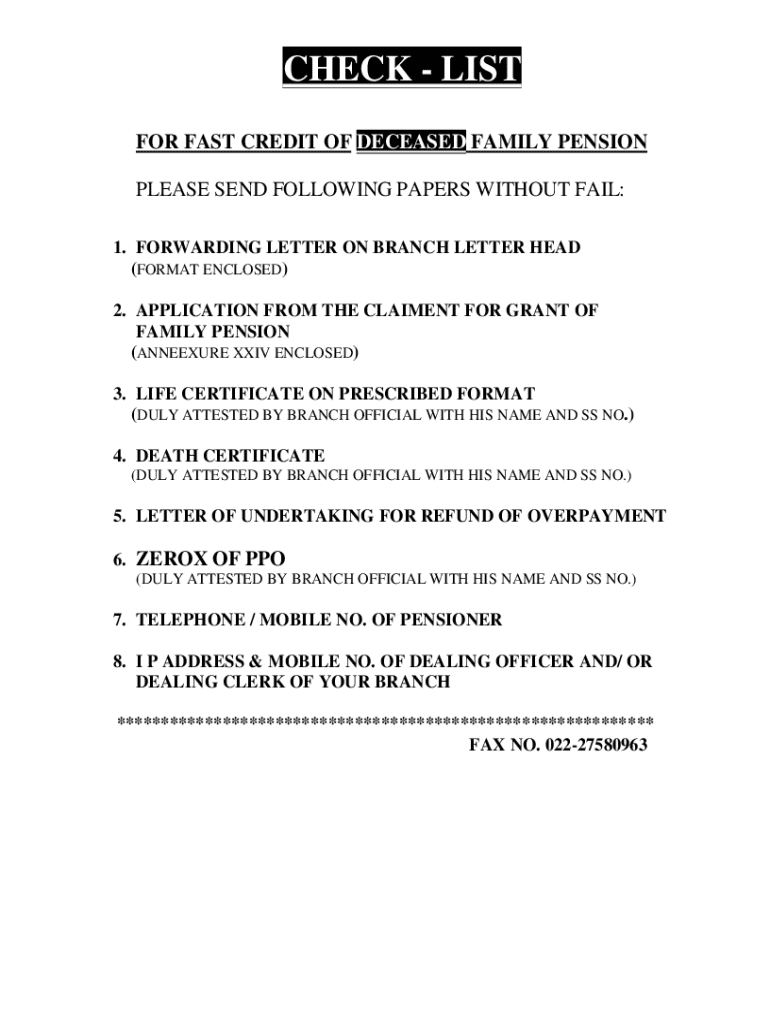

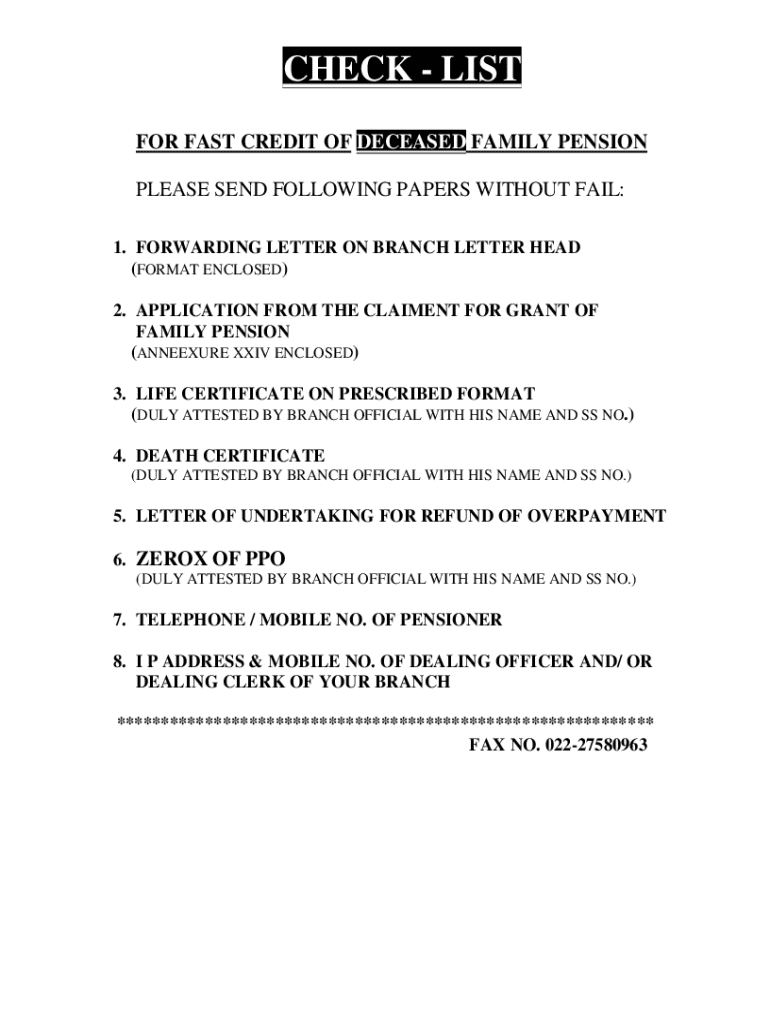

Get the free Checklist for Fast Credit of Deceased Family Pension

Get, Create, Make and Sign checklist for fast credit

Editing checklist for fast credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checklist for fast credit

How to fill out checklist for fast credit

Who needs checklist for fast credit?

