Get the free Charge Card Authorization

Get, Create, Make and Sign charge card authorization

How to edit charge card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charge card authorization

How to fill out charge card authorization

Who needs charge card authorization?

Charge Card Authorization Form: A Comprehensive How-to Guide

Understanding charge card authorization forms

A charge card authorization form is a crucial document used to obtain permission from a cardholder before processing any charges to their credit or debit card. This form serves as a clear agreement between the cardholder and the merchant, ensuring that both parties understand the terms of the transaction, including the amount to be charged and the purpose of the charge.

The importance of charge card authorization forms cannot be overstated. These forms protect merchants from disputes related to unauthorized charges, effectively reducing the risks of chargebacks, which can be costly for businesses. Furthermore, they help build trust with customers, assuring them that their payment information is handled securely and responsibly.

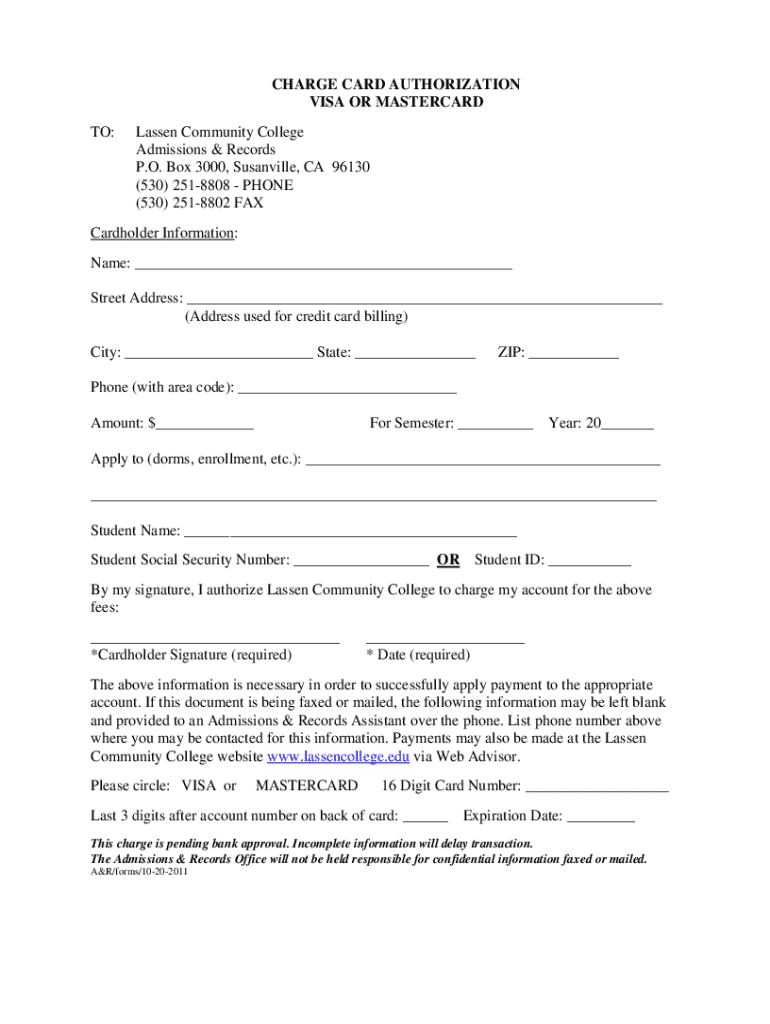

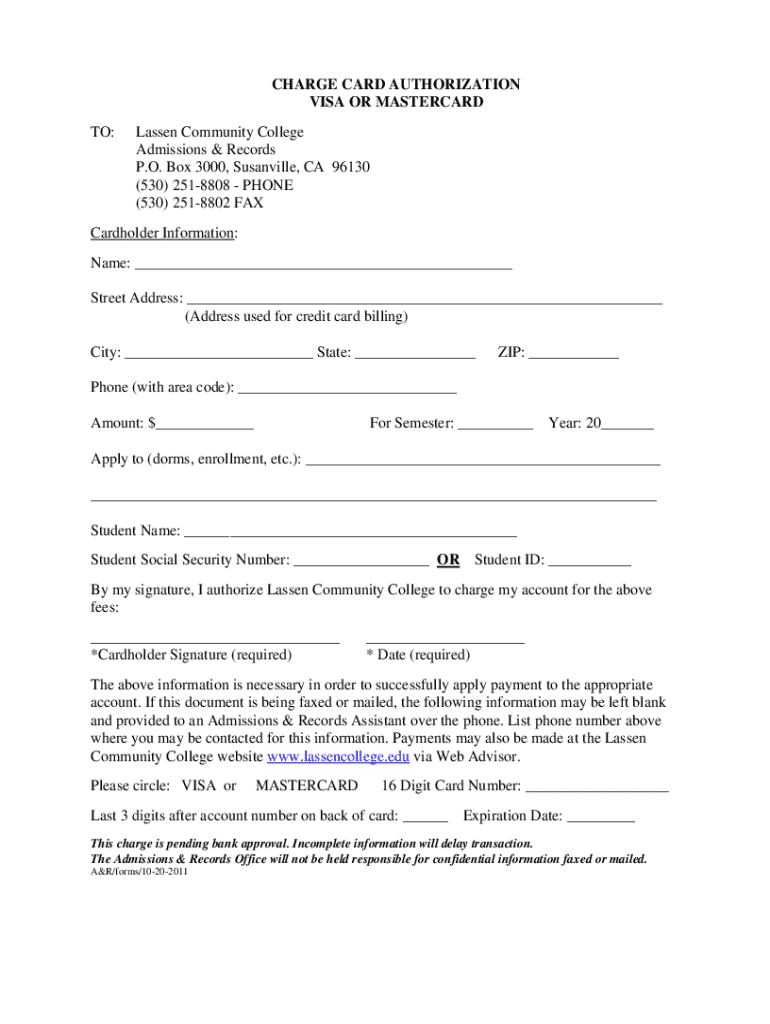

The anatomy of a charge card authorization form

A well-structured charge card authorization form typically includes several essential components. Primarily, it collects cardholder information, including the full name, billing address, and contact details, which confirm the identity of the individual authorizing the transaction.

Next, payment details are crucial. This section specifies the card number, expiration date, and the amount to be charged. Additionally, the form must contain clear authorization statements that outline the cardholder's consent for the transaction.

Lastly, signature and date requirements are fundamental, as they indicate the cardholder's acceptance of the terms. Optional components, such as additional terms and conditions or a space for the CVV, can be included based on the nature of the transaction and the level of security desired.

Benefits of using charge card authorization forms

One of the foremost benefits of utilizing charge card authorization forms is the prevention of chargeback abuse. When a customer claims an unauthorized charge, the presence of a well-documented authorization form can serve as vital evidence in disputing these claims, ultimately safeguarding the financial interests of the business.

Moreover, these forms strengthen security and build customer trust. By transparently collecting and documenting payment information, businesses demonstrate their commitment to protecting customer data. This trust can lead to repeat business and positive word-of-mouth referrals.

Additionally, charge card authorization forms enhance transaction efficiency. By having clear parameters and agreements established before processing, businesses can streamline their payment processes, reducing the chances of errors and misunderstandings that could delay transactions.

Common use cases for charge card authorization forms

Charge card authorization forms are widely used across various industries. The hotel and hospitality sector often relies on these forms to secure reservations and minimize no-show risks. Furthermore, in e-commerce and retail, businesses can protect themselves from fraudulent transactions by obtaining explicit authorization from customers prior to charging their cards.

Service providers, especially those that offer subscription models, can utilize these forms to streamline recurring payments and ensure that cardholders are aware of the charges that will occur on their accounts regularly. This proactive approach can mitigate disputes arising from unexpected charges.

Creating your charge card authorization form

When creating a charge card authorization form, following a systematic approach can enhance accuracy and efficiency. Start by gathering necessary information, including the cardholder's personal and payment details. This is essential to ensuring the form is complete and correct.

Once you have all the information, you can choose the right template on pdfFiller. Selecting a professionally designed template can save you time and ensure that the form meets all legal requirements. After selecting the appropriate template, complete the form with careful attention to detail, following best practices for content clarity and accuracy.

Before finalizing, review and edit the form using pdfFiller tools, checking for any errors or inconsistencies. Finally, ensure that the form is signed and stored securely to protect sensitive information.

Managing charge card authorization forms

Effective management of charge card authorization forms involves adhering to best practices for storage and handling. Digitally storing these forms is recommended, especially on secure platforms that offer compliance with data protection regulations. Choosing a reliable digital storage solution not only protects sensitive information but also enhances accessibility for authorized personnel.

Retention period guidelines also need to be established. It's generally recommended to retain signed charge card authorization forms for a specific period to handle any potential disputes. Additionally, be vigilant about addressing noncompliance risks related to these forms. This includes checking for common errors, ensuring proper documentation, and complying with PCI DSS standards, which help to safeguard cardholder data.

Frequently asked questions (FAQ)

Am I legally obligated to use charge card authorization forms? While there may not be a universal legal requirement, using them greatly benefits businesses and customers by clarifying agreements and reducing chargebacks.

Why doesn’t my charge card authorization form have a space for CVV? Not all transactions warrant a CVV field, but including it can enhance security for sensitive transactions.

What is the difference between card on file and charge card authorization? Card on file refers to storing payment information for future transactions, while charge card authorization specifically pertains to a single transaction.

How long should I keep signed charge card authorization forms? Generally, retaining them for 3 to 5 years is advisable, depending on your industry regulations.

What are the risks of not using authorization forms? Without these forms, businesses expose themselves to potential fraud, chargebacks, and disputes, which can lead to financial losses.

Security considerations

Protecting customer data is paramount in today’s digital marketplace. Safeguarding the information collected in charge card authorization forms starts with ensuring secure storage and transmission. Using encryption and secure access protocols is crucial to protect against data breaches.

Understanding PCI compliance and its importance is essential for businesses handling payment information. Ensuring that your processes meet PCI DSS standards not only helps protect customer data but also enhances your company's credibility. Familiarizing yourself with common signs of fraudulent activities can help you identify and mitigate risks proactively.

Advanced topics in charge card authorization

The role of technology in authorization and fraud prevention is continuously evolving. Innovations in payment processing, including advanced encryption methods and AI technologies, significantly enhance the security of charge card authorization forms. Businesses must keep abreast of these advancements to effectively protect their interests and those of their customers.

Furthermore, exploring future trends in payment authorization forms reveals an increasing shift towards digital solutions. More businesses are adopting automated systems for processing charge card authorizations, which not only streamline operations but also improve accuracy and security.

Conclusion: Empowering your business with charge card authorization forms

Using charge card authorization forms effectively empowers your business to operate smoothly while safeguarding customer payment details. The key takeaways from this guide emphasize the importance of understanding the components of these forms, the benefits they offer, and the best practices for creating and managing them.

By implementing these forms, you can significantly reduce the risks of chargebacks, enhance customer trust, and streamline your payment processes. Take the necessary steps today to ensure your business is equipped with robust charge card authorization procedures that prioritize security and efficacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in charge card authorization?

How do I make edits in charge card authorization without leaving Chrome?

Can I create an eSignature for the charge card authorization in Gmail?

What is charge card authorization?

Who is required to file charge card authorization?

How to fill out charge card authorization?

What is the purpose of charge card authorization?

What information must be reported on charge card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.