Get the free Consumer Credit Application

Get, Create, Make and Sign consumer credit application

Editing consumer credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit application

How to fill out consumer credit application

Who needs consumer credit application?

Consumer Credit Application Form: A Comprehensive How-To Guide

Understanding consumer credit applications

A consumer credit application form is a document used by individuals seeking credit from lenders. This form gathers all necessary information about the applicant, allowing lenders to assess the risk involved in granting credit. Understanding the purpose of this form is crucial, as it serves as the first step in the lending process, impacting your chances of approval.

The significance of filling out a credit application cannot be overstated. It not only showcases your financial history but also highlights your responsibility towards debt management. Lenders are interested in key factors such as your credit score, income level, job stability, and debt-to-income ratio. These elements play a vital role in determining your eligibility for the loan.

Types of consumer credit applications

Different types of consumer credit applications exist based on the applicant's needs and circumstances. Individual applications are for single borrowers, while joint applications allow couples or partners to apply together, increasing their chances of approval through combined financial histories.

The medium of application also varies – applicants can choose between online and paper forms. Online applications offer convenience and speed, while paper applications might be preferred by individuals less comfortable with technology. Both formats have their pros and cons, impacting the application process's ease and efficiency.

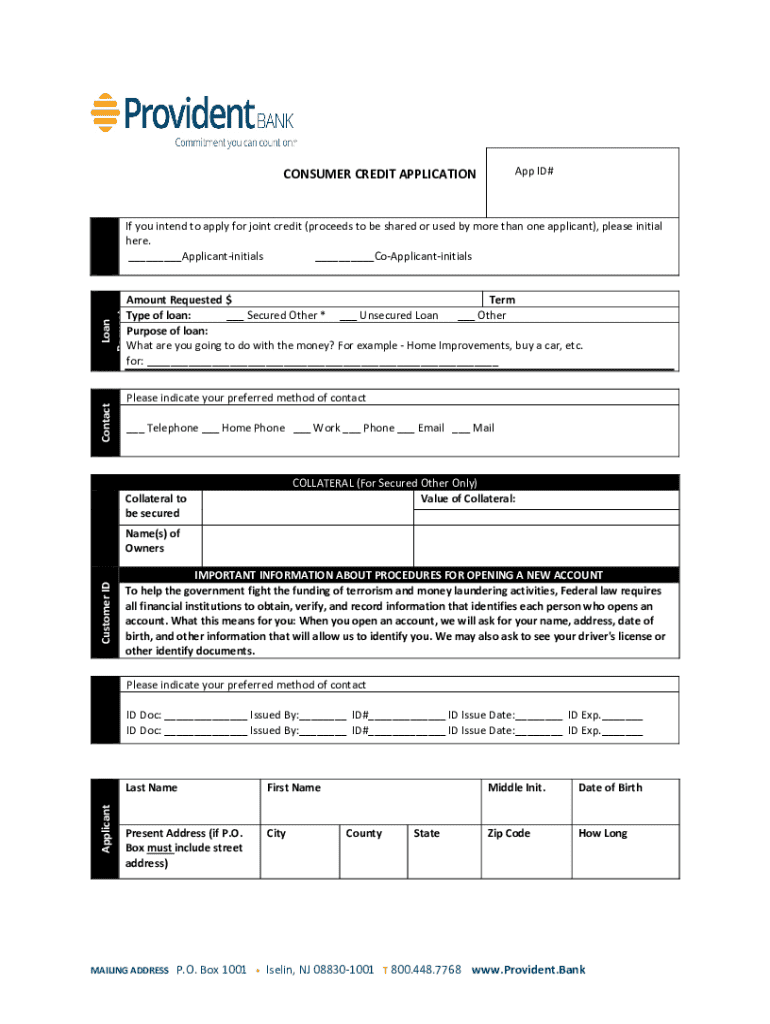

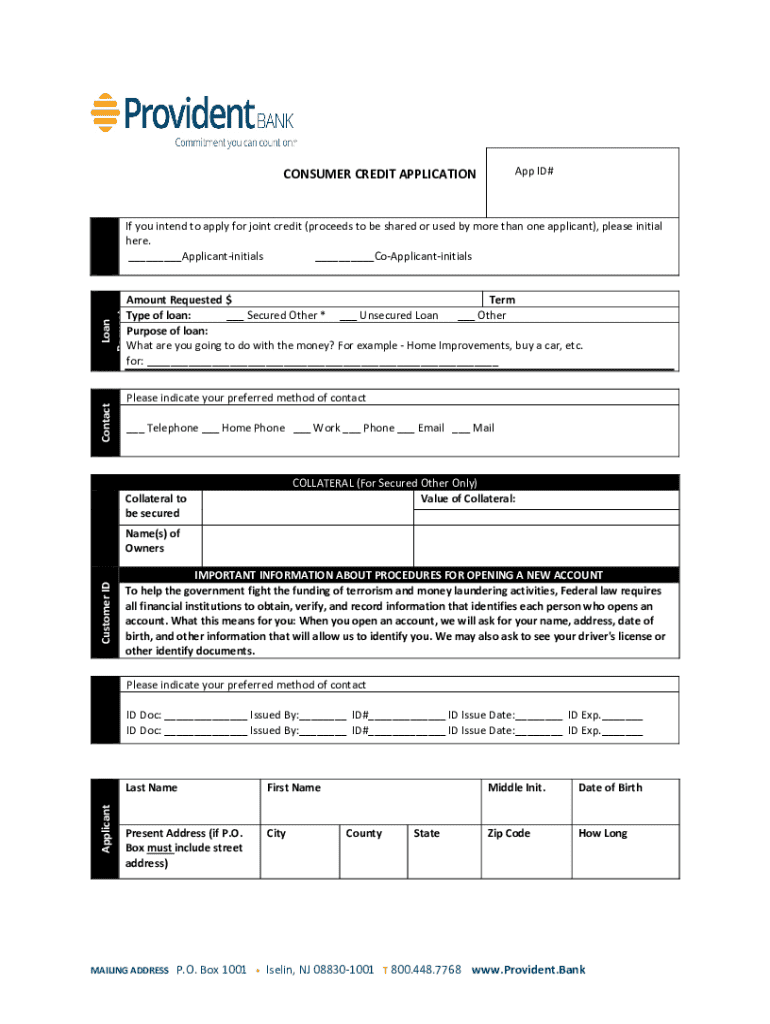

Essential components of a consumer credit application form

When you consider the essential components of a consumer credit application form, the first section usually requires personal information. This includes your full name, contact information, social security number, and date of birth. Lenders use this data to verify your identity and track your credit history.

The financial information sections detail your employment status, current employer, job title, income details, assets, and liabilities. This information helps lenders assess your financial stability. Additionally, sharing your credit history is essential. This includes previous credit accounts and any relevant financial obligations, such as outstanding loans or credit card balances.

Step-by-step guide to filling out a consumer credit application form

Filling out a consumer credit application form requires careful preparation and attention to detail. Start with Step 1: Gathering necessary information and documentation. Ensure you have to hand identification documents such as your driver's license and social security card, as well as recent financial statements that show your income and expenses.

Step 2 involves completing the application. Follow a detailed walkthrough for each section, ensuring that all entries are accurate and clear. Take your time to avoid typographical errors that can delay processing. Finally, Step 3 is to review your application before submission. Be vigilant about common errors, such as incorrect social security numbers or missing income information, and ensure that all details are up to date.

Editing and customizing your consumer credit application form

Using pdfFiller, you can easily edit your consumer credit application form to ensure all information is accurate and well-presented. This platform provides interactive tools to customize forms, allowing you to add or remove sections depending on your needs. Edit fields effortlessly, ensuring clarity in your application.

One of the significant features of pdfFiller is the ability to add electronic signatures, which is a crucial step in the submission process. This functionality, combined with the intuitive layout of the application, ensures your form meets lender requirements while saving you time.

Submit your application: Best practices and next steps

