Get the free California Small Group Employer Application

Get, Create, Make and Sign california small group employer

How to edit california small group employer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california small group employer

How to fill out california small group employer

Who needs california small group employer?

California small group employer form: A how-to guide

Understanding the California small group employer form

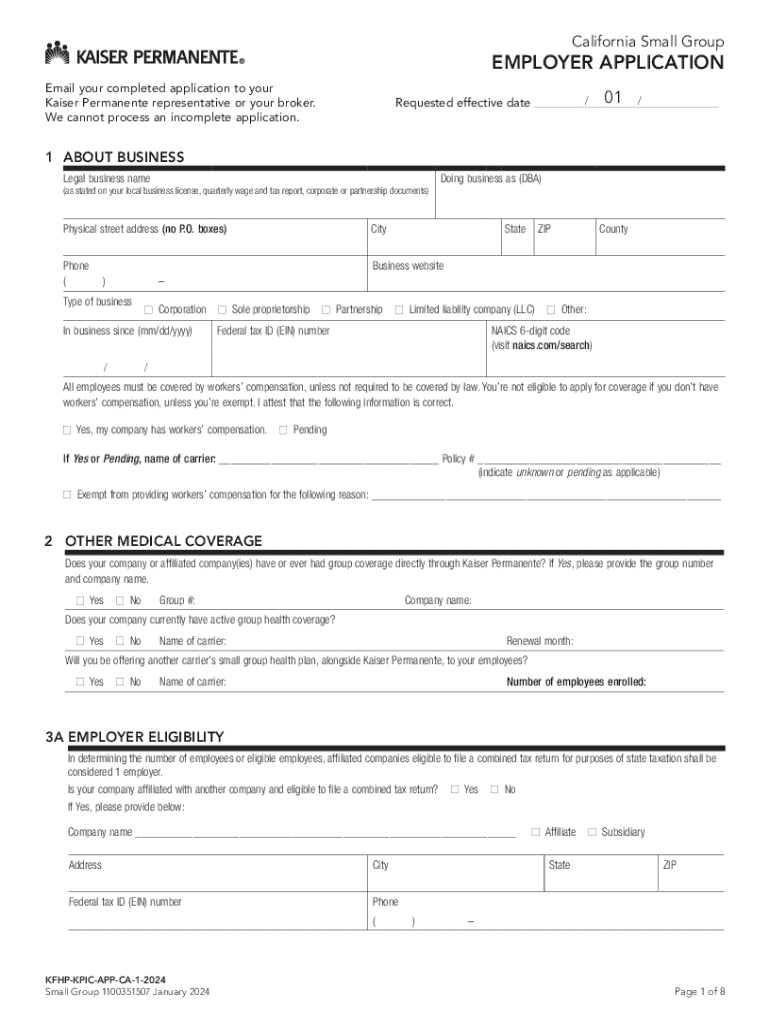

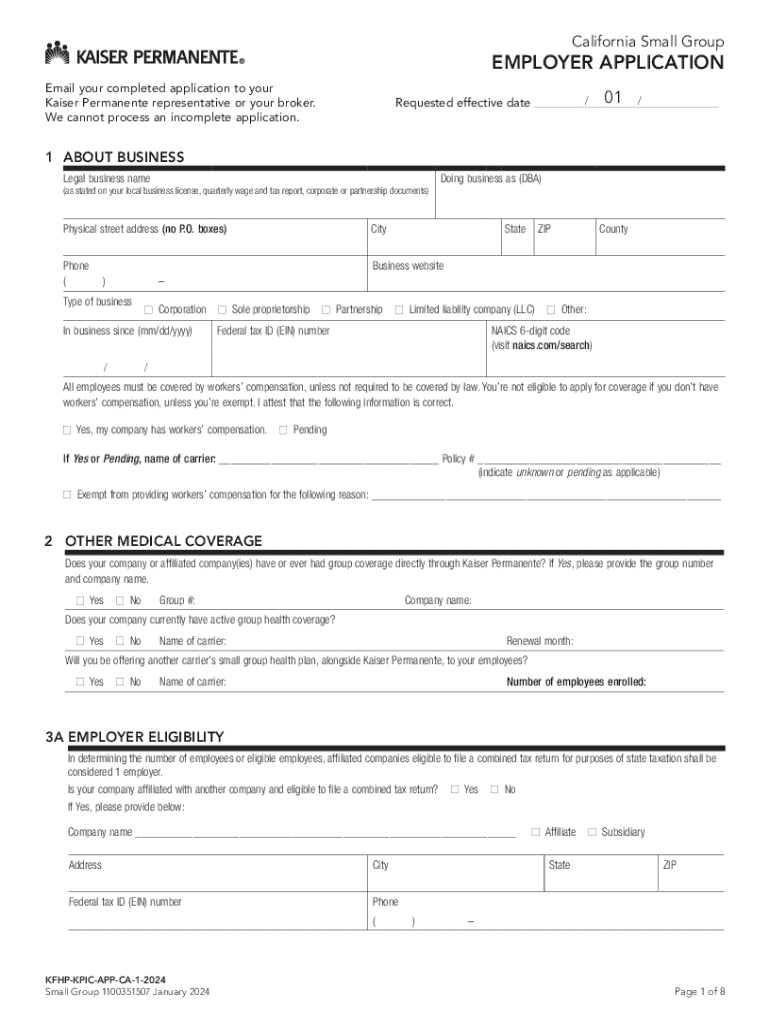

Navigating the California small group employer form is essential for small businesses looking to provide health insurance to their employees. This form collects vital information that will help determine eligibility, available plans, and employer compliance with state regulations.

In California, this form serves as a bridge for small employers to access health benefits, ensuring they remain competitive in attracting talent while meeting legal obligations. Both the Affordable Care Act (ACA) and California's specific regulations mandate certain aspects of health coverage that employers must adhere to.

Preparing to complete the form

Before diving into the California small group employer form, employers must ensure they meet the eligibility criteria. Typically, California defines small groups as businesses with 1 to 100 employees, which can vary based on the health insurance market and other factors.

Additionally, understanding the business structure—whether it’s a sole proprietorship, partnership, or corporation—is crucial for the completion of the form. Employers should gather essential documentation to include on the form, such as business registration details, comprehensive employee rosters, and specific health insurance requirements.

Step-by-step guide to filling out the California small group employer form

Completing the California small group employer form is a systematic process. Below is a comprehensive breakdown of each section to help employers navigate through the form effectively.

Section 1: Basic employer information

In this section, provide the business name, its primary contact details, and the Employer Identification Number (EIN). Make sure that all details are correct to prevent delays in processing.

Section 2: Employee information

Next, detail the total employee count and the specific health plans offered to them. It’s essential to classify full-time and part-time employees correctly.

Section 3: Coverage and benefits

This section will require an overview of available health plans including the type of coverage offered, premiums, and deductibles. Be transparent about additional benefits available to employees, such as dental and vision insurance.

Section 4: Compliance statements and signatures

Finally, ensure that all compliance statements are accurately confirmed with necessary signatures and dates. This section emphasizes the employer's commitment to abide by state regulations.

