Get the free Cash Isa Transfer in Form

Get, Create, Make and Sign cash isa transfer in

Editing cash isa transfer in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash isa transfer in

How to fill out cash isa transfer in

Who needs cash isa transfer in?

Cash ISA transfer in form - How-to guide

Understanding cash ISA transfers

A Cash ISA (Individual Savings Account) allows you to earn interest on your savings tax-free. Designed primarily for those looking to save, a Cash ISA is a simple yet effective way of securing your money in a safe environment while maximizing potential interest earnings. The key advantages of a Cash ISA include tax-free interest, no need to declare earnings on your tax return, and the flexibility to withdraw funds without penalties.

Transferring your Cash ISA is crucial when seeking better interest rates or more favorable terms. The financial landscape is always evolving, and banks and building societies frequently alter their offerings. This guide will provide you with a comprehensive understanding of how to effectively transfer your Cash ISA to a new provider.

Cash ISA transfer process overview

To successfully complete a Cash ISA transfer, you should be aware of a few key steps that form the backbone of the transfer process. This typically involves identifying a new provider, completing the transfer form, and submitting your request. Therefore, understanding this process will prepare you to act quickly and efficiently.

Preparing for your cash ISA transfer

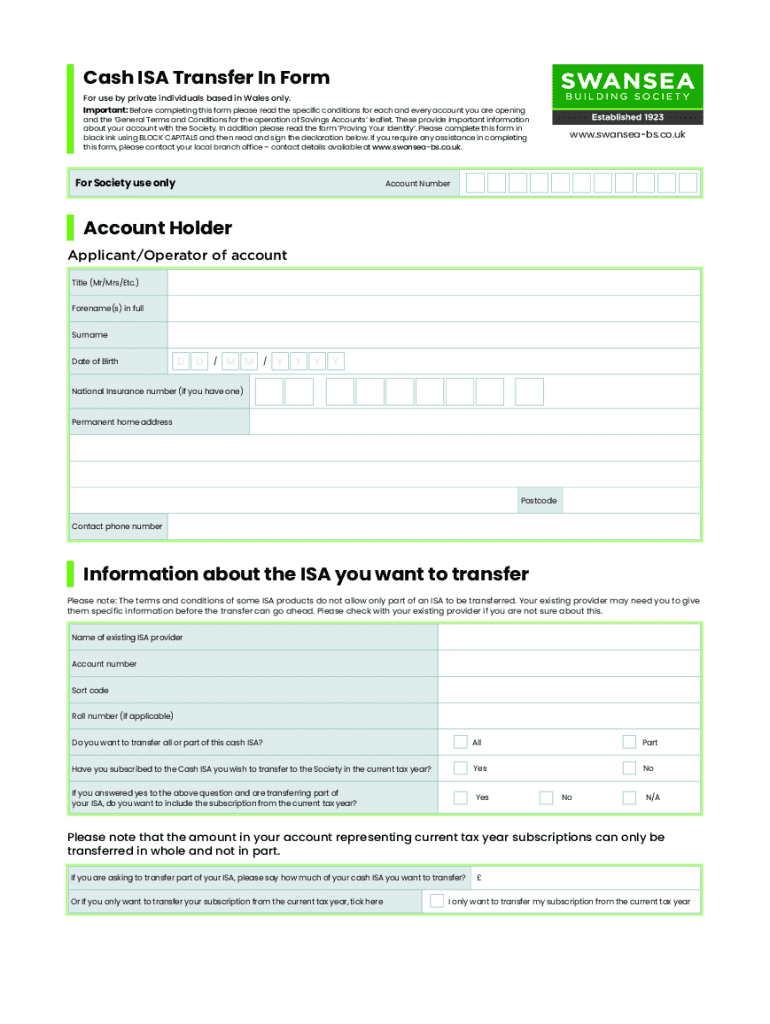

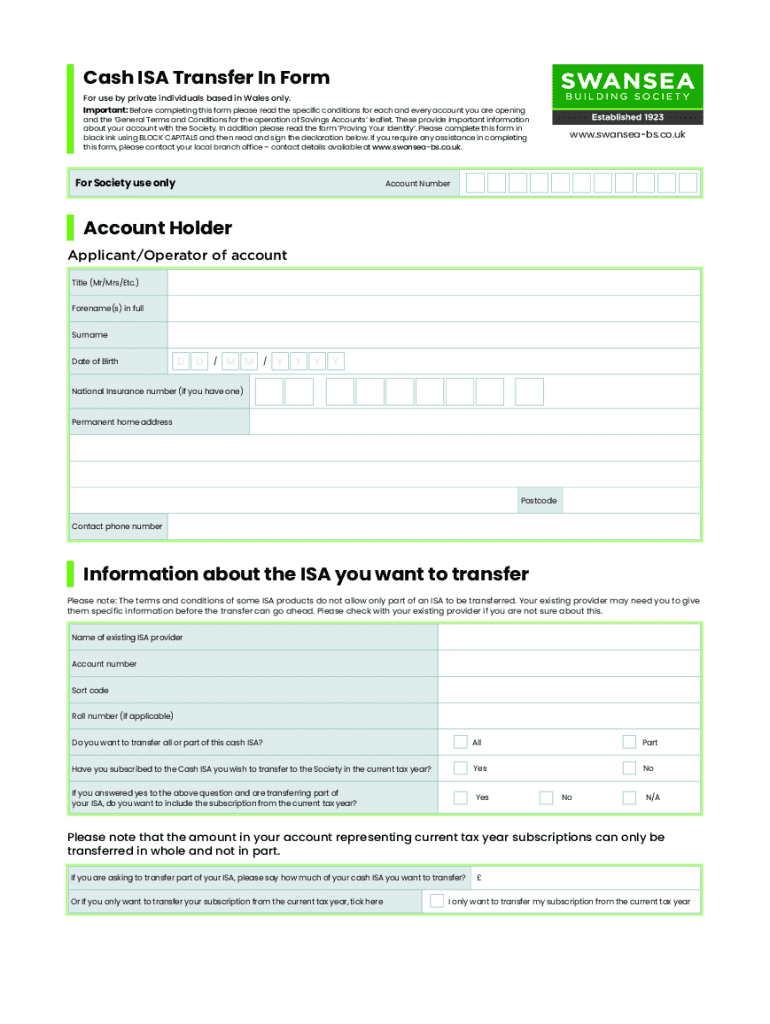

Before initiating your Cash ISA transfer, it's vital to collect essential information that will streamline the process. This includes your current account number, provider details, and any specific information your new provider may require. Timely preparation can save you from potential delays.

Furthermore, it's imperative to conduct thorough research on potential ISA providers. Pay particular attention to their interest rates and terms. Explore customer reviews to gauge reliability and satisfaction, as this is integral to a successful long-term investment.

How to initiate a cash ISA transfer

Starting your Cash ISA transfer involves a few straightforward steps. First, you should reach out to your chosen new provider, either by phone or online. Ask clear questions regarding their ISA offerings to ensure they meet your financial goals.

Once you've gathered enough information, move on to complete your transfer form. This document is vital to ensure the smooth movement of funds from the old provider to the new one. Double-check all entries for accuracy to avoid delays.

Completing the cash ISA transfer

Following the completion of your form, it's time to submit your transfer request. Many providers today offer multiple submission methods, including online, via mail, or in-person. Be sure to choose the method that works best for you, and keep a record of your submission for future reference.