Once your consumer credit application form is complete, it's time to submit it. Consider your options: online submissions through lender websites tend to be faster, while in-person submissions might offer the opportunity for immediate feedback. Mailing your application is slower but can be necessary for certain lenders.

After submission, you should know what to expect. Many lenders have standard processing times, typically ranging from 24 hours to several days. Understanding these timelines helps manage your expectations while awaiting a response.

Track the status of your credit application

Tracking your consumer credit application status is essential as it keeps you informed throughout the process. Many lenders provide an online portal for applicants to check their application progress. Be proactive in contacting lenders if you haven't received updates within the standard processing timeframe.

Utilizing these portals not only keeps you updated but also allows you to address any questions or provide additional documentation if requested.

Managing rejections and next steps

Not every application will be approved, and understanding how to manage rejections is as important as knowing how to apply. Common reasons for application denials include low credit scores, high debt-to-income ratios, and insufficient income. It's beneficial to review these factors and use them to improve your chances of approval the next time.

If denied, you can often request a review or reapply after addressing the underlying issues. Furthermore, working on improving your creditworthiness, such as clearing existing debts or ensuring timely bill payments, is advisable for future applications.

Frequently asked questions about consumer credit applications

Many applicants have questions when navigating consumer credit applications. It's vital to know what to do if you encounter issues during application submission or processing. Some applicants may wonder whether their credit score impacts their application. The answer is a resounding yes, as most lenders heavily weigh credit scores in their approval decisions.

Additionally, prospective borrowers can often request a copy of their application for personal records or to track changes in their financial situation.

The role of pdfFiller in managing your consumer credit application

pdfFiller plays an integral role in managing your consumer credit application, providing a seamless experience for document management. Whether you're filling out forms on your smartphone or laptop, pdfFiller ensures access from anywhere. Its collaborative features allow teams to work together efficiently, streamlining the application preparation process.

Real-time editing and eSigning features enhance efficiency further, ensuring that your consumer credit application form is ready for submission without unnecessary delays, helping you navigate the often stressful lending process with ease.

Additional insights on consumer credit forms

Examining case studies of successful consumer credit applications can provide valuable lessons. These examples often highlight clear application processes and demonstrate how financial literacy plays a significant role in securing credit. Education resources are available to improve your understanding of credit terms, lending practices, and other financial concepts.

As the world of consumer credit evolves, staying informed on future trends in consumer credit applications is essential. Whether it involves technological advancements in application submissions or changes in lending standards, remaining knowledgeable will empower consumers to navigate the credit landscape effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit consumer credit application from Google Drive?

How do I complete consumer credit application on an iOS device?

How do I edit consumer credit application on an Android device?

What is consumer credit application?

Who is required to file consumer credit application?

How to fill out consumer credit application?

What is the purpose of consumer credit application?

What information must be reported on consumer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.