Get the free Check Order Form

Get, Create, Make and Sign check order form

Editing check order form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check order form

How to fill out check order form

Who needs check order form?

Check Order Form: Your Comprehensive How-To Guide

Understanding the check order form

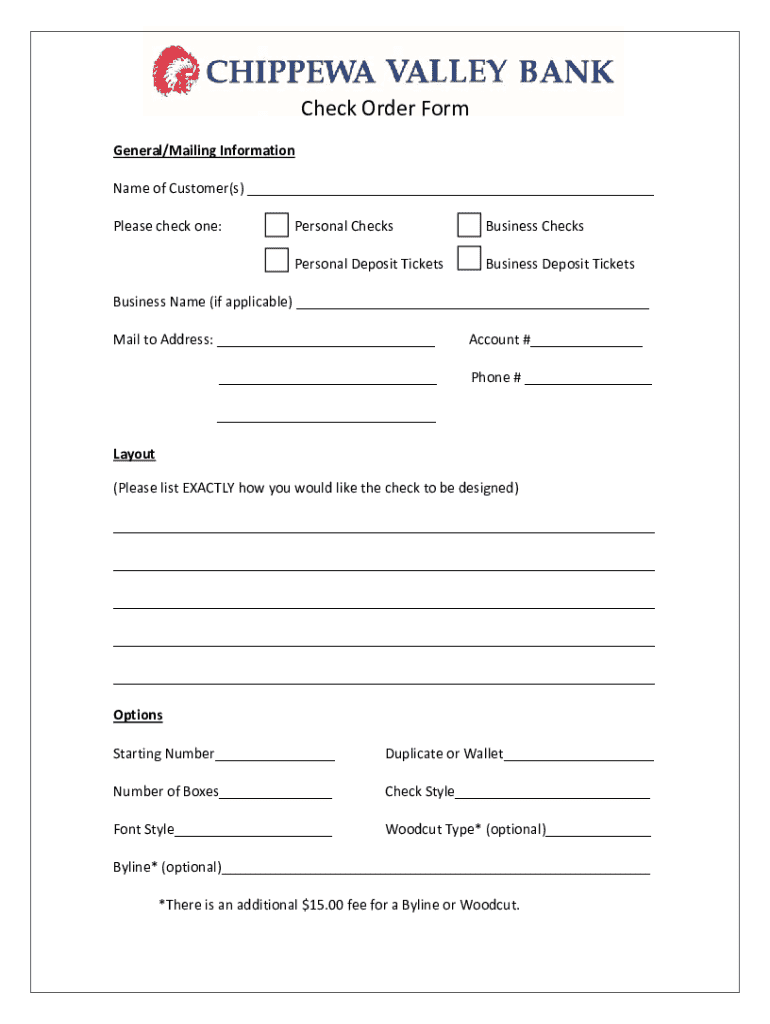

A check order form is a document used to request a batch of checks from a bank or a printing service. It outlines essential information regarding the customer, their bank account details, and the specifications for the checks desired. These forms play a critical role in both personal and business finances, ensuring the creation of checking instruments that reflect individual tastes and organizational branding.

The importance of check order forms extends beyond mere convenience; they streamline the ordering process, reduce errors, and enhance security by clearly detailing the essential elements needed for check production. Common uses include ordering personal checks for everyday expenses, business checks for payroll and vendor payments, and specialized checks for trust funds or retirement accounts.

Types of check order forms

Certain banks provide specific check order forms tailored to their services, which can differ significantly from generic forms found online. For example, Bank of America, Chase, and Wells Fargo each offer unique designs and security features to enhance protection against fraud. Customers are encouraged to use their bank’s website or app to find these tailored forms, as they may include bank-specific logos and layouts that resonate with clients’ needs.

There are two primary categories of checks: personal checks and business checks. Personal checks are typically used for individual transactions such as paying bills or rent, whereas business checks are designed for corporate use, with additional features such as company branding, tailored layouts, and sometimes even higher security measures. Choosing the right type is crucial, as it impacts how the check is perceived and processed.

Preparing to order checks

Before you can order checks, it's essential to gather all necessary information. For individuals, you’ll need your name, address, and banking details such as account number and routing number. If you’re ordering business checks, in addition to your company name and address, you may want to include your tax ID number, logo, and any other branding elements relevant to your business identity.

Once you have collected the required information, consider the design aspects of your checks. The style should align with your personal taste or your company branding. Think about color choices, graphics, and security features such as watermarks or micro-printing that can help prevent fraud. Remember, the appearance of your checks can affect how recipients perceive your payments.

Using pdfFiller for creating your check order form

pdfFiller offers a user-friendly platform for generating your check order form easily. Start by creating an account on pdfFiller's website, which takes only a few minutes and requires basic information like your name and email address. Once your account is set up, navigate to the check order form template available within their library of documents.

The pdfFiller platform allows you to edit the check order form efficiently. You can personalize it according to your preferences by adding relevant personal or business information. Their editing tools are intuitive and include options for changing fonts, colors, and layouts to match your desired look. Don’t forget to explore interactive tools that let you easily fill in required fields, making the process even more streamlined.

Filling out the check order form

Filling out your check order form can be done swiftly. Follow these steps to ensure accuracy: First, input your personal or company information accurately in the designated sections. Next, select the quantity of checkbooks you wish to order along with the type, whether personal or business. Pay special attention to verifying your bank details and any customization choices you've made, like color and design.

To minimize mistakes, it’s essential to double-check all information entered on the order form. Common pitfalls include transposing numbers in your account information or neglecting to select specific design features. A careful review before submission can save you time and trouble later.

Reviewing and submitting your check order form

Once you’ve filled out your check order form, it's time for a final review. Create a checklist for yourself to ensure all required details are correct, including your name, address, bank account information, and chosen designs. Take a moment to look over the design features to ensure they meet your expectations.

When ready, submit your order through pdfFiller. There are various submission methods available, whether directly online or via email. Upon submission, you can track your order’s status, which can provide peace of mind while you wait for your new checks to arrive.

Managing and reordering checks

Managing your check orders is simplified with pdfFiller's tracking system. You can easily check the status of your check order and track shipping directly on the platform. It’s also possible to find past orders, which can be especially helpful if you often order checks or need to reorder specific quantities.

Reordering checks is made easy through pdfFiller as well. You can save and reuse previous orders, ensuring consistency in your check style. If your needs change, such as an updated address or branding redesign, simply make the necessary modifications before submitting a new order.

Troubleshooting common issues

If an error occurs with your order details after submission, immediate action is crucial. You may need to modify your submitted check order. pdfFiller's support team is available to assist you with these changes, ensuring your checks reflect the correct information.

In the event of delivery issues, understand common reasons why there might be delays in receiving checks, such as postal service disruptions or processing times. If your checks haven’t arrived within the expected timeframe, reaching out to customer support can help resolve these delivery concerns.

Enhancements offered by pdfFiller

Beyond just check orders, pdfFiller provides robust document management capabilities. Users can create and manage a wide variety of documents, including invoices, contracts, and forms, all in one place. This versatility makes pdfFiller an essential solution for those looking to streamline their financial documentation needs.

Utilizing a cloud-based document solution like pdfFiller means you can access your documents from anywhere. Whether you’re in the office or on the go, collaboration features allow teams to work together efficiently on financial documentation.

Frequently asked questions (FAQs)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in check order form?

How do I edit check order form on an iOS device?

How can I fill out check order form on an iOS device?

What is check order form?

Who is required to file check order form?

How to fill out check order form?

What is the purpose of check order form?

What information must be reported on check order form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.