Get the free Credit Card Processing Form

Get, Create, Make and Sign credit card processing form

Editing credit card processing form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card processing form

How to fill out credit card processing form

Who needs credit card processing form?

Comprehensive Guide to Credit Card Processing Forms

Understanding credit card processing forms

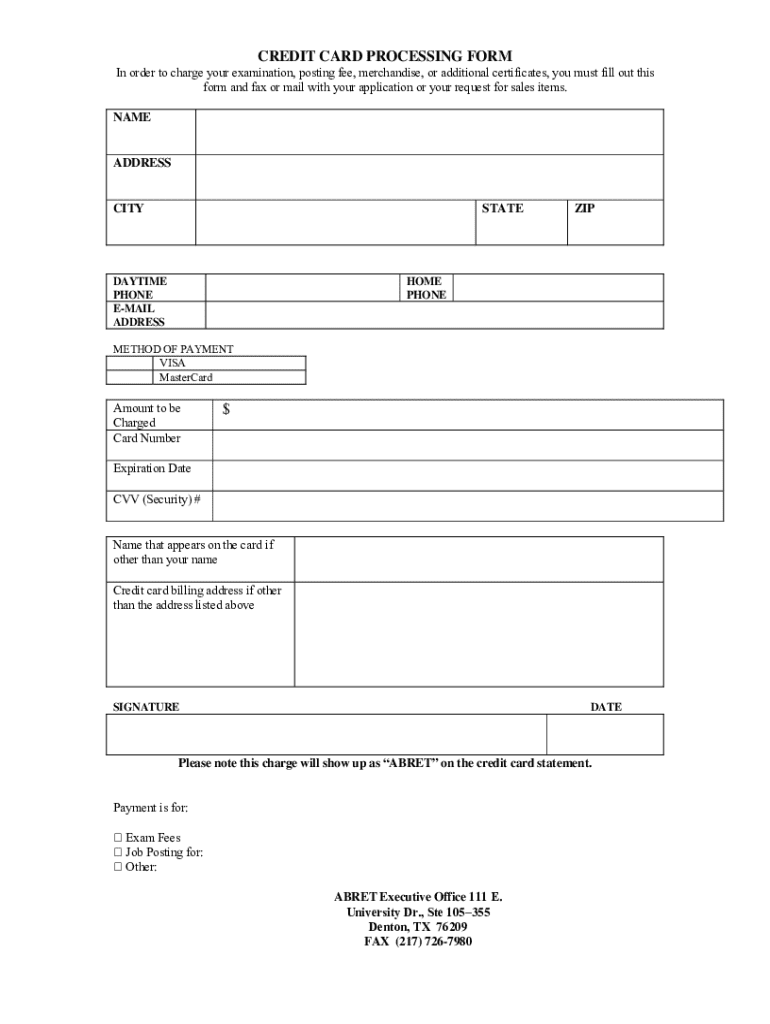

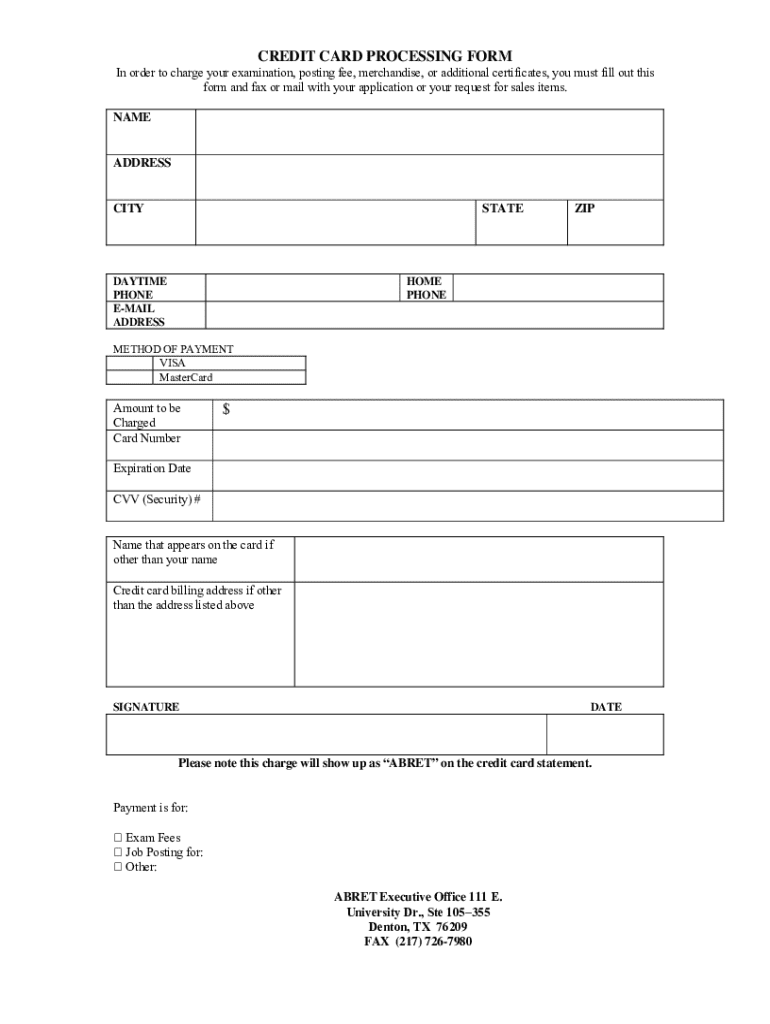

A credit card processing form is an essential document used by businesses to gather payment information from customers. It typically includes fields for cardholder details, card numbers, and expiration dates, along with an authorization statement that allows the merchant to process the payment. These forms play a vital role in ensuring secure transactions, especially in a digital economy.

