Get the free Check Requisition

Get, Create, Make and Sign check requisition

Editing check requisition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check requisition

How to fill out check requisition

Who needs check requisition?

Your Comprehensive Guide to Check Requisition Forms

Understanding the check requisition form

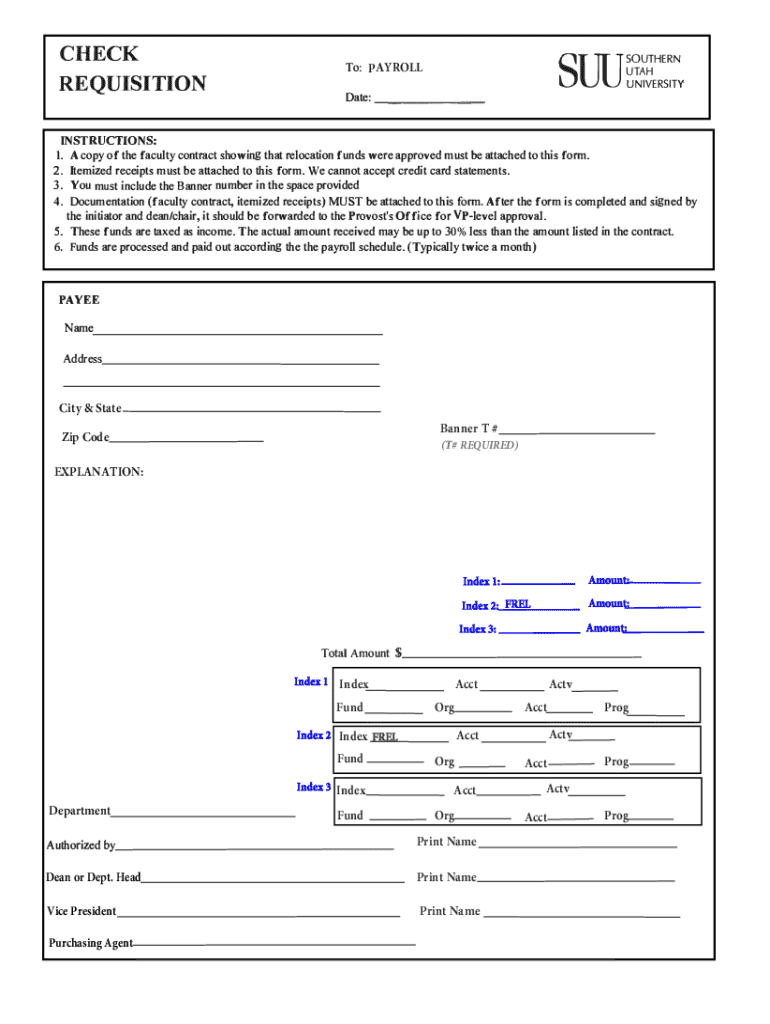

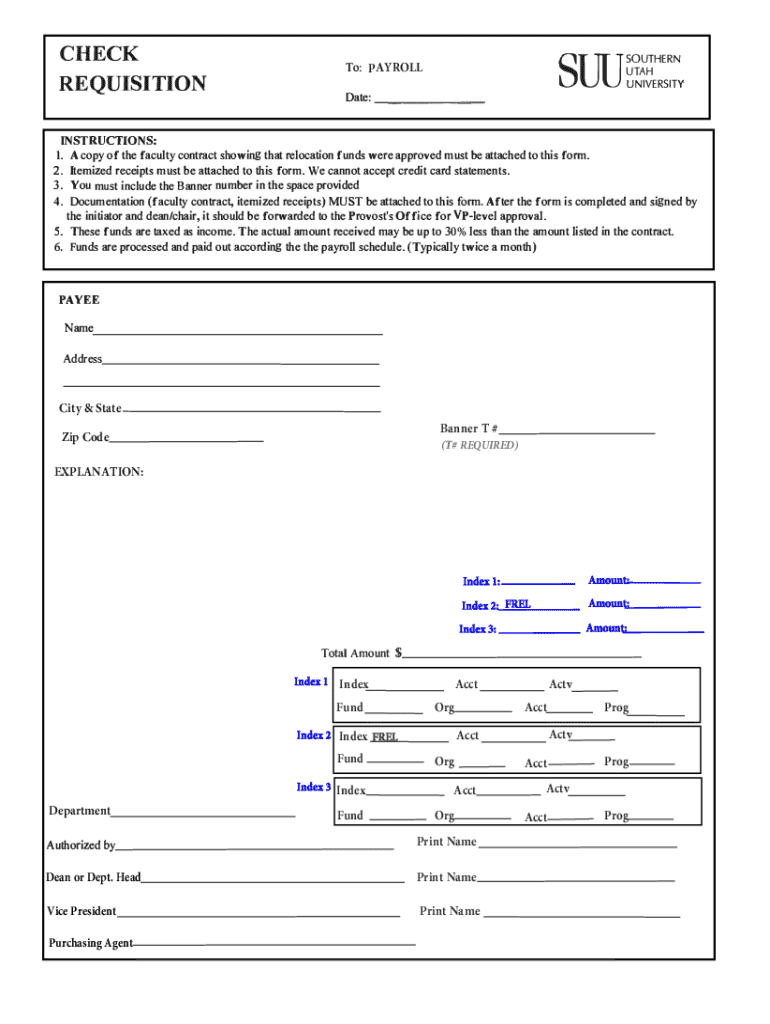

A check requisition form is a formal document used by organizations to request the issuance of a check for various business purposes. Typically, this form is filled out by employees or team members who need funds for expenses, such as services rendered or purchase of materials. Its primary role is to ensure that financial transactions are recorded, approved, and processed in a structured manner, ultimately enhancing the efficiency and accountability of an organization's financial processes.

Every organization utilizes check requisition forms to streamline their payment processes. By using this form, teams can manage budgets, track spending, and prevent unauthorized transactions. Common users include accounts payable departments, project managers, and administrative personnel, who manage the financial dealings for their respective teams or departments.

Types of check requisition forms

Check requisition forms vary in their format and usage, catering to different organizational needs. The most common distinctions include standard check requisition forms and customized versions tailored to specific business processes. Standard forms typically contain the essential fields required for any transaction, while customized forms may include additional project codes, department identifiers, or alternative approval processes.

Furthermore, organizations are increasingly adopting digital forms over traditional paper formats. Digital check requisition forms are not only environmentally friendly but also enable users to fill out, submit, and track requests more efficiently, often integrating directly with accounting systems. This is where platforms like pdfFiller come into play, offering robust digital solutions to simplify this essential process.

Benefits of using a check requisition form

Implementing a check requisition form brings numerous benefits to organizations. First and foremost, it streamlines the request process, allowing team members to easily articulate their financial needs. This efficiency not only accelerates payment processing but also enhances overall workflow within teams. Enhanced budget tracking is another significant advantage, as proper documentation allows organizations to monitor expenses accurately and remain within budget.

Moreover, check requisition forms play a crucial role in fraud prevention. By requiring approvals and providing a clear record of transactions, these forms minimize risks associated with unauthorized payments. Finally, they encourage clear communication among teams. Whether it's clarifying what the funds are intended for or ensuring that necessary approvals are in place, a standardized form fosters dialogue around financial requests.

Components of a check requisition form

A well-structured check requisition form contains several essential components to ensure clarity and compliance in financial requests. Required fields typically include payee information, the amount requested, and the purpose of the request. Providing these details allows for swift processing and accountability. Optional fields can further enhance the form, incorporating additional notes, project codes, or even approval signatures to facilitate oversight.

Additionally, using a platform like pdfFiller enhances the user experience when interacting with these components. The tool simplifies the filling, signing, and sharing of forms while ensuring that all necessary fields are addressed before submission. This not only saves time but also reduces the risk of errors commonly found in traditional paperwork.

How to fill out a check requisition form

Filling out a check requisition form can be made straightforward with the right approach. First, access the form on pdfFiller, which provides an intuitive interface for navigating various document templates. Once the form is open, begin by accurately completing the required sections. Accurate information entry is crucial, as mistakes in this area can lead to delays or even rejections of the request.

After entering the necessary information, it’s essential to review the form for accuracy and compliance. Check for any inconsistencies or missing details, as these can hinder the approval process. Finally, save your form and manage it conveniently within pdfFiller, where you can track the status and ensure all appropriate approvals are acquired.

Submitting your check requisition form

Once the check requisition form is completed, the next step is submission. There are several methods available, including digital submissions via email, printing and delivering the form physically, or utilizing electronic signatures through platforms like pdfFiller, which streamline the signing process. Each method has its advantages and can be selected based on organizational protocols or personal preference.

To ensure timely submissions, it’s crucial to familiarize yourself with deadlines and approval hierarchies. Regularly check with your financial department to avoid any delays in processing requests, keeping in mind that timely submissions not only enhance financial tracking but also improve vendor relationships and operational efficiency.

Common mistakes to avoid

Filling out a check requisition form can be straightforward, but mistakes can derail the process. Common errors include providing incomplete information, which can lead to significant delays in processing requests. Additionally, entering incorrect account codes or amounts can create discrepancies in budgeting and payment, leading to potential financial issues.

Another critical mistake is failing to acquire the required approvals before submission. Each organization has its own guidelines regarding who needs to sign off on requests, and bypassing these can lead to rejected forms or unauthorized payments. To mitigate these risks, ensure careful review and follow the established protocols.

Check requisition form examples

Real-life scenarios help illustrate how check requisition forms are utilized across different contexts. For example, if an employee is requesting reimbursement for travel expenses, the completed form may include sections detailing the travel purpose, date, and associated costs. Conversely, a requisition for office supplies might focus more on item descriptions and quantities.

Platforms like pdfFiller can assist in creating customized templates that suit various requests while ensuring compliance with organizational policies. Utilizing examples can also serve as a learning tool for employees unfamiliar with the requisition process, allowing them to navigate the system with greater confidence.

Use cases for check requisition forms

Understanding when to use a check requisition form is essential for effective financial management. These forms are often employed for both pre-purchase and post-purchase requests. A pre-purchase requisition may be made for approving expected expenses before any purchase takes place, helping to ensure that funds are available and authorized at the outset.

On the other hand, post-purchase requests are typically made for refunding expenses already incurred. Both situations benefit from maintaining precise tracking and detailed record-keeping, which are facilitated through the formal structure provided by check requisition forms.

Managing your check requisition forms with pdfFiller

pdfFiller offers an array of features that enhance the management of check requisition forms. Users can easily edit and customize forms to fit their needs, making it easier to adapt templates to specific organizational standards. Collaboration tools are also available, allowing multiple team members to participate in filling out or approving requests seamlessly.

Additionally, the platform ensures secure storage and retrieval of documents in the cloud, which means your forms are always accessible and protected. This is especially important in maintaining an organized records system and enables teams to streamline their financial workflows effectively.

Key takeaways for effective use of check requisition forms

To maximize the effectiveness of check requisition forms, adhering to best practices is fundamental. Always ensure that forms are filled out completely and accurately, including all required information and securing necessary approvals. Leveraging digital tools like pdfFiller can significantly enhance the experience by simplifying processes, reducing errors, and providing easy access to forms.

Finally, encourage your team members to familiarize themselves with the check requisition process and stay informed on organizational protocols. This proactive approach not only facilitates smoother transactions but also nurtures a culture of diligence and accountability in financial matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check requisition to be eSigned by others?

How do I execute check requisition online?

Can I edit check requisition on an iOS device?

What is check requisition?

Who is required to file check requisition?

How to fill out check requisition?

What is the purpose of check requisition?

What information must be reported on check requisition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.