Checklist for Fast Credit Form: A Comprehensive Guide

Overview of credit forms

Credit forms serve as essential documents in making financial applications clear and concise. They outline vital information that lenders need to assess an applicant's financial situation and risk level. Having a well-structured credit form not only speeds up the application process but also minimizes potential errors that could lead to delays.

There are various types of credit forms, including personal credit forms, business loan applications, mortgage applications, and specific forms for lines of credit. Each type requires distinctive information, tailored to meet the unique needs of different financial products.

Why use a checklist for fast credit form?

Utilizing a checklist is invaluable during the credit application process. First and foremost, it helps streamline the application process by ensuring that all necessary information is included before submission, which can significantly reduce approval delays.

A checklist also enhances document accuracy, reducing the chances of errors that can derail your application. For instance, a business applicant might miss including significant income documentation, which could lead lenders to reject their application outright. Real-world scenarios repeatedly demonstrate that applicants who use checklists tend to have faster approval rates.

Key components of a fast credit form checklist

A well-structured checklist for your fast credit form should cover all essential components. Start with essential information required from the applicant, including:

Move on to specific sections of the credit form, ensuring you fill out details like:

Lastly, include a list of supporting documents that can help substantiate your request, such as recent bank statements, tax returns, and asset documentation to showcase your financial health.

How to create your personalized fast credit form checklist

Creating a personalized checklist can be as simple as following a step-by-step guide. Start by determining the type of credit you are applying for—personal, business, or maybe a mortgage. Each will have different requirements.

Conduct thorough research on the required documents. You can visit the lender's website or reach out to customer service to gather accurate details. Once you know what's needed, organize these documents into a clear, structured format. Review your checklist for completeness before you begin filling out the form.

Consider utilizing interactive tools for checklist creation. Platforms like pdfFiller can provide templates that you can modify based on your specific requirements, helping you stay organized in a digital format.

Filling out your fast credit form: Best practices

Accurately completing each section of your fast credit form is crucial. Be clear and precise in your language, ensuring you provide complete and accurate information. For example, avoid using abbreviations that may not be understood by the reviewer.

It's essential to double-check every entry. Common mistakes include misplacing a decimal in your income figures or failing to sign the form. A quick review can save you from unnecessary delays in processing your application.

The role of collaboration in credit applications

Collaboration is key to ensuring your application process runs smoothly. pdfFiller’s features allow you to collaborate with team members or financial advisors seamlessly. You can share the credit form documents securely in the cloud, enabling partners to review and edit them collaboratively.

Being able to work together in real-time fosters better communication, ensuring that nothing is overlooked. Utilizing shared tools helps all parties remain updated on changes and feedback.

Managing your documents after submission

After you've submitted your credit application, it’s imperative to track it effectively. Implementing a system to monitor submitted forms ensures you’re aware of their status. Use organizational tools available on platforms such as pdfFiller to manage submitted documents systematically.

Establish a follow-up process to ensure timely approval. Consider scheduling reminders for yourself or alerts to check in with the lender if you haven’t heard back within a reasonable timeframe.

Frequently asked questions about the fast credit form

Understanding a fast credit form checklist and its importance can save you significant time and effort. A checklist is beneficial as it outlines every document and piece of information needed, preventing last-minute scrambles. You can certainly customize your credit form checklist template using pdfFiller, making it more tailored to your application needs.

If your credit application is denied, don't despair. Review the feedback provided by the lender to understand their reasoning before addressing any gaps or resubmitting your application. Accessing documents and forms online can significantly expedite your application process, eliminating postal delays and providing a streamlined approach.

Additional considerations for special circumstances

Certain applicants may face unique challenges requiring specific considerations. For instance, self-employed individuals often need to provide additional documentation, such as profit and loss statements or business licenses, to validate their income.

Mortgage-related credit forms might include guidelines on property appraisals, while individuals applying for proposed construction loans might need to submit detailed plans alongside their application.

Utilizing pdfFiller to enhance your credit application experience

pdfFiller offers various features that simplify the form management process. These include user-friendly editing tools that allow applicants to fill out forms electronically, along with eSigning tools that expedite approval processes. Real-life examples include users who complete credit forms faster using the platform's organizational capabilities.

By leveraging pdfFiller's solutions, users gain a competitive edge in managing their applications, making the entire credit application experience smoother and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in checklist for fast credit without leaving Chrome?

Can I create an electronic signature for the checklist for fast credit in Chrome?

How do I fill out the checklist for fast credit form on my smartphone?

What is checklist for fast credit?

Who is required to file checklist for fast credit?

How to fill out checklist for fast credit?

What is the purpose of checklist for fast credit?

What information must be reported on checklist for fast credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.