Get the free Credit Card Payment Authorization Form

Get, Create, Make and Sign credit card payment authorization

How to edit credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

The Essential Guide to Credit Card Payment Authorization Forms

Understanding credit card payment authorization forms

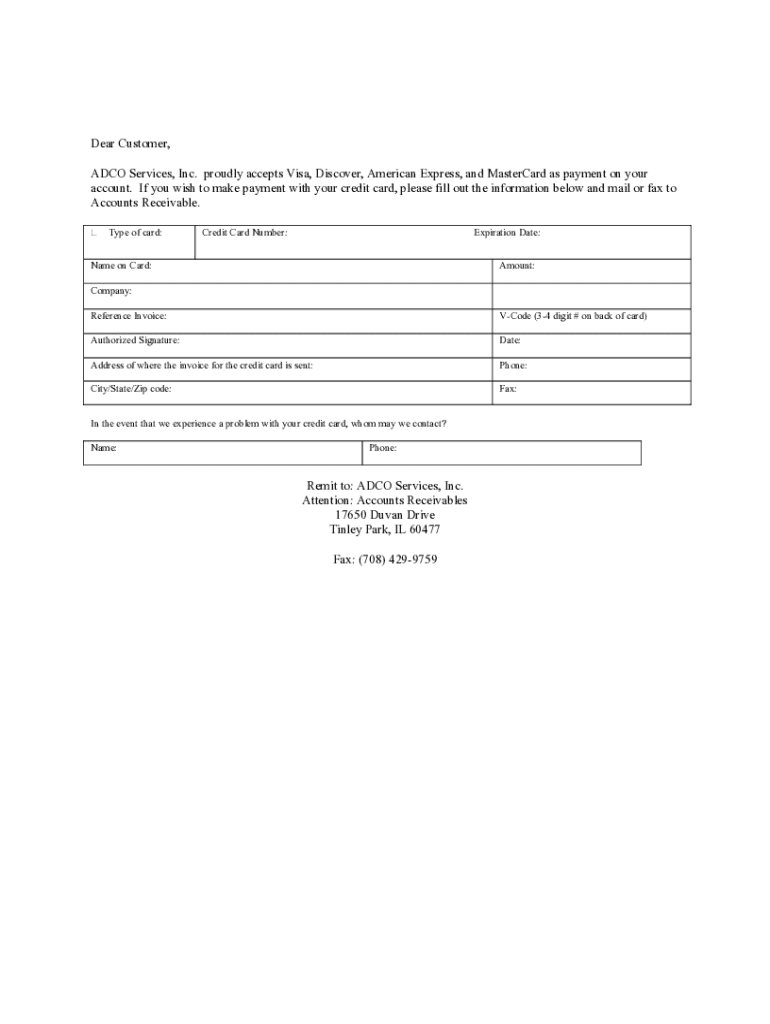

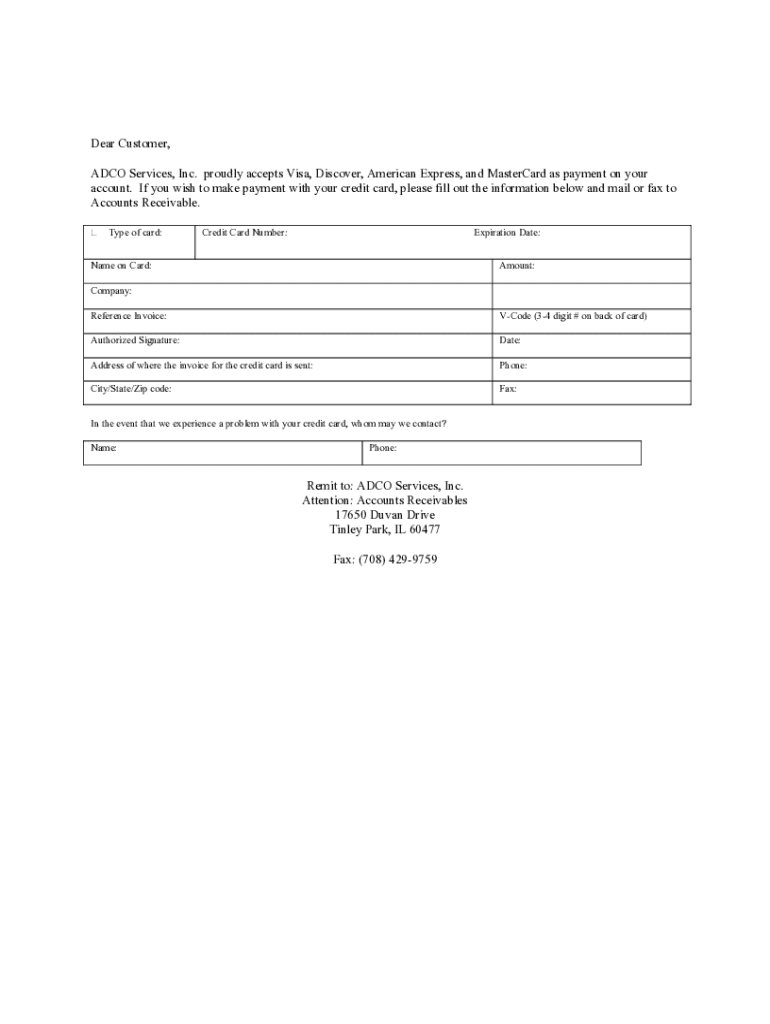

A credit card payment authorization form is a critical document that allows businesses to obtain permission from customers to charge their credit cards. This form serves as a formal agreement, detailing the terms under which payments will be processed. In an age where digital transactions dominate, having a robust authorization protocol is essential for both buyers and sellers.

