Get the free Compliance Institute 2025 Lending Registration

Get, Create, Make and Sign compliance institute 2025 lending

How to edit compliance institute 2025 lending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out compliance institute 2025 lending

How to fill out compliance institute 2025 lending

Who needs compliance institute 2025 lending?

Understanding the Compliance Institute 2025 Lending Form: A Comprehensive Guide

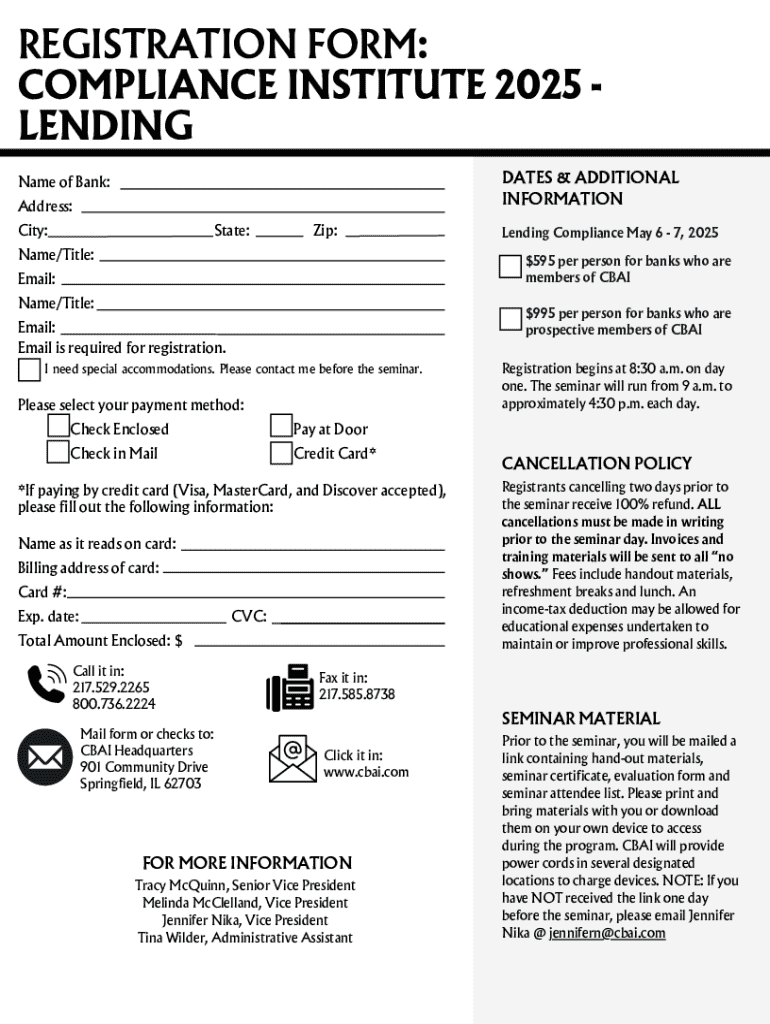

Overview of the Compliance Institute 2025 Lending Form

The Compliance Institute 2025 Lending Form serves a critical function in ensuring that financial institutions adhere to established regulations while processing loans. This form is designed not only to facilitate lending operations but also to enhance transparency and compliance with financial laws.

Key stakeholders involved in this process include lending institutions, borrowers, compliance officers, and regulatory agencies. Each party must understand their roles and responsibilities to ensure a smooth lending process.

Moreover, compliance regulations such as the Truth in Lending Act and the Equal Credit Opportunity Act pose strict guidelines that all parties must follow when processing lending applications. Familiarizing oneself with these regulations is vital for a successful lending operation.

Interactive features of the lending form

Modern lending forms are equipped with various interactive features that simplify the application process. The Compliance Institute 2025 Lending Form includes a step-by-step interactive guide that assists users in navigating the form effortlessly.

Key features of the form include real-time instructions on each section, making it easier for users to complete it without hesitation. Additionally, integrated collaboration tools allow multiple users to interact with the document simultaneously.

Filling out the Compliance Institute 2025 Lending Form

Filling out the Compliance Institute 2025 Lending Form requires specific personal and financial details. Essential information includes identification data, employment status, income, and credit history.

