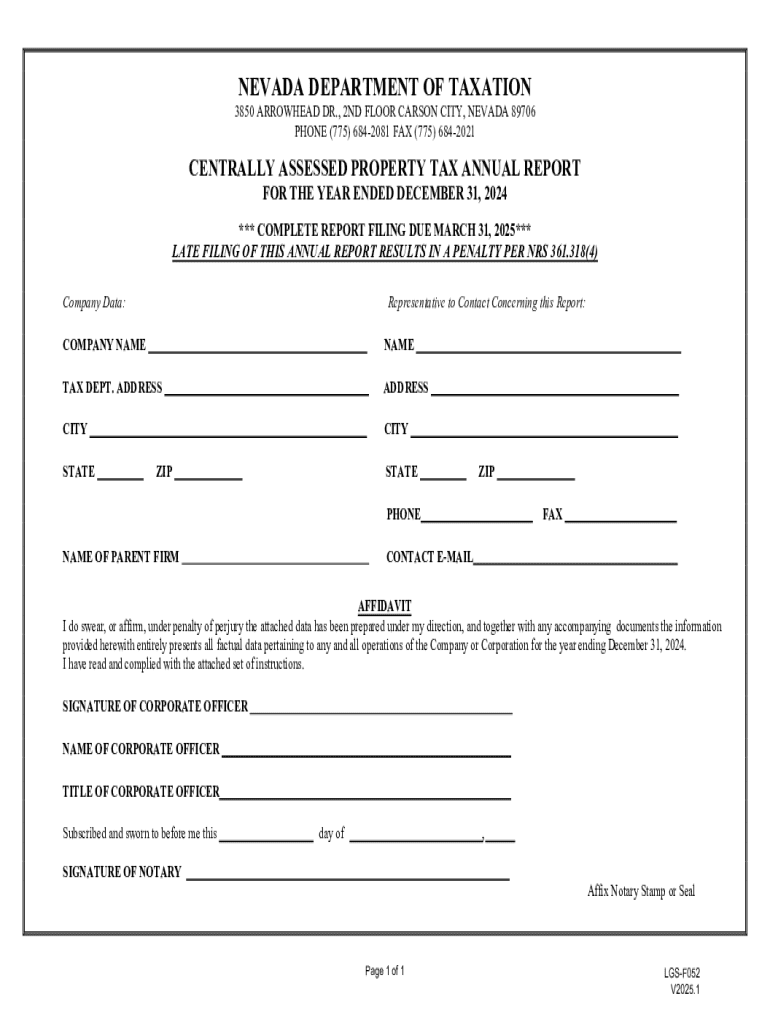

Get the free Centrally Assessed Property Tax Annual Report

Get, Create, Make and Sign centrally assessed property tax

Editing centrally assessed property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out centrally assessed property tax

How to fill out centrally assessed property tax

Who needs centrally assessed property tax?

Centrally Assessed Property Tax Form: A Comprehensive How-to Guide

Understanding centrally assessed property

Centrally assessed property encompasses properties that are assessed by a central authority rather than local government entities. This category typically includes large-scale utilities, railroads, telecommunications, and other infrastructural assets. The significance of centrally assessed property in the taxation system stems from its impact on state and local revenue generation. It allows for uniformity in taxation across jurisdictions, ensuring that property owners contribute equitably to public finances.

The difference between centrally assessed and locally assessed properties is crucial. While locally assessed properties undergo individual assessment by local tax assessors, centrally assessed properties are evaluated by state agencies, leading to standardized valuation processes. Understanding these differences is essential for property owners to navigate tax obligations and reporting accurately.

Overview of the centrally assessed property tax form

The centrally assessed property tax form serves as a comprehensive document that gathers necessary information regarding properties assessed centrally. The primary purpose of this form is to assure accurate tax assessments aligned with the value of the property in question. Key information required on the form includes property identification details, valuation metrics, and any applicable deductions or exemptions.

Types of property covered by the centrally assessed property tax form typically include utilities, railroads, pipelines, and certain other commercial enterprises. These properties are often located across multiple jurisdictions, thus requiring central assessment to ensure compliance and equitable taxation.

Getting started with the centrally assessed property tax form

Before you begin filling out the centrally assessed property tax form, it's essential to compile a few necessary documents. Firstly, proof of ownership is essential to validate that the property in question is truly yours. Additionally, gathering your previous tax returns can provide context and continuity for your current financial situation. Finally, property appraisal documents are crucial, as they lay the groundwork for your property's assessed value.