The primary purpose of this form is to protect against fraud and ensure that the funds are transferred appropriately. It acts as legal proof that the cardholder agrees to the transaction, thereby reducing the chance of disputes. Without utilizing a credit card payment authorization form, businesses may expose themselves to chargebacks and loss of revenue.

Components of a credit card payment authorization form

A thorough understanding of the components of a credit card payment authorization form is crucial for businesses looking to streamline their payment processes. Required field items typically include the cardholder's name, billing address, credit card number, expiration date, and an authorization signature. Each of these elements plays a role in affirming the legitimacy of transactions.

Additionally, options for supplementary information enhance both security and clarity. The CVV code, while often excluded from forms to minimize security risks, can be important depending on the payment method employed. Specifying the amount to be charged can also create a clear understanding between both parties involved.

Benefits of using a credit card payment authorization form

Utilizing a credit card payment authorization form presents an array of benefits for businesses. One of the foremost advantages is the reduction of chargeback abuse. When a customer disputes a transaction, possessing a signed authorization form significantly bolsters the seller’s position, providing essential documentation that the charge was approved.

Moreover, these forms are integral for protecting business interests by adding a layer of accountability and legal defense in financial disputes. From a transaction perspective, they streamline the payment process, allowing sellers to efficiently handle billing while enhancing customer trust through transparent practices.

How to properly fill out a credit card payment authorization form

Filling out a credit card payment authorization form accurately is vital for ensuring the transaction is processed smoothly. Begin by gathering all necessary information, including personal details and credit card specifics. Platforms like pdfFiller offer easy access to customizable templates that allow you to fill out these details securely and accurately.

Once you’ve accessed the template via pdfFiller, input the required information and take a moment to review each entry for accuracy. Double-check the credit card number, expiration date, and other relevant fields before proceeding to sign. Utilizing pdfFiller’s cloud platform enhances security and ensures that documents are saved securely, allowing for easy access and management.

Best practices for managing credit card payment authorization forms

Effective management of credit card payment authorization forms is essential for maintaining compliance and mitigating risks. Storing signed forms safely must top the priority list; consider using secure physical or digital storage solutions that safeguard sensitive information. Retention guidelines indicate that completed forms should be kept for a minimum period, depending on local regulations.

Understanding how to manage cards on file while ensuring compliance with the Payment Card Industry Data Security Standard (PCI DSS) adds another layer of security. Adhering to these standards helps protect sensitive cardholder information from data breaches and builds customer confidence in your business.

Scenarios where a credit card payment authorization form is essential

There are various instances where a credit card payment authorization form is not just optional but essential for effective transaction management. For businesses that offer recurring payments, such as subscription services, having a signed authorization form ensures compliance and reduces the risk of chargebacks. In one-off transactions, especially in industries like health, education, or real estate, this authorization becomes equally important to protect both the business and consumer.

E-commerce transactions particularly benefit from this form, as they often lack the face-to-face interaction that creates trust. A well-structured credit card payment authorization form provides customers with the assurance that their financial information is protected, fostering a more secure shopping experience.

Addressing common questions and concerns

Many individuals and businesses have questions about the necessity and legality of credit card payment authorization forms. A common query is whether it is a legal requirement to use such a form. While it may not be mandated by law in all situations, it is a best practice that significantly reduces liability in a transaction. Without this form, businesses may face difficulties when disputing chargebacks or fraudulent transactions.

Concerning the CVV code, it's often not included as a security measure to prevent potential misuse. Handling disputes related to unauthorized charges often requires robust, documented proof, such as a credit card payment authorization form, which is pivotal in defending the transaction and protecting against financial loss.

Interactive tools for creating credit card payment authorization forms with pdfFiller

Using pdfFiller, businesses can take advantage of various interactive tools that facilitate the creation and management of credit card payment authorization forms. Features include easy access to editable templates, facilitating seamless collaboration among teams. This is particularly useful for businesses operating in multiple locations, where centralized document management can streamline operations.

Tutorials on editing and e-signing forms ensure that users are well-equipped to handle the document workflow, whether they need to make adjustments or obtain signatures from clients. These collaborative tools enhance team-based workflows and elevate the overall efficiency of payment processing.

Downloadable templates for your convenience

pdfFiller provides accessible templates tailored to various business needs, allowing users to quickly create or modify a credit card payment authorization form. With formats available in both PDF and Word, these templates can easily align with the specific payment scenarios businesses face, enhancing efficiency in transaction management.

Customization options are abundant, empowering users to adapt the language and terms in the template to reflect their unique brand identity. This flexibility adds an additional layer of professionalism to your documents and ensures that they meet the needs of your specific market.

Explore related resources

Beyond credit card payment authorization forms, it's beneficial for businesses to consider other essential documents for transaction management. Complementary resources include invoices for clear billing, service agreements that outline terms and conditions, and guides on payment processing and merchant accounts.

Staying informed on payment security is particularly crucial in today’s digital transaction environment. Articles and materials focused on enhancing payment security can significantly aid businesses in safeguarding cardholder data and maintaining compliance with industry standards.

Stay updated

Engaging with ongoing developments in payment processing and document management helps businesses maintain a competitive edge. Subscribing to newsletters focused on payments and finance can provide timely updates, new resources, and valuable insights.

In addition, downloading guides focused on effective payment processing can equip businesses with strategies to refine their workflows, enhance customer satisfaction, and drive growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card payment authorization to be eSigned by others?

How can I get credit card payment authorization?

How do I edit credit card payment authorization on an iOS device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.