Accuracy is vital, and applicants must carefully review each field to avoid common mistakes during submission. One critical area of focus should be ensuring that all documents are scanned correctly and attachments are in the required format.

Common mistakes to avoid include leaving fields incomplete and uploading incorrect or poorly formatted documents. Addressing these issues upfront can significantly streamline the approval process.

Editing and customizing the lending form

Customization of the Compliance Institute 2025 Lending Form is vital to ensure that it meets compliance standards while remaining clear and readable. Users can utilize various PDF editing tools to highlight important sections and add annotations directly onto the document.

Best practices for document customization include maintaining a clean layout, using distinct fonts, and avoiding excessive jargon to enhance readability. Ensuring compliance standards are upheld while customizing the document is essential to avoid legal pitfalls.

Signing and submitting the form

The eSignature process is a cornerstone of modern lending forms, enabling users to sign documents electronically. Users can choose from various signature options that suit their preference, with built-in verification protocols ensuring that the signing process remains secure and compliant.

To submit the form successfully, a final review checklist should be conducted to confirm that all information is accurate and complete. Once satisfied, users can send the document through the specified submission channels, receiving a confirmation of receipt immediately.

Managing and storing completed forms

Once the Compliance Institute 2025 Lending Form is completed and submitted, managing and storing these documents effectively is crucial. Employing cloud-based document management systems offers numerous benefits, including enhanced security and easy access from any device.

Organizing files by category and tagging documents appropriately allows for quick retrieval when necessary. Establishing a robust system to keep track of all forms will enhance efficiency and compliance management.

Compliance insights and continuing education

Staying informed about lending compliance is paramount for professionals in the financial industry. The compliance landscape is constantly evolving, and awareness of new regulations and practices keeps organizations ahead of potential pitfalls.

Various opportunities for professional development, including webinars, workshops, and available certifications, offer avenues for individuals to expand their knowledge and skills continually.

Real-world scenarios and examples

Examining real-world scenarios provides valuable insights into the practical application of the Compliance Institute 2025 Lending Form. Case studies highlighting successful compliance demonstrate that organizations can effectively utilize the form to improve their lending operations.

On the flip side, examining compliance failures offers lessons on what to avoid in the process. Testimonials from users often reflect how early adoption of the form improved their workflows and mitigated compliance risks.

Addressing your concerns: FAQs

As users engage with the Compliance Institute 2025 Lending Form, they may have questions regarding the process. Common inquiries often revolve around handling mistakes on the form or how to retrieve submitted documents.

Ensuring easy access to technical support is essential, as users may require assistance navigating the digital environment of the form.

Latest trends in lending compliance

The world of lending compliance is witnessing a rapid transformation driven by changes in regulatory frameworks and technological advancements. Keeping abreast of these changes is essential for adapting practices to remain compliant.

Anticipated challenges in 2025 include adapting to stricter regulatory standards. Incorporating technology such as AI to streamline compliance management processes can play a pivotal role in overcoming these challenges.

Additional tools and resources

The integration of the Compliance Institute 2025 Lending Form with other compliance software enhances overall productivity. By utilizing additional tools, organizations can create a comprehensive compliance ecosystem that supports their lending operations.

Furthermore, accessing community forums and educational resources facilitates professional networking and learning opportunities, allowing compliance professionals to stay updated and share best practices.

Why choose pdfFiller for your lending form needs

pdfFiller is a leading platform for managing the Compliance Institute 2025 Lending Form, empowering users with versatile tools to edit PDFs, eSign, collaborate, and manage documents effortlessly from the cloud. Its unique value proposition caters to both individuals and teams, providing a comprehensive document management solution.

Success stories from users highlight the advantages of employing pdfFiller for their lending forms, demonstrating how the platform streamlines processes and enhances compliance management. By choosing pdfFiller, users unlock a powerful resource for all their lending document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get compliance institute 2025 lending?

Can I create an eSignature for the compliance institute 2025 lending in Gmail?

How do I edit compliance institute 2025 lending straight from my smartphone?

What is compliance institute lending?

Who is required to file compliance institute lending?

How to fill out compliance institute lending?

What is the purpose of compliance institute lending?

What information must be reported on compliance institute lending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.