To access the form, you can visit pdfFiller's website. Here's a step-by-step guide to finding the form online: 1) Go to the pdfFiller homepage. 2) Use the search bar at the top of the page to enter 'centrally assessed property tax form.' 3) Review the search results and find the appropriate template. 4) Click on the link to access the form for editing or filling out.

Detailed instructions for completing the tax form

Completing the centrally assessed property tax form involves several distinct sections. In Part A, you will need to provide general information, including your name, address, and the type of property you own. This sets the foundation for the assessment process.

Part B requires detailed property information, including location, size, and usage. In Part C, valuation information is provided, often derived from your appraisal documents, clarifying the basis for the property's assessed value. Finally, Part D deals with any deductions, ensuring you accurately report all potential tax reliefs available to you.

Editing and customizing your form

pdfFiller’s editing tools offer flexibility in customizing the centrally assessed property tax form to suit your needs. Users can easily add or remove sections that are relevant to their particular circumstances. For instance, if certain property details do not apply, you can simply eliminate those fields for clarity and conciseness.

Incorporating digital signatures is another standout feature of pdfFiller. This option facilitates a seamless sign-off process, allowing you to sign documents directly within the platform. Additionally, using templates can enhance efficiency, ensuring that you don't have to start from scratch each year.

eSigning the centrally assessed property tax form

eSigning your centrally assessed property tax form is crucial for maintaining compliance and legitimacy in the submission process. It formalizes your submission and verifies that the information provided is accurate to the best of your knowledge. Using pdfFiller, the eSigning process is straightforward and user-friendly.

To eSign, follow these steps: 1) Open your completed form in pdfFiller. 2) Click on the 'Sign' button. 3) Choose to draw, type, or upload your signature. 4) Place your signature in the designated field on the form. 5) Save your signed document for submission.

Validating signatures is essential. Ensure your electronic signature adheres to state regulations, as compliance varies by jurisdiction. Failure to do so could result in delays or complications with your tax assessment.

Submitting the centrally assessed property tax form

After completing and signing your centrally assessed property tax form, it’s time to submit it. A couple of options are available, including online submission via pdfFiller and mail-in submission. For online submissions, ensure your internet connection is stable to avoid any disruptions.

Mail-in submissions require meticulous attention to guidelines provided by your tax authority. Typically, you need to send your form to a specified mailing address, and it’s advisable to use certified mail to track your submission. After submission, keep a record of any confirmation receipts or tracking numbers.

Frequently asked questions

Common questions surrounding centrally assessed property often arise, particularly concerning specific details about the tax form process. A frequently asked question is whether the centrally assessed tax form applies to all types of property. The answer is no; it applies primarily to properties classified under central assessment by state regulations.

Another common inquiry relates to submission errors. Should you encounter issues, such as the form not submitting or errors during the submission process, it’s vital to review all entered information for inaccuracies. Addressing these areas will often resolve the issue and allow for successful form finalization.

Additional information and resources

To find more help regarding centrally assessed property taxes, consider accessing your state's resources. Each state may provide unique avenues for assistance, whether through dedicated tax offices or online portals. Additionally, consulting professional tax advisors can offer insights tailored to your specific situation, ensuring compliance and optimal filing.

Related forms and documents may also be available through pdfFiller, which can streamline further tax-related tasks. Staying updated on changes to centrally assessed property tax regulations can help you anticipate necessary adjustments for future filings.

How to stay updated and connected

For taxpayers seeking to stay informed about changes in tax regulations, signing up for notifications or newsletters from state tax authorities can be invaluable. These notifications can alert you to changes that may affect your tax obligations or filing requirements.

Engaging in community forums for taxpayers is another great way to navigate the complexities of centrally assessed property taxes. Discussions with peers can unveil useful insights and tips for managing your tax responsibilities. Lastly, following pdfFiller on social media can provide additional best practices and tips for document management.

Managing your tax documents

Organizing your tax records is key to efficient management of your financial documents. Ensuring that everything is categorized and easily retrievable can make a significant difference during tax season. digital tools such as pdfFiller do more than just streamline the filling out of forms—they also enable you to organize and store all your documents in one location.

Utilizing pdfFiller aids in archiving and retrieving past filings with ease. Features such as cloud storage ensure your documents are safe, accessible from anywhere, and easily shareable with tax professionals when needed. This kind of comprehensive management simplifies the entire tax process, enabling you to focus on achieving the best tax outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my centrally assessed property tax directly from Gmail?

How do I edit centrally assessed property tax in Chrome?

How can I edit centrally assessed property tax on a smartphone?

What is centrally assessed property tax?

Who is required to file centrally assessed property tax?

How to fill out centrally assessed property tax?

What is the purpose of centrally assessed property tax?

What information must be reported on centrally assessed property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.