Coordination between providers is crucial for a successful ISA transfer. The old provider will close your existing Cash ISA and release the funds to the new provider, which can take several days depending on their processing times.

What happens during the cash ISA transfer

During this transfer period, it’s essential to understand that interest on your funds may be impacted. Typically, while your funds are being transferred, you will not earn interest, which is an important consideration when timing your transfer.

Once the transfer is finalized, there may occasionally be issues such as delays or administrative errors. Should these arise, act promptly to contact both providers for clarification and solutions. The timeframe for completion can vary yet is often swift if all documents are correctly processed.

Common questions and concerns about cash ISA transfers

The process of transferring your Cash ISA may raise several questions. For instance, many individuals wonder if transferring an ISA counts as opening a new one. The straightforward answer is No; your original allowance remains intact.

Familiarizing yourself with the regulations governing ISA transfers is also beneficial. Understanding these rules can help avoid penalties and facilitate a smooth experience throughout the process.

Resources for managing your cash ISA post-transfer

After finalizing your transfer, managing your Cash ISA effectively becomes crucial. Digital tools, like those offered by pdfFiller, are incredibly valuable for documenting and tracking your financial status. With features allowing seamless management, you can store and organize your transfer documents efficiently.

Monitoring your ISA performance regularly is vital. Set reminders to review your financial health and be on the lookout for better offerings. In addition, don't hesitate to seek further assistance if needed. Many providers offer customer support to guide you in your ISA management journey.

Additional insights into cash ISAs and transfers

As the market for Cash ISAs evolves, expect trends affecting interest rates and provider competition to emerge in the coming years. Adapting to these changes can enhance your savings potential, making it essential to stay informed.

Exploring all available funds could put you in a better position to capitalize on potential savings growth across various types of investment accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cash isa transfer in from Google Drive?

How can I get cash isa transfer in?

How do I edit cash isa transfer in straight from my smartphone?

What is cash isa transfer in?

Who is required to file cash isa transfer in?

How to fill out cash isa transfer in?

What is the purpose of cash isa transfer in?

What information must be reported on cash isa transfer in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.