Editing and managing the form with pdfFiller

Using pdfFiller to manage the California small group employer form makes the entire process more seamless. With its powerful document editing tools, employers can easily fill, edit, and save their forms digitally.

pdfFiller also offers secure eSigning features, allowing employers to sign documents electronically, which saves time and ensures compliance with minimal effort.

Common mistakes to avoid when filling out the form

Even small oversights can lead to significant issues when filling out the California small group employer form. It's crucial to avoid common pitfalls to ensure that the submission process goes smoothly.

Frequently asked questions (FAQs) about the California small group employer form

Employers often have questions regarding the California small group employer form. Here, we address some of the most commonly asked questions for clarity on the process.

Useful resources and tools for small group employers

To support small group employers, numerous resources exist. These can help companies stay informed about regulations, compare insurance plans, and understand more about the field they operate within.

Exploring the benefits of using pdfFiller

pdfFiller's functionalities extend to enhance document management for small group employers. The platform allows users to access critical forms from anywhere, promoting flexibility and efficiency.

Additionally, pdfFiller’s ability to integrate with popular applications facilitates a smoother workflow, making it an invaluable tool for document management.

Case studies: Success stories from small group employers

Real-world experiences highlight the effectiveness of using tools like pdfFiller in completing the California small group employer form. Many employers report significant time savings and improved accuracy in their submissions.

Staying updated on changes in California health insurance regulations

Given the dynamic nature of health insurance regulations, it's crucial for employers to stay informed. Utilizing resources dedicated to regulatory updates ensures your business remains compliant.

pdfFiller regularly updates its users about relevant changes, making it easier for employers to manage their compliance effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california small group employer to be eSigned by others?

Can I create an eSignature for the california small group employer in Gmail?

Can I edit california small group employer on an Android device?

What is california small group employer?

Who is required to file california small group employer?

How to fill out california small group employer?

What is the purpose of california small group employer?

What information must be reported on california small group employer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.