Having a credit card processing form is crucial for businesses as it streamlines the payment process, reduces the likelihood of errors, and enhances customer trust. By presenting a professional and secure method for transactions, businesses can increase customer conversion rates and maintain steady cash flow.

Overview of credit card processing mechanisms

Credit card processing involves a series of steps that ensure payment is authorized and fulfilled. Initially, when a customer submits their payment details, the system sends a request for authorization to the bank that issued the card. This process verifies that the customer has sufficient funds before allowing the transaction to proceed.

Once authorized, the transaction undergoes a settlement process. After the sale, the funds are transferred from the customer’s bank to the merchant’s account. Understanding key terms such as authorization, capture, chargeback, and refund is essential for anyone handling credit card processing.

PCI compliance is critical when creating credit card processing forms. It refers to the standards set to ensure secure processing of card transactions, safeguarding customer data against breaches or fraud.

Creating an effective credit card processing form

An effective credit card processing form must contain several essential elements to be functional and secure. Key components include the cardholder's name, billing address, payment details such as card number, expiration date, and CVV number. Additionally, an authorization statement that the cardholder agrees to the terms of payment should be prominently displayed.

Utilizing tools like pdfFiller allows for in-depth customization of credit card forms. Businesses can add their branding elements, such as logos and color schemes, to enhance their professional appearance. Interactive fields can also be incorporated to improve user experience, allowing customers to fill out forms easily.

Ensuring security and compliance

Security is of utmost importance when handling credit card information. Businesses must adopt best practices including encryption, secure storage solutions, and limitations on access to sensitive data. Ensuring that your credit card processing form complies with PCI standards is crucial in protecting customer information.

pdfFiller aids businesses in maintaining PCI compliance by providing secure solutions for data transmission and storage. Companies should evaluate their form storage practices, opting for secure digital solutions over paper forms, which are more vulnerable to theft and loss.

Implementing your credit card processing form

Distributing your credit card processing form effectively is paramount. An online implementation strategy can include embedding the form on your website or linking it through social media. Offline strategies might involve direct customer engagement in-store with kiosks or physical forms. Whichever method you choose, the goal is to ensure ease of access for customers.

Leveraging pdfFiller's features can significantly enhance the accomplishment of your distribution strategy. The platform offers cloud-based access, allowing for real-time collaboration and faster processing of forms. eSigning capabilities provide an additional layer of convenience, ensuring that customers can complete transactions quickly and securely.

Troubleshooting common issues

Challenges may arise when using credit card processing forms. Common issues include incorrect customer data entry, leading to transaction failures or delayed processing. Training staff on the importance of accurate form completion can mitigate such errors, enhancing the overall customer experience.

Declined transactions can also be frustrating for customers. It’s important to handle these situations with transparency and prompt communication. In the case of disputes or chargebacks, keeping thorough documentation of all transactions can be invaluable in resolving issues effectively and maintaining customer trust.

Advanced features to enhance credit card processing

Integrating payment gateways with your credit card processing form adds efficiency and convenience for both the business and its customers. Popular gateways, such as PayPal and Stripe, can streamline payment processing, offering secure handling of transactions. When selecting a payment gateway, consider factors such as transaction fees, customer service, and user experience.

Automating payment reminders and follow-ups can significantly improve cash flow for businesses. By utilizing pdfFiller's automated workflows, businesses can set reminders for upcoming payments, ensuring that invoices are monitored and payments collected in a timely manner.

Frequently asked questions

An often-asked question is whether a credit card processing form is genuinely necessary. The answer is yes; it facilitates secure and efficient transactions and protects both the merchant and customer. It's also essential for keeping transactions organized and easily retrievable, especially during audits.

Choosing pdfFiller offers many advantages for those needing a credit card processing solution. It provides an easily customizable interface, ensuring forms meet diverse transaction needs while guaranteeing compliance and security.

Real-life applications and success stories

Businesses across various sectors, including retail, e-commerce, and services, have successfully implemented credit card processing forms to enhance their operations. For instance, an online clothing retailer streamlined its checkout process substantially with an optimized processing form, resulting in a significant increase in customer conversion rates.

Testimonials from users of pdfFiller often highlight improvements in document management efficiency and secure payment handling. Many businesses reported reduced transaction errors and enhanced customer satisfaction by utilizing customizable forms integrated with payment gateways.

Future trends in credit card processing

Emerging technologies such as artificial intelligence and machine learning are revolutionizing credit card processing. They enhance fraud detection methodologies, helping to secure transactions in an increasingly digital world. In addition, mobile payment solutions like Apple Pay are changing how consumers approach purchases, making it imperative for businesses to adapt their processing forms accordingly.

As regulations continually evolve, businesses must prepare for changes in compliance requirements, particularly related to customer data protection. Staying ahead of these trends ensures that businesses not only remain compliant but also foster customer trust through robust security measures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card processing form without leaving Google Drive?

Can I create an eSignature for the credit card processing form in Gmail?

How do I fill out credit card processing form using my mobile device?

What is credit card processing form?

Who is required to file credit card processing form?

How to fill out credit card processing form?

What is the purpose of credit card processing form?

What information must be reported on credit card processing form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.