide the guidance necessary to navigate through your investments.

Summary of the CDIs process

Navigating the Crest Depository Interests process involves several key steps from initial understanding through to complete management. Each of these steps is integral to ensuring appropriate access and ownership.

Utilizing these guidelines will not only streamline your experience in handling Crest Depository Interests but also empower you to make informed investment decisions confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my crest depository interests cdis directly from Gmail?

How can I send crest depository interests cdis for eSignature?

How do I edit crest depository interests cdis on an Android device?

What is crest depository interests cdis?

Who is required to file crest depository interests cdis?

How to fill out crest depository interests cdis?

What is the purpose of crest depository interests cdis?

What information must be reported on crest depository interests